NEW

YORK, July 10, 2024 /PRNewswire/ -- The global

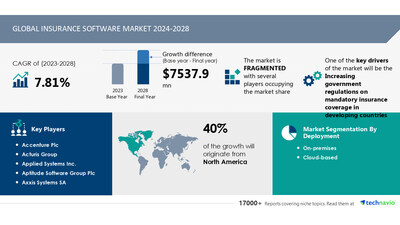

insurance software market size is estimated to grow by USD 7.53 billion from 2024-2028, according to

Technavio. The market is estimated to grow at a CAGR of

7.81% during the forecast period. The global

insurance software market is poised for substantial growth, driven

primarily by increasing government regulations mandating insurance

coverage in developing countries. This trend compels insurers to

adopt advanced software solutions to comply with regulatory

requirements efficiently. Moreover, the integration of wearable

technology into life insurance customer engagement metrics is

enhancing market expansion by providing personalized services.

Despite these opportunities, insurance players face challenges from

a tightening regulatory environment. Key market players such as

Accenture Plc, IBM Corp., and SAP SE are pivotal in driving

innovation and meeting industry demands for sophisticated software

solutions.

Get a detailed analysis on regions, market

segments, customer landscape, and companies- View the

snapshot of this report

|

Insurance Software

Market Scope

|

|

Report

Coverage

|

Details

|

|

Base year

|

2023

|

|

Historic

period

|

2018 - 2022

|

|

Forecast

period

|

2024-2028

|

|

Growth momentum &

CAGR

|

Accelerate at a CAGR of

7.81%

|

|

Market growth

2024-2028

|

USD 7537.9

million

|

|

Market

structure

|

Fragmented

|

|

YoY growth 2022-2023

(%)

|

7.24

|

|

Regional

analysis

|

North America, APAC,

Europe, Middle East and Africa, and South America

|

|

Performing market

contribution

|

North America at

40%

|

|

Key

countries

|

US, China, Japan, UK,

and France

|

|

Key companies

profiled

|

Accenture Plc,

Acturis Group, Applied Systems Inc., Aptitude Software Group

Plc, Axxis Systems SA, Dell Technologies Inc., Ebix Inc., Enlyte,

Guidewire Software Inc., Hyland Software Inc., International

Business Machines Corp., Jenesis Software, Microsoft Corp., Nest

Innovative Solutions Pvt. Ltd., Oracle Corp., Rocket Software Inc.,

Roper Technologies Inc., Salesforce Inc., SAP SE, SAPIENS

INTERNATIONAL CORP. N.V, and Solartis LLC

|

Market Driver

Wearable technology, such as sensor-based devices, is

revolutionizing the insurance industry, particularly in the life

insurance sector. These devices enable real-time tracking of

customer lifestyle habits, physical activity levels, and food

intake. Insurers can leverage this data to enhance customer

engagement, tailor products, and make informed business decisions.

Wearables integrate with online insurance software to provide

valuable insights at scale. This data analysis can lead to product

innovation, claims optimization, and improved underwriting

performance. The market for insurance software is poised to grow

significantly due to the adoption of wearable technology and the

resulting opportunities for personalized insurance offerings and

risk mitigation.

The insurance software market is experiencing significant growth

as insurers seek comprehensive cybersecurity solutions to mitigate

fraud and address cybersecurity concerns. Blockchain

technology and digital transformation are key trends, offering

transparency, streamlined claim processes, and increased trust.

SaaS-based and cloud-based solutions provide accessibility through

an internet connection, reducing infrastructure costs and enabling

automatic updates and software deployment. Accident and Health,

Life and Annuity, Reinsurance, Commercial Property/Casualty, and

Personal Property/Casualty industries benefit from these robust

software solutions. AI and machine learning enhance customer

experiences, improve data analytics, and predict policyholder

behavior and changing circumstances. Regulatory changes and

compliance requirements are met with ease, ensuring competitiveness

and agility. Chatbots streamline claims assessment and settlement

processes, increasing customer satisfaction while reducing

administrative overhead.

