Form 424B3 - Prospectus [Rule 424(b)(3)]

February 19 2025 - 7:40AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-279147

931,099 Ordinary Shares Underlying the Warrants

PROSPECTUS SUPPLEMENT NO. 1

DATED February 19, 2025

(To Prospectus dated September 13, 2024)

This Prospectus Supplement No. 1, dated February 19, 2025 (“Supplement No. 1”), filed by SuperCom Ltd. (the “Company,” “we,” “us” or “our”), modifies and supplements certain

information contained in the Company’s prospectus, dated September 13, 2024 (as amended and supplemented from time to time, the “Prospectus”), as part of the Company’s Post-Effective Amendment No. 1 to Registration Statement on Form F-1 declared

effective by the U.S. Securities and Exchange Commission on September 13, 2024. This Supplement No. 1 is not complete without, and may not be delivered or used except in connection with, the Prospectus, including all amendments and supplements

thereto. The Prospectus, as amended by this Supplement No. 1, relates to the offering of warrants to purchase up to an aggregate of 1,143,599 ordinary shares, par value NIS 50 per share (the “ordinary shares”), of the Company (the “Warrants”)

(and the ordinary shares issuable from time to time upon exercise of the Warrants) pursuant to the terms of the Agreement (as defined below).

On February 19, 2025, we entered into a letter agreement (the “Agreement”) with a certain accredited institutional investor holder of certain of the Warrants (the “Investor”)

whereby we agreed that if and only if an Investor exercises for cash 931,099 of the Warrants issued to the Investor (the “Investor Warrants”) for all of the ordinary shares issuable upon exercise of such Investor Warrants before the end of the

period beginning from the time of the Investor’s execution of the Agreement and delivery of the Agreement to us and our delivery of this Supplement No. 1 to the Investor and until 9:00 a.m. Eastern Time on February 19, 2025 (the “Modified

Exercise Price Term”), we will issue to the Investor a new warrant in the form attached to the Agreement (the “New Warrants”), in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities

Act”), pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(b) promulgated thereunder, which New Warrant shall be initially exercisable for 75% of the number of ordinary shares issued to the Investor pursuant to the exercise of the

Investor Warrants during the Modified Exercise Price Term, at an exercise price of $13.50 per ordinary share. The New Warrants will be exercisable commencing 60 days after the issuance date for a period until May 1, 2029, which is in line with

the remaining duration of the Investor Warrants which were scheduled to expire between April 17, 2029 and May 15, 2029.

Accordingly, this Supplement No. 1 amends and supplements the Prospectus to reflect that the Investor Warrants shall be immediately exercisable during the Modified Exercise

Price Term. Following the Agreement, if all of the Investor Warrants are exercised for cash during the Modified Exercise Price Term, we would receive gross proceeds of approximately $8.2 million.

The information in this Supplement No. 1 modifies and supersedes, in part, the information contained in the Prospectus. Any information that is modified or superseded in the

Prospectus shall not be deemed to constitute a part of the Prospectus, except as so modified or superseded by this Supplement No. 1. We may further amend or supplement the Prospectus from time to time by filing additional amendments or

supplements as required. You should read the entire Prospectus and any amendments or supplements carefully before you make an investment decision.

Our ordinary shares are traded on the Nasdaq Capital Market under the symbol “SPCB.” On February 18, 2025, the closing sale price of our ordinary shares was $11.90 per share.

Investing in our securities involves a high degree of risk. Before buying any of our securities, you should read and carefully consider risks

described in the “Risk Factors” section in the Prospectus, under similar headings in the other documents that are incorporated by reference into the Prospectus and in our most recent reports on Form 6-K.

Neither the U.S. Securities and Exchange Commission, the Israeli Securities Authority nor any state securities commission has approved or disapproved of

these securities or determined if the Prospectus, or any of the supplements or amendments relating thereto, is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 19, 2025

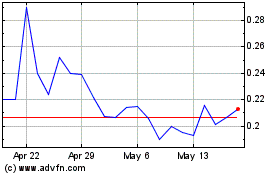

SuperCom (NASDAQ:SPCB)

Historical Stock Chart

From Jan 2025 to Feb 2025

SuperCom (NASDAQ:SPCB)

Historical Stock Chart

From Feb 2024 to Feb 2025