Atos reports full year 2024 results

Press release

Atos reports full year 2024

results

Recovery of the commercial activity in Q4

2024

- Q4 order entry at

€2.7 billion

- Q4 book to bill at

117%, +9 points vs Q4 2023, benefitting from the signature of large

multi-year contract renewals and wins

- FY 2024 book to bill

at 82% vs 94% in prior year

FY 2024 revenue: €9,577 million, down -5.4% organically,

impacted by previously-established contract terminations or scope

reductions and by market softness in key geographies

- Eviden: down -6.7%

organically

- Tech Foundations

down -4.1% organically

Operating margin of 2.1% at €199m, with

Eviden at 2.0% and Tech Foundations at 2.2%

-

Down -210 bps organically compared with FY 2023, mainly due to the

allocation to the business of SG&A costs previously allocated

to Other Operating Income & Expenses, as part of the separation

project in prior year

-

Operating margin includes circa €40 million of provision for

underperforming contracts following negotiations with

customers

Free cash flow at €-2,233 million

reflecting the end of one-off working capital optimization actions

and higher capex linked to High Performance Computing

contracts

-

Working capital optimization at December 2024 of €0.3 billion

compared to €1.8 billion in prior year

-

Consisting solely of customer invoices paid in advance without any

discount and on a pure voluntary basis;

-

No usage at all of account receivable factoring or specific

optimization on trade payables.

Net income group share of €248 million,

including notably:

-

€3,520 million income from the financial restructuring, including a

€2,766 million gain on the debt-to-equity swap and €965 million

IFRS 9 debt fair value treatment, which will be amortized in

subsequent years

-

Goodwill and other non-current assets impairment charge of €2,357

million, reflecting the decrease of the Group’s enterprise value,

which takes into account a lower fair value of the financial debts

and a lower market capitalization

Paris, March 5, 2025 - Atos, a

global leader in digital transformation, high-performance computing

and information technology infrastructure, today announces its 2024

financial results.

Philippe Salle, Atos Chairman of the

Board of Directors and Chief Executive Officer,

declared:

“It was with great enthusiasm and conviction

that I have joined the Atos Group in October 2024. Now that our

financial restructuring has been successfully completed in

December, the Group can focus on its transformation journey and on

providing the highest level of support to our customers through

innovation and quality of service. I will present my vision for

Atos and our mid-term strategy during a Capital Markets Day on May

14.

During the fourth quarter, our commercial

activity recovered thanks to the positive change of perception of

our clients, who took note of the improvement of our credit rating.

This positive commercial momentum materialized in renewals or

extensions of large strategic multi-year contracts.

I would like to take this opportunity to

sincerely thank the teams involved for their outstanding

contribution to the financial structuring of the company and to our

employees, customers and partners for their continued

support.”

FY 2024 performance

highlights

| In €

million |

FY 2024 |

FY 2023 |

Var. |

|

FY 2023* |

Organic Var. |

|

Revenue |

9,577 |

10,693 |

-10.4% |

|

10,124 |

-5.4% |

|

Operating Margin |

199 |

467 |

-268 |

|

423 |

-224 |

|

In % of revenue |

2.1% |

4.4% |

-230bps |

|

4.2% |

-210bps |

|

OMDA |

722 |

1,026 |

-304 |

|

|

|

|

In % of revenue |

7.6% |

9.6% |

-200bps |

|

|

|

|

Net income |

248 |

-3,441 |

3,689 |

|

|

|

|

Free Cash Flow |

-2,233 |

-1,078 |

-1,154 |

|

|

|

|

Net debt excl. IFRS 9 fair value treatment |

-1,238 |

-2,230 |

992 |

|

|

|

|

Net debt |

-275 |

-2,230 |

1,955 |

|

|

|

*: at constant scope and December 2024

average exchange rates

FY 2024 performance by

Business

|

In € million |

FY 2024

Revenue |

FY 2023

revenue |

FY 2023

revenue* |

Organic variation* |

|

Eviden |

4,604 |

5,089 |

4,937 |

-6.7% |

|

Tech Foundations |

4,972 |

5,604 |

5,187 |

-4.1% |

|

Total |

9,577 |

10,693 |

10,124 |

-5.4% |

| In €

million |

FY 2024

Operating margin |

FY 2023 Operating margin |

FY 2023

Operating margin* |

|

FY 2024

Operating margin % |

FY 2023 Operating margin% |

FY 2023 Operating margin%* |

Organic variation* |

|

Eviden |

90 |

294 |

272 |

|

2.0% |

5.8% |

5.5% |

-350 bps |

|

Tech Foundations |

109 |

172 |

151 |

|

2.2% |

3.1% |

2.9% |

-70 bps |

|

Total |

199 |

467 |

423 |

|

2.1% |

4.4% |

4.2% |

-210 bps |

*: at constant scope and December 2024

average exchange rates

Group revenue was €9,577

million, down -5.4% organically compared with FY 2023. Overall,

Group revenue evolution in 2024 reflects previously-established

contract terminations or scope reductions and market softness in

key geographies

Eviden revenue was €4,604 million, down -6.7%

organically.

