TIDMHOTC

RNS Number : 6858A

Hotel Chocolat Group PLC

24 January 2024

24 January 2024

Hotel Chocolat Group plc

(" Hotel Chocolat ", the "Company" or the "Group")

Director/PDMR Dealing - Exercise of Options

The Company announces that options ("Options") over 2,966,984

ordinary shares of 0.1p in the Company ("Ordinary Shares") have

been exercised pursuant to the Hotel Chocolat Group plc 2016 Long

Term Incentive Plan (the "Plan"). The Options were subject to an

exercise price of 0.1 pence per Ordinary Share.

Certain of the Options have been exercised by persons

discharging managerial responsibilities ("PDMRs"), as set out

below:

PDMR / Director No. of Shares covered by Options exercised

under the Plan

Jonathan Akehurst (Chief

Financial Officer) 416,667

-------------------------------------------

Peter Harris (Development

Director and Co-founder) 166,667

-------------------------------------------

Angus Thirlwell (Chief

Executive Officer and

Co-founder) 525,000

-------------------------------------------

The Company also announces that options over a further 210,865

Ordinary Shares have been exercised pursuant to the Hotel Chocolat

Group plc 2016 Save As You Earn Plan and Hotel Chocolat Group plc

2022 Restricted Stock Plan. None of the options exercised under

these plans were held by PDMRs.

The exercises of options under all the Company's share plans

were effective upon sanction of the Scheme of Arrangement, pursuant

to which all the Ordinary Shares in issue and to be issued are to

be acquired by Hive Bidco, Inc, a wholly-owned subsidiary of Mars

Incorporated. The Ordinary Shares issued pursuant to these option

exercises will be acquired for cash under the terms of the

Scheme.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name 1. Jonathan Akehurst

2. Peter Harris

3. Angus Thirlwell

-------------------------- --------------------------------------------

Reason for the notification

2

------------------------------------------------------------------------

a) Position/status 1. Chief Financial Officer

2. Development Director and Co-founder

3. Chief Executive Officer and Co-founder

-------------------------- --------------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- --------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name Hotel Chocolat Group plc

-------------------------- --------------------------------------------

b) LEI 213800B4D3J15PZHVY29

-------------------------- --------------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------

a) Description of the

financial instrument, Options over Ordinary shares of 0.1

type of instrument pence each

Identification code ISIN: GB00BYZC3B04

-------------------------- --------------------------------------------

b) Nature of the transaction Exercise of options pursuant to the

Hotel Chocolat Group plc 2016 Long

Term Incentive Plan

-------------------------- --------------------------------------------

c) Price(s) and volume(s) Name Price(s) Volume(s)

Jonathan

Akehurst 0.1 pence 416,667

----------- ----------

Peter Harris 0.1 pence 166,667

----------- ----------

Angus Thirlwell 0.1 pence 525,000

----------- ----------

-------------------------- --------------------------------------------

d) Aggregated information

N/A

- Aggregated volume

- Price

-------------------------- --------------------------------------------

e) Date of the transaction 23 January 2024

-------------------------- --------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- --------------------------------------------

Enquiries

Bidco and Mars

Fabiano Lima, Global VP of Corporate Affairs,

Mars Snacking

Denise Young, Global VP of Corporate Communications, +1 (312) 794

Mars 6200

Morgan Stanley (Financial Adviser to Bidco

and Mars)

Laurence Hopkins

Imran Ansari

Mae Wang +44 (0)20 7425

Stuart Wright 8000

Brunswick (Public Relations Adviser to Bidco

and Mars)

Max McGahan

Rosie Oddy +44 (0)20 7404

James Baker 5959

Hotel Chocolat

Angus Thirlwell, Co-Founder and CEO +44 (0)1763

Jonathan Akehurst, Chief Financial Officer 257 746

Lazard (Lead Financial Adviser and Rule 3

Adviser to Hotel Chocolat)

