0000912562false00009125622025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 19, 2025 (February 19, 2025)

GIBRALTAR INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-22462 | | 16-1445150 |

(State or other jurisdiction of

incorporation ) | | (Commission File Number) | | (IRS Employer Identification No.) |

3556 Lake Shore Road

P.O. Box 2028

Buffalo, New York 14219-0228

(Address of principal executive offices) (Zip Code)

(716) 826-6500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | ROCK | | NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

The following information is furnished pursuant to Item 2.02:

On February 19, 2025, Gibraltar Industries, Inc. (the “Company”) issued a news release and will hold a conference call regarding financial results for the three and twelve months ended December 31, 2024. A copy of the news release (the “Release”) is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. The information in this Form 8-K under the caption Item 2.02, including the Release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, unless the Company specifically incorporates it by reference in a document filed under the Securities Act or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(a)-(c) Not Applicable

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | GIBRALTAR INDUSTRIES, INC. |

| Date: | February 19, 2025 | |

| | By: | /s/ Joseph A. Lovechio |

| | | Joseph A. Lovechio |

| | | Vice President and Chief Financial Officer |

GIBRALTAR ANNOUNCES FOURTH QUARTER 2024 FINANCIAL RESULTS

2024 EPS: GAAP up 24%, Adjusted up 4% on 5% Net Sales Decrease

Strong 2024 Cash Generation of $174 Million

Expands Agtech’s Structures Business with Acquisition of Lane Supply

2025 Guidance: Net Sales $1.40B – $1.45B, GAAP EPS $4.25 - $4.50,

Adjusted EPS $4.80 - $5.05

Buffalo, New York, February 19, 2025 – Gibraltar Industries, Inc. (Nasdaq: ROCK), a leading manufacturer and provider of products and services for the residential, renewable energy, agtech and infrastructure markets, today reported its financial results for the three- and twelve-month periods ended December 31, 2024.

“Fourth quarter results were roughly in line with expectations for each segment with adjusted EPS reaching the top end of the range at $4.25, and net sales reaching $1.31 billion, just under the range. We also generated strong operating cash flow of $174 million for the year. We executed well in Residential, Agtech and Infrastructure, and our Renewables business continued to accelerate through the launch learning curve of its new tracker product line.”

Fourth Quarter 2024 Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

($Millions, except EPS) Three Months Ended December 31, |

| 2024 | 2023 | Change |

| 2024 | 2023 | Change |

Net Sales | $302.1 | $328.8 | (8.1)% | Adjusted Net Sales | $302.1 | $327.9 | (7.9)% |

Net Income | $46.2 | $19.4 | 138.1% | Adjusted Net Income | $31.0 | $26.3 | 17.9% |

Diluted EPS | $1.50 | $0.63 | 138.1% | Adjusted Diluted EPS | $1.01 | $0.86 | 17.4% |

GAAP and adjusted net sales decreased 8.1% and 7.9% respectively, driven primarily by ongoing industry headwinds impacting the Renewables business, and continued slowness in the Residential market.

GAAP net income more than doubled to $46.2 million, or $1.50 per share, and adjusted net income increased 17.9% to $31.0 million, or $1.01 per share. During the quarter, Gibraltar divested its residential electronic locker business.

Adjusted measures exclude charges for restructuring initiatives, acquisition-related items, senior leadership transition costs, and portfolio management actions including the gain on sale of the electronic locker business, as further described in the appended reconciliation of adjusted financial measures.

Fourth Quarter Segment Results

Residential

| | | | | | | | | | | | | | | | | | | | | | | | | | |

($Millions) Three Months Ended December 31, |

| 2024 | 2023 | Change |

| 2024 | 2023 | Change | |

Net Sales | $170.7 | $179.3 | (4.8)% | Adjusted Net Sales | $170.7 | $179.3 | (4.8)% | |

Operating Income | $29.1 | $27.4 | 6.2% | Adjusted Operating Income | $29.5 | $31.5 | (6.3)% | |

Operating Margin | 17.0% | 15.3% | 170 bps | Adjusted Operating Margin | 17.3% | 17.5% | (20) bps | |

Net sales decreased 4.8% driven by ongoing market softness reflected in customer point-of-sale results being down 3%-4% across product categories sold in various local / regional markets. Sales were also impacted by 80/20 PLS initiatives on safety harness and drywall metals product lines. Delays in the transition of new business awarded in 2024 also impacted net sales in the quarter, but order activity for our building accessories products has been accelerating since the beginning of the year. New products launched in the second half of 2024 are also gaining momentum and will contribute to growth in 2025.

Operating margin decreased slightly primarily related to volume and product mix, but overall execution, price/cost management, and 80/20 initiatives delivered solid results.

Renewables

| | | | | | | | | | | | | | | | | | | | | | | |

($Millions) Three Months Ended December 31, |

| 2024 | 2023 | Change |

| 2024 | 2023 | Change |

Net Sales | $70.5 | $87.7 | (19.6)% | Adjusted Net Sales | $70.5 | $86.8 | (18.8)% |

Operating Income | $(0.8) | $9.1 | (108.8)% | Adjusted Operating Income | $5.1 | $11.7 | (56.4)% |

Operating Margin | (1.1)% | 10.3% | (1140)bps | Adjusted Operating Margin | 7.2% | 13.5% | (630)bps |

As expected, net sales and new bookings were suppressed as experienced in the third quarter as customers focused on completing panel installations ahead of the December 3, 2024 deadline related to the June 2024 expiration of the Presidential Proclamation. New contract signings were pushed into January which impacted backlog in the 4th quarter, down 32%, however, since the start of 2025, new bookings have accelerated and are up 33% versus prior year.

GAAP and adjusted operating margins were impacted by the ramp of and product mix shift toward the recently launched 1P tracker product along with lower volumes while navigating through the abovementioned deadline. GAAP results were further impacted by a $5.3 million non-cash charge for the discontinuation of legacy RBI tradenames in this segment. Although net sales were down 16.2% from the third quarter, adjusted operating margins improved sequentially by 70 basis points from improved operating efficiencies associated with the new tracker product launch.