-

Digital activities decreased high single

digit. The business was impacted by previously-established contract

terminations and contract scope reductions, as well as by the

continued market softness in North America, in the UK & Ireland

and in Benelux and the Nordics.

- Big Data & Security

(BDS) revenue was roughly stable organically.

Advanced Computing grew mid-single digit with large project

deliveries in Denmark and Germany particularly during the fourth

quarter. Revenue in Digital Security decreased low single digit due

to contract terminations and volume decline.

Tech

Foundations revenue was €4,972 million, down -4.1%

organically.

- Core

revenue (excluding BPO and value-added resale

(“VAR”)) decreased low single digit. Stronger revenue in Major

Events (related to the Paris Olympic & Paralympic games and the

UEFA) was offset by previously-established contract terminations

and completions in North America and by contract scope and volume

reduction in the UK.

- Non-core

revenue declined high single digit as planned,

reflecting deliberate reduction of BPO activities in the UK and

reduced value-added resale for hardware and software products.

Group

operating margin was €199 million representing 2.1%

of revenue, down -210 basis points organically compared with

2023:

- This margin decrease comes mainly

from the allocation to the business of €103 million SG&A costs

previously allocated to Other Operating Income & Expenses as

they related to the separation project conducted in 2023. The

profitability of the Group was also impacted by revenue decrease

and lower utilization of resources. Operating margin also includes

circa €40 million of provision for underperforming contracts

following negotiations with customers

-

Eviden’s operating margin was €90 million or

2.0% of revenue, down -350 basis points organically. Beyond the

allocation of SG&A costs to the business for €48 million,

profitability was also impacted by revenue decrease and lower

utilization of resources.

- Tech

Foundations’ operating margin was €109 million or

2.2% of revenue down by -70 basis points organically. The positive

impacts from the continued execution of the transformation program

and the accelerated reduction of under-performing contracts via

renegotiation were offset by higher allocation of SG&A cost to

the business for €55 million.

FY 2024 performance by Regional Business

Unit

| In €

million |

FY 2024

Revenue |

FY 2023

revenue |

FY 2023

revenue* |

Organic variation* |

|

North America |

1,909 |

2,280 |

2,177 |

-12.3% |

| UK / IR |

1,500 |

1,770 |

1,763 |

-14.9% |

| Benelux and

the Nordics (BTN) |

946 |

911 |

905 |

+4.6% |

| Central

Europe |

2,207 |

2,506 |

2,253 |

-2.1% |

| Southern

Europe |

2,080 |

2,284 |

2,119 |

-1.9% |

| Growing

markets |

924 |

930 |

893 |

+3.4% |

| Others &

Global structures |

11 |

12 |

13 |

-16.3% |

|

Total |

9,577 |

10,693 |

10,124 |

-5.4% |

| In €

million |

FY 2024

Operating margin |

FY 2023 Operating margin |

FY 2023

Operating margin* |

|

FY 2024

Operating margin % |

FY 2023 Operating margin% |

FY 2023 Operating margin%* |

Organic variation* |

|

North America |

161 |

244 |

229 |

|

8.5% |

10.7% |

10.5% |

-200 bps |

| UK / IR |

72 |

75 |

77 |

|

4.8% |

4.2% |

4.3% |

+40 bps |

| Benelux and the

Nordics (BTN) |

7 |

23 |

23 |

|

0.8% |

2.5% |

2.5% |

-170 bps |

| Central

Europe |

10 |

31 |

23 |

|

0.5% |

1.3% |

1.0% |

-60 bps |

| Southern

Europe |

80 |

99 |

82 |

|

3.9% |

4.3% |

3.9% |

+0 bps |

| Growing

markets |

31 |

92 |

88 |

|

3.4% |

9.9% |

9.9% |

-650 bps |

| Others &

Global structures |

-163 |

-97 |

-98 |

|

N/A |

N/A |

N/A |

N/A |

|

Total |

199 |

467 |

423 |

|

2.1% |

4.4% |

4.2% |

-210 bps |

*: at constant scope and December 2024

average exchange rates

North America revenue was

€1,909 million, down -12.3% organically, impacted

by contract terminations and general slowdown in market

conditions.

- Eviden revenue was down double

digit, impacted by contract terminations and volume decline in

Healthcare, Finance, and Transport & Logistics. BDS revenue

remained stable.

- Tech Foundations revenue was down

high single digit due to contract completions and terminations in

Media and in Insurance, as well as scope reductions with select

customers.

Operating margin was €161 million

or 8.5% of revenue, down -200 basis

points organically.

- Eviden’s margin declined, impacted

by volume reduction and contract terminations.

- Tech Foundations margin declined,

due to lower utilization of resources and volume reduction.

UK & Ireland revenue was

€1,500 million, down -14.9% organically.

- Eviden revenue was down double

digit. Digital revenue decreased, reflecting contract completions

and volume reduction in the Public Sector. BDS revenue decreased as

well, following the discontinuation of the low-margin “computing as

a service” offering.

- Revenue in Tech Foundations was

down double digit, due to contract completion in Public Sector BPO

activities.

