TIDMCMB

RNS Number : 5100M

Cambria Africa PLC

14 September 2023

Cambria Africa Plc

("Cambria" or the "Company")

Audited FY 2022 Results ("the Results"):

Loss per Share of 0.03 US cents and NAV of 1.06 US cents (0.85p

GBP)

Cambria Africa Plc ( AIM: CMB ) ("Cambria" or the "Company")

announces its audited results for the year ended 31 August 2022

("FY 2022"). The Audited Financial Statements are available on the

Company's website ( www.cambriaafrica.com ) and will be sent to

shareholders tomorrow. With the publishing of the Group`s FY 2022

and HY 2023 results, the suspension of the Company`s shares on the

AIM is expected to be lifted at 7.30am on 15 September 2023.

A loss attributable to Cambria Shareholders of $178,306 (0.03 US

cents per share) was recorded for FY 2022. Before inventory

impairments, the Company's subsidiaries in Zimbabwe continued to

operate above or near breakeven EBITDA, despite a revenue decline

of 24% to US $920,077 in FY 2022 from US $1.22 million in FY 2021.

The Company's subsidiaries are expected to continue to report at

breakeven levels in FY 2023. The Company's FY 2022 consolidated

profits stem mainly from Tradanet, the 51% owned subsidiary of

Paynet Zimbabwe with revenues of US$654,824.

Net Equity (NAV) fell by 9% from US $6.32 million (1.16 US cents

per share) in FY 2021 to $5.75 million FY 2022 (1.06 US cents per

share) is mainly attributable to foreign currency translation

adjustments of $394,000, inventory impairments in Millchem of

$150,000, and mark-to-market adjustments of the Company`s listed

share investments.

FY 2022 Results highlights:

12 Months Ended 31 August (US$'000) 2022 2021 Change

------------------------------------------- ---------- -------- --------

Group:

- Revenue 920 1,216 (24%)

- Operating costs 623 838 26%

- Consolidated EBITDA (before exceptional

items) 344 385 (11%)

- Consolidated (Loss)/p rofit after tax (5) 181 (103%)

- (Loss)/profit after tax attributable to

owners of the Company (178) 82 (317%)

- Central costs 127 130 2%

- (Loss)/Earnings per share - cents (0.03) 0.02 (250%)

- Net Asset Value (NAV) attributable to

owners of the Company 5,745 6,317 (9%)

- NAV per share - cents 1.06 1.16 (9%)

Weighted average shares in issue ('000) 544,576 544,576 -

Shares in issue at year-end ('000) 544,576 544,576 -

Divisional:

- Payserv - consolidated profit after tax

("PAT") 300 652 (54%)

- Payserv - consolidated EBITDA 433 505 (14%)

- Millchem - EBITDA (3) 11 (127%)

Group Highlights:

-- Net Equity (NAV) decreased by 9% from US $6.32 million (1.16

US cents per share) to US $5.75 million (1.06 US cents per

share)

-- Revenues declined by 24% to $920,077 while operating costs

decreased by 26% to $623,000. As a result of careful cost

management, the Company has managed to scale operations in

accordance with revenue declines

-- Cambria recorded a loss for the year of $4,588 as operations edged around breakeven.

-- Consolidated EBITDA before fair value adjustments to

investments and marketable securities decreased by 11% to $344,000

from $385,000 in FY 2021.

-- Cambria's central costs associated with listing and

associated operational expense decreased by 2% to $127,004. The

balance of the Company`s operating costs comprises

hyperinflationary adjustments, foreign currency translation and

mark-to-market adjustments of its listed investments. Cambria's CEO

and Directors continued to render services to Cambria without

compensation during FY 2022.

Divisional Highlights:

-- Tradanet (Pvt) Ltd, Paynet Zimbabwe's 51% held subsidiary,

continued to provide loan management services to CABS, the

country's largest building society. The persistent devaluation of

the country's currency led to an increase in salary-based loans.

However, due to liquidity constraints in the banking sector, this

increase was not in proportion to the depreciation of the

currency.

