US, European Companies Strike Deals to Further Consolidate Oil Industry -- At a Glance

October 23 2023 - 6:32AM

Dow Jones News

Large energy players in the U.S. and Europe are striking deals

with smaller companies this year amid efforts to consolidate the

oil industry. The moves are seen as a vote of confidence in the

long-term resilience of fossil-fuel demand despite policymakers'

growing efforts to promote low-carbon energy.

--Oil giant Chevron agreed to acquire medium-sized rival Hess in

an all-stock deal valued at $53 billion. Chevron said the

acquisition would upgrade and diversify its portfolio, and that

Hess would add about 10% to its overall oil-and-gas production of

about 3 million barrels a day.

--Exxon Mobil struck a nearly $60 billion deal to buy

exploration-and-production company Pioneer Natural Resources,

cementing its status as the dominant player in the U.S. fracking

industry, now centered in West Texas, where Pioneer has more places

to drill than almost all of its rivals.

--Italy's Eni and Norway's Var Energi agreed to acquire Neptune

Energy's global and Norway businesses for around $4.9 billion

including debt. The Italian oil major said the deal would support

its goal to increase the share of gas in its portfolio by the end

of the decade.

--BP and Abu Dhabi National Oil Co., also known as ADNOC, have

made a nonbinding offer to acquire Israeli gas producer NewMed

Energy, aiming to form a joint venture focused on gas

development.

Write to Barcelona editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

October 23, 2023 07:17 ET (11:17 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

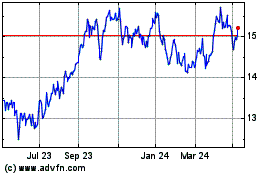

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024