Agtech

| | | | | | | | | | | | | | | | | | | | | | | |

($Millions) Three Months Ended December 31, |

| 2024 | 2023 | Change |

| 2024 | 2023 | Change |

Net Sales | $42.7 | $42.4 | 0.7% | Adjusted Net Sales | $42.7 | $42.4 | 0.7% |

Operating Income | $2.3 | $(4.3) | NMF | Adjusted Operating Income | $8.3 | $(1.4) | NMF |

Operating Margin | 5.4% | (10.1)% | 1550 bps | Adjusted Operating Margin | 19.4% | (3.3)% | 2270 bps |

Net sales increased 1% despite project start dates moving from the fourth quarter into first and second quarters of 2025. Demand continues to grow with over $45 million of new orders booked since January 1st with a strong pipeline of opportunities in process. The move of new project signings from the fourth quarter into 2025 resulted in fourth quarter backlog being down 23%.

GAAP and adjusted operating income were driven by strong execution and business mix as well as a benefit from a customer payment received that was written off in the prior year’s quarter. Excluding this payment, operating margins expanded 1,000 basis points to approximately 15%. GAAP results were further impacted by a $6.0 million non-cash charge for the discontinuation of legacy RBI tradenames in this segment.

Infrastructure

| | | | | | | | | | | | | | | | | | | | | | | | | | |

($Millions) Three Months Ended December 31, |

| 2024 | 2023 | Change |

| 2024 | 2023 | Change | |

Net Sales | $18.1 | $19.4 | (6.7)% | Adjusted Net Sales | $18.1 | $19.4 | (6.7)% | |

Operating Income | $3.7 | $3.6 | 2.8% | Adjusted Operating Income | $3.7 | $3.6 | 2.8% | |

Operating Margin | 20.4% | 18.6% | 180 bps | Adjusted Operating Margin | 20.4% | 18.6% | 180 bps | |

Net sales decreased by 6.7%, impacted by the timing on a large project in the prior year. Backlog increased 10% on strong conversion of bid volume. Demand and quoting remain robust, supported by ongoing investment at the federal and state levels.

Operating margins increased 180 basis points, driven by a favorable mix shift and continued strong operating execution.

Gibraltar Adds Lane Supply Inc to Agtech’s Structures Business

On February 11, 2024, Gibraltar acquired Lane Supply, Inc., an industry leader in the design, manufacture, and installation of structural canopies serving the convenience store, travel center, food retail, EV charging stations, and quick serve restaurant markets for $120 million in cash, subject to customary working capital and other adjustments. During 2024, Lane recorded revenue and adjusted EBITDA of approximately $112.2 million and $16.7 million, respectively. The transaction is expected to be immediately accretive to earnings.

Business Outlook

Mr. Bosway concluded, “For 2025, we expect to deliver growth, solid margin expansion, and strong cash flow generation across the business. We expect participation gains to support growth in our existing businesses, our renewables business to improve execution, and solid growth and margin contribution from the addition of Lane Supply in the Agtech segment.”

Gibraltar is providing its guidance for earnings for the full year 2025. Consolidated net sales are expected to range between $1.40 billion and $1.45 billion, compared to $1.31 billion in 2024. GAAP EPS is expected to range between $4.25 and $4.50, compared to $4.46 in 2024, and adjusted EPS is expected to range between $4.80 and $5.05, compared to $4.25 in 2024.

Fourth Quarter 2024 Conference Call Details

Gibraltar will host a conference call today starting at 9:00 a.m. ET to review its results for the fourth quarter of 2024. Interested parties may access the webcast through the Investors section of the Company’s website at www.gibraltar1.com, where related presentation materials will also be posted prior to the conference call. The call also may be accessed by dialing (877) 407-3088 or (201) 389-0927. For interested individuals unable to join the live conference call, a webcast replay will be available on the Company’s website for one year.

About Gibraltar

Gibraltar is a leading manufacturer and provider of products and services for the residential, renewable energy, agtech, and infrastructure markets. Gibraltar’s mission, to make life better for people and the planet, is fueled by advancing the disciplines of engineering, science, and technology. Gibraltar is innovating to reshape critical markets in comfortable living, sustainable power, and productive growing throughout North America. For more please visit www.gibraltar1.com.

Forward-Looking Statements

Certain information set forth in this news release, other than historical statements, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are based, in whole or in part, on current expectations, estimates, forecasts, and projections about the Company’s business, and management’s beliefs about future operations, results, and financial position. These statements are not guarantees of future performance and are subject to a number of risk factors, uncertainties, and assumptions. Actual events, performance, or results could differ materially from the anticipated events, performance, or results expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from current expectations include, among other things, the availability and pricing of principal raw materials and component parts, supply chain challenges causing project delays and field operations inefficiencies and disruptions, the loss of any key customers, adverse effects of inflation, the ability to continue to improve operating margins, the ability to generate order flow and sales and increase backlog; the ability to translate backlog into net sales, other general economic conditions and conditions in the particular markets in which we operate, changes in spending due to laws and government incentives, such as the Infrastructure Investment and Jobs Act, changes in customer demand and capital spending, competitive factors and pricing pressures, the ability to develop and launch new products in a cost-effective manner, the ability to realize synergies from newly acquired businesses, disruptions to IT systems, the impact of trade and regulation (including the latest Department of Commerce’s solar panel anti-circumvention investigation, the Auxin Solar challenge to the Presidential waiver of tariffs, deadline to install certain modules under the waiver, and the Uyghur Forced Labor Prevention Act (UFLPA)), rebates, credits and incentives and variations in government spending and ability to derive expected benefits from restructuring, productivity initiatives, liquidity enhancing actions, and other cost reduction actions. Before making any investment decisions regarding the company, we strongly advise you to read the section entitled “Risk Factors” in the most recent annual report on Form 10-K which can be accessed under the “SEC Filings” link of the “Investor Info” page of the website at www.Gibraltar1.com. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law or regulation.