-- Autopay, Paynet Zimbabwe's payroll processing division saw an

increase in its revenue base due to a new management team with

extensive payroll experience. Autopay established an independent

contract relationship with payroll managers on a pure profit share

basis

Net Equity (Net Asset Value):

Components to the decrease of NAV in 2022

The Group reported a decrease of $570,000 in NAV to $5.75

million (1.06 US cents per share) at 31 August 2022, compared to

$6.32 million (1.16 US cents per share) at 31 August 2021. This

decrease was due to the following material factors:

-- Foreign currency translation adjustments of $394,000;

-- Inventory impairments of $150,000 related to raw materials and packaging held by Millchem;

-- Reduction of $30,000 in the carrying value of listed share investments.

Components of NAV at 31 August 2022

The Group NAV of $5.75 million as at the end of FY 2022 includes

the following material tangible and intangible assets:

Building and properties valued at $2.3 million - The valuation

was prepared by Hollands Harare Estate Agents in January 2022.

Holland conducted the previous valuations of the prominently

located commercial office space and its equally well-positioned

vacant plot in Harare's Mount Pleasant Business Park.

Investment in Radar Holdings Limited - 9.74% or 4.98 million

shares valued at US $1.743 million (net of minority interests)

based on 35 US cents per equivalent Radar share. In the post

balance sheet period, the Company conditionally agreed to sell its

78.2% shareholding in A.F. Philips (Pvt) Ltd ("AFP") for a sum of

US $1.743 million

(35 US cents per equivalent Radar Share) in cash. The sale is

subject to conditions precedent which the Company has reasonable

cause to believe will be met and that the full purchase price will

be realized at the holding Company level.

USD Cash and Cash Equivalents - US dollar cash totalling $1.26

million at the end of FY 2022.

Old Mutual and Nedbank shares - the Company holds 204,047 Old

Mutual Limited common shares that were suspended on the Zimbabwe

Stock Exchange (ZSE) on 31 July 2020 and valued on its FY 2022

Statement of Financial Position at US $122,820 based on the closing

price of Old Mutual Limited on the Johannesburg Stock Exchange

(JSE) at the year end. By way of an unbundling by Old Mutual in

November 2021, the Company received 2,692 Nedbank shares, which are

retained in Zimbabwe.

Goodwill - The Company has a goodwill value of $717,000 on its

Statement of Financial Position relating to its investment in the

Payserv group of Companies. The Company believes this is a fair

assessment of the intangible asset despite the impact of the

decisions made by Zimbabwe`s banking institutions against using its

payment platforms. Turnaround opportunities are being explored and

are more recently evidenced by the granting to Multi-Pay Solutions

(Pvt) Ltd (Multi-Pay Solutions) the exclusive rights to use,

distribute, and operate Paynet Software in the Southern African

Development Community (SADC). Payserv Africa will continue to

operate Paynet outside of the SADC. Tradanet, in which the Company

holds an effective 51% interest, is the largest contributor to the

Company's earnings in FY 2022. Tradanet processes microloans on

behalf of CABS, Zimbabwe's largest Building Society. At their peak

in 2019, these microloans comprised about a third of the banks

assets and the Directors believe that a return to those levels is

fully conceivable. Accordingly, the Company continues to believe

that Payserv's intellectual property value and the amalgamation of

the above exceeds the book value of the goodwill.

Chief Executive's Report

At this point in time, the Company's investment proposition is

underpinned by its realizable Net asset value ("NAV") within the

constructs of Zimbabwe's current economic policy and its outlook.

It is important to consider the components of NAV and efforts by

the Company to ensure that any disposal is realized at the holding

Company level. Investors might find value in examining our estimate

of realizable NAV at US $7.5 million (1.4 US cents per share). Our

estimate draws from the following actual and anticipated

components:

-- Cash : As at the 2022 financial year end, the Group held cash

reserves of US$1.3 million. As at 31 August 2023, in addition to

Zimbabwe-held US dollar-denominated cash, shares and gold coins ,

the Company holds a Fixed Deposit of $1.4 million in Mauritius,

yielding 5% per annum.

-- Commercial Property: This is represented by the prominently

located Mt. Pleasant Business Park Commercial Property valued

annually by Hollands Harare Estate Agents at $2.3 million.

-- Recovery of Legacy Debts : The Company is actively pursuing

the recovery of "Legacy Debts" or "Blocked Funds" owed by our

Zimbabwe subsidiaries to the holding companies. As at 31 August

2023, we've successfully recovered US$407,350, leaving an

outstanding balance of $1.2 million held by the Ministry of

Finance. These funds, initially held by the Reserve Bank in ZWL on

a one-to-one basis with the USD, were marked down to a negligible

value in the FY 2021 accounts based on the official exchange rate.

