Bruntwood Bond 2 PLC June 21 Quarterly Rent Update

July 21 2021 - 2:00AM

RNS Non-Regulatory

TIDMBRU2

Bruntwood Bond 2 PLC

21 July 2021

21st July 2021

BRUNTWOOD GROUP LIMITED

BRUNTWOOD INVESTMENTS PLC

BRUNTWOOD BOND 2 PLC

UPDATE STATEMENT ON COVID-19 RENT COLLECTION AND INTERIM

RESULTS

Bruntwood Group Limited ("Bruntwood") today updates the market

on the impact of the Covid-19 pandemic on its business and a

summary of the latest rent collection position.

Chris Oglesby, CEO of Bruntwood, said

"Over the last quarter we have continued to keep our buildings

open for customers and support them to work safely and effectively

from them. There has been a phased return to workplaces with

footfall stabilising around 40% during this quarter. In parallel

customers are preparing for more substantial numbers of staff to

return as the national Covid restrictions are lifted.

This quarter saw the successful conclusion of the Manchester ID

procurement process for Bruntwood SciTech and also the acquisition

of Castle House which will enhance our footprint in Leeds.

We know from engagement in the business communities in our

cities the value that businesses are placing on their offices as

places for people to collaborate, create and develop strong

business cultures. There is a growing recognition about the impact

of long term homeworking on colleagues mental wellbeing and career

development both of which have major impacts on individuals and

businesses"

Financial Position

On 30th June Bruntwood agreed a new GBP276m, 15-year

sustainable-linked loan facility with Aviva Investors. The

agreement sees Bruntwood consolidate and extend the maturity of its

long-term funding facilities until 2036 by refinancing and

increasing an existing credit line of GBP114m to GBP155m and

extending the term of the existing GBP121m Aviva facility

originally due to mature in 2031.

As at 16th July, the Group had GBP30m of cash reserves (compared

to GBP17m on 20 April, the date of the last update), GBP40m of

undrawn committed available facilities and GBP68m of unencumbered

assets upon which further finance could be secured. In addition,

the group has GBP19m of retained bonds which it could issue to the

market.

Bruntwood has modelled various scenarios including reviewing

estimated customer default rates, lower retention rates, higher

concessions and valuation yield movement. Based on the output of

these models, The Board considers there to be sufficient income and

valuation headroom across Bruntwood's debt facilities and does not

expect Bruntwood to breach any terms relating to them. We have

modelled the forecast covenant performance on each loan facility.

Valuation covenant headroom is in excess of 20% across our

facilities. Income would have to fall by over 30% on all of our

facilities before any interest cover covenants are breached. In

addition, we would expect that the existence of GBP68m of

unencumbered assets would provide the resources to remedy any

breaches in such circumstances. The earliest major bank facility

maturity is not until March 2022.

Impact on Operations

As of 16th July 2021, 95% of March quarter rents and 98% of

December rents were collected with the balance being on payment

plans or being actively pursued at the date of this

announcement.

Some 85% of June rents had been collected as at the same date.

This is consistent with the March / December quarters at a

comparable point. We continue to speak with all our customers on a

regular basis and work with every customer to support them as far

as possible through these challenging times. We will continue to

work closely with all customers and where support is required we

will seek to reach a fair solution for everyone.

Strong cash collection and a focus on controlling non-essential

expenditure has ensured that the business continues to stay cash

positive before capital outlay is taken into account. Retention

levels at break and expiry are in excess of 70% and vacancy levels

are currently 9.9%, showing a consistent positive trend across the

year.

Headline rents remain consistent with previous run rates

although there is some evidence of pressure on the rent free

concessions and fit out contributions required to secure new

lettings, albeit consistent with our forward plan assumptions.

Since the last update, Bruntwood SciTech has continued to make

significant traction on it's lettings plan at both Alderley Park

(the 1m sq ft life science campus) and the newly completed Circle

Square scheme (400k sq ft of commercial office space aimed at the

digital and tech sectors). SciTech continues to advance its growth

plans with the 120k sq ft Enterprise Wharf development on the

digital focussed Innovation Birmingham campus starting on site,

planning permission for the first phase of Birmingham Health

Innovation Campus being secured and further acquisition

opportunities being investigated.

In May 2021 Bruntwood SciTech was selected as the preferred

development partner by the University of Manchester in respect of

the ID Manchester site in the heart of the city centre's innovation

district after an almost two year procurement process. This will

see Bruntwood SciTech working in Joint Venture with the University

of Manchester to deliver a 4 million sq ft mixed use campus across

the final major development site of scale left in Manchester City

Centre.

ENDS

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

Patrick King (Peel Hunt) +44 (0) 203 597 8622

Mark Glowery (Allia C&C) +44 (0) 203 039 3465

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to Bruntwood's expectations

and plans, strategy, management objectives, future developments and

performances, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond Bruntwood's ability to control or estimate

precisely and which could cause actual results or developments to

differ materially from those expressed or implied by these

forward-looking statements. Certain statements have been made with

reference to forecast process changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of Bruntwood are based upon the knowledge and

information available to Directors on the date of this

announcement. Accordingly, no assurance can be given that any

particular expectation will be met and Bruntwood's bondholders are

cautioned not to place undue reliance on the forward-looking

statements. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), Bruntwood

does not undertake to update forward-looking statements to reflect

any changes in events, conditions or circumstances on which any

such statement is based. Past bond performance cannot be relied on

as a guide to future performance. Nothing in this announcement

should be construed as a profit forecast. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in Bruntwood or an invitation or inducement to

engage in any other investment activities.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAEADXEAFKFEFA

(END) Dow Jones Newswires

July 21, 2021 03:00 ET (07:00 GMT)

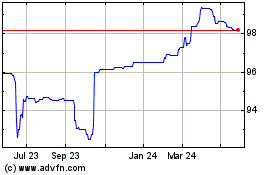

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Nov 2024 to Dec 2024

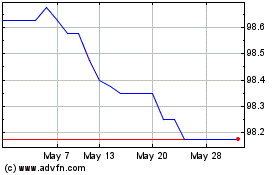

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Dec 2023 to Dec 2024