Adjusted Financial Measures

To supplement Gibraltar’s consolidated financial statements presented on a GAAP basis, Gibraltar also presented certain adjusted financial measures in this news release and its quarterly conference call, including adjusted net sales, adjusted operating income and margin, adjusted net income, adjusted earnings per share (EPS), free cash flow and adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), each a non-GAAP financial measure. Adjusted net sales reflects the removal of net sales associated with the Processing business, which has been liquidated and the Japan renewables business which was sold on December 1, 2023. Adjusted net income, operating income and margin exclude special charges consisting of restructuring costs (primarily comprised of exit activities costs and impairment of both tangible and intangible assets associated with 80/20 simplification, lean initiatives and / or discontinued products), senior leadership transition costs (associated with new and / or terminated senior executive roles), acquisition related costs (legal and consulting fees for recent business acquisitions), and portfolio management (which includes the recent gain on sale of the electronic locker business and operating results generated by the processing business which was liquidated in 2023 and the Japan renewables business which was sold in 2023). These special charges are excluded since they

may not be considered directly related to the Company’s ongoing business operations. The aforementioned exclusions along with other adjustments to other income below operating profit are excluded from adjusted EPS. Adjusted EBITDA further excludes interest, taxes, depreciation, amortization and stock compensation expense. In evaluating its business, the Company considers and uses these non-GAAP financial measures as supplemental measures of its operating performance. Free cash flow is operating cash flow less capital expenditures and the related margin is free cash flow divided by net sales. The Company believes that the presentation of adjusted measures and free cash flow provides meaningful supplemental data to investors, as well as management, that are indicative of the Company’s core operating results and facilitates comparison of operating results across reporting periods as well as comparison with other companies. Adjusted EBITDA and free cash flow are also useful measures of the Company’s ability to service debt and adjusted EBITDA is one of the measures used for determining the Company’s debt covenant compliance.

Adjustments to the most directly comparable financial measures presented on a GAAP basis are quantified in the reconciliation of adjusted financial measures provided in the supplemental financial schedules that accompany this news release. These adjusted measures should not be viewed as a substitute for the Company’s GAAP results and may be different than adjusted measures used by other companies and the Company’s presentation of non-GAAP financial measures should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items.

Reconciliations of non-GAAP measures related to full-year 2025 guidance have not been provided due to the unreasonable efforts it would take to provide such reconciliations due to the high variability, complexity and uncertainty with respect to forecasting and quantifying certain amounts that are necessary for such reconciliations.

Contact:

Alliance Advisors Investor Relations

Jody Burfening/Carolyn Capaccio

(212) 838-3777

rock@allianceadvisors.com

GIBRALTAR INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 302,057 | | | $ | 328,811 | | | $ | 1,308,764 | | | $ | 1,377,736 | |

| Cost of sales | 224,016 | | | 245,897 | | | 956,936 | | | 1,015,770 | |

| Gross profit | 78,041 | | | 82,914 | | | 351,828 | | | 361,966 | |

| Selling, general, and administrative expense | 41,921 | | | 54,025 | | | 197,505 | | | 207,440 | |

| Intangible asset impairment | 11,300 | | | 3,797 | | | 11,300 | | | 3,797 | |

| Income from operations | 24,820 | | | 25,092 | | | 143,023 | | | 150,729 | |

| Interest (income) expense, net | (1,995) | | | (214) | | | (6,171) | | | 3,002 | |

| Other (income) expense | (24,512) | | | 681 | | | (24,731) | | | (1,265) | |

| Income before taxes | 51,327 | | | 24,625 | | | 173,925 | | | 148,992 | |

| Provision for income taxes | 5,170 | | | 5,191 | | | 36,585 | | | 38,459 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | $ | 46,157 | | | $ | 19,434 | | | $ | 137,340 | | | $ | 110,533 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings per share: | | | | | | | |

| Basic | $ | 1.52 | | | $ | 0.64 | | | $ | 4.50 | | | $ | 3.61 | |

| Diluted | $ | 1.50 | | | $ | 0.63 | | | $ | 4.46 | | | $ | 3.59 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 30,464 | | | 30,523 | | | 30,538 | | | 30,626 | |

| Diluted | 30,697 | | | 30,724 | | | 30,769 | | | 30,785 | |

GIBRALTAR INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 269,480 | | | $ | 99,426 | |

| Trade receivables, net of allowance of $3,394 and $5,351, respectively | 169,350 | | | 172,736 | |

| Costs in excess of billings, net | 34,570 | | | 51,814 | |

| Inventories, net | 138,140 | | | 120,503 | |

| Prepaid expenses and other current assets | 39,792 | | | 17,772 | |

| | | |

| Total current assets | 651,332 | | | 462,251 | |

| Property, plant, and equipment, net | 109,820 | | | 107,603 | |

| Operating lease assets | 45,021 | | | 44,918 | |

| Goodwill | 507,419 | | | 513,383 | |

| Acquired intangibles | 103,882 | | | 125,980 | |

| Other assets | 1,936 | | | 2,316 | |

| | | |

| $ | 1,419,410 | | | $ | 1,256,451 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 117,408 | | | $ | 92,124 | |

| Accrued expenses | 95,664 | | | 88,719 | |

| Billings in excess of costs | 41,790 | | | 44,735 | |

| | | |

| Total current liabilities | 254,862 | | | 225,578 | |

| | | |

| Deferred income taxes | 56,655 | | | 57,103 | |

| Non-current operating lease liabilities | 35,125 | | | 35,989 | |

| Other non-current liabilities | 24,734 | | | 22,783 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.01 par value; authorized 10,000 shares; none outstanding | — | | | — | |

| Common stock, $0.01 par value; authorized 100,000 shares; 34,313 and 34,219 shares issued and outstanding in 2024 and 2023 | 343 | | | 342 | |

| Additional paid-in capital | 343,583 | | | 332,621 | |

| Retained earnings | 875,851 | | | 738,511 | |

| Accumulated other comprehensive loss | (5,326) | | | (2,114) | |

| Cost of 3,960 and 3,778 common shares held in treasury in 2024 and 2023 | (166,417) | | | (154,362) | |