However, post-FY 2022, the Ministry of Finance began repaying these

debts and assures us of the balance, as funds become available. As

a result, our NAV after the financial year-end will see an

increase, accounting for the recovered debts.

-- Listed Portfolio Value : We aim to realise the value of the

204,047 Old Mutual shares and 2,692 Nedbank shares by transferring

these shares to the South African register. The total value of this

portfolio was

$168,120 based on the Johannesburg Stock Exchange (JSE) closing

price`s as at 11 September 2023. These shares were originally

purchased on the JSE and subsequently transferred to the ZSE.

However, before their fungibility could be realized, trading was

suspended by the Zimbabwean government. We persistently urge the

Government of Zimbabwe to reinstate fungibility and permit foreign

investors to repatriate Old Mutual and Nedbank shares to the

JSE.

-- Sale of Radar : The Company has conditionally agreed to sell

its 78.2% shareholding in A.F. Philips (Pvt) Ltd ("AFP") for a sum

of US $1.74 million in cash. This amount is equivalent to the book

value of its shareholding in AFP at 31 August 2022. The Company

made its initial investment in August 2018, and through the

holding, has an effective 9.74% interest in a property development

and bricks manufacturing business. The sale is subject to

conditions precedent which the Company has reasonable cause to

believe will be met and that the full purchase price will be

realized at the holding company level. The Company will provide a

further update once the sale has completed.

-- Intellectual Property Value : The Board is committed to

deriving maximum value from our intellectual property, both in our

current operations and future endeavours. The Company's Statement

of Financial Position lists a goodwill value of $717,000. Our

assessment is that this represents the baseline value of the

Company's intellectual property, considering Tradanet's historical

profitability and Paynet's potential profits from its proposed

agreement with Multi-Pay

These estimates, culminating in a projected NAV of US $7.5

million, come with the following considerations:

1. Maintenance of stable commercial real estate prices in Harare

and successful sales realization at the holding Company level.

2. Successful completion of the Radar Sale agreement.

3. Repayment of US $1.2 million in Legacy Debts.

4. Effective utilization of intellectual properties for

profit.

5. Resumption of Fungibility of dual-listed shares.

Continuing Operations

Tradanet - As mentioned in the discussion of our goodwill above,

Tradanet, the 51%-owned subsidiary of Paynet Zimbabwe remains the

Company's most profitable operation. With greater reliance on the

US Dollar for remuneration, Tradanet expects its ZWL earnings to

transition to USD.

Other operations: Autopay and Millchem - These companies provide

a modest revenue to the group, primarily in ZWL. Their operations

are beneficial in offsetting local expenses.

Cambria's Board of Directors have continued to serve the Company

without compensation since 2015, fighting to return value to

shareholders. Despite the unfavourable economic factors leading to

the abandonment of parity to the US dollar and its huge impact on

the Company, we hold on jealously to our cash, our liabilities are

negligible, and our remaining operations are profitable. While we

still see value in our listing, the Board is considering whether to

maintain the listing.

With the publishing the Group`s FY 2022 and HY 2023 results, the

suspension of the Company`s shares on the AIM will be lifted. This

should enable shareholders to trade with a comprehensive

understanding of the investment landscape confronting Cambria. At

the time of suspension, Cambria shares were valued at 0.027p,

contrasting with a book NAV of 0.084p and our estimate of 1.35 US

cents per share or 1.04p per share. Shareholders must determine

whether the market has aptly gauged the discount to the Company's

book NAV and management's estimates of realizable NAV, which we are

committed to achieving.

We remain cautiously optimistic about achieving full value for

the Company's assets beyond its NAV.

Samir Shasha

12 September 2023

Report of the Independent Auditors

For the year ended 31 August 2022

Report of the Independent Auditors, Baker Tilly Isle of Man LLC,

to the members of Cambria Africa Plc

OPINION

We have audited the financial statements of Cambria Africa Plc

(the 'Parent company') and its subsidiaries (the 'Group') for the

year ended 31 August 2022 which comprise the Consolidated and

Company Statements of Profit or Loss, the Consolidated and Company

Statements of Comprehensive Income, the Consolidated and Company

Statements of Changes in Equity, the Consolidated and Company

Statements of Financial Position, the Consolidated and Company

Statements of Cash Flows and related notes to the financial

statements, including a summary of significant accounting policies.

