TIDMMPH

Mereo BioPharma Group plc

30 November 2020

Mereo BioPharma Reminds Market of Key Dates for AIM

Delisting

London and Redwood City, Calif., November 30, 2020 - Mereo

BioPharma Group plc (NASDAQ: MREO, AIM: MPH) ("Mereo" or "the

Company"), a clinical stage biopharmaceutical company focused on

oncology and rare diseases, provides a reminder of the key

deadlines in relation to the conversion of Ordinary Shares into

ADSs, as part of the previously announced delisting from AIM.

As previously announced on November 11, 2020, the last day of

trading of the Company's Ordinary Shares on AIM will be Thursday

December 17, 2020 and the proposed AIM Delisting will be effective

from 7.00am London time on Friday December 18, 2020. The Company

will retain the listing of its ADSs on NASDAQ under ticker symbol

MREO. Following the AIM Delisting, shares will only be tradeable on

NASDAQ.

Further information about the process to convert Ordinary Shares

into ADSs was provided in the announcement and circular published

by the Company on November 11, 2020. The information, forms and

contacts at the Company's registrar, Link Group (in respect of

completion of the block transfer participation request form for

certificated holders), and the Company's ADS depositary, Citibank

(in respect of the conversion by CREST holders of Ordinary Shares

to ADSs), are included on Mereo's website at

www.mereobiopharma.com/AIM-Delisting

The deadlines for conversion of Ordinary Shares held in either

certificated form or in CREST are as follows:

Last date for receipt by Link 4 December 2020 at 11.00 a.m.

Group from certificated shareholders London time

of duly completed block transfer

participation request forms and

original share certificates

Last date for receipt by Citibank 9 December 2020 at 3.00 p.m.

from CREST holders of duly completed London time

issuance forms

------------------------------

Shareholders who elect to convert their Ordinary Shares into

ADSs prior to the AIM Delisting will not incur a UK stamp duty, or

stamp duty reserve tax ("SDRT"), charge. However, it is expected

that shareholders who elect to convert their Ordinary Shares into

ADSs following the AIM Delisting will incur a stamp duty, or SDRT,

charge, at a rate of 1.5 per cent. of the market value of the

Ordinary Shares being converted, to the UK taxation authority,

HMRC.

Capitalized terms used but not defined in this announcement are

the same as those included in the announcement made on November 11,

2020.

About Mereo BioPharma

Mereo BioPharma is a biopharmaceutical company focused on the

development and commercialization of innovative therapeutics that

aim to improve outcomes for oncology and rare diseases. Mereo's

lead oncology product candidate, etigilimab (Anti-TIGIT), has

completed a Phase 1a dose escalation clinical trial in patients

with advanced solid tumors and has been evaluated in a Phase 1b

study in combination with nivolumab in select tumor types. The

company recently announced initiation of a Phase 1b/2 study of

etigilimab in combination with an anti-PD-1/PDL-1 in a range of

different tumor types. Mereo's rare disease product portfolio

consists of setrusumab, which has completed a Phase 2b dose-ranging

study in adults with osteogenesis imperfecta (OI), as well as

alvelestat, which is being investigated in a Phase 2

proof-of-concept clinical trial in patients with alpha-1

antitrypsin deficiency (AATD) and in a Phase 1b/2 clinical trial in

COVID-19 respiratory disease.

Forward-Looking Statements

This Announcement contains "forward-looking statements." All

statements other than statements of historical fact contained in

this Announcement are forward-looking statements within the meaning

of Section 27A of the United States Securities Act of 1933, as

amended and Section 21E of the United States Securities Exchange

Act of 1934, as amended. Forward-looking statements usually relate

to future events and anticipated revenues, earnings, cash flows or

other aspects of our operations or operating results.

Forward-looking statements are often identified by the words

"believe," "expect," "anticipate," "plan," "intend," "foresee,"

"should," "would," "could," "may," "estimate," "outlook" and

similar expressions, including the negative thereof. The absence of

these words, however, does not mean that the statements are not

forward-looking. These forward-looking statements are based on the

Company's current expectations, beliefs and assumptions concerning

future developments and business conditions and their potential

effect on the Company. While management believes that these

forward-looking statements are reasonable as and when made, there

can be no assurance that future developments affecting the Company

will be those that it anticipates.

All of the Company's forward-looking statements involve known

and unknown risks and uncertainties some of which are significant

or beyond its control and involve assumptions that could cause

actual results to differ materially from the Company's historical

experience and its present expectations or projections.

These forward-looking statements are subject to risks and

uncertainties, including, among other things, those described in

the Company's latest Annual Report on Form 20-F, Reports on Form

6-K and other documents filed from time to time by the Company with

the United States Securities and Exchange Commission. The Company

wishes to caution investors not to place undue reliance on any

forward-looking statements, which speak only as of the date hereof.

The Company undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except to the extent

required by law.

Mereo BioPharma Contacts:

Mereo +44 (0)333 023 7300

Denise Scots-Knight, Chief Executive Officer

N+1 Singer (Nominated Adviser and Broker

to Mereo) +44 (0)20 7496 3081

Phil Davies

Will Goode

Burns McClellan (US Investor Relations

Adviser to Mereo) +01 212 213 0006

Lisa Burns

Lee Roth

FTI Consulting (UK Public Relations Adviser

to Mereo) +44 (0)20 3727 1000

Simon Conway

Ciara Martin

Investors investors@mereobiopharma.com

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABUBDBDDDDGGC

(END) Dow Jones Newswires

November 30, 2020 02:00 ET (07:00 GMT)

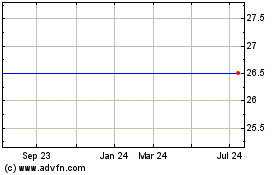

Mereo Biopharma (LSE:MPH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mereo Biopharma (LSE:MPH)

Historical Stock Chart

From Dec 2023 to Dec 2024