Westmount Energy Limited Kaieteur Block -- Ratio Petroleum Update (8824N)

September 27 2023 - 9:49AM

UK Regulatory

TIDMWTE

RNS Number : 8824N

Westmount Energy Limited

27 September 2023

27(th) September 2023

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Kaieteur Block - Ratio Petroleum Update

Westmount Energy Limited (UK AIM: WTE.L, USA OTCQB: WMELF), the

AIM-quoted oil and gas investing company focussed on high impact

drilling outcomes in emerging basins, notes the announcenment today

by Ratio Petroleum Energy Limited Partnership ("Ratio Petroleum"),

that ExxonMobil has now decided not to commit to drilling a second

well on the Kaieteur Block(1) and that both ExxonMobil and Hess

Corporation have elected to withdraw from the Kaieteur Block and

return their participating interests to the original Kaieteur

Licence holders Ratio Guyana Limited and Cataleya Energy Limited.

The parties will now seek government approval to reassign the

participating interests, so that Ratio Guyana Limited and Cataleya

Energy Limited will each retain a 50% participating interest, and

appoint Ratio Guyana Limited as the operator of the block. .

The current Kaieteur Block participating interests are as

follows:

Esso Exploration and Production Guyana Limited 35%

(operator)

Ratio Guyana Limited 25%

Cataleya Energy Limited 20%

Hess Guyana (Block B) Exploration Limited 20%

After reassignment of the participating interests the revised

Kaieteur Block interests will be as follows:

Ratio Guyana Limited 50% (operator)

Cataleya Energy Limited 50%

It is also noted that the announcement by Ratio Petroleum states

that under the terms of the Kaieteur Petroleum Agreement, and upon

submission of an application to enter the second extension

period(2) , the participating interests on the block will have

until February 2025 to commit to drilling a well. Furthermore, it

is noted, that Ratio Petroleum is seeking a farm-down of

participating interests and operatorship and, in this context, is

already in discussions with major oil companies with a view to

bringing a new entrant or entrants to the block.

In this regard, it is also of note that the two deepwater blocks

(D1 & D2), immediately adjacent to the Kaieteur block, have

been the subject of at least one application during the recent

Guyanese Bid Round(3) which offered acreage under less benign

fiscal terms than the original Kaieteur Block terms.

In 2020, the first well drilled on the Kaieteur block,

Tanager-1, evaluated a number of plays - encountering 16 metres of

net oil pay (20(o) API oil) in high-quality sandstone reservoirs of

Maastrichtian age and confirming the extension of the Cretaceous

petroleum system and the Liza play fairway outboard from the

prolific discoveries on the neighbouring ExxonMobil operated

Stabroek Block. The well was reported as an oil discovery which is

currently considered to be noncommercial as a standalone

development. Tanager-1 also encountered high quality reservoirs in

deeper Santonian and Turonian plays though interpretation of the

reservoir fluids in these intervals was reported to be equivocal

and requirefurther analysis.

A post-well Netherland, Sewell & Associates Inc. ("NSAI")

published CPR(4) indicates that the Tanager-1 Maastrichtian

discovery contains a 'Best Estimate' Unrisked Gross (2C) Contingent

Oil Resource of 65.3 MMBBLs (Low to High Estimates 17.7 MMBBLs to

131 MMBBLs) - with a 'Best Estimate' Unrisked Net (2C) Contingent

Oil Resource attributable to the Kaieteur Block of 42.7 MMBBLs (Low

to High Estimates 11.3 MMBBLs to 86 MMBBLs).

Westmount holds approximately 5.26% of the issued share capital

of Cataleya Energy Corporation(5) , the parent company of CEL and

circa 0.04% of the issued share capital of Ratio Petroleum the

ultimate holding entity with respect to Ratio Guyana Limited.

(1) Previous announcements by Ratio Petroleum indicate that,

under a farm-in agreement executed with ExxonMobil in 2016, the

original Kaieteur 2nd well prospect nomination date was 22nd August

2021, with any drilling consequent to this decision to commence

within nine months of the nomination date. The prospect nomination

date was subsequently extended twice by agreement to 22(nd) March

2022 and again to the 2(nd) October 2023.

(2) The Kaieteur Petroleum Agreement is currently in the first

extension period, which began on February 2, 2021 and lasts for 3

years.

(3)

https://oilnow.gy/featured/ali-jagdeo-see-guyana-oil-bid-responses-as-favourable-given-governments-terms/

(4) CPR by Netherland, Sewell & Associates Inc. ("NSAI") 14

February 2021- published by Ratio

Petroleum

(5) Based upon number of shares in issue at 6(th) January

2023

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0) 1534 823000

email: westmountenergy@stonehagefleming.com

Cavendish Securities plc ( Nomad and Broker) Tel: +44 (0) 20 7397 8900

Neil McDonald/Peter Lynch (Corporate Finance)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPPUACBUPWGCM

(END) Dow Jones Newswires

September 27, 2023 10:49 ET (14:49 GMT)

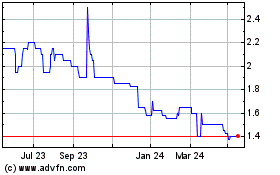

Westmount Energy (LSE:WTE)

Historical Stock Chart

From Dec 2024 to Jan 2025

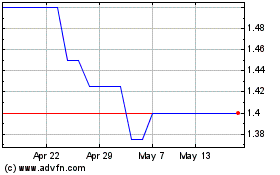

Westmount Energy (LSE:WTE)

Historical Stock Chart

From Jan 2024 to Jan 2025