The financial reporting framework that has been applied in their

preparation is applicable law and International Financial Reporting

Standards (IFRSs) as adopted by the United Kingdom.

In our opinion the financial statements:

-- give a true and fair view of the state of the Group's and the

Parent Company's affairs as at 31 August 2022, and of the results

for the year then ended; and

-- have been properly prepared in accordance with IFRSs as adopted by the United Kingdom.

--

BASIS FOR OPINION

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

'Auditor's responsibilities for the audit of the financial

statements' section of our report. We are independent of the group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

EMPHASIS OF MATTER

We draw attention to the "Functional and Presentational Currency

and the effect of Hyperinflation" section of Note 2 of the

financial statements which describes the effects of the change in

functional currency of a number of the Group entities and the

subsequent hyperinflationary conditions which have prevailed during

the financial year. Our opinion is not modified in relation to

these matters.

We note the disclosure made by the Directors in relation to the

goodwill value that is recognised in the Consolidated Statement of

Financial Position. We draw attention to Note 12 in relation to

this issue. The model used by management in relation to the

assessment for impairment is based upon the audited financial

statements of Paynet Zimbabwe and Tradanet for the year ended 31

August 2022. If the Group does not achieve the levels of

profitability predicted, then the need for an impairment of this

figure may arise. Our opinion is not modified in relation to this

matter.

CONCLUSIONS RELATING TO GOING CONCERN

We have nothing to report in respect of the following matters in

relation to which the ISAs (UK) require us to report to you

where:

-- the directors' use of the going concern basis of accounting

in the preparation of the financial statements is not appropriate;

or

-- the directors have not disclosed in the financial statements

any identified material uncertainties that may cast significant

doubt about the Group's or the Parent Company's ability to continue

to adopt the going concern basis of accounting for a period of at

least twelve months from the date when the financial statements are

authorised for issue.

OTHER INFORMATION

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact. We

have nothing to report in this regard.

MATTERS ON WHICH WE ARE REQUIRED TO REPORT BY EXCEPTION

In the light of our knowledge and understanding of the Group and

Parent Company and its environment obtained in the course of the

audit, we have not identified material misstatements in the Chief

Executive's Report and the Directors' Report.

RESPONSIBILITIES OF DIRECTORS

As explained more fully in the Directors' Responsibilities

Statement set out on page 6, the directors are responsible for the

preparation of the financial statements and for being satisfied

that they give a true and fair view, and for such internal control

as the directors determine is necessary to enable the preparation

of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the Group's and Parent Company's ability

to continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

Group or the Parent Company or to cease operations, or have no

realistic alternative but to do so.

AUDITOR'S RESPONSIBILITIES FOR THE AUDIT OF THE FINANCIAL

STATEMENTS

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists.

Misstatements can arise from fraud or error and are considered

material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users

taken on the basis of these financial statements.

As part of an audit in accordance with ISAs (UK), we exercise

professional judgment and maintain professional scepticism

throughout the audit. We also:

-- Identify and assess the risks of material misstatement of the

financial statements, whether due to fraud or error, design and

perform audit procedures responsive to those risks, and obtain

audit evidence that is sufficient and appropriate to provide a

basis for our opinion. The risk of not detecting a material

misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional

omissions, misrepresentations, or the override of internal

control.

-- Obtain an understanding of internal control relevant to the

audit in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the Group's internal control.

-- Evaluate the appropriateness of accounting policies used and

the reasonableness of accounting estimates and related disclosures

made by the directors.

-- Conclude on the appropriateness of the directors' use of the

going concern basis of accounting and, based on the audit evidence

obtained, whether a material uncertainty exists related to events

or conditions that may cast significant doubt on the Group's and

the Parent Company's ability to continue as a going concern. If we

conclude that a material uncertainty exists, we are required to

draw attention in our auditor's report to the related disclosures

in the financial statements or, if such disclosures are inadequate,

to modify our opinion. Our conclusions are based on the audit

evidence obtained up to the date of our auditor's report. However,

future events or conditions may cause the Group to cease to

continue as a going concern.

-- Evaluate the overall presentation, structure and content of

the financial statements, including the disclosures, and whether

the financial statements represent the underlying transactions and

events in a manner that achieves fair presentation.