| Total stockholders’ equity | 1,048,034 | | | 914,998 | |

| $ | 1,419,410 | | | $ | 1,256,451 | |

GIBRALTAR INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | | | |

| Twelve Months Ended December 31, | | |

| | 2024 | | 2023 | | |

| Cash Flows from Operating Activities | | | | | |

| Net income | $ | 137,340 | | | $ | 110,533 | | | |

| | | | | |

| | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 27,312 | | | 27,378 | | | |

| Intangible asset impairment | 11,300 | | | 3,797 | | | |

| Stock compensation expense | 10,963 | | | 9,750 | | | |

| Gain on sale of business | (25,265) | | | — | | | |

| Exit activity costs, non-cash | 31 | | | 2,771 | | | |

| (Benefit of) provision for deferred income taxes | (486) | | | 10,800 | | | |

| Other, net | 5,865 | | | 12,492 | | | |

| Changes in operating assets and liabilities net of effects from acquisitions: | | | | | |

| Trade receivables and costs in excess of billings | 17,914 | | | (15,375) | | | |

| Inventories | (18,623) | | | 45,908 | | | |

| Other current assets and other assets | (22,515) | | | 514 | | | |

| Accounts payable | 26,528 | | | (14,387) | | | |

| Accrued expenses and other non-current liabilities | 3,900 | | | 24,295 | | | |

| | | | | |

| | | | | |

| Net cash provided by operating activities | 174,264 | | | 218,476 | | | |

| Cash Flows from Investing Activities | | | | | |

| Acquisitions, net of cash acquired | — | | | (9,863) | | | |

| | | | | |

| Purchases of property, plant, and equipment, net | (19,930) | | | (13,906) | | | |

| | | | | |

| Net proceeds from sale of business | 28,474 | | | 8,047 | | | |

| | | | | |

| | | | | |

| Net cash provided by (used in) investing activities | 8,544 | | | (15,722) | | | |

| Cash Flows from Financing Activities | | | | | |

| Proceeds from long-term debt | — | | | 50,000 | | | |

| Long-term debt payments | — | | | (141,000) | | | |

| | | | | |

| Purchase of common stock at market prices | (12,189) | | | (29,329) | | | |

| | | | | |

| | | | | |

| Net cash used in financing activities | (12,189) | | | (120,329) | | | |

| Effect of exchange rate changes on cash | (565) | | | (607) | | | |

| Net increase in cash and cash equivalents | 170,054 | | | 81,818 | | | |

| Cash and cash equivalents at beginning of year | 99,426 | | | 17,608 | | | |

| Cash and cash equivalents at end of year | $ | 269,480 | | | $ | 99,426 | | | |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of GAAP and Adjusted Financial Measures

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2024 |

| | Income before taxes | | Provision for income taxes | | Net income | | Net income per share - diluted | | | | |

| As Reported in GAAP Statements | | $ | 51,327 | | | $ | 5,170 | | | $ | 46,157 | | | $ | 1.50 | | | | | |

| Restructuring Charges (1) | | 1,011 | | | 382 | | | 629 | | | 0.02 | | | | | |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | (24,154) | | | 141 | | | (24,295) | | | (0.79) | | | | | |

| Intangible Asset Impairment (3) | | 11,300 | | | 2,825 | | | 8,475 | | | 0.28 | | | | | |

| Adjusted Financial Measures | | $ | 39,484 | | | $ | 8,518 | | | $ | 30,966 | | | $ | 1.01 | | | | | |

| | | | | | | | | | | | |

| | Residential | | Renewables | | Agtech | | Infrastructure | | Corporate | | Consolidated |

| Operating Margin | | 17.0 | % | | (1.1) | % | | 5.4 | % | | 20.4 | % | | n/a | | 8.2 | % |

| Restructuring Charges (1) | | 0.3 | % | | 0.8 | % | | — | % | | — | % | | n/a | | 0.3 | % |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | — | % | | — | % | | — | % | | — | % | | n/a | | 0.4 | % |

| Intangible Asset Impairment (3) | | — | % | | 7.5 | % | | 14.0 | % | | — | % | | n/a | | 3.7 | % |

| Adjusted Operating Margin | | 17.3 | % | | 7.2 | % | | 19.4 | % | | 20.4 | % | | n/a | | 12.7 | % |

| | | | | | | | | | | | |

| Income from Operations | | $ | 29,070 | | | $ | (767) | | | $ | 2,297 | | | $ | 3,690 | | | $ | (9,470) | | | $ | 24,820 | |

| Restructuring Charges (1) | | 427 | | | 536 | | | — | | | — | | | 48 | | | 1,011 | |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | — | | | — | | | — | | | — | | | 1,163 | | | 1,163 | |

| Intangible Asset Impairment (3) | | — | | | 5,300 | | | 6,000 | | | — | | | — | | | 11,300 | |

| Adjusted Income from Operations | | $ | 29,497 | | | $ | 5,069 | | | $ | 8,297 | | | $ | 3,690 | | | $ | (8,259) | | | $ | 38,294 | |

| | | | | | | | | | | | |

| Net Sales & Adjusted Net Sales (4) | | $ | 170,729 | | | $ | 70,464 | | | $ | 42,749 | | | $ | 18,115 | | | $ | — | | | $ | 302,057 | |

| | | | | | | | | | | | |

| (1) Comprised primarily of exit activities costs and impairments of assets associated with 80/20 simplification, lean initiatives and / or discontinued operations. |

| (2) Represents senior leadership transition costs associated with changes in leadership positions, acquisition related expenses including due diligence costs and portfolio management costs resulting from terminated or liquidated businesses, including the ($25.3M) gain on sale of the residential electronic locker business. |

| (3) Represents write off of indefinite-lived trademarks. |

| (4) There were no adjustments to Net Sales in 2024. |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of GAAP and Adjusted Financial Measures