Operating margin was €72 million,

or 4.8% of revenue, up +40 basis points

organically. Tech Foundations margin benefited from the extension

of a large multi-year contract renewed at better financial terms,

while Eviden margin was impacted by revenue decline and lower

utilization of resources in Digital.

Benelux and the Nordics revenue

was € 946 million, up +4.6% organically

- Eviden revenue was up double digit,

thanks particularly to BDS, with a new supercomputer sold to an

innovation center in Denmark.

- Revenue in Tech Foundations was

down low single digit, with contract completions and volume decline

in Healthcare and in Utilities.

Operating margin was €7 million,

or 0.8% of revenue, down -170 basis

points organically. Profitability was impacted by project overruns

and lower utilization of resources in Digital.

Central Europe revenue was €

2,207 million, down -2.1% organically.

- Eviden revenue was down low single

digit. Decline in Digital due to volume reduction from

Manufacturing and Defense customers was partially offset by the

ongoing delivery of a large HPC in Germany.

- Tech Foundations revenue was down

low-single digit, reflecting scope reductions in the Banking and

Automotive sectors.

Operating margin was €10 million

or 0.5% of revenue, down -60 basis

points organically. Tech Foundations’ margin improvement was offset

by Eviden’s profitability decrease.

Southern Europe revenue was

€2,080 million, down -1.9% organically.

- Eviden revenue was down low-single

digit. Digital activities declined due to volume reduction in

Automotive, Transport & Logistics and Banking sectors. The

delivery of a supercomputer project in Spain provided a higher

prior year comparison basis for BDS.

- Tech Foundations revenue declined

low single digit due to contract completions with select

customers.

Operating margin was €80 million

or 3.9% of revenue, broadly stable

organically. BDS’ margin improvement driven by ongoing contracts

deliveries was partially offset by Eviden profitability decrease

due to lower utilization of resources in Digital.

Growing Market revenue was €924

million, up +3.4% organically, reflecting stronger

contributions related to the Paris Olympic & Paralympic Games

and the UEFA contract.

Operating margin was €31 million or

3.4% of revenue, down -650 basis points reflecting

higher marketing expenses for Major Events.

Others and Global Structures

encompass the Group’s global delivery centers and global

structures:

- Global delivery centers net

cost was €-72 million, broadly stable compared with last

year.

- Global Structures net

cost was €-91 million and increased by €65 million,

impacted by higher SG&A costs allocated to Operating margin in

2024 (rather than allocated to Other Operating Income, as part of

the separation project in prior year).

Order entry and backlog

FY 2024 commercial activity

Order

entry reached €7.9 billion in 2024. Eviden order entry was

€4.1 billion and Tech Foundations order entry was €3.8 billion.

Book-to-bill ratio for the Group was

82% in 2024, down from 94% in 2023.

- Eviden reported a

book-to-bill ratio of 88% in 2024, down from 94% in 2023

- Tech Foundations

reported a book-to-bill ratio of 76% in 2024, down from 94% in

2023

Q4 2024 commercial activity

Order

entry reached €2.7 billion in Q4 2024 bringing book to

bill ratio to 117% for the quarter, benefitting

from renewed client confidence thanks to the completion of the

financial restructuring.

Eviden reported a book-to-bill

ratio of 111% for the fourth quarter, increasing strongly by +12

points compared with Q4 2023, notably led by a strong performance

of Digital with a book to bill at 127%.

Main contract signatures in the fourth quarter included an

application management services contract with a Ministry of

Economy, contract renewals in application management and

cybersecurity services with a large American retail company and

with a large health provider, as well as a High-Performance

Computer (HPC) upgrade with a European scientific community.

Tech Foundations reported a

book-to-bill ratio of 122% for the fourth quarter, increasing by +6

points compared with Q4 2023.

Main contract signatures in the fourth quarter included a 4-years

contract extension for IT and digital transformation services with

a state-owned savings bank. Several multi-year strategic contracts

were renewed, in particular to provide Digital Workplace and Hybrid

Cloud & Infrastructure services for North American and UK &

Ireland customers in Financial Services, Public Sector, and

Transport & Logistic.

Backlog & commercial pipeline

At the end of December 2024, the full

backlog reached €13.0 billion representing 1.3 years of

revenue.

The full qualified pipeline

amounted to €4.3 billion at the end of December 2024, representing

5.1 months of revenue.

Human resources

The total

headcount was 78,112 at

the end of December 2024, decreasing by -17.9% compared with the

end of December 2023 and includes:

- Transfers of 4,900 employees to new

providers in Q3 2024 following contract completions in North

America and in the UK. Excluding these transfers, headcount has

decreased by circa -13%,

- Worldgrid disposal in Q4 2024 (-973

employees).

During the year, the

Group hired 9,388 staff (of which 93.3% were Direct employees).

Employe attrition rate

remained in line with historical levels, increasing slightly from

14.5% in 2023 to 15.6% in 2024. FY 2024 retention rate for key

employees remained high at 92%.

Net income

Net income

group share was €248 million, primarily due to a €3,520

million financial gain related to the financial restructuring of

the Group and a €2,858 million cost recorded in Other Operating

Income and Expenses, which included a €2,357 million impairment

charges on goodwill and non-current assets.