-- Obtain sufficient appropriate audit evidence regarding the

financial information of the entities or business activities within

the Group to express an opinion on the consolidated financial

statements. We are responsible for the direction, supervision and

performance of the group audit. We remain solely responsible for

our audit opinion.

We communicate with those charged with governance regarding,

among other matters, the planned scope and timing of the audit and

significant audit findings, including any significant deficiencies

in internal control that we identify during our audit.

CAPABILITY OF THE AUDIT IN DETECTING IRREGULARITIES, INCLUDING

FRAUD

Our approach to identifying and assessing the risks of material

misstatement in respect of irregularities, including fraud and

non-compliance with laws and regulations, was as follows:

-- we identified the laws and regulations applicable to the

Company through discussions with Directors and other management,

and from our commercial knowledge and experience of the sector;

-- we made specific requests of component auditors within the

Group to determine their approach to detecting irregularities,

including fraud and non-compliance with laws and regulations, and

considered their findings as part of our approach;

-- we focused on specific laws and regulations which we

considered may have a direct material effect on the financial

statements or the operations of the Company, including company law,

taxation legislation, anti-bribery, environmental and health and

safety legislation;

-- we assessed the extent of compliance with the laws and

regulations identified above through making enquiries of management

and inspecting legal correspondence; and

-- identified laws and regulations were communicated within the

audit team regularly and the team remained alert to instances of

non-compliance throughout the audit.

We assessed the susceptibility of the Company's financial

statements to material misstatement, including obtaining an

understanding of how fraud might occur, by:

-- making enquiries of management as to where they considered

there was susceptibility to fraud, their knowledge of actual,

suspected and alleged fraud;

-- considering the internal controls in place to mitigate risks

of fraud and non-compliance with laws and regulations; and

-- understanding the design of the Company's remuneration policies.

To address the risk of fraud through management bias and

override of controls, we:

-- performed analytical procedures to identify any unusual or unexpected relationships;

-- we tested journal entries to identify unusual transactions;

-- assessed whether judgements and assumptions made in

determining the accounting estimates were indicative of potential

bias; and

-- investigated the rationale behind significant or unusual transactions.

In response to the risk of irregularities and non-compliance

with laws and regulations, we designed procedures which included,

but were not limited to:

-- agreeing financial statement disclosures to underlying supporting documentation;

-- reading the minutes of meetings of those charged with governance;

-- enquiring of management as to actual and potential litigation and claims; and

-- reviewing correspondence with tax authorities, relevant

regulators and the company's legal advisors.

There are inherent limitations in our audit procedures described

above. The more removed that laws and regulations are from

financial transactions, the less likely it is that we would become

aware of non-compliance. Auditing standards also limit the audit

procedures required to identify non-compliance with laws and

regulations to enquiry of the Directors and other management and

the inspection of regulatory and legal correspondence, if any.

Material misstatements that arise due to fraud can be harder to

detect than those that arise from error as they may involve

deliberate concealment or collusion.

USE OF OUR REPORT

This report is made solely to the Company's members, as a body,

in accordance with the terms of our engagement letter dated 21

January 2021. Our audit work has been undertaken so that we might

state to the Company's members those matters we are required to

state to them in an auditor's report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company and the Company's

members as a body, for our audit work, for this report, or for the

opinions we have formed.

BAKER TILLY ISLE OF MAN LLC, CHARTERED ACCOUNTANTS,

2A LORD STREET, DOUGLAS, ISLE OF MAN, IM1 2BD

12 SEPTEMBER 2023

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Contacts

Cambria Africa Plc www.cambriaafrica.com

Samir Shasha +44 (0)20 3287 8814

WH Ireland Limited https://www.whirelandplc.com/

James Joyce / Sarah Mather +44 (0) 20 7220 1666

Cambria Africa Plc

Audited consolidated income statement

For the year ended 31 August 2022

Audited Audited

31-Aug-22 31-Aug-21

US$'000 US$'000

--------------------------------------- ---------- ----------------

Revenue 920 1,216

Cost of sales (22) (138)

--------------------------------------- ---------- ----------------

Gross profit 898 1,078

Operating costs (623) (838)

Other income 69 79

Exceptionals (212) (21)

--------------------------------------- ---------- ----------------

Operating P rofit 132 298

Finance income 12 -

Finance costs (5) (22)

--------------------------------------- ---------- ----------------

Net finance income/(costs) 7 (22)

--------------------------------------- ---------- ----------------

P rofit before tax 139 276

Income tax (144) (95)