William Lawes

Davin Staats

Fariza Steel +44 (0)20 7187

Adam Blin 2000

Liberum (Co-Financial Adviser, Nominated

Adviser and Corporate Broker to Hotel Chocolat)

Dru Danford

Tim Medak

Ed Thomas +44 (0)20 3100

Matt Hogg 2000

Citigate Dewe Rogerson (Financial Communications

Adviser to Hotel Chocolat)

Angharad Couch

Ellen Wilton +44 (0)20 7638

Alex Winch 9571

Freshfields Bruckhaus Deringer LLP is acting as legal adviser to

Bidco and Mars in connection with the Acquisition. Herbert Smith

Freehills LLP is acting as legal adviser to Hotel Chocolat in

connection with the Acquisition.

Important notices

This announcement is for information purposes only and is not

intended to, and does not, constitute, or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of, any

securities or the solicitation of any vote or approval in any

jurisdiction pursuant to the Acquisition or otherwise, nor shall

there be any sale, issuance or transfer of securities of Hotel

Chocolat in any jurisdiction in contravention of applicable law.

The Acquisition will be implemented solely pursuant to the terms of

the Scheme Document (or, if the Acquisition is implemented by way

of a Takeover Offer, the offer document), which will contain the

full terms and conditions of the Acquisition, including details of

how to vote in respect of the Acquisition. Any vote in respect of

the Scheme or other response in relation to the Acquisition should

be made only on the basis of the information contained in the

Scheme Document (or, if the Acquisition is implemented by way of a

Takeover Offer, the offer document).

This announcement does not constitute a prospectus, prospectus

equivalent document or exempted document.

If you are in any doubt about the contents of this announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your stockbroker,

bank manager, solicitor, accountant or independent financial

adviser duly authorised under the Financial Services and Markets

Act 2000 (as amended) if you are resident in the United Kingdom or,

if not, from another appropriately authorised independent financial

adviser.

Notices related to financial advisers

Morgan Stanley, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting exclusively as financial adviser to Bidco and Mars and no

one else in connection with the matters contained in this

announcement and Morgan Stanley, its affiliates and their

respective directors, officers, employees and agents will not

regard any other person as their client, nor will they be

responsible to anyone other than Bidco and Mars for providing the

protections afforded to clients of Morgan Stanley nor for providing

advice in connection with the matters contained in this

announcement or any other matter referred to herein.

Lazard & Co., Limited, which is authorised and regulated in

the United Kingdom by the Financial Conduct Authority ("FCA"), is

acting exclusively as lead financial adviser and Rule 3 adviser to

Hotel Chocolat and no one else in connection with the matters

described in this announcement and will not be responsible to

anyone other than Hotel Chocolat for providing the protections

afforded to clients of Lazard nor for providing advice in relation

to the contents of this announcement or any other matter or

arrangement referred to herein. Neither Lazard nor any of its

affiliates (nor their respective directors, officers, employees or

agents) owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Lazard in connection with this announcement, any matter,

arrangement or statement contained or referred to herein or

otherwise.

Liberum, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting exclusively for

Hotel Chocolat and for no one else in connection with the subject

matter of this announcement and will not be responsible to anyone

other than Hotel Chocolat for providing the protections afforded to

its clients or for providing advice in connection with the subject

matter of this announcement. Neither Liberum nor any of its

affiliates (nor their respective directors, officers, employees or

agents) owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Liberum in connection with the Acquisition, this announcement,

any statement contained herein or otherwise. No representation or

warranty, express or implied, is made by Liberum as to the contents

of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHSEFEFDELSEDF

(END) Dow Jones Newswires

January 24, 2024 02:01 ET (07:01 GMT)

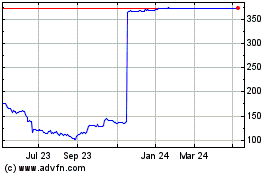

Hotel Chocolat (LSE:HOTC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hotel Chocolat (LSE:HOTC)

Historical Stock Chart

From Mar 2024 to Mar 2025