Free cash flow

Free cash

flow was €-2,233 million in 2024 reflecting primarily the

end of one-off working capital optimization actions resulting in a

negative change in working capital requirement for €1,498 million

and higher capex linked to HPC contracts for €239 million.

Net debt and debt covenants

At December 31, 2024, net debt was €1,238

million (€275 million including IFRS 9 debt fair value treatment),

compared to € 2,230 million as of December 31, 2023. and consisted

of:

-

Cash and cash equivalents for €1,739 million

-

Short-term financial assets for €93 million

-

Borrowings for €3,069 million (nominal value) or €2,107 million

(IFRS fair value)

The new credit documentation requires

the Group to maintain:

- from 31 March

2025, a minimum liquidity level of €650 million, to be verified at

the end of each financial quarter;

- from 30 June

2027, as from each half-year end, a maximum level of financial

leverage (“Total Net Leverage Ratio Covenant”), which is defined as

the ratio of Financial indebtedness (mainly excluding IFRS 16

impacts and IFRS 9 debt fair value treatment) to pre-IFRS 16 OMDA;

the ceilings thus applicable will be determined no later than 30

June 2026 with reference to a flexibility of 30% in relation to the

Business Plan adopted by the Group at that time; these ceilings

will in any event remain between 3.5x and 4.0x.

As at December 31, 2024, the Group financial

leverage (as defined above and pre IFRS 9 debt fair value

treatment) was 3.16x.

Going concern and liquidity

The consolidated financial statements of the

Group for the year ended December 31, 2024 have been prepared on a

going concern basis.

The Group’s cash forecasts for the twelve months

following the approval of the 2024 consolidated financial

statements by the Board of Directors, result in a cash situation

that meets its liquidity needs over that period.

The cash forecasts, which take into account the

latest business forecasts, have been prepared based on the

assumptions which were in line with the Group updated business plan

communicated on September 2, 2024.

It is reminded that as part of its financial

restructuring and following the completion on 18 December 2024 of

the final steps of the Accelerated Safeguard Plan approved by the

specialized Commercial Court of Nanterre on 24 October 2024, which

resulted in:

(i) a €2.1 billion gross debt

reduction through the equitization of €2.9 billion of existing

financial debts and the repayment of €0.8 billion interim

financings with the new money debt provided to the Company;

(ii) €1.6 billion of new money

debt and €0.1 billion of new money equity from the rights issue and

the additional reserved capital increase and

(iii) no debt maturities before

the end of 2029,

the Group now has the

resources and flexibility to execute its midterm strategy.

Operating margin to Operating

income

|

In € million |

2024 |

2023 |

|

Operating margin |

199 |

467 |

|

Reorganization |

-119 |

-696 |

|

Rationalization and associated costs |

-37 |

-38 |

|

Integration and acquisition costs |

3 |

4 |

|

Amortization of intangible assets (PPA from acquisitions) |

-57 |

-108 |

|

Equity based compensation |

-2 |

-19 |

|

Impairment of goodwill and other non-current assets |

-2 357 |

-2 546 |

| Other

items |

-288 |

-169 |

|

Operating (loss) |

-2 659 |

-3 106 |

Non recurring items

were a net expense of €2,858 million.

Reorganization

costs amounted to € 119 million.

- Workforce adaptation measures

relating mainly to restructuring plans launched in previous years

were €77 million compared with €343 million in 2023, as the Group

limited restructuring expenses to manage its cash position in

2024.

- Separation and transformation

related to the 2023 legal carve-out were incurred mostly at the

start of the year for €42 million. In 2023, these costs amounted to

€353 million, of which about one third corresponded to internal

project costs.

Rationalization and associated costs amounted to €

37 million compared to € 38 million in 2023, mainly corresponding

to the continuation of the data centers consolidation program.

Integration

and acquisition costs amounted to € 3 million as certain

earn-out and retention schemes did not materialize and were thus

released to the income statement.

Amortization

of intangible assets recognized in the purchase price

allocation amounted to €57 million and was mainly composed of

Syntel customer relationships and technologies.

Impairment of

goodwill and other non-current assets amounted to € 2,357

million and mostly related:

- To the

impairment of goodwill for € 2,240 million in both Eviden (Americas

and Northern Europe & APAC) and Tech Foundations (Northern

Europe & APAC), and ;

- To the

impairment of customer relationships for € 109 million in Americas

as a result of customer contract terminations.

In 2024, Other

items were a net expense of €288 million compared with

€169 million in 2023 and included:

- €74 million of

net capital gain related to the sale of Worldgrid offset by

additional losses recognized on past transactions ;

- €160 million of

losses related to onerous contracts that were accounted for in OOI

in previous years;

- €96 million of

legal fees and settlement related to major litigations, including

the settlement concluded with Unisys in December;

- €78 million of

current assets write offs; and

- €28 million of

costs related to early retirement programs in Germany, the UK and

France as well as others non-recurring items.