Discover 360° analysis of this market. For

complete information, schedule your consultation - Book

Here!

Market Challenges

- Regulatory bodies, such as the Australian Prudential Regulation

Authority (APRA) and the Australian Securities and Investments

Commission (ASIC) in Australia, and the National Association of

Insurance Commissioners (NAIC) in the US, play a crucial role in

the insurance industry by establishing and enforcing regulations.

The NAIC recently introduced the Own Risk and Solvency Assessment

(ORSA), an internal process for insurers to evaluate their risk

management capabilities in light of all material risks that may

impact their ability to meet customer obligations. With increasing

regulations, insurance companies face heightened industry

requirements, which will influence the revenue of the global

Insurance software market. Vendors must continually update their

offerings to ensure compliance, posing challenges to market growth

during the forecast period.

- The insurance industry is undergoing a digital transformation,

with virtual assistants, smart contracts, and tokenized assets

shaping the future of insurance. However, this digitization brings

challenges such as operational costs, complexity, and integration

with legacy systems. Automation, data analytics,

and fraud detection are key areas of focus for

efficiency gains and improved customer experiences. Digital

channels like mobile apps and online portals are essential for

operational agility, but cybersecurity is a major concern.

Businesses must address cyberattacks and cyber threats through

cybersecurity solutions like firewalls, antivirus programs, and

threat intelligence platforms to protect their digital footprint.

Comprehensive coverage, policies, and pricing models require

advanced risk assessment tools and regulatory compliance.

Scalability and flexibility are crucial for adapting to the

evolving insurance landscape. Cloud technology and digital

solutions are essential for meeting the demands of open enrollment

and managing policy and claims processing.

For more insights on driver and

challenges - Request a sample report!

Segment Overview

This insurance software market report extensively covers market

segmentation by

- Deployment

- 1.1 On-premises

- 1.2 Cloud-based

- Type

- 2.1 Life insurance

- 2.2 Accident and health insurance

- 2.3 Property and casualty insurance

- 2.4 Others

- Geography

- 3.1 North America

- 3.2 APAC

- 3.3 Europe

- 3.4 Middle East and

Africa

- 3.5 South America

1.1 On-premises- The on-premises deployment model

for Insurance software continues to gain traction in the market due

to several unique advantages. Unlike cloud-based solutions,

on-premises deployments allow companies to maintain complete

control over their operations. This includes their in-house server,

IT infrastructure, IT team, and intranet. In contrast, cloud-based

solutions rely on vendor infrastructure and the Internet, making

them susceptible to disruptions. Another significant factor is the

handling of legacy systems. Migrating data from legacy servers to

the cloud can be a complex process that risks data corruption and

loss. For the insurance industry, the potential consequences of

partial data loss can be severe, leading to financial losses and

damage to customer relationships. Moreover, branches in rural areas

may not have reliable Internet access, necessitating the use of

on-premises Insurance software for core applications. Additionally,

the security of cloud-based solutions depends on vendors, whereas

on-premises deployments enable organizations to maintain their data

security and privacy in-house. Large organizations, which

prioritize data privacy and security, dominate the Insurance

software market. A data leak can have disastrous consequences for

stakeholder interests and organizational reputation. Consequently,

these organizations prefer functionality over cost-effectiveness

and opt for on-premises Insurance software to ensure enterprise

risk management. In this technologically advanced and

threat-enhanced environment, the importance of secure data

management cannot be overstated. Therefore, these factors are

expected to fuel the growth of the on-premises segment in the

global Insurance software market during the forecast period.

