Pan African Resources Plc - Director/PDMR Shareholding

July 02 2024 - 9:45AM

UK Regulatory

Pan African Resources Plc - Director/PDMR

Shareholding

PR Newswire

LONDON, United Kingdom, July 02

|

Pan

African Resources PLC

(Incorporated

and registered in England and Wales under the Companies Act 1985

with registered number 3937466 on 25 February 2000)

Share code

on AIM: PAF

Share code

on JSE: PAN

ISIN:

GB0004300496

ADR ticker

code: PAFRY

(“Pan

African Resources” or the “Company”)

|

Pan

African Resources Funding Company Limited

Incorporated

in the Republic of South Africa with limited liability

Registration

number: 2012/021237/06

Alpha

code: PARI

|

DIRECTOR’S

DEALINGS IN SECURITIES

DEALING

NOTIFICATION FORM

FOR

USE BY PERSONS DISCHARGING MANAGERIAL RESPONSIBILITY AND THEIR

CLOSELY ASSOCIATED PERSONS

The

Company announces that it has received notification that on

28 June 2024, the Finance Director

Deon Louw, entered into the

following transactions:

-

The

transfer of 2 000

000 ordinary

shares from Figit (Pty) Ltd, an entity associated with Deon Louw, into his own name

-

Collar

transaction for 2,000,000 ordinary shares of 1p each in Pan African

Resources

-

The

advance of a loan of ZAR

11,122,505.00 for a term of 1 year with 2,000,000 shares

pledged as security for the loan and the dividend on these secured

shares sacrificed for the loan’s tenure.

Following

these transactions, which is detailed in the PDMR Notification

Dealing Form below, Mr Louw has an indirect beneficial interest of

245,209 ordinary shares, representing 0.0110% of the Company's

issued share capital and a direct beneficial interest of 4,728,254

ordinary shares, representing 0.2127% of the Company's issued share

capital.

Whereas

the announcement on dealings by the Financial Director Deon Louw, dated 10 May

2024, made reference to the transfer of 2,000,000 shares

from Figit (Pty) Ltd into his own name, the actual amount of shares

transferred was only 877,140 shares, as he already held 1,122,860

shares in his own name at that time.

The below

information and notification are made in accordance with the EU

Market Abuse Regulation and the JSE Listings

Requirements.

|

1.

|

Details

of the person discharging managerial responsibilities/person

closely associated

|

|

|

a)

|

Name:

|

Deon

Louw

|

|

2.

|

Reason

for the notification

|

|

|

a)

|

Position/status:

|

Finance

Director

|

|

b)

|

Initial

notification/Amendment:

|

Initial

notification

|

|

3.

|

Details

of the issuer, emission allowance market participant, auction

platform, auctioneer or auction monitor

|

|

|

a)

|

Company

name:

|

Pan

African Resources PLC

|

|

b)

|

LEI:

|

213800EAXURCXMX6RL85

|

|

4.

|

Details

of the transaction(s): section to be repeated for (i) each type of

instrument; (ii) each type of transaction; (iii) each date; and

(iv) each place where transactions have been

conducted

|

|

|

a)

|

Description

of the financial instrument, type of instrument:

|

Ordinary

shares of 1p each

Identification

code: GB0004300496

|

|

b)

|

Nature of

the transaction:

|

Trade 1:

Transfer

Trade 2:

Collar structure

Trade 3:

Security for loan

|

|

c)

|

Price(s)

and volume(s):

|

Trade 1:

Transfer 2,000,000 ordinary shares for nil consideration

Trade 2:

Collar structure over 2,000,000 shares. Put option strike price

(bought) ZA607 cents per share and call option strike price (sold)

ZA 698 cents per share for 2,000,000 shares.

Trade 3:

Pledged 2,000,000

shares with a dividend sacrifice as security for a 1 year term loan

of ZAR 11,122,505.00

|

|

d)

|

Aggregated

information:

|

Trade 1:

Transfer 2,000,000 ordinary shares for nil consideration

Trade 2:

Collar structure over 2,000,000 shares

Trade 3:

Loan amount ZAR11,122,505

|

|

e)

|

Dates of

the transaction:

|

28 June

2024

|

|

f)

|

Place of

the transaction:

|

Johannesburg

Stock Exchange

|

Additional

information disclosed in accordance with the JSE Listings

Requirements:

|

a)

|

Nature of

interest of executive:

|

Trade 1:

Direct beneficial

Trade 2:

Direct beneficial

Trade 3:

Direct beneficial

|

|

b)

|

On-market

or off-market:

|

Trade 1:

Off-market

Trade 2:

Off-market

Trade 3:

Off-market

|

|

c)

|

Clearance

given in terms of paragraph 3.66 of the JSE Listings

Requirements:

|

Yes

|

|

d)

|

Total

value of transaction

|

Trade 1:

Nil consideration

Trade 2:

No premium

Trade 3:

ZAR11,122,505.00

|

|

e)

|

Holding

following transactions:

|

Indirect

beneficial 245,209 ordinary shares,

Direct

beneficial 4,728,254 ordinary shares

|

Johannesburg

2 July 2024

For

further information on Pan African, please visit the Company's

website at

www.panafricanresources.com

|

Corporate

information

|

|

Corporate

office

The Firs

Building

2nd Floor,

Office 204

Cnr.

Cradock and Biermann Avenues

Rosebank,

Johannesburg

South

Africa

Office: +

27 (0)11 243 2900

info@paf.co.za

|

Registered

office

2nd

Floor

107

Cheapside

London

EC2V

6DN

United

Kingdom

Office: +

44 (0)20 7796 8644

info@paf.co.za

|

|

Chief

executive officer

Cobus

Loots

Office: +

27 (0)11 243 2900

|

Financial

director

Deon

Louw

Office: +

27 (0)11 243 2900

|

|

Head:

Investor relations

Hethen

Hira

Tel: + 27

(0)11 243 2900

E-mail:

hhira@paf.co.za

|

Website:

www.panafricanresources.com

|

|

Company

secretary

Jane

Kirton

St

James's Corporate Services Limited

Office: +

44 (0)20 7796 8644

|

Nominated

adviser and joint broker

Ross

Allister/Georgia Langoulant

Peel

Hunt LLP

Office:

+44 (0)20 7418 8900

|

|

JSE

Sponsor and JSE debt sponsor

Ciska

Kloppers

Questco

Corporate Advisory Proprietary Limited

Office: +

27 (0)11

011 9200

|

Joint

broker

Thomas

Rider/Nick Macann

BMO

Capital Markets Limited

Office:

+44 (0)20 7236 1010

|

|

|

Joint

broker

Matthew

Armitt/Jennifer Lee

Joh.

Berenberg, Gossler & Co KG

Office:

+44 (0)20 3207 7800

|

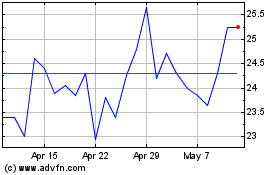

Pan African Resources (LSE:PAF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pan African Resources (LSE:PAF)

Historical Stock Chart

From Dec 2023 to Dec 2024