TIDMBRU2

RNS Number : 7770O

Bruntwood Bond 2 PLC

06 February 2023

6th February 2023

BRUNTWOOD GROUP LIMITED

BRUNTWOOD INVESTMENTS PLC

BRUNTWOOD BOND 2 PLC

UPDATE STATEMENT ON 2022 ANNUAL RESULTS

Bruntwood Group Limited ("Bruntwood") today updates the market

on the recent publication of the 2022 financial statements and a

summary of the latest rent collection position.

Across the group, net asset value rose by more than 10% to

GBP671.5m (2021: GBP606.5m) and the value of its combined

portfolio, including Bruntwood SciTech assets and other joint

ventures reached GBP2.0bn (2021: GBP1.8bn).

Chris Oglesby, CEO of Bruntwood, said

"We have aligned our products and proposition with the

businesses and organisations driving the future of the UK economy

in innovation-linked sectors like tech and digital, life sciences

and their supporting ecosystems, all of which continue to show huge

potential in many of our regional cities.

"As we now lean into the challenges presented by the end of

another economic cycle, this will remain our focus. We will

continue to focus our energies on investing in assets, whether

that's for Bruntwood SciTech or Works, in such a way that meets the

needs of modern business and industry, targeting growth into new

and existing cities around the UK."

Bruntwood made a number of significant investments and

acquisitions that contributed to this growth, while market

sentiment towards science and technology real estate assets

strengthened.

Within the Bruntwood SciTech portfolio, it unveiled a GBP76.2m

investment into the purchase and regeneration of Glasgow's famous

Met Tower, to create a new tech and digital campus and marking

Bruntwood and Bruntwood SciTech's first development in

Scotland.

Within the Bruntwood Works portfolio, it completed the GBP3m

refurbishment of Liverpool's The Plaza, gained approval for the net

zero redevelopment of Manchester's Grade II listed Pall Mall and

work started on the 90,000 sq ft Castle House in Leeds as part of

the wider West Village regeneration project.

Financial Position

The Group filed its annual accounts for the year ending

September 30th 2022. Key highlights include:

-- Reported pre-tax profit of GBP75.2m (2021: GBP44.9m) - the

second-best results in the group's 46-years of trading

-- Net asset value increases of 10.7% (GBP671.5m) and total

assets under management hits GBP2.0bn (2021: GBP1.8bn)

-- Further investment of GBP147m of capital, realised

revaluation gains of GBP153m and non-core disposals of GBP72m.

The full financial statements can be found at:

https://bruntwood.co.uk/our-performance/disclaimer/retail-bond-2025/

The Group's liquidity position has also improved. As of 31st

January 2023, the Group has GBP16m of cash reserves (10 January

2022: GBP9.2m), GBP40m of undrawn committed available facilities

(10 January 2022: GBP28m) and GBP70m (10 January 2022: GBP71m) of

unencumbered assets upon which further finance could be

secured.

The 2025 bond covenants have been tested as at September 2022

and are met with significant headroom. The covenant testing and

compliance certificate can be found on the Bruntwood website (link

as above).

At the same time, given the challenging economic outlook, the

Board has increased its stress testing and the consideration of

various scenarios including reviewing estimated customer default

rates, lower retention rates, higher concessions and valuation

yield movement. Based on the output of these models, the Board

considers there to be sufficient income and valuation headroom

across Bruntwood's debt facilities and does not expect Bruntwood to

breach any terms relating to them. We have modelled the forecast

covenant performance on each loan facility. Valuation covenant

headroom is in excess of 30% on all of our facilities.

Nevertheless, due to the rise in interest rates, the Group has

negotiated less onerous Interest Cover (ICR) covenants on its main

debt facility to help support the business for the future.

Impact on Operations

As of 27th January 2022, 93% of December quarter rents had been

collected. This is comparable to the September / June quarters at

the same point and ahead of the prior year comparative.

ENDS

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

Patrick King, Mark Truman (WH Ireland +44 (0) 207 220 1666

Capital Markets)

Mark Glowrey (Allia C&C) +44 (0) 203 039 3465

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to Bruntwood's expectations

and plans, strategy, management objectives, future developments and

performances, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond Bruntwood's ability to control or estimate

precisely and which could cause actual results or developments to

differ materially from those expressed or implied by these

forward-looking statements. Certain statements have been made with

reference to forecast process changes, economic conditions and the

current regulatory environment. Any forward-looking statements made

by or on behalf of Bruntwood are based upon the knowledge and

information available to Directors on the date of this

announcement. Accordingly, no assurance can be given that any

particular expectation will be met and Bruntwood's bondholders are

cautioned not to place undue reliance on the forward-looking

statements. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), Bruntwood

does not undertake to update forward-looking statements to reflect

any changes in events, conditions or circumstances on which any

such statement is based. Past bond performance cannot be relied on

as a guide to future performance. Nothing in this announcement

should be construed as a profit forecast. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in Bruntwood or an invitation or inducement to

engage in any other investment activities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSSDFDEEDSEIE

(END) Dow Jones Newswires

February 06, 2023 03:00 ET (08:00 GMT)

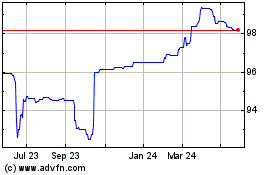

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Nov 2024 to Dec 2024

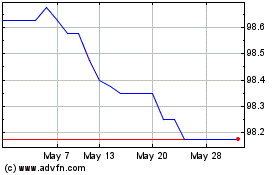

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Dec 2023 to Dec 2024