--------------------------------------- ---------- ----------------

(Loss)/profit for the year (5) 181

======================================= ========== ================

Attributable to:

Owners of the company (178) 82

Non-controlling Interests 173 99

--------------------------------------- ---------- ----------------

(Loss)/profit for the year (5) 181

======================================= ========== ================

(Loss)/Earnings per share

Basic and diluted (loss)/earnings per

share (cents) (0.03c) 0.02c

(Loss)/Earnings per share - continuing

operations

Basic and diluted (loss)/earnings per

share (cents) (0.03c) 0.02c

Weighted average number of shares 544,576 544,576

Cambria Africa Plc

Audited consolidated statement of comprehensive

income

For the year ended 31 August 2022

---------------------------------------------------------------------------- -----------------------------------------------

Audited

Audited 31-Aug- 31-Aug-

22 21

US$'000 US$'000

---------------------------------------------------------------------------- ---------------- -----------------------------

(Loss)/profit for the year (5) 181

Other comprehensive income

Items that will not be reclassified to Statement

of Profit or Loss:

Increase in investment in subsidiary - impact

on equity - -

Foreign currency translation differences for

overseas operations (424) (4)

---------------------------------------------------------------------------- ---------------- -----------------------------

Total comprehensive (loss)/ profit for the year (429) 177

============================================================================ ================ =============================

Attributable to:

Owners of the company (602) 78

Non-controlling interest 173 99

---------------------------------------------------------------------------- ---------------- -----------------------------

Total comprehensive (loss)/profit for the year (429) 177

============================================================================ ================ =============================

Cambria Africa Plc

Audited consolidated statement of changes in

equity

For the year ended 31 August 2022

Foreign

Share Share Revaluation exchange Accumulated Non-Controlling

US$000 Capital premium reserve reserve losses NDR Total interests Total

----------------- -------- -------- ----------- --------- ----------- ------- ------- ----------------- ------------

Balance at 1

September (10,7

2021 77 88,459 (190) 34 ) (73,666) 2,371 6,317 477 6,794

-------- -------- ----------- --------- ------------ ------- ------- ----------------- ----------

(Loss)/Profit for

the

year - - - - (178) - (178) 173 (5)

Increase in

investment

in subsidiary -

Foreign currency

translation

differences

for overseas

operations - - - (424) - - (424) - (424)

Foreign currency

translation

differences for

overseas

operations - NCI - - - 30 - 30 (30) -

-------- -------- ----------- --------- ------------ ------- ------- ----------------- ----------

Total

comprehensive

income for the

year 77 88,459 (190) (11,128) (73,844) 2,371 5,745 620 6,365

Contributions

by/distributions

to owners of

the Company

recognised

directly in

equity

Dividends paid to

minorities - - - - - - - (195) (195)

-------- -------- ----------- --------- ------------ ------- ------- ----------------- ----------

Total

contributions

by and

distributions

to owners of the

Company - - - - - - - (195) (195)

----------------- -------- -------- ----------- --------- ------------ ------- ------- ----------------- ----------

Balance at 31

August

2022 77 88,459 (190) (11,128) (73,844) 2,371 5,745 425 6,170

================= ======== ======== =========== ========= ============ ======= ======= ================= ==========

Foreign

Share Share Revaluation exchange Accumulated Non-Controlling

US$000 Capital premium reserve reserve losses NDR Total interests Total

----------------- -------- -------- ----------- -------- ----------- ------- ----- ----------------- ------------

Balance at 1

September (10,7 6,4

2020 77 88,459 - 36 ) (73,748) 2,371 23 496 6,919

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Profit for the

year - - - - 82 - 82 99 181

Increase in

investment

in subsidiary -

Revaluation of

investment

property held at

fair

value (190) (190) (190)

Foreign currency

translation

differences

for overseas

operations - - - (4) - - (4) - (4)

Foreign currency

translation

differences for

overseas

operations - NCI - - - 6 - 6 (6) -

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Total

comprehensive

income for the

year 77 88,459 (190) (10,734) (73,666) 2,371 6,317 589 6,906

Contributions

by/distributions

to owners of

the Company

recognised

directly in

equity

Dividends paid to

minorities - - - - - - - (112) (112)

-------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Total

contributions

by and

distributions

to owners of the

Company - - - - - - - (112) (112)

----------------- -------- -------- ----------- -------- ------------ ------- ----- ----------------- ----------

