TD Ameritrade to Acquire Scottrade

October 24 2016 - 6:10AM

Dow Jones News

TD Ameritrade Holding Corp. will buy Scottrade Financial

Services Inc. in a $4 billion deal, combining two leaders in the

retail market for the buying and selling of stocks as the landscape

for stock picking continues to lose favor to index investing.

Both companies helped bring low-cost stock trading to small-time

investors and away from the exclusive world of brokerage that

existed before.

The combined company will have 600,000 average client trades a

day and $944 billion in client assets.

The deal will happen in two parts. First, TD Bank Group, which

owns a large stake in TD Ameritrade, will purchase Scottrade Bank

from Scottrade Financial Services for $1.3 billion in cash. TD Bank

Group will also purchase $400 million in new common equity from TD

Ameritrade in connection with the deal. Then, immediately following

that acquisition, TD Ameritrade will acquire Scottrade Financial

Services Inc. for $4 billion, or $2.7 billion after the proceeds

from the sale of Scottrade Bank.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 24, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

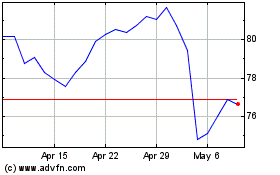

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toronto Dominion Bank (TSX:TD)

Historical Stock Chart

From Apr 2023 to Apr 2024