TIDMZAIM

RNS Number : 9493V

Adalan Ventures PLC

07 December 2023

Not for release or distribution, directly or indirectly, within,

into or in the United States or to or for the account or benefit of

persons in the United States, Australia, Canada, Japan or any other

jurisdiction where such offer or sale would violate the relevant

securities laws of such jurisdiction.

For Release at 7 am

7 December 2023

Adalan Ventures Plc

("Adalan" or the "Company")

Reverse Takeover

Adalan Ventures plc (the 'Company' or 'Adalan') is pleased to

announce that it has reached agreement on a non-binding basis for

the acquisition of entire issued share capital of two operating

businesses in the financial technology sectors via a reverse

takeover ('Acquisitions').

The Board of the Company has considered a variety of potential

opportunities, focused on the Fintech industry with a preference

for inclusive projects with good ESG credentials and/or created

Social Impact. The Board believe the proposed Acquisitions meet

these goals. With the targets selected having complementarity

technologies, which when combined have potential to create

significant synergies.

The two target businesses are Topos Network Pte. Ltd ('Topos')

and Re-Lender S.P.A ('Re-Lender'). The Board believes that

combining with these two businesses will give the Company the

opportunity to create one "world unique end-to-end financial

infrastructure" that provides to "now unbankable" people, living

both in developed countries and even in poor rural areas of

developed world, access to proper bank accounts, to digital

financial services and directly link them.

Background information on Topos

Singapore based Topos develops and extends a financial

technology suite that allows the creation and management of last

mile banking networks in frontier markets. Topos licenses its

technology to newly established equity joint ventures with local

stakeholders and supervised financial institutions to operate in

target markets retaining a minority stake in such joint

ventures.

Topos's proprietary technology allows for the creation and

operation of digital last mile banking that is able to open and

operate micro accounts by GSM and/or low-tech mobiles to now

unbankable people living below the threshold of 5U$D per day. This

technology is suited to unserved rural areas of developing

countries where lack of data grids is a barrier to more traditional

digital providers.

Topos's platform in the last 2 years has managed to:

-- Attract 680,000 new clients accounts in 24 months;

-- Pull more than 320,000 clients up to "Credit grade" level; and

-- Forged relationships with 46,000 bank agents.

Topos has to date principally focused on Sub-Saharan Africa but

has recently begun forging relationships with local banks in a

number of other countries and is the process of establishing joint

ventures with local banks in Middle East and North Africa region

and Latin America and Southeast Asia. These joint ventures will be

locally licensed "Last mile banks".

Topos's technology suite enables its users to connect with

family members who are part of their diaspora in developed world to

facilitate access to credit.

However, Topos lacks the regulatory permissions to directly

access clients in the "Sending side" of money transaction and this

is an important benefit in the proposed combination of the Company

with Re-Leder and Topos. This is through the relationship with

Re-Lender which operates a fintech lending platform in Italy.

Background information on Re-Lender

Re-Lender began operating in 2020 and achieved breakeven point

after few months and has since then has been operating profitably.

By integrating its own authorisations and the authorisations of

third parties, Re-Lender has rapidly built a successful business

ecosystem with 35,000 permanent investors, a track record of EUR 40

million in transactions and has a significant pipeline of potential

future opportunities.

RE-Lender has been recognised by the Politecnico di Milano

crowdfunding report as the lending crowdfunding platform - with a

broader focus beyond real estate - in terms of fundraising,

emphasising its impactful presence in the industry in Italy.

Following completion of the Acquisitions, the Company plans to

integrate the Re-Lender business with Topos's platform to allow

Topos to directly access its clients.

The Company's aim is that the integration of Re-Lender and Topos

as part of Adalan's business will help them realise their potential

and create the "end to end" financial infrastructure that will

allow direct connection between people and organizations in

developed countries with people and organizations in developing

countries.

The Company has signed a term sheet with Topos and Re-Lender and

their significant shareholders regarding the Acquisitions ('Term

Sheet') that was inter alia conditional on completing a fundraise

which the issue of shares announced on 14 November 2023 and an

unsecured loan of GBP163,580 from Re-Lender more details of which

are below.

Under the Term Sheet, subject to various conditions the Company

has agreed to acquire 100% of outstanding capital of Topos in

exchange for 452.5 million shares of Adalan for an approximate

value of GBP33.9 million. The Company has also agreed to acquire

the entire issued share capital of Re-lender in exchange for the

issue of 230.3 million shares in Adalan for an approximate value of

GBP17.3m. These values are based upon the expected financial

results for the year ended 2023 and are subject to due

diligence.

Under the Term Sheet the Company, Re-Lender S.P.A and Topos will

use their reasonable endeavours to complete the Acquisitions, the

readmission of Company's issued share capital to the Standard

Segment of the Official List and a placing. However, the

transaction remains subject to due diligence, regulatory consents

and other conditions.

As the FCA have classed the Company as a "Shell Company" and

there is insufficient publicly available information about the

proposed Acquisitions, the Company has decided to request a

suspension of its shares pursuant to LR 5.6.8 and therefore trading

in the Company's shares on the Main Market of the London Stock

Exchange and their admission to the Official List have been

temporarily suspended.

A further announcement regarding the Acquisition will be made as

and when appropriate.

Further information can be found at the corporate website:

https://adalanventures.com/

Topos Network - The bank for one billion people and

RE-LENDER - Reconversion Crowdfunding (relender.eu)

Enquiries:

Adalan Ventures Plc

Siro Cicconi

Tel: +44 (0) 73 9377 9849

Optiva Securities Limited

Vishal Balasingham Tel: +44 (0) 20 3137 1902

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRUPGCCPUPWGRQ

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

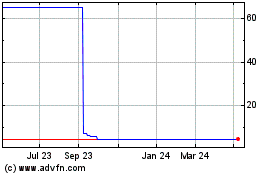

Adalan Ventures (LSE:ZAIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Adalan Ventures (LSE:ZAIM)

Historical Stock Chart

From Feb 2024 to Feb 2025