Dollar Mixed After U.S. Jobs Data

July 07 2017 - 4:20AM

RTTF2

The greenback was trading mixed against its major counterparts

in the European session on Friday, after a data showed

stronger-than-expected U.S. jobs growth in June, although the

unemployment rate ticked up.

Data from the Labor Department showed that U.S. employment

increased much more than expected in the month of June.

The report said non-farm payroll employment jumped by 222,000

jobs in June following an upwardly revised increase of 152,000 jobs

in May.

Economists had expected employment to climb by 179,000 jobs

compared to the addition of 138,000 jobs originally reported for

the previous month.

Despite the stronger than expected job growth, the unemployment

rate inched up to 4.4 percent in June from 4.3 percent in May.

Economists had expected the unemployment rate to hold steady.

The G20 economic summit got underway in Germany, with issues on

terrorism, global trade and climate change to be high on the

agenda. German Chancellor Angela Merkel, who is hosting the summit,

said she expects to find "compromises and answers" on contentious

subjects on the agenda as world leaders met amid protests to

disrupt the summit.

The greenback rose against its major opponents in the Asian

session, with the exception of the franc.

The greenback retreated to 0.9607 Swiss franc, from a high of

0.9644 hit in the immediate aftermath of the data. The greenback is

likely to target support around the 0.93 region.

Data from the State Secretariat for Economic Affairs showed that

Switzerland's unemployment rate remained stable in June.

The jobless rate held steady at seasonally adjusted 3.2 percent

in June, in line with expectations.

The greenback spiked up to a 9-day high of 1.2878 against the

pound, compared to yesterday's closing value of 1.2970. Next likely

resistance for the greenback is seen around the 1.27 level.

Data from the Office for National Statistics showed that UK

industrial production fell unexpectedly in May.

Industrial output fell 0.1 percent month-on-month in May,

confounding expectations for an increase of 0.4 percent and

reversed a 0.2 percent rise registered in April.

The greenback resumed its early advance against its Japanese

counterpart, touching a near a 2-month high of 113.86. The

greenback is seen finding resistance around the 115.00 mark. The

pair ended Thursday's trading at 113.21.

Preliminary data from the Cabinet Office showed that Japan's

leading index strengthened in May, while coincident index fell from

April.

The leading index that measures the future economic activity,

rose to 104.7 in May from 104.2 in April. The score was forecast to

rise to 104.6.

The greenback fell to a weekly low of 1.1440 against the euro,

following a brief rise to 1.1384 soon after the data. Continuation

of the greenback's downtrend may see it challenging support around

the 1.16 area.

Data from Destatis showed that German industrial production grew

at the fastest pace in four months in May.

Industrial production grew 1.2 percent month-on-month in May,

faster than the 0.4 percent increase seen in April and exceeded

economists' forecast of 0.2 percent.

Looking ahead, Canada Ivey PMI for May is due shortly.

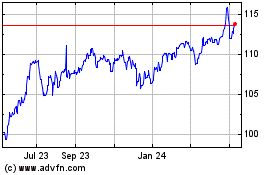

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

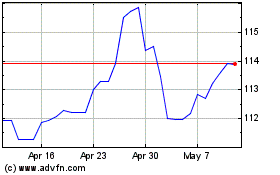

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024