UPDATE: Wynn Macau's Solid 2nd Quarter Sets Positive Tone For Rivals

July 19 2011 - 7:23AM

Dow Jones News

HONG KONG (Dow Jones)--Wynn Macau Ltd. (1128.HK) on Tuesday set

the tone for another strong earnings season for casino operators

with a presence in Macau, where gambling revenue growth has been on

a tear for the past two years.

The Wynn Resorts Ltd. (WYNN) unit said its second-quarter

adjusted property earnings before interest, taxes, depreciation and

amortization--a measure widely used to evaluate the performance of

gambling companies--rose 45% to $314.3 million from $216.2 million

in the second quarter of 2010. The result beat the consensus

estimate of $310 million, according to JP Morgan.

"We expect others to see similarly strong quarters that could

drive earnings expectations and stock prices higher," Morgan

Stanley analyst Praveen Choudhary wrote in a report Tuesday.

Wynn's solid performance was fueled by rapid gambling revenue

growth in Macau--gambling revenue rose 45% from a year earlier in

the January-June period, following a 58% surge for the whole of

last year. The only place in China where casino gambling is legal,

Macau overtook the Las Vegas Strip as the world's biggest gambling

market in 2006 and is poised to rake in five times the Strip's

gambling revenue this year.

Macau's gambling revenue growth, particularly in the high-roller

segment, is primarily driven by liquidity outflows from China,

Credit Suisse analyst Gabriel Chan wrote in a report Monday. He

said China's real interest rate peaked in July 2009 and turned

negative in February 2010 amid surging inflation, while Macau's

gambling revenue growth accelerated.

"The negative interest rate environment and limited investment

opportunities in China are driving liquidity outflow to (seek)

higher return overseas, with the Macau gaming market, through the

junket system, being used as a window," he said. Junkets are the

middlemen who bring customers to casinos, extend them credit and

collect debt.

Wynn's fellow U.S. casino companies Las Vegas Sands Corp. (LVS)

and MGM Resorts International (MGM) are forecast to post strong

growth at their Macau properties for the second quarter, while a

Las Vegas recovery remains uncertain. Sands China Ltd. (1928.HK) is

Las Vegas Sands's Macau unit. MGM Resorts has a joint venture with

a daughter of Macau kingpin Stanley Ho called MGM China Holdings

Ltd. (2282.HK), which debuted on the Hong Kong stock exchange last

month.

Stanley Ho's SJM Holdings Ltd. (0880.HK), the market's largest

operator with about one third of the territory's gambling revenue;

Melco Crown Entertainment Ltd. (MPEL), a joint venture co-chaired

by Ho's son Lawrence and Australian James Packer; and Galaxy

Entertainment Group Ltd. (0027.HK), controlled by the family of

Hong Kong tycoon Lui Che Woo, are also forecast to report strong

results, which will trickle out through the end of August.

Wynn Macau, which operates an eponymous property located on

Macau's peninsula, is planning to build a casino resort in the

territory's fast-growing Cotai area, home to Sands China's massive

Venetian Macao and the territory's newest casino resort which

opened in May--the Galaxy Macau. It will have 500 gambling tables

and 1,500 hotel rooms, Chairman Steve Wynn said during Wynn

Resorts' earnings call. But the local government has yet to grant

the company land rights for the project.

Choudhary said the "limited visibility on approval" renders the

company "constrained for growth," prompting the house to retain its

equalweight rating on the stock.

Wynn Macau's net profit for the three months ended June 30 was

$120.33 million, down from $132.52 million a year earlier,

according to international financial reporting standards. The

figure was hit by a $107 million charge representing the present

value of a charitable contribution made to the University of Macau

Development Foundation.

Operating revenue rose 37% to $976.51 million in the second

quarter from $714.41 million a year earlier.

The company didn't recommend a dividend.

Wynn Macau's Hong Kong-listed shares ended 1.1% lower at

HK$26.15, in line with a decline in shares of most Macau

companies.

-By Kate O'Keeffe, Dow Jones Newswires; 852-2802-7002;

kathryn.okeeffe@dowjones.com

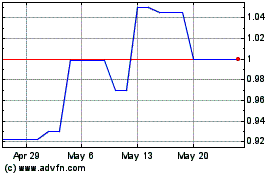

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From May 2024 to Jun 2024

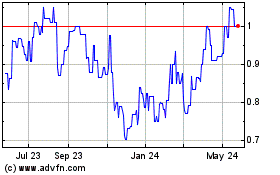

Wynn Macau (PK) (USOTC:WYNMF)

Historical Stock Chart

From Jun 2023 to Jun 2024