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | Income before taxes | | Provision for income taxes | | Net income | | Net income per share - diluted | | | | |

| As Reported in GAAP Statements | | $ | 24,625 | | | $ | 5,191 | | | $ | 19,434 | | | $ | 0.63 | | | | | |

| Restructuring Charges (1) | | 9,293 | | | 2,354 | | | 6,939 | | | 0.23 | | | | | |

| Portfolio Management & Acquisition Related Items (2) | | 636 | | | 994 | | | (358) | | | (0.01) | | | | | |

| Adjusted Financial Measures Previously Reported | | $ | 34,554 | | | $ | 8,539 | | | $ | 26,015 | | | $ | 0.85 | | | | | |

| Portfolio Management (4) | | 245 | | | (57) | | | 302 | | | 0.01 | | | | | |

| Adjusted Financial Measures Recast | | $ | 34,799 | | | $ | 8,482 | | | $ | 26,317 | | | $ | 0.86 | | | | | |

| | | | | | | | | | | | |

| | Residential | | Renewables | | Agtech | | Infrastructure | | Corporate | | Consolidated |

| Operating Margin | | 15.3 | % | | 10.3 | % | | (10.1) | % | | 18.6 | % | | n/a | | 7.6 | % |

| Restructuring Charges (1) | | 2.2 | % | | 2.4 | % | | 7.5 | % | | — | % | | n/a | | 2.9 | % |

| Portfolio Management & Acquisition Related Items (3) | | — | % | | 0.4 | % | | (0.8) | % | | — | % | | n/a | | — | % |

| Adjusted Operating Margin Previously Reported | | 17.5 | % | | 13.1 | % | | (3.3) | % | | 18.6 | % | | n/a | | 10.5 | % |

| Portfolio Management (4) | | — | % | | 0.4 | % | | — | % | | — | % | | n/a | | 0.1 | % |

| Adjusted Operating Margin Recast | | 17.5 | % | | 13.5 | % | | (3.3) | % | | 18.6 | % | | n/a | | 10.6 | % |

| | | | | | | | | | | | |

| Income from Operations | | $ | 27,442 | | | $ | 9,076 | | | $ | (4,277) | | | $ | 3,601 | | | $ | (10,750) | | | $ | 25,092 | |

| Restructuring Charges (1) | | 4,021 | | | 2,075 | | | 3,196 | | | — | | | 1 | | | 9,293 | |

| Portfolio Management & Acquisition Related Items (3) | | — | | | 331 | | | (339) | | | — | | | 1 | | | (7) | |

| Adjusted Income from Operations Previously Reported | | $ | 31,463 | | | $ | 11,482 | | | $ | (1,420) | | | $ | 3,601 | | | $ | (10,748) | | | $ | 34,378 | |

| Portfolio Management (4) | | — | | | 259 | | | — | | | — | | | — | | | 259 | |

| Adjusted Income from Operations Recast | | $ | 31,463 | | | $ | 11,741 | | | $ | (1,420) | | | $ | 3,601 | | | $ | (10,748) | | | $ | 34,637 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net Sales & Adjusted Net Sales Previously Reported (5) | | $ | 179,327 | | | $ | 87,712 | | | $ | 42,421 | | | $ | 19,351 | | | $ | — | | | $ | 328,811 | |

| Portfolio Management (4) | | — | | | (933) | | | — | | | — | | | — | | | (933) | |

| Adjusted Net Sales Recast | | $ | 179,327 | | | $ | 86,779 | | | $ | 42,421 | | | $ | 19,351 | | | $ | — | | | $ | 327,878 | |

| | | | | | | | | | | | |

| (1) Comprised primarily of exit activities costs and impairments of assets associated with 80/20 simplification, lean initiatives and / or discontinued operations |

| (2) Comprised primarily of consulting and legal fees for the acquisition and integration of recent business combinations, along with the results generated by the processing business liquidated in 2023 and the loss on the sale of the Japan renewables business sold in 2023. |

| (3) Comprised primarily of consulting and legal fees for the acquisition and integration of recent business combinations, along with the results generated by the processing business liquidated in 2023. |

| (4) Represents the results generated by the Japan renewables business sold in 2023. |

| (5) There were no adjustments to Net Sales Previously Reported for the three months ended December 31, 2023. |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of GAAP and Adjusted Financial Measures

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 |

| | Income before taxes | | Provision for income taxes | | Net income | | Net income per share - diluted | | | | |

| As Reported in GAAP Statements | | $ | 173,925 | | | $ | 36,585 | | | $ | 137,340 | | | $ | 4.46 | | | | | |

| Restructuring Charges (1) | | 11,061 | | | 2,738 | | | 8,323 | | | 0.27 | | | | | |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | (23,329) | | | 8 | | | (23,337) | | | (0.76) | | | | | |

| Intangible Asset Impairment (3) | | 11,300 | | | 2,825 | | | 8,475 | | | 0.28 | | | | | |

| Adjusted Financial Measures | | $ | 172,957 | | | $ | 42,156 | | | $ | 130,801 | | | $ | 4.25 | | | | | |

| | | | | | | | | | | | |

| | Residential | | Renewables | | Agtech | | Infrastructure | | Corporate | | Consolidated |

| Operating Margin | | 19.0 | % | | 1.2 | % | | 7.2 | % | | 24.2 | % | | n/a | | 10.9 | % |

| Restructuring Charges (1) | | 0.1 | % | | 3.5 | % | | 0.3 | % | | — | % | | n/a | | 0.8 | % |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | — | % | | 0.1 | % | | — | % | | — | % | | n/a | | 0.1 | % |

| Intangible Asset Impairment (3) | | — | % | | 1.9 | % | | 3.9 | % | | — | % | | n/a | | 0.9 | % |

| Adjusted Operating Margin | | 19.1 | % | | 6.6 | % | | 11.5 | % | | 24.2 | % | | n/a | | 12.8 | % |

| | | | | | | | | | | | |

| Income from Operations | | $ | 148,784 | | | $ | 3,349 | | | $ | 11,040 | | | $ | 21,295 | | | $ | (41,445) | | | $ | 143,023 | |

