UPDATE: MGM China Shares Finish 1.8% Higher On Debut Vs HSI's 1.3% Fall

June 03 2011 - 4:37AM

Dow Jones News

Shares of MGM China Holdings Ltd. (2282.HK), a casino joint

venture between MGM Resorts International (MGM) and a daughter of

Macau gambling tycoon Stanley Ho, finished 1.8% higher Friday on

their first day of trade following a US$1.5 billion initial public

offering in Hong Kong.

The shares opened at HK$16.20 at 0130 GMT, 5.6% higher than

their IPO price of HK$15.34, and closed at HK$15.62. Hong Kong's

benchmark Hang Seng Index fell 1.3%.

Ahead of the listing, MGM China sold 760 million shares at the

top of the offering's indicative price range of HK$12.36 to

HK$15.34, reflecting investor optimism about Macau's booming

gambling industry. MGM China is the last of Macau's six casino

operators to be listed.

Gambling revenue in Macau rose 42% in May from a year earlier to

a record MOP24.31 billion ($3 billion), government statistics

issued Wednesday showed. Macau overtook the Las Vegas Strip as the

world's biggest gambling market in 2006 and analysts expect

gambling revenue in the Chinese territory to grow to five times the

size of the Strip's this year.

Analysts said MGM China is trading at a discount to its U.S.

peers as it doesn't have the growth pipeline of Sands China Ltd.

(1928.HK), which is scheduled to open a new property next year, or

the strong history of profitability of Wynn Macau Ltd. (1128.HK).

But they said the stock is trading at a higher valuation than local

operators Melco Crown Entertainment Ltd. (MPEL), which has a weaker

balance sheet, and market leader SJM Holdings Ltd. (0880.HK), where

uncertainties remain over succession plans.

Credit Suisse analyst Gabriel Chan, who initiated coverage of

MGM China with a Neutral rating and HK$17.50 target price, wrote in

a Friday report that he thought the company's earnings growth would

be strong in 2011 but that he was less positive on the longer term

outlook for MGM China. "Among the three companies (SJM, Wynn Macau

and MGM China) that have applied to have another casino in Cotai,

we believe SJM has the highest chance to commence operation first

in 2015-2016, while MGM China may only (start) later in 2016-2017,

with only 3-4 years left before its gaming license expires in

2020," wrote Chan.

Macau's Cotai area is home to the world's largest casino, Sands

China's Venetian Macao, and Macau's newest casino resort, Galaxy

Entertainment Group Ltd.'s (0027.HK) $2 billion Galaxy Macau.

Following the IPO, Las Vegas-based MGM Resorts International now

has a 51% stake in MGM China and joint-venture partner Pansy Ho has

a 29% stake, after selling the rest of her shares to the public

according to the terms of a deal announced in April. The two

partners previously each held a 50% stake in MGM China.

Wall Street analysts have lauded the new structure that gives

MGM Resorts a controlling stake in the Macau operator, saying it

will give the debt-laden U.S. casino company more exposure to the

profitable Macau market and management control over the joint

venture.

The listing plan of MGM China comes after the March settlement

of a months-long family feud for control of Stanley Ho's

multibillion-dollar gambling empire. A family feud burst into the

open earlier this year when the gambling tycoon accused the

children of his second wife, including Pansy Ho, of colluding with

his third wife, Ina Chan, to steal a company that held the bulk of

his assets. They denied his accusations. The dispute was eventually

resolved, and Stanley Ho dropped his lawsuit against his family

members.

Soaring gambling revenue growth in Macau has helped push shares

of Galaxy Entertainment, controlled by the family of Hong Kong

tycoon Lui Che Woo, up more than 90% since the start of the year.

Shares of SJM and Wynn Macau, the Hong Kong-listed unit of Wynn

Resorts Ltd. (WYNN), have both risen over 40% so far in 2011. Las

Vegas Sands Corp. (LVS) unit Sands China's shares have lagged the

sector with a 16% rise.

-By Kate O'Keeffe, Dow Jones Newswires; 852-2802-7002;

kathryn.okeeffe@dowjones.com

--Polly Hui contributed to this article.

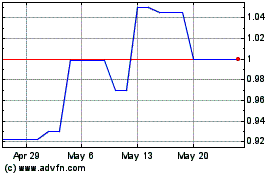

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From Feb 2025 to Mar 2025

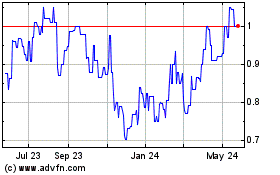

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From Mar 2024 to Mar 2025