Jack Daniel's Maker Warns Emerging-Markets Pain Will Extend to Results -- Update

March 02 2016 - 4:25PM

Dow Jones News

By Tripp Mickle

Brown-Forman Corp. warned Wednesday that struggles in emerging

markets will hurt future results and said it would try to offset

that by shifting advertising and promotional support from areas

like Asia and Russia to more stable ones like the U.S. and

Europe.

The maker of Jack Daniel's Tennessee Whiskey is struggling in

those markets where softening economies have made it tougher for

consumers to buy its higher-priced American whiskeys. Sales in

those emerging markets declined 11% during the quarter ended Jan.

31, lowering the company's net sales 1% from a year earlier to

$1.08 billion and leading it to cut its earnings outlook for the

year.

The Louisville, Ky., company now expects net sales growth of 5%

for the fiscal year ending April 30, excluding foreign exchange and

trade inventory adjustments. That is down from earlier expectations

for 6%-to-7% sales growth. It lowered per-share earnings

expectations to between $3.32 and $3.42 from $3.40 to $3.60.

Chief Executive Paul Varga said the company remains committed to

emerging markets in the long term but plans to intensify efforts to

increase American whiskey sales in more stable economies.

"This does not imply some radical reallocation of resources or

exiting of investment positions in emerging markets," Mr. Varga

said. "It's more of a subtle shift in the expectations we will have

for where we are likely to derive our growth in the short

term."

The company will shift advertising and promotional spending from

emerging markets to developed markets, supporting priorities such

as its expansion of Jack Daniel's Tennessee Fire in the U.K. and

Australia and Herradura tequila in the U.S.

Weakness in emerging markets during the quarter was countered by

6% sales growth in the U.S., which accounts for about 40% of the

company's business. Strong U.S. sales of Jack Daniel's and

Tennessee Honey has helped the company deliver global sales growth

for the three quarters ended Jan. 31 of 4% and 11%, respectively,

excluding foreign exchange and trade inventory adjustments.

Overall, Brown-Forman reported a quarterly profit of $190

million, up 2% from $186 million a year earlier. The company said

its results were pressured by weaker foreign currencies,

particularly the British pound. Its lower forecast for the year

reflects a 6-cent impact from foreign currencies.

Mr. Varga said the results were "pretty solid," considering the

emerging-market struggles, this year's stock-market tumult, and the

Paris attacks in November, which briefly dampened restaurant and

bar sales in Europe.

The company expects to benefit in the coming quarters from its

recent sale of Southern Comfort and Tuaca to Sazarac Co. for $542

million. Mr. Varga said shedding Southern Comfort would help sales

staff focus more narrowly on Jack Daniel's. The Southern Comfort

sale will support a $1 billion share repurchase program

Brown-Forman announced in January. "This ends up being a

multidimensional benefit for us," Mr. Varga said.

Lisa Beilfuss contributed to this article.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

March 02, 2016 17:10 ET (22:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

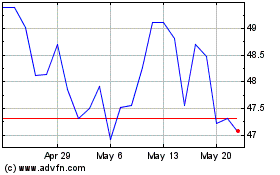

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024