| Restructuring Charges (1) | | 606 | | | 9,895 | | | 477 | | | — | | | 83 | | | 11,061 | |

| Senior Leadership Transition, Acquisition and Portfolio Management Related Costs (2) | | 195 | | | 233 | | | — | | | — | | | 2,207 | | | 2,635 | |

| Intangible Asset Impairment (3) | | — | | | 5,300 | | | 6,000 | | | — | | | — | | | 11,300 | |

| Adjusted Income from Operations | | $ | 149,585 | | | $ | 18,777 | | | $ | 17,517 | | | $ | 21,295 | | | $ | (39,155) | | | $ | 168,019 | |

| | | | | | | | | | | | |

| Net Sales & Adjusted Net Sales (4) | | $ | 782,519 | | | $ | 285,405 | | | $ | 152,811 | | | $ | 88,029 | | | $ | — | | | $ | 1,308,764 | |

| | | | | | | | | | | | |

| (1) Comprised primarily of exit activities costs and impairments of assets associated with 80/20 simplification, lean initiatives and / or discontinued operations. |

| (2) Represents senior leadership transition costs associated with changes in leadership positions, acquisition related expenses including due diligence costs and portfolio management costs resulting from terminated or liquidated businesses, including the ($25.3M) gain on sale of the residential electronic locker business. |

| (3) Represents write off of indefinite-lived trademarks. |

| (4) There were no adjustments to Net Sales in 2024. |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of GAAP and Adjusted Financial Measures

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| | Income before taxes | | Provision for income taxes | | Net income | | Net income per share - diluted | | | | |

| As Reported in GAAP Statements | | $ | 148,992 | | | $ | 38,459 | | | $ | 110,533 | | | $ | 3.59 | | | | | |

| Restructuring Charges (1) | | 18,072 | | | 4,583 | | | 13,489 | | | 0.43 | | | | | |

| Portfolio Management & Acquisition Related Items (2) | | 3,900 | | | 1,382 | | | 2,518 | | | 0.09 | | | | | |

| Adjusted Financial Measures Previously Reported | | $ | 170,964 | | | $ | 44,424 | | | $ | 126,540 | | | $ | 4.11 | | | | | |

| Portfolio Management (4) | | (1,069) | | | (322) | | | (747) | | | (0.02) | | | | | |

| Adjusted Financial Measures Recast | | $ | 169,895 | | | $ | 44,102 | | | $ | 125,793 | | | $ | 4.09 | | | | | |

| | | | | | | | | | | | |

| | Residential | | Renewables | | Agtech | | Infrastructure | | Corporate | | Consolidated |

| Operating Margin | | 17.6 | % | | 9.1 | % | | (0.6) | % | | 21.2 | % | | n/a | | 10.9 | % |

| Restructuring Charges (1) | | 0.6 | % | | 2.8 | % | | 2.7 | % | | — | % | | n/a | | 1.3 | % |

| Portfolio Management & Acquisition Related Items (3) | | — | % | | 0.3 | % | | 2.8 | % | | — | % | | n/a | | 0.4 | % |

| Adjusted Operating Margin Previously Reported | | 18.2 | % | | 12.3 | % | | 5.1 | % | | 21.2 | % | | n/a | | 12.7 | % |

| Portfolio Management (4) | | — | % | | — | % | | — | % | | — | % | | n/a | | — | % |

| Adjusted Operating Margin Recast | | 18.2 | % | | 12.3 | % | | 5.1 | % | | 21.2 | % | | n/a | | 12.7 | % |

| | | | | | | | | | | | |

| Income from Operations | | $ | 143,068 | | | $ | 30,160 | | | $ | (928) | | | $ | 18,529 | | | $ | (40,100) | | | $ | 150,729 | |

| Restructuring Charges (1) | | 4,811 | | | 9,394 | | | 3,918 | | | — | | | (51) | | | 18,072 | |

| Portfolio Management & Acquisition Related Items (3) | | 12 | | | 968 | | | 4,156 | | | — | | | 389 | | | 5,525 | |

| Adjusted Income from Operations Previously Reported | | $ | 147,891 | | | $ | 40,522 | | | $ | 7,146 | | | $ | 18,529 | | | $ | (39,762) | | | $ | 174,326 | |

| Portfolio Management (4) | | — | | | (1,252) | | | — | | | — | | | — | | | (1,252) | |

| Adjusted Income from Operations Recast | | $ | 147,891 | | | $ | 39,270 | | | $ | 7,146 | | | $ | 18,529 | | | $ | (39,762) | | | $ | 173,074 | |

| | | | | | | | | | | | |

| Net Sales | | $ | 814,803 | | | $ | 330,738 | | | $ | 144,967 | | | $ | 87,228 | | | $ | — | | | $ | 1,377,736 | |

| Portfolio Management (5) | | — | | | — | | | (4,059) | | | — | | | — | | | (4,059) | |

| Adjusted Net Sales Previously Reported | | $ | 814,803 | | | $ | 330,738 | | | $ | 140,908 | | | $ | 87,228 | | | $ | — | | | $ | 1,373,677 | |

| Portfolio Management (4) | | — | | | (11,724) | | | — | | | — | | | — | | | (11,724) | |

| Adjusted Net Sales Recast | | $ | 814,803 | | | $ | 319,014 | | | $ | 140,908 | | | $ | 87,228 | | | $ | — | | | $ | 1,361,953 | |

| | | | | | | | | | | | |

| (1) Comprised primarily of exit activities costs and impairments of assets associated with 80/20 simplification, lean initiatives and / or discontinued operations and costs associated with new and / or terminated senior leadership positions. |

| (2) Comprised primarily of consulting and legal fees for the acquisition and integration of recent business combinations, along with the results generated by the processing business liquidated in 2023 and the loss on the sale of the Japan renewables business sold in 2023. |

| (3) Comprised primarily of consulting and legal fees for the acquisition and integration of recent business combinations, along with the results generated by the processing business liquidated in 2023. |