As a result, operating

loss was at €-2,659 million, compared with a loss of €-3,106

million in 2023, reflecting primarily the €2,357 million impairment

charge.

Operating Income to Net income Group

Share

|

In € million |

2024 |

2023 |

|

Operating (loss) |

-2,659 |

-3,106 |

|

Net financial income (expense) |

3,121 |

-227 |

|

Tax charge |

-214 |

-112 |

|

Non-Controlling interests |

- |

-1 |

|

Share of net profit of equity-accounted investments |

- |

5 |

|

Net income (loss) Group Share |

248 |

-3,441 |

|

Basic earning per share |

0.034 |

-31.04 |

|

Diluted earning per share |

0.031 |

-31.04 |

Net financial

income was €3,121 million and was composed of:

- The net cost of financial debt of

€178 million, compared with €102 million in 2023. This €76 million

increase mainly resulted from:

- €38 million higher cost on the old

debt (additional portions drawn on the RCF and higher interest

rates on the Term Loan A);

- €13m interests on the interim

financing;

- €12m interests on the new financing

structure.

- Other financial

items for a net income of € 3,299 million in 2024 compared

to net expense of € 125 million in 2023, composed mainly of:

- The gain

related to the financial restructuring of the Group for €3,520

million, detailed as follows:

|

In € million |

2024 |

| Fair value

gain on the debt converted into equity |

2,766 |

|

Fair value gain on the new debt |

965 |

|

Fair value of the issued warrants |

-45 |

|

Subtotal at financial restructuring date |

3,686 |

|

Costs and fees reported in the income statement |

-165 |

|

Impact reported under the other financial

income |

3,520 |

- Other items of

€221 million, including notably:

- €78 million

of exit fees on Interim financing loans repaid as part of financial

restructuring on December 18, 2024;

- €36 million

lease liability interest (€26 million in 2023). This variation

mainly resulted from the increase in discount rates;

- €30 million

financial expense on pensions(€31 million in 2023). This pension

financial cost represents the difference between interest costs on

pension obligations and the return on plan assets;

- €29 million of

net foreign exchange loss, including hedges (loss of €19 million in

2023);

- €15 million of

prior year transaction costs included in financial debts, which

were fully amortized in 2024 in the context of the financial

restructuring of the Group.

The tax

charge for 2024 was €214 million, compared with €112

million in 2023. This €+102 million increase was mainly due to:

- A €59 million impairment charge on

deferred tax assets

- A €37 million expense related to

non-recoverable withholding tax

Net income

group share was €248 million, primarily due to a €3,520

million financial gain related to the financial restructuring of

the Group and a €2,858 million cost recorded in Other Operating

Income and Expenses, which included a €2,357 million impairment

charges on goodwill and non-current assets.

Earnings per share

Basic earnings per

share were €0.034. per share in 2024 and diluted earnings per share

were €0.031 per share.

Free cash flow and net cash

|

In € million |

2024 |

2023 |

|

Operating Margin before Depreciation and Amortization

(OMDA) |

722 |

1,026 |

|

Capital expenditures |

-444 |

-205 |

|

Lease payments |

-301 |

-358 |

|

Change in working capital requirement* |

-1,192 |

-391 |

|

Cash from operations (CFO)* |

-1,214 |

73 |

|

Tax paid |

-81 |

-77 |

|

Net cost of financial debt paid |

-178 |

-102 |

|

Reorganization in other operating income |

-245 |

-605 |

|

Rationalization & associated costs in other operating

income |

-9 |

-47 |

|

Integration and acquisition costs in other operating income |

-3 |

-8 |

|

Other changes** |

-504 |

-312 |

|

Free Cash Flow (FCF) |

-2,233 |

-1,078 |

|

Net (acquisitions) disposals |

162 |

411 |

|

Capital increase |

3,049 |

- |

|

Share buy-back |

-2 |

-3 |

|

Dividends paid |

-18 |

-35 |

|

Change in net (debt) |

958 |

-705 |

|

Opening net cash (debt) |

-2,230 |

-1,450 |

|

Change in net cash (debt) |

958 |

-705 |

|

Foreign exchange rate fluctuation on net cash (debt) |

34 |

-75 |

|

Closing net (debt) excl. IFRS fair value

treatment |

-1,238 |

-2,230 |

|

IFRS Debt fair value treatment |

963 |

- |

|

Closing net (debt) |

-275 |

-2,230 |

* Change in

working capital requirement excluding the working capital

requirement change related to items reported in other operating

income and expense.

** "Other changes" include other operating income and expense

with cash impact (excluding staff reorganization, rationalization

and associated costs, integration and acquisition costs) and other

financial items with cash impact, net long term financial

investments excluding acquisitions and disposals, and profit

sharing amounts payable transferred to debt

Free cash

flow was €-2,233 million in 2024 reflecting primarily the

end of one-off working capital optimization actions resulting in a

negative change in working capital requirement for €1,498 million

and higher capex linked to HPC contracts for €239 million.

Capital expenditures and lease

payments totaled €745 million, up €182 million from the prior year

reflecting a significant investment in the energy-efficient

Exascale technology.

