AT&T on Track for $16.5 Billion in Free Cash Flow in 2023

December 11 2023 - 3:09PM

Dow Jones News

By Denny Jacob

AT&T remains on track to meet certain financial targets and

expects some to improve, said Chief Financial Officer Pascal

Desroches.

The telecom giant is on track for 2023 free cash flow of about

$16.5 billion and expects the metric to improve in 2024 due to

profitable wireless and fiber customer additions, among other

reasons, said Desroches, speaking at an Oppenheimer conference. It

forecast adjusted EPS at the higher end of its previous forecast

range between $2.35 and $2.45, or in the low $2.40's range.

AT&T expects 2024 adjusted earnings-per-share to reflect the

impact of accelerated depreciation from its plans with Ericsson.

AT&T earlier this month struck a deal with the Swedish

equipment supplier to buy up to $14 billion of its hardware and

services after the company pledged to open up its software to

competing systems.

Dallas-based AT&T said it also remains on track to achieving

its goal of 2.5x net-debt to adjusted earnings before interest,

taxes, depreciation and amortization in the first half of 2025.

For the fourth quarter, AT&T said postpaid phone net adds

are expected to grow sequentially and are tracking around 500,000.

It expects fiber net adds in the 250,000 range for the quarter,

which it said reflects normal seasonality.

Write to Denny Jacob at denny.jacob@wsj.com

(END) Dow Jones Newswires

December 11, 2023 15:54 ET (20:54 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

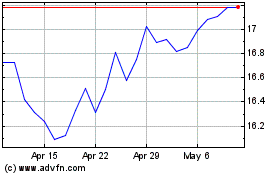

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2024 to May 2024

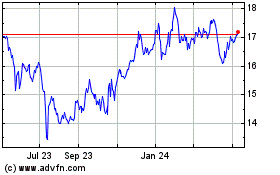

AT&T (NYSE:T)

Historical Stock Chart

From May 2023 to May 2024