TIDMWTI

RNS Number : 9281X

Weatherly International PLC

20 January 2014

Weatherly International Plc

("Weatherly" or "the Company")

Quarterly Operations and Production Update

Weatherly International Plc (AIM: WTI) is pleased to announce

its quarterly update for the second quarter of the financial year

ending 30 June 2014.

Highlights

-- Second quarter production from Central Operations was 75,281

tonnes of ore producing 5,330 tonnes of copper concentrate,

containing 1,311 tonnes of copper metal

-- C1 cash costs for the quarter were US$ 6,375(US$ 2.88lb)

-- Mine construction underway at Tschudi following ground

breaking ceremony held in November 2013, mobilisation gaining pace

and acid procurement contract being finalised

-- RFC Ambrian managed a placing and subscription on behalf of

the company that raised US$1.8 million

Rod Webster CEO of Weatherly commented:

"Copper concentrate produced in the month of December was 542

tonnes, our 3(rd) highest production month, to achieve this during

the Christmas break demonstrates that we are moving in the right

direction. Most importantly we now have access to the new Hoffnung

Fault West area where we mined our first copper during the

month."

Tschudi Project

Members of the Weatherly board attended the ground breaking

ceremony in November 2013 officially kicking off the construction

phase for the Tschudi project which will see us commence copper

production from the Tschudi mine in the second calendar quarter of

2015.

All the contracts with the main suppliers for the project are

now in place with the exception of acid supply. We expect to

finalise a direct acid supply contract with Dundee Precious Metals

Tsumeb, the owners of the nearby Tsumeb smelter, based on a Heads

of Agreement signed last year.

The Tschudi project has made significant progress with all the

elements to commence on site work now in place. The first teams are

mobilising to site in January 2014. All orders for long lead items

have been issued to ensure completion as per schedule.

Central Operations

Production

Production results for the second quarter 2014 financial year

are set out in the table below:

Quarter Quarter Quarter Quarter

ended ended Ended Ended

Mar-13 Jun-13 Sept-13 Dec 2013

Ore Treated

(t) 67,833 64,872 75,060 75,281

Grade (%) 1.81 2.05 1.72 1.87

Recovery (%) 92.92 93.49 93.02 93.1

Copper concentrate

(t) 4,948 5,250 5,118 5,330

Copper contained

(t) 1,142 1,242 1,201 1,311

Ore treated is up compared to the previous quarter. Ore grade is

up at 1.87%, an improvement of 8% on the previous quarter, the

amount of copper concentrate is up by 4% compared to our previous

quarter and copper contained is up by 8.4% against previous

quarter.

Our unit cash cost (C1) for the quarter, US$ 6,375/t (US$

2.88/lb), was higher than the previous quarter largely due to 'one

off' costs incurred in October and November. Specifically, at

Matchless there was a program of rebuilding scoops and drill rigs,

while at Otjihase there was the initial establishment cost

associated with commencing production from the new mining area

Hoffnung Fault West (HFW). By December C1 costs had reduced to US$

5,354/t Cu.

We continue to work towards reducing our unit costs, through

better access to ore and improved equipment, and improving our ore

and metal output. We anticipate additional improvements to be

realised over the coming months as we continue to increase the

ratio of ore from stoping as opposed to development at Matchless

and move to reduce our dependency at Otjihase on pillar recovery

through primary mining in the HFW area.

Commercial

During the quarter, the Company delivered 1,238 tonnes of copper

contained in 5,638 tonnes of concentrate to metal trader Louis

Dreyfus at a weighted average price of US$7289/t copper (US$

3.30/lb).

During the quarter we raised US$1.8 million by way of a placing

of 35,733,336 new Ordinary Shares of 0.5p each with both new and

existing institutional shareholders at a price of 3.0 pence per

Placing Share. The purpose of the raising was to increase our

working capital.

As at 31 December 2013, the Company had:

(1) Reduced its working capital loan from US$3.2 million to

US$2.480 million, having made loan repayments of US$0.72 million in

the quarter.

(2) Forward contracts over 1400 tonnes copper to be delivered

during the next seven months at an average price of US$8091/t. The

Company has ceased forward selling at current prices.

Conference call

The Company will hold a conference call on Wednesday 22nd

January at 11.00 am UK time. If you would like to attend please

send an email to info@weatherlyplc.com and we will send you the

dial in telephone number.

About Weatherly

Weatherly is an AIM listed, copper focused mining company, the

principal assets of which are located in Namibia. It currently has

two producing copper mines (Otjihase and Matchless), and is

developing the Tschudi open cut Copper Project. These assets will

enable Weatherly to achieve its medium term strategy of

establishing a copper mining business capable of sustaining

approximately 25,000tpa of copper production. The Company also has

a 25% stake in AIM listed company, China Africa Resources Plc

(CAR), which is currently focused on the development of the

lead/zinc project at Berg Aukas in Northern Namibia.

For further information please contact:

Weatherly International Plc +44 (0) 20 7917 2989

Rod Webster, Chief Executive Officer

Rolf Gerritsen, Senior Executive

RFC Ambrian Limited +44 (0) 20 3440 6800

(Nominated Adviser & Broker)

Samantha Harrison

Jen Boorer

Shore Capital +44 (0) 20 7408 4090

Jerry Keen

Toby Gibbs

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGCGDBXSBBGSR

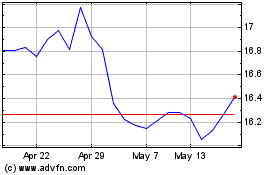

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

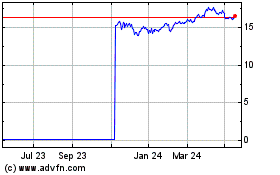

Wti Oil Etc (LSE:WTI)

Historical Stock Chart

From Jul 2023 to Jul 2024