Change in working capital

requirement was €-1,192 million, primarily from €-1,498

million lower working capital optimization compared with end of

fiscal 2023. As at December 2024, working capital benefited from

invoices paid in advance by customers for € 319 million, without

any discount and on a pure voluntary basis. As at December 31,

2023, total specific optimization carried out by the Group to

optimize its working capital amounted to € 1,817 million.

Cash out related to taxes paid

increased by € 4 million and amounted to € 81 million in 2024,

including € 6 million of taxes paid in connection with carve-out

transactions completed in 2024.

Net cost of

financial debt was €178 million as explained above.

The total of reorganization,

rationalization & associated costs and

integration & acquisition costs reached €256

million compared with €660 million in 2023 and included:

- €135 million of reorganization

costs in connection with restructuring measures as well as the

continuation of the German restructuring plans; and

- €110 million of costs related to

the outstanding activities on the separation of the Group incurred

mostly over the first quarter of the year.

Cash out related to

Other changes was €-504 million compared to € -312

million in 2023, and included:

- €166 million of costs incurred on

onerous contracts (purchase commitments and customer

contracts);

- €144 million of transaction costs

paid in the context of the financial restructuring;

- €78 million of exit fees on interim

financing

- Costs related to litigations

As a result of the

above impacts mainly driven by the change in the working capital

requirement, the Group Free Cash Flow was € -2,233

million in 2024, compared to € -1,078 million in 2023.

The net cash impact resulting from

disposals was €162 million mainly related to the net cash

proceeds from the Worldgrid disposal of €232 million, partly offset

by the write-off of a receivable on a past disposal.

Capital increase amounted to

€3,049 million and were made of :

- €2,904 million of equitization of

financial debts; and

- €145 million of new money equity

raised mainly from the Rights Issue

In the context of the financial restructuring

process of the Group.

No dividends were paid to Atos

SE shareholders in 2024. The €18 million cash out (€35 million in

2023) corresponded to taxes withheld on internal dividend

distributions and to dividends paid to minority interests.

Foreign exchange rate

fluctuation determined on debt or cash exposure by country

represented a decrease in net debt of €34 million.

As a result, the Group net debt

position as of December 31, 2024 was €275 million (€1,238

million excluding the IFRS 9 debt fair value treatment), compared

to €2,230 million as of December 31, 2023.

Consolidated financial

statements

Atos consolidated financial statements for the

year ended December 31, 2024, were approved by the Board of

Directors on March 4, 2025. Audit procedures on the consolidated

financial statements have been completed and the audit report will

be issued after the review of the 2024 Universal Registration

Document.

Advance Computing sales process

update

On November 25, 2024, Atos announced that it has

received a non-binding offer from the French State for the

potential acquisition of 100% of the Advanced Computing activities

of its BDS division, based on an enterprise value of €500 million,

to be potentially increased to €625 million including

earn-outs.

The offer received from the French State

provides for an exclusivity period until May 31, 2025. If the

exclusive negotiations lead to an agreement and subject to

obtaining the customary commercial, employee and administrative

authorizations, a Share Purchase Agreement, subject to work

councils’, opinion may be signed by that date. An initial payment

of €150 million is expected to be made available to Atos upon

signing of the Share Purchase Agreement.

In addition, Atos has engaged into a sale

process for its Mission Critical Systems business.

Capital Markets Day

Atos will present an update of its strategy and

organization during a Capital Markets Day that will be held in

Paris on May 14, 2025.

Dividend

Atos Board of Directors decided, in its meeting

held on March 4, 2025, not to propose a dividend payment to the

next Annual General Meeting.

Conference call

Atos’ Management invites you to an international

conference call on the Group 2024 results, on Wednesday,

March 5th, 2025 at

08:00 am (CET – Paris).

You can join the webcast of the

conference:

- via the following link:

https://edge.media-server.com/mmc/p/5g7hv4ka

- by telephone

with the dial-in, 10 minutes prior the starting time. Please note

that if you want to join the webcast by telephone, you must

register in advance of the conference using the following

link:

https://register.vevent.com/register/BIa3f9570d64b4412c8f5192ad4ad6d30b

Upon registration, you will be provided with

Participant Dial In Numbers, a Direct Event Passcode and a unique

Registrant ID. Call reminders will also be sent via email the day

prior to the event.

During the 10 minutes prior to the beginning of the call, you will

need to use the conference access information provided in the email

received upon registration.

After the conference, a replay of the webcast

will be available on atos.net, in the Investors section.

