Brown Forman's Results Boosted by Divestitures

June 08 2016 - 8:40AM

Dow Jones News

Brown-Forman Corp., the maker of Jack Daniel's Tennessee

whiskey, said divestures of two liquor brands drove fiscal

fourth-quarter results higher and helped offset weakness in

emerging markets.

The Louisville, Ky., company in January said it struck a deal to

sell Southern Comfort, its struggling sweet whiskey-flavored liquor

and Tuaca, an Italian liqueur, for $543.5 million to Sazerac Co.

The sale was part of Brown-Forman's push to focus on Jack Daniel's

and Woodford Reserve, which have grown in recent years behind a

surge in American whiskey sales.

Meanwhile, the company has been shifting advertising dollars

away from emerging markets across Asia and elsewhere, where demand

has dwindled due to economic downturns. In March, Chief Executive

Paul Varga said the company would remain committed to emerging

markets in the long term, but noted that it would step up efforts

to increase American whiskey sales in more stable economies.

On Wednesday, Mr. Varga called the company's recently-ended

fiscal year "a tale of two halves," with emerging market sales

rising by 8% in the first half of the year before paring that

decline to 1% in the second half. Mr. Varga noted "some signs of

stabilization" as fourth-quarter sales in those markets matched

third-quarter sales, but said countries in Asia and Russia

continued to log double-digit sales drops.

Continued growth in the company's Jack Daniel's portfolio helped

offset weakness in foreign sales. Revenue from Jack Daniel's brands

rose 6% during the year, resulting in an overall decline of 2.1%

for the full year.

In its latest quarter, ended April 30, Brown-Forman said total

sales slipped 1.5% from a year earlier, to $933 million. That

topped the $899 million analysts polled by Thomson Reuters had

predicted.

The company reported a profit of $522 million, or $2.60 a share,

up from $140 million, or 66 cents a share, a year earlier. The

result includes a $485 million gain on the sales of Southern

Comfort and Tuaca. Excluding that gain, earnings per share were 81

cents, the company said, a penny short of analysts' estimate.

For its newly started business year, Brown-Forman gave guidance

that brackets analysts' average estimate. The company expects to

post $3.42 to $3.62 in per-share profit, compared with the $3.58

analysts have predicted.

Shares in the company, down 2% this year through Tuesday's

close, were inactive during premarket trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

June 08, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

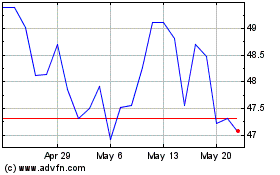

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024