| (4) Represents the results generated by the Japan renewables business sold in 2023. |

| (5) Represents the net sales generated by the processing business liquidated in 2023. |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2024 |

| | Consolidated | | Residential | | Renewables | | Agtech | | Infrastructure |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted Net Sales | | $ | 302,057 | | | $ | 170,729 | | | $ | 70,464 | | | $ | 42,749 | | | $ | 18,115 | |

| | | | | | | | | | |

| Net Income | | 46,157 | | | | | | | | | |

| Provision for Income Taxes | | 5,170 | | | | | | | | | |

| Interest Income | | (1,995) | | | | | | | | | |

| Other Income | | (24,512) | | | | | | | | | |

| Operating Profit | | 24,820 | | | 29,070 | | | (767) | | | 2,297 | | | 3,690 | |

| Adjusted Measures* | | 13,474 | | | 427 | | | 5,836 | | | 6,000 | | | — | |

| Adjusted Operating Profit | | 38,294 | | | 29,497 | | | 5,069 | | | 8,297 | | | 3,690 | |

| Adjusted Operating Margin | | 12.7 | % | | 17.3 | % | | 7.2 | % | | 19.4 | % | | 20.4 | % |

| Adjusted Other Expense | | 805 | | | — | | | — | | | — | | | — | |

| Depreciation & Amortization | | 7,075 | | | 2,773 | | | 2,140 | | | 745 | | | 736 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Stock Compensation Expense | | 2,277 | | | 459 | | | 234 | | | 94 | | | 63 | |

| Less: SLT Related Stock Compensation Expense | | (93) | | | — | | | — | | | — | | | — | |

| Adjusted Stock Compensation Expense | | 2,184 | | | 459 | | | 234 | | | 94 | | | 63 | |

| Adjusted EBITDA | | $ | 46,748 | | | $ | 32,729 | | | $ | 7,443 | | | $ | 9,136 | | | $ | 4,489 | |

| | | | | | | | | | |

| Adjusted EBITDA Margin | | 15.5 | % | | 19.2 | % | | 10.6 | % | | 21.4 | % | | 24.8 | % |

| | | | | | | | | | |

| Cash Flow - Operating Activities | | 19,929 | | | | | | | | | |

| Purchase of PPE, Net | | (5,604) | | | | | | | | | |

| Free Cash Flow | | 14,325 | | | | | | | | | |

| Free Cash Flow - % of Adjusted Net Sales | | 4.7 | % | | | | | | | | |

|

| *Adjusted Measures details are presented on the corresponding Reconciliation of GAAP and Adjusted Financial Measures |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | Consolidated | | Residential | | Renewables | | Agtech | | Infrastructure |

| | | | | | | | | | |

| Adjusted Net Sales* | | $ | 327,878 | | | $ | 179,327 | | | $ | 86,779 | | | $ | 42,421 | | | $ | 19,351 | |

| | | | | | | | | | |

| Net Income | | 19,434 | | | | | | | | | |

| Provision for Income Taxes | | 5,191 | | | | | | | | | |

| Interest Income | | (214) | | | | | | | | | |

| Other Expense | | 681 | | | | | | | | | |

| Operating Profit | | 25,092 | | | 27,442 | | | 9,076 | | | (4,277) | | | 3,601 | |

| Adjusted Measures* | | 9,545 | | | 4,021 | | | 2,665 | | | 2,857 | | | — | |

| Adjusted Operating Profit | | 34,637 | | | 31,463 | | | 11,741 | | | (1,420) | | | 3,601 | |

| Adjusted Operating Margin | | 10.6 | % | | 17.5 | % | | 13.5 | % | | (3.3) | % | | 18.6 | % |

| Adjusted Other Expense** | | 103 | | | — | | | — | | | — | | | — | |

| Depreciation & Amortization** | | 6,804 | | | 2,537 | | | 2,109 | | | 940 | | | 788 | |

| Less: Japan Depreciation & Amortization | | (115) | | | — | | | (115) | | | — | | | — | |

| Adjusted Depreciation & Amortization | | 6,689 | | | 2,537 | | | 1,994 | | | 940 | | | 788 | |

| Stock Compensation Expense | | 2,493 | | | 498 | | | 230 | | | 57 | | | 77 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted EBITDA Recast** | | $ | 43,716 | | | $ | 34,498 | | | $ | 13,965 | | | $ | (423) | | | $ | 4,466 | |

| | | | | | | | | | |

| Adjusted EBITDA Margin Recast** | | 13.3 | % | | 19.2 | % | | 16.1 | % | | (1.0) | % | | 23.1 | % |

| | | | | | | | | | |

| Adjusted EBITDA Previously Reported | | $ | 43,586 | | | $ | 34,498 | | | $ | 13,821 | | | $ | (423) | | | $ | 4,466 | |

| Adjusted EBITDA Margin Previously Reported | | 13.3 | % | | 19.2 | % | | 15.8 | % | | (1.0) | % | | 23.1 | % |

| | | | | | | | | | |

| Cash Flow - Operating Activities | | 11,820 | | | | | | | | | |

| Purchase of PPE, Net | | (5,930) | | | | | | | | | |

| Free Cash Flow | | 5,890 | | | | | | | | | |

| Free Cash Flow - % of Adjusted Net Sales | | 1.8 | % | | | | | | | | |

|

| *Details of recast amounts for the sale of the Japan based solar racking business within the Renewables segment are presented on corresponding Reconciliation of GAAP and Adjusted Financial Measures |

| **Recast to exclude sale of Japan based solar racking business within the Renewables segment |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2024 |

| | Consolidated | | Residential | | Renewables | | Agtech | | Infrastructure |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted Net Sales | | $ | 1,308,764 | | | $ | 782,519 | | | $ | 285,405 | | | $ | 152,811 | | | $ | 88,029 | |