Forthcoming events

April 25, 2025 (Before Market Opening)

|

First quarter

2025 revenue |

|

May 14, 2025 |

Capital Markets

Day

|

|

June 13, 2025 |

Annual General

Meeting |

| |

|

|

August 1st, 2025 (Before Market Opening) |

First semester

2025 results |

APPENDIX

Q4 2024 revenue

|

In € million |

Q4 2024

Revenue |

Q4 2023

Revenue* |

Organic variation* |

|

Eviden |

1,126 |

1,280 |

-12.0% |

|

Tech Foundations |

1,182 |

1,329 |

-11.0% |

|

Total |

2,309 |

2,608 |

-11.5% |

|

In € million |

Q4 2024

Revenue |

Q4 2023

Revenue* |

Organic variation* |

| North

America |

410 |

528 |

-22.3% |

| UK / IR |

322 |

447 |

-28.1% |

| Benelux and

the Nordics (BTN) |

218 |

232 |

-6.1% |

| Central

Europe |

586 |

580 |

+1.1% |

| Southern

Europe |

519 |

556 |

-6.6% |

| Growing

markets |

251 |

261 |

-3.9% |

| Others &

Global structures |

2 |

4 |

-34.6% |

|

Total |

2,309 |

2,608 |

-11.5% |

*: at constant scope and December 2024

average exchange rates

Group revenue was €2,309

million in Q4, down -11.5% organically compared with Q4 2023.

Eviden revenue was €1,126 million, down

-12.0% organically.

-

Digital activities decreased double digit.

The business was impacted by previously-established contract

terminations contract scope reductions, as well as the continued

market softness in North America and in the UK & Ireland.

- Big Data & Security

(BDS) revenue grew low single digit organically.

Advanced Computing grew with large project deliveries in

Germany.

Tech

Foundations revenue was €1,182.0 million, down -11.0%

organically.

- Core

revenue (excluding BPO and value-added resale

(“VAR”)) decreased high-single digit, mainly impacted by contract

terminations in North America and previously-established contract

scope and volume reduction in UK.

- Non-core

revenue declined double digit reflecting deliberate

reduction of BPO activities in the UK and less value-added resale

for hardware and software products.

FY 2023 revenue and operating margin at

constant scope and exchange rates reconciliation

For the analysis of the Group’s performance,

revenue and OM for FY 2024 is compared with FY 2023 revenue and OM

at constant scope and foreign exchange rates. Reconciliation

between the FY 2023 reported revenue and OM, and the FY 2023

revenue and OM at constant scope and foreign exchange rates is

presented below, by Business Lines and Regional Business Units.

FY 2023 revenue

In € million |

FY 2023

published |

Internal transfers |

Scope effects |

Exchange rates effects |

FY 2023* |

| Eviden |

5,089 |

33 |

-192 |

7 |

4,937 |

| Tech

Foundations |

5,604 |

-33 |

-401 |

17 |

5,187 |

|

Total |

10,693 |

0 |

-592 |

24 |

10,124 |

| |

|

|

|

|

|

| |

|

|

|

|

|

FY 2023 revenue

In € million |

FY 2023

published |

Internal transfers |

Scope effects |

Exchange rates effects |

FY 2023* |

| North

America |

2,280 |

-1 |

-96 |

-6 |

2,177 |

| Benelux and the

Nordics (BTN) |

911 |

0 |

-7 |

0 |

905 |

| UK / IR |

1,770 |

0 |

-53 |

47 |

1,763 |

| Central

Europe |

2,506 |

0 |

-254 |

2 |

2,253 |

| Southern

Europe |

2,284 |

0 |

-164 |

0 |

2,119 |

| Growing

Markets |

930 |

0 |

-18 |

-19 |

893 |

| Others &

Global structures |

12 |

1 |

0 |

0 |

13 |

|

Total |

10,693 |

0 |

-592 |

24 |

10,124 |

*: at constant scope and December 2024

average exchange rates

FY 2023 Operating margin

In € million |

FY 2023

published |

Internal transfers |

Scope effects |

Exchange rates effects |

FY 2023* |

| Eviden |

294 |

0 |

-25 |

2 |

272 |

| Tech

Foundations |

172 |

0 |

-20 |

-1 |

151 |

|

Total |

467 |

0 |

-45 |

1 |

423 |

| |

|

|

|

|

|

| |

|

|

|

|

|

FY 2023 Operating margin

In € million |

FY 2023

published |

Internal transfers |

Scope effects |

Exchange rates effects |

FY 2023* |

| North

America |

244 |

1 |

-15 |

-1 |

229 |

| Benelux and the

Nordics (BTN) |

23 |

0 |

-1 |

0 |

23 |

| UK / IR |

75 |

4 |

-5 |

2 |

77 |

| Central

Europe |

31 |

-3 |

-6 |

0 |

23 |

| Southern

Europe |

99 |

-2 |

-16 |

0 |

82 |

| Growing

Markets |

92 |

0 |

-3 |

-1 |

88 |

| Others &

Global structures |

-97 |

-1 |

0 |

0 |

-98 |

|

Total |

467 |

0 |

-45 |

1 |

423 |

*: at constant scope and December 2024

average exchange rates

Scope effects on

revenue amounted to €-592 million and €-45 million on operating

margin. They mainly related to the divesture of UCC, EcoAct, Italy,

State Street JV, and Worldgrid.

Currency effects

positively contributed to revenue for €+24 million and €+1 million

on operating margin. They mostly came from the appreciation of the

British pound, partially compensated by the depreciation of the

Brazilian real, the US dollar, the Argentinian peso and the Turkish

lira.

Q4 2023 revenue at constant scope and

exchange rates reconciliation

For the analysis of

the Group’s performance, revenue for Q4 2024 is compared with 2023

revenue at constant scope and foreign exchange rates.

