Canadian Dollar Strengthens On Higher Oil Prices

July 06 2017 - 1:50AM

RTTF2

The Canadian dollar climbed against its major counterparts in

the European session on Thursday, as an industry data showed a

bigger-than-expected draw in U.S. stockpiles last week, in an

indication of moderating oil production from the U.S.

Crude for August delivery rose $0.55 to $45.68 per barrel.

Data from the American Petroleum Institute showed Wednesday that

U.S. crude inventories fell to 5.8 million barrels in the week to

June 30, higher than expectations for a decline of 2.3 million

barrels.

Gasoline inventories fell by 5.7 million barrels, exceeding

economists' expectations for a 500,000 barrel draw.

The data came a day before official report from the Energy

Information Administration, which is forecast to show a decline of

2.4 million barrels in crude oil inventories.

The European Central Bank will release minutes from its June 8

meeting today, with investors looking for hints on whether the bank

is close to tightening its ultraloose monetary policy.

Traders also awaited cues from this week's G20 summit and

Friday's U.S. jobs report.

The loonie showed mixed performance in the Asian session. While

the loonie held steady against the aussie and the euro, it fell

against the yen and the greenback.

The loonie rose to 1.2936 against the greenback and 87.67

against the yen, from its early lows of 1.2983 and 87.03,

respectively. Further gains may take the loonie to resistance

levels of around 1.28 against the greenback and 89.00 against the

yen.

The loonie reversed from its early lows of 1.4726 against the

euro and 0.9866 against the aussie, rising to 1.4674 and 0.9836,

respectively. The loonie is poised to target resistance around 1.45

against the euro and 0.97 against the aussie.

Looking ahead, the European Central Bank releases account of the

monetary policy meeting of the Governing Council held on June 7-8

at 7:30 am ET.

In the New York session, ADP private payrolls data for June,

weekly jobless claims for the week ended July 1, trade data for May

and ISM non-manufacturing composite index for June as well as

Canada building permits and trade data for May are set for

release.

At 10:00 am ET, the Fed Reserve Governor Jerome Powell gives a

speech titled "The Case for Housing Finance Reform" at the American

Enterprise Institute, in Washington DC.

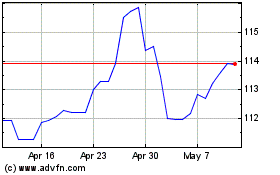

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

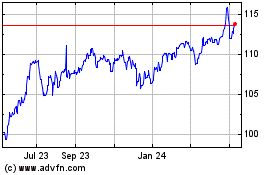

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024