Rockpool Acquisitions PLC Expiry of Listing Rules Transitional Arrangements (4505V)

December 01 2023 - 9:17AM

UK Regulatory

TIDMROC

RNS Number : 4505V

Rockpool Acquisitions PLC

01 December 2023

Press Release 1 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as retained in UK law

pursuant to the European Union (Withdrawal) Act 2018 and as amended

by the Market Abuse (Amendment) (EU Exit) Regulations 2019 (SI

2019/310). Upon the publication of this announcement via the

Regulatory Information Service, this inside information is now

considered to be in the public domain.

Rockpool Acquisitions Plc

("Rockpool" or "the Company")

Expiry of Listing Rules Transitional Arrangements

The minimum market capitalisation of a company seeking admission

to the Official List pursuant to Listing Rule 2.2.7R was increased

from GBP700,000 to GBP30 million with effect from 2 December 2021,

subject to certain transitional provisions that disapplied that

increase to certain companies in certain circumstances. Those

companies include shell companies that had a listing immediately

before 3 December 2021 and that make a complete submission for

eligibility review for listing and a prospectus review by 4pm on 1

December 2023 (the "SPAC Provisions"). The Company would meet the

criteria for the application of the SPAC Provisions and so could be

admitted to listing with a market capitalisation of GBP700,000 or

more following a Reverse Take Over ("RTO") if it made the

appropriate submissions to the FCA by 4pm today in respect of that

particular RTO.

As announced on 15 November 2022, the Company is proposing to

acquire the entire issued share capital of Amcomri Group Limited

("Amcomri") (the "Acquisition"). The Acquisition, if completed,

will constitute an RTO under the Listing Rules. Therefore, at the

Company's request a suspension of its listing pending either the

issue of an announcement giving further details of the RTO, the

publication of a Prospectus, or an announcement that the RTO is no

longer in contemplation was granted on 15 November 2022.

Since that time, the Company and Amcomri have been working

together to prepare a prospectus, but it does not yet meet the

"substantially complete" requirement for making the first

submission to the FCA. As the Company will therefore not be making

an application for prospectus review and eligibility review before

the expiry of the SPAC Provisions, the minimum GBP30 million market

capitalisation requirement will apply to any application for

readmission whether following the Acquisition or any other RTO.

Amcomri has made a number of further acquisitions since 15

November 2022 and the Board now expects that the market

capitalisation of the Company on readmission following a successful

completion of the Acquisition will exceed the minimum requirement

of GBP30 million. The Company now expects the Acquisition to

complete and an application for readmission to be made in the

second half of 2024.

The Company will make further announcements concerning the

Acquisition and preparation of the prospectus at the appropriate

time.

For further information please contact:

Rockpool Acquisitions Plc

Mike Irvine, Non-Executive Director mike@cordovancapital.com

www.rockpoolacquisitions.plc.uk

Abchurch (Financial PR)

Julian Bosdet Tel: +44 (0)20 4594 4070

julian.bosdet@abchurch-group.com

- Ends -

Notes:

Rockpool Acquisitions Plc, is a special purpose acquisition

company formed to undertake the acquisition of a company or

business headquartered or materially based in Northern Ireland or

alternative transactions with suitable targets, including those

that may not have a direct connection with Northern Ireland . On 15

November 2022, it entered into heads of terms relating to the

proposed acquisition of the entire issued and to be issued share

capital of Amcomri Group Limited, the holding company of a

fast-growing, acquisitive group of quality UK Engineering and

Manufacturing businesses.

The target group consists of SMEs acquired over the past five

years in those industrial sectors and has a wealth of experience in

optimising business performance. The Group primarily provides a

range of specialist engineering and equipment services to the

power, rail, petrochemical, process and production electronics

industries in the UK and Ireland. Within these sectors it offers a

range of services and equipment to allow asset owners to extend the

operating life of key high value critical assets or associated

infrastructure. More recently it has established a second focus

area in specialist printing in which it owns a further two

operating companies.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBUBDDDBGDGXB

(END) Dow Jones Newswires

December 01, 2023 10:17 ET (15:17 GMT)

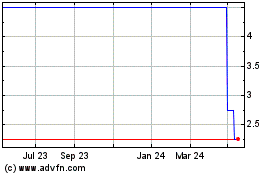

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Dec 2024 to Jan 2025

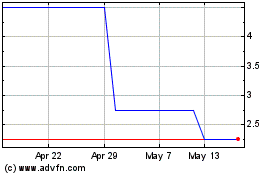

Rockpool Acquisitions (LSE:ROC)

Historical Stock Chart

From Jan 2024 to Jan 2025