In 2023, the Group

reviewed the accounting treatment of certain third-party standard

software resale transactions following the decision published by

ESMA in October 2023 that illustrated the IFRS IC decision and

enacted a restrictive position on the assessment of Principal vs.

Agent under IFRS 15 for such transactions. The Q4 2023 revenue is

therefore restated by € +48 million. The impact affected Eviden in

North America RBU.

Reconciliation between

the 2023 reported fourth quarter revenue and the 2023 fourth

quarter revenue at constant scope and foreign exchange rates is

presented below, by Business Lines and Regional Business Units:

Q4 2023 revenue

In € million |

Q4 2023 published |

Restatement |

Q4 2023 restated |

Internal transfers |

Scope effects |

Exchange rates effects |

Q4 2023* |

| Eviden |

1,247 |

48 |

1,295 |

-1 |

-22 |

8 |

1,280 |

| Tech

Foundations |

1,308 |

- |

1,308 |

1 |

-1 |

21 |

1,329 |

|

Total |

2,555 |

48 |

2,602 |

0 |

-23 |

29 |

2,608 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Q4 2023 revenue

In € million |

Q4 2023 published |

Restatement |

Q4 2023 restated |

Internal transfers |

Scope effects |

Exchange rates effects |

Q4 2023* |

| North

America |

483 |

48 |

531 |

-1 |

-1 |

-1 |

528 |

| Benelux and the

Nordics |

233 |

0 |

233 |

0 |

-1 |

0 |

232 |

| UK / IR |

433 |

0 |

433 |

0 |

-3 |

18 |

447 |

| Central

Europe |

582 |

0 |

582 |

0 |

-2 |

0 |

580 |

| Southern

Europe |

571 |

0 |

571 |

0 |

-16 |

0 |

556 |

| Growing

markets |

250 |

0 |

250 |

0 |

0 |

12 |

261 |

| Others &

Global structures |

3 |

0 |

3 |

1 |

0 |

0 |

4 |

|

Total |

2,555 |

48 |

2,602 |

0 |

-23 |

29 |

2,608 |

*: at constant scope and December 2024

average exchange rates

Disclaimer

This document contains

forward-looking statements that involve risks and uncertainties,

including references, concerning the Group’s expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Atos’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Atos’s plans, objectives, strategies, goals, future events, future

revenues or synergies, or performance, and other information that

is not historical information. Actual events or results may differ

from those described in this document due to a number of risks and

uncertainties that are described within the 2023 Universal

Registration Document filed with the Autorité des Marchés

Financiers (AMF) on May 24, 2024 under the registration number

D.24-0429, as updated by chapter 2 “Risk factors” of the first

amendment to Atos' 2023 universal registration document filed with

the Autorité des Marchés Financiers (AMF) on November 7, 2024 under

the registration number D.24-0429-A01 and by chapter 2 “Risk

factors” of the second amendment to Atos' 2023 universal

registration document filed with the Autorité des Marchés

Financiers (AMF) on December 11, 2024 under the registration number

D.24-0429-A02, and the half-year report filed published on August

6, 2024. Atos does not undertake, and specifically disclaims, any

obligation or responsibility to update or amend any of the

information above except as otherwise required by law.

This document does not

contain or constitute an offer of Atos’s shares for sale or an

invitation or inducement to invest in Atos’s shares in France, the

United States of America or any other jurisdiction. This document

includes information on specific transactions that shall be

considered as projects only. In particular, any decision relating

to the information or projects mentioned in this document and their

terms and conditions will only be made after the ongoing in-depth

analysis considering tax, legal, operational, finance, HR and all

other relevant aspects have been completed and will be subject to

general market conditions and other customary conditions, including

governance bodies and shareholders’ approval as well as appropriate

processes with the relevant employee representative bodies in

accordance with applicable laws.

About

Atos

Atos is a global

leader in digital transformation with circa 78,000 employees and

annual revenue of circa €10 billion. European number one in

cybersecurity, cloud and high-performance computing, the Group

provides tailored end-to-end solutions for all industries in 68

countries. A pioneer in decarbonization services and products, Atos

is committed to a secure and decarbonized digital for its clients.

Atos is a SE (Societas Europaea) and listed on Euronext

Paris.

The purpose of

Atos is to help design the future of the information space.

Its expertise and services support the development of knowledge,

education and research in a multicultural approach and contribute

to the development of scientific and technological excellence.

Across the world, the Group enables its customers and employees,

and members of societies at large to live, work and develop

sustainably, in a safe and secure information space.

Contacts

Investor relations:

David Pierre-Kahn | investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33 6 29 34 85

67

Individual shareholders: +33 8 05 65 00 75

Press contact: globalprteam@atos.net

- PR - Atos - FY 2024 results

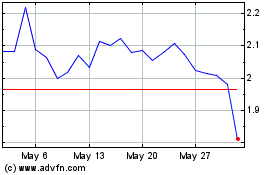

Atos (TG:AXI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atos (TG:AXI)

Historical Stock Chart

From Mar 2024 to Mar 2025