TIDMITS

RNS Number : 8805G

Itsarm PLC

24 July 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF THE MARKET ABUSE REGULATION (EU)

596/2014 WHICH IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018

24 July 2023

Itsarm plc

Proposed Board Changes

Proposed withdrawal of the winding-up petition

Itsarm plc ("Itsarm" or the "Company") today announces that its

board of directors (the "Board") has entered into various

conditional agreements which together form a proposal (the

"Proposal") that gives the Company a viable alternative to the

proposed compulsory liquidation announced by the Company on 5 June

2023.

The Proposal allows for Itsarm to continue as a solvent company

conditional on the winding-up petition in respect of the Company

presented on 5 June 2023 (the "Winding-up Petition") being

withdrawn and/or dismissed at the scheduled court hearing on 26

July 2023, or by no later than 31 July 2023 (the "Withdrawal").

Conditional on the Withdrawal, binding agreements to effect the

following actions have been entered into:

-- David Craven and Jean-Paul Rohan (the "Proposed Directors")

will be appointed to the Board as Directors with effect from the

Withdrawal. The Proposed Directors have agreed to take up their

positions for annual remuneration of GBP1 each until further

notice. Brief biographies for the Proposed Directors are included

in the Appendix to this announcement and the information required

to be disclosed for the purposes of Schedule 2(g) of the AIM Rules

for Companies will be included in a subsequent announcement if and

when their appointments to the board come into effect.

-- James Sharp and Richard Monaghan (the "Current Directors")

will resign as Directors of the Company with effect from the

Withdrawal, immediately following the appointment of the Proposed

Directors. The Current Directors have both agreed to waive their

payments in lieu of notice along with their unpaid fees for July

2023.

The Proposal significantly reduces the Company's liabilities,

contingent liabilities and ongoing costs resulting in the Company

becoming solvent in the view of the Current Directors. As a result,

the Current Directors will provide a witness statement to the court

hearing on 26 July 2023 requesting that the Winding-up Petition be

withdrawn or dismissed.

As at 20 July 2023, the Company had cash of approximately

GBP223,000. The Proposal which includes the waiving of certain

Current Directors' fees, significantly reduces the Company's

liabilities and contingent liabilities to circa GBP140,000, all of

which will be settled as soon as reasonably practicable on the

Withdrawal.

AIM Rule 15 cash shell status

Subject to the Withdrawal, the Proposed Directors intend to

enter into an acquisition or acquisitions which would constitute a

reverse takeover under Rule 14 of the AIM Rules for Companies (the

"AIM Rules"). At this time there is no certainty as to the exact

structure, identity or timing of such a transaction(s) but the

Proposed Directors are assessing a number of potential

opportunities.

The Company has been an AIM Rule 15 cash shell since the

disposal of its trading business on 27 March 2023. If the Company

is unable to enter into a transaction which qualifies as an AIM

Rule 14 transaction by 27 September 2023, the Company's Ordinary

Shares will be suspended from trading on AIM, pursuant to Rule 40

of the AIM Rules. Admission to trading on AIM would then be

cancelled six months from the date of suspension.

Court hearing timetable

Further to the timetable published by the Company on 15 June

2023, the Company announces the following updated timetable in

respect of the Company's court hearing of the Winding-up Petition

on 26 July 2023.

7.30 a.m. on 26 July 2023 Trading in ordinary shares of Itsarm

plc suspended from trading, pending the outcome of the court

hearing

10.30 a.m. on 26 July 2023 Court hearing of the Winding-up

Petition at the Business and Property Courts of England and Wales,

7 Rolls Building, Fetter Lane, London EC4A 1NL.

In the unexpected event that the court rejects the request for

withdrawal and/or dismissal and thereby approves the Winding-up

Petition and makes the winding-up order, the Official Receiver of

the Insolvency Service will be appointed to act as liquidator with

immediate effect.

Subject to the discretion of the court, it is expected that the

court will order the withdrawal and/or dismissal of the Winding-up

Petition. In this scenario the Company will continue as a going

concern, the restoration of trading in the ordinary shares of the

Company will be announced as soon as practicable (probably

intraday) and the Proposal will come into effect immediately.

7.00 a.m. on 27 July 2023 If the court approves the Winding-up

Petition and makes the winding-up order, cancellation of the

Company's ordinary shares from trading on AIM will become effective

as previously disclosed

As soon as practicable after the court hearing on 26 July 2023

the Company will make a further announcement, as appropriate.

Enquiries:

Itsarm plc Via Hudson Sandler

Jim Sharp, Chairman

Rich Monaghan, Chief Financial Officer

Hudson Sandler +44 (0)20 7796 4133

Alex Brennan itsarm@hudsonsandler.com

Ben Wilson

Liberum Capital Limited (Nomad and Broker) +44 (0)20 3100 2000

Clayton Bush

Scott Mathieson

Miquela Bezuidenhoudt

APPENDIX

David Craven

David is an experienced board level executive who has been

involved in the expansion and successful exits of many recognised

groups.

He has significant and broad commercial experience, having held

senior executive roles with News Corporation, UPC Media, BT, Sky

and Allwyn. David was joint MD of the Tote, the Government

statutory betting monopoly for six years, driving its privatisation

and has held senior executive roles at UK Betting Plc and Wembley

Plc. David was a co-founder of broadband and interactive TV media

group UPC Chello which was floated in 1999 at a valuation of c.$1

billion.

David managed a portfolio of investments for the Tavistock Group

delivering significant returns through his Chairmanship of Turf TV

and asset-backed lender, the Ultimate Finance Group. He was

appointed CEO of DCD Media Plc in November 2012 and Executive

Chairman in January 2013 and successfully sold the business in

2021. As Chief Executive Officer of Allwyn, David recently led the

company in its successful bid to operate the UK Fourth National

Lottery Licence and the subsequent buyout of incumbent operator

Camelot following an extensive bidding process.

Jean-Paul Rohan

Jean-Paul Rohan is a highly experienced commercial and business

development specialist, with hands-on executive experience of

building businesses in sports, media, games, wireless, broadband

and digital TV markets on a European and global basis.

He specialises in the commercial exploitation of brands across

digital and real-world mediums including games, internet, mobile

platforms and digital television, focusing on e-commerce and

digital retailing.

As an independent consultant, Jean-Paul has helped numerous

companies to commercialise and deliver their commerce services to

mobile devices, PCs and interactive TV, working closely with

content owners to exploit their intellectual property right and

drive new revenues from end users.

Jean-Paul has held senior positions and been a founder of a

number of successful businesses including NetChannel, the first

company in the UK to deliver internet access and interactive

services to TV sets via set top boxes, and UPC Chello, a broadband

and interactive TV media group. He was previously a non-executive

Director of AIM listed DCD Media Plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDZGZNGFNGFZZ

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

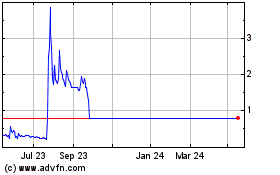

Itsarm (LSE:ITS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Itsarm (LSE:ITS)

Historical Stock Chart

From Jan 2024 to Jan 2025