SITE Centers Provides Transaction and Curbline Balance Sheet Update

September 30 2024 - 5:59AM

Business Wire

SITE Centers Corp. (NYSE: SITC) (the “Company” or “SITE

Centers”), an owner of open-air shopping centers in suburban, high

household income communities, today provided an update on

transaction activity along with updated projected Curbline

Properties Corp. (“Curbline”) balance sheet information.

From September 17, 2024 to September 27, 2024, SITE Centers sold

11 wholly owned properties for an aggregate gross price of $610.1

million. As a result of disposition activity, Curbline is now

expected to be capitalized with $800 million of cash at the time of

the spin-off in addition to a $400 million undrawn, unsecured line

of credit, a $100 million unsecured, delayed draw term loan and no

indebtedness.

As previously announced, the distribution of the shares of

Curbline common stock is expected to be completed at 12:01 a.m.

Eastern Time on October 1, 2024. Following such distribution,

Curbline will be an independent, publicly traded company listed on

the New York Stock Exchange under the ticker symbol “CURB”. SITE

Centers shareholders will receive two shares of Curbline common

stock for every one common share of SITE Centers held at the close

of business on the record date of September 23, 2024.

Dispositions ($ in thousands) SITE Property

Name MSA Own Price 09/18/24 Springfield

Center Washington-Arlington-Alexandria, DC-VA-MD-WV

100

%

49,100

09/24/24 Hamilton Marketplace (1) Trenton, NJ

100

%

116,500

09/26/24 Whole Foods at Bay Place San Francisco-Oakland-Hayward, CA

100

%

44,400

09/26/24 Shops at Midtown Miami (2) Miami-Fort Lauderdale-West Palm

Beach, FL

100

%

83,750

09/26/24 Ridge at Creekside (3)

Sacramento--Roseville--Arden-Arcade, CA

100

%

39,750

09/26/24 Echelon Village Plaza (4) Philadelphia-Camden-Wilmington,

PA-NJ-DE-MD

100

%

8,500

09/26/24 Three Property Portfolio (5) Various

100

%

180,500

09/27/24 University Hills (6) Denver-Aurora-Lakewood, CO

100

%

56,500

09/27/24 Village Square at Golf Miami-Fort Lauderdale-West Palm

Beach, FL

100

%

31,100

Total

$610,100

1 Excludes 62K SF retained by SITE Centers (Shops at

Hamilton) 2 Excludes 119K SF retained by SITE Centers (Collection

at Midtown Miami) 3 Excludes 43K SF retained by SITE Centers

(Creekside Plaza II) 4 Excludes 4K SF retained by SITE Centers

(Shops at Echelon VIllage) 5 Includes Fairfax Towne Center,

Presidential Commons (excludes 10K SF retained by SITE Centers

(Presidential Plaza South)), and Village at Stone Oak 6 Excludes

26K SF retained by SITE Centers (Shops at University Hills)

About SITE Centers Corp.

SITE Centers is an owner and manager of open-air shopping

centers located in suburban, high household income communities. The

Company is a self-administered and self-managed REIT operating as a

fully integrated real estate company, and is publicly traded on the

New York Stock Exchange under the ticker symbol SITC. Additional

information about the Company is available at www.sitecenters.com.

To be included in the Company’s e-mail distributions for press

releases and other investor news, please click here.

Safe Harbor

SITE Centers considers portions of the information in this press

release to be forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, both as amended, with respect to

the Company's expectation for future periods. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, it can give no

assurance that its expectations will be achieved. For this purpose,

any statements contained herein that are not historical fact may be

deemed to be forward-looking statements. There are a number of

important factors that could cause our results to differ materially

from those indicated by such forward-looking statements, including,

among other factors, our ability to complete the spin-off of

Curbline in a timely manner or at all, our ability to satisfy the

various closing conditions to the spin-off, the impact of the

spin-off on our business and that of Curbline, Curbline’s ability

to qualify as a REIT, and the Company’s and Curbline’s ability to

execute their respective business strategies following the

spin-off. Other risks and uncertainties that could cause our

results to differ materially from those indicated by such

forward-looking statements include general economic conditions,

including inflation and interest rate volatility; local conditions

such as the supply of, and demand for, retail real estate space in

our geographic markets; the consistency with future results of

assumptions based on past performance; the impact of e-commerce;

dependence on rental income from real property; the loss of,

significant downsizing of or bankruptcy of a major tenant and the

impact of any such event on rental income from other tenants and

our properties; our ability to enter into agreements to buy and

sell properties on commercially reasonable terms and to satisfy

closing conditions applicable to such sales; our ability to secure

equity or debt financing on commercially acceptable terms or at

all; redevelopment and construction activities may not achieve a

desired return on investment; impairment charges; valuation and

risks relating to our joint venture investments; the termination of

any joint venture arrangements or arrangements to manage real

property; property damage, expenses related thereto and other

business and economic consequences (including the potential loss of

rental revenues) resulting from extreme weather conditions or

natural disasters in locations where we own properties, and the

ability to estimate accurately the amounts thereof; sufficiency and

timing of any insurance recovery payments related to damages from

extreme weather conditions or natural disasters; any change in

strategy; the impact of pandemics and other public health crises;

unauthorized access, use, theft or destruction of financial,

operations or third party data maintained in our information

systems or by third parties on our behalf; and our ability to

maintain REIT status. For additional factors that could cause the

results of the Company to differ materially from those indicated in

the forward-looking statements, please refer to the Company's most

recent reports on Forms 10-K and 10-Q. The Company undertakes no

obligation to publicly revise these forward-looking statements to

reflect events or circumstances that arise after the date

hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930928833/en/

Conor Fennerty, EVP and Chief Financial Officer 216-755-5500

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Oct 2024 to Nov 2024

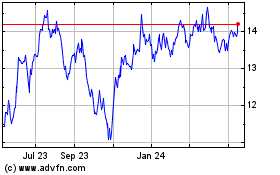

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Nov 2023 to Nov 2024