For more information on market segmentation with geographical

analysis including forecast (2024-2028) and historic data

(2017-2021) - Download a Sample Report

Research Analysis

The Insurance Software Market is experiencing significant

transformation as customer expectations shift towards more

personalized and efficient services. Artificial intelligence (AI)

and machine learning are driving this change, enabling predictive

analytics to assess insurance policies based on policyholder

behavior, preferences, and changing circumstances. Regulatory

changes and compliance requirements continue to shape the market,

with a focus on data security and privacy. AI and machine learning

also play a crucial role in claims assessment and settlement

process, reducing administrative overhead and increasing customer

satisfaction. Chatbots and virtual assistants offer 24/7 support,

while smart contracts and tokenized assets facilitate faster and

more secure transactions. Quantum computing and digital insurance

channels are emerging trends, offering the potential for

unprecedented data analysis and operational cost savings. However,

the market faces challenges such as complexity, integration with

legacy systems, and operational costs. Digital insurance channels,

mobile apps, and online portals are essential for reaching

customers, but they require significant investment and expertise.

Fraud detection and data analytics are critical, but

they also raise concerns around privacy and data security. The

market is also exploring the potential of automation, cloud

technology, and scalability to meet evolving customer needs during

open enrollment periods.

Market Research Overview

The Insurance Software Market is experiencing significant

digitization as customer expectations shift towards more

personalized and efficient experiences. Artificial intelligence

(AI) and machine learning are driving advancements in predictive

analytics, enabling insurers to assess risk and adjust pricing

models based on policyholder behavior and changing circumstances.

Regulatory changes and compliance requirements are also pushing the

industry towards digital solutions, including smart contracts and

tokenized assets. Insurance software solutions are streamlining

claims assessment and settlement processes, reducing administrative

overhead and increasing customer satisfaction. Chatbots and virtual

assistants are becoming commonplace, providing 24/7 support and

freeing up human resources for more complex tasks. Insurance

landscape digitization brings operational agility, digital

solutions, and cybersecurity solutions to the forefront. Cloud

technology, SaaS-based solutions, and automation are reducing

infrastructure costs and enabling automatic updates and software

deployment. However, the insurance industry faces complexities such

as integration with legacy systems, scalability, and flexibility.

Cybersecurity is a major concern, with sophisticated cyber threats

targeting digital assets and sensitive information. Comprehensive

cybersecurity solutions, including firewalls, antivirus programs,

and threat intelligence platforms, are essential to mitigate risks

and increase trust in digital operations. Insurance software

solutions cover various sectors, including Accident and Health,

Life and Annuity, Reinsurance, Commercial Property/Casualty, and

Personal Property/Casualty. Pricing models and risk assessment

tools are becoming more sophisticated, enabling insurers to offer

comprehensive coverage and meet the evolving needs of businesses

and individuals.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Deployment

-

- Type

-

- Life Insurance

- Accident And Health Insurance

- Property And Casualty Insurance

- Others

- Geography

-

- North America

- APAC

- Europe

- Middle East And Africa

- South America

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory

company. Their research and analysis focuses on emerging market

trends and provides actionable insights to help businesses identify

market opportunities and develop effective strategies to optimize

their market positions.

With over 500 specialized analysts, Technavio's report library

consists of more than 17,000 reports and counting, covering 800

technologies, spanning across 50 countries. Their client base

consists of enterprises of all sizes, including more than 100

Fortune 500 companies. This growing client base relies on

Technavio's comprehensive coverage, extensive research, and

actionable market insights to identify opportunities in existing

and potential markets and assess their competitive positions within

changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download

multimedia:https://www.prnewswire.com/news-releases/insurance-software-market-size-is-set-to-grow-by-usd-7-53-billion-from-2024-2028--increasing-government-regulations-on-mandatory-insurance-coverage-in-developing-countries-boost-the-market-technavio-302192937.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/insurance-software-market-size-is-set-to-grow-by-usd-7-53-billion-from-2024-2028--increasing-government-regulations-on-mandatory-insurance-coverage-in-developing-countries-boost-the-market-technavio-302192937.html

SOURCE Technavio