| | | | | | | | | | |

| Net Income | | 137,340 | | | | | | | | | |

| Provision for Income Taxes | | 36,585 | | | | | | | | | |

| Interest Income | | (6,171) | | | | | | | | | |

| Other Income | | (24,731) | | | | | | | | | |

| Operating Profit | | 143,023 | | | 148,784 | | | 3,349 | | | 11,040 | | | 21,295 | |

| Adjusted Measures* | | 24,996 | | | 801 | | | 15,428 | | | 6,477 | | | — | |

| Adjusted Operating Profit | | 168,019 | | | 149,585 | | | 18,777 | | | 17,517 | | | 21,295 | |

| Adjusted Operating Margin | | 12.8 | % | | 19.1 | % | | 6.6 | % | | 11.5 | % | | 24.2 | % |

| Adjusted Other Expense | | 1,233 | | | — | | | — | | | — | | | — | |

| Depreciation & Amortization | | 27,312 | | | 10,416 | | | 8,192 | | | 3,165 | | | 2,972 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Stock Compensation Expense | | 10,963 | | | 1,800 | | | 918 | | | 377 | | | 244 | |

| Less: SLT Related Stock Compensation Expense | | (152) | | | — | | | — | | | — | | | — | |

| Adjusted Stock Compensation Expense | | 10,811 | | | 1,800 | | | 918 | | | 377 | | | 244 | |

| Adjusted EBITDA | | $ | 204,909 | | | $ | 161,801 | | | $ | 27,887 | | | $ | 21,059 | | | $ | 24,511 | |

| | | | | | | | | | |

| Adjusted EBITDA Margin | | 15.7 | % | | 20.7 | % | | 9.8 | % | | 13.8 | % | | 27.8 | % |

| | | | | | | | | | |

| Cash Flow - Operating Activities | | 174,264 | | | | | | | | | |

| Purchase of PPE, Net | | (19,930) | | | | | | | | | |

| Free Cash Flow | | 154,334 | | | | | | | | | |

| Free Cash Flow - % of Adjusted Net Sales | | 11.8 | % | | | | | | | | |

|

| *Adjusted Measures details are presented on the corresponding Reconciliation of GAAP and Adjusted Financial Measures |

GIBRALTAR INDUSTRIES, INC.

Reconciliation of Adjusted Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| | Consolidated | | Residential | | Renewables | | Agtech | | Infrastructure |

| | | | | | | | | | |

| Adjusted Net Sales* | | $ | 1,361,953 | | | $ | 814,803 | | | $ | 319,014 | | | $ | 140,908 | | | $ | 87,228 | |

| | | | | | | | | | |

| Net Income | | 110,533 | | | | | | | | | |

| Provision for Income Taxes | | 38,459 | | | | | | | | | |

| Interest Expense | | 3,002 | | | | | | | | | |

| Other Income | | (1,265) | | | | | | | | | |

| Operating Profit | | 150,729 | | | 143,068 | | | 30,160 | | | (928) | | | 18,529 | |

| Adjusted Measures* | | 22,345 | | | 4,823 | | | 9,110 | | | 8,074 | | | — | |

| Adjusted Operating Profit | | 173,074 | | | 147,891 | | | 39,270 | | | 7,146 | | | 18,529 | |

| Adjusted Operating Margin | | 12.7 | % | | 18.2 | % | | 12.3 | % | | 5.1 | % | | 21.2 | % |

| Adjusted Other Expense** | | 228 | | | — | | | — | | | — | | | — | |

| Depreciation & Amortization** | | 27,378 | | | 10,079 | | | 8,670 | | | 3,790 | | | 3,137 | |

| Less: Japan Depreciation & Amortization | | (676) | | | — | | | (676) | | | — | | | — | |

| Adjusted Depreciation & Amortization | | 26,702 | | | 10,079 | | | 7,994 | | | 3,790 | | | 3,137 | |

| Stock Compensation Expense | | 9,750 | | | 1,633 | | | 881 | | | 197 | | | 289 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted EBITDA Recast** | | $ | 209,298 | | | $ | 159,603 | | | $ | 48,145 | | | $ | 11,133 | | | $ | 21,955 | |

| | | | | | | | | | |

| Adjusted EBITDA Margin Recast** | | 15.4 | % | | 19.6 | % | | 15.1 | % | | 7.9 | % | | 25.2 | % |

| | | | | | | | | | |

| Adjusted EBITDA Previously Reported | | $ | 211,043 | | | $ | 159,603 | | | $ | 50,073 | | | $ | 11,133 | | | $ | 21,955 | |

| Adjusted EBITDA Margin Previously Reported | | 15.4 | % | | 19.6 | % | | 15.1 | % | | 7.9 | % | | 25.2 | % |

| | | | | | | | | | |

| Cash Flow - Operating Activities | | 218,476 | | | | | | | | | |

| Purchase of PPE, Net | | (13,906) | | | | | | | | | |

| Free Cash Flow | | 204,570 | | | | | | | | | |

| Free Cash Flow - % of Adjusted Net Sales | | 14.9 | % | | | | | | | | |

| | | | | | | | | | |

| *Details of recast amounts for the sale of the Japan based solar racking business within the Renewables segment are presented on corresponding Reconciliation of GAAP and Adjusted Financial Measures |

| **Recast to exclude sale of Japan based solar racking business within the Renewables segment |

COVER PAGE COVER PAGE

|

Feb. 19, 2025 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity Registrant Name |

GIBRALTAR INDUSTRIES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-22462

|

| Entity Tax Identification Number |

16-1445150

|

| Entity Address, Address Line One |

3556 Lake Shore Road

|

| Entity Address, Address Line Two |

P.O. Box 2028

|

| Entity Address, City or Town |

Buffalo

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14219-0228

|

| City Area Code |

716

|

| Local Phone Number |

826-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

ROCK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000912562

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

rock_Coverpage.Abstract |

| Namespace Prefix: |

rock_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

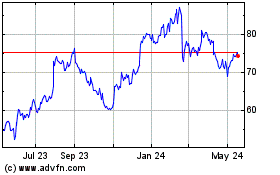

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Feb 2024 to Feb 2025