Balance at 31

August

2021 77 88,459 (190) (10,734) (73,666) 2,371 6,317 477 6,794

================= ======== ======== =========== ======== ============ ======= ===== ================= ==========

Cambria Africa Plc

Audited consolidated Statement of Financial Position

As at 31 August 2022

Audited Audited

Group Group

31-Aug-22 31-Aug-21

US$'000 US$'000

Restated

-------------------------------- ---------- ----------

Property, plant and equipment 2306 2,317

Goodwill 717 717

Intangible assets - 1

Investments in subsidiaries - -

and investments at f air v

alue

Financial assets at fair value

through profit and loss 155 184

----------------------------------- ---------- ----------

Total non-current assets 3,178 3,219

----------------------------------- ---------- ----------

Inventories 8 158

Financial assets at fair value

through profit and loss 28 75

Trade and other receivables 142 155

Cash and cash equivalents 1,263 1,656

----------------------------------- ---------- ----------

Total current assets 1,441 2,044

----------------------------------- ---------- ----------

Assets classified as held

for sale 2,228 2,228

----------------------------------- ---------- ----------

Total assets 6,847 7,491

=================================== ========== ==========

Equity

Issued share capital 77 77

Share premium account 88,459 88,459

Revaluation reserve (190) (190)

Foreign exchange reserve (11,128) (10,734)

Non-distributable reserves 2,371 2,371

Accumulated losses (73,844) (73,666)

----------------------------------- ---------- ----------

Equity attributable to owners

of the company 5,745 6,317

Non-controlling interests 425 477

----------------------------------- ---------- ----------

Total equity 6,170 6,794

=================================== ========== ==========

Liabilities

Loans and b orrowings - -

Trade and other payables - 90

Provisions - -

Deferred tax liabilities 188 189

----------------------------------- ---------- ----------

Total non-current liabilities 188 279

----------------------------------- ---------- ----------

Current tax liabilities 141 107

Loans and borrowings - 101

Trade and other payables 348 210

----------------------------------- ---------- ----------

Liabilities directly associated

with assets classified as held - -

for sale

-------------------------------- ---------- ----------

Total current liabilities 489 418

----------------------------------- ---------- ----------

Total liabilities 677 697

=================================== ========== ==========

Total equity and liabilities 6,847 7,491

=================================== ========== ==========

Cambria Africa Plc

Audited consolidated statement of cash flows

As at 31 August 2022

Audited Audited

31-Aug-22 31-Aug-21

US$'000 US$'000

----------------------------------------------- ------------ ----------

Cash generated from operations 495 202

Taxation paid (111) (31)

------------------------------------------------ ------------ ----------

Cash generated from operating activities 384 171

------------------------------------------------ ------------ ----------

Cash flows from investing activities

Proceeds on disposal of property, plant

and equipment 17 134

Purchase of property, plant and equipment (6) -

Interest received 12 -

Non-cash proceeds from scrip dividend (33) -

------------------------------------------------ ------------ ----------

Net cash (utilized in)/ generated by investing

activities (10) 134

------------------------------------------------ ------------ ----------

Cash flows from financing activities

Dividends paid to non-controlling interests (195) (112)

Interest paid (5) (22)

Loans repaid (100) (407)

Net cash utilized by financing activities (300) (541)

------------------------------------------------ ------------ ----------

Net decrease in cash and cash equivalents 74 (236)

Cash and cash equivalents at the beginning

of the Period 1,656 1,896

Foreign exchange (467) (4)

------------------------------------------------ ------------ ----------

Net cash and cash equivalents at 31 August 1 ,263 1 ,656

================================================ ============ ==========

Cash and cash equivalents as above comprise

the following

Cash and cash equivalents attributable

to continuing operations 1, 263 1, 656

------------------------------------------------ ------------ ----------

Net cash and cash equivalents at 31 August 1,263 1,656

================================================ ============ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKQBPPBKDBCD

(END) Dow Jones Newswires

September 14, 2023 12:00 ET (16:00 GMT)

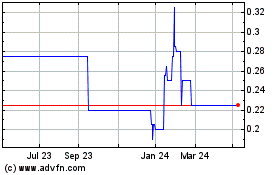

Cambria Africa (LSE:CMB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cambria Africa (LSE:CMB)

Historical Stock Chart

From Jan 2024 to Jan 2025