MLP ETFs: Still Good for Income Investors? - ETF News And Commentary

January 15 2014 - 11:00AM

Zacks

2013 was pretty volatile

for interest-rate sensitive sectors like Master Limited

Partnerships (MLPs) thanks to the Fed tapering talks which pushed

up interest rates substantially. Despite this sluggish trend, MLPs

delivered a decent performance finishing the year with

average gains of about 16%.

With the Fed finally deciding on a soft QE cut-back ($10 billion

per month) from this month, investors are concerned whether MLPs

will able to march ahead in 2014 or not.

The Fed chairman, Ben Bernanke also commented on December 18 that

the bond buying program will be curtailed in phases in 2014 and may

finally end by late 2014, if improvement in the labor market

matches the regulatory body’s expectation, (read: Fed Tapers Bond

Purchases: 3 ETFs in Focus on the News). Since then, the downside

risk in the MLP sector has increased.

Are MLPs at Risk?

MLPs are publicly traded partnerships generally engaged in the

transportation, storage, production, or mining of minerals and

natural resources. MLPs often operate pipelines or similar energy

infrastructures that make it an interest-rate sensitive sector.

MLPs catch investor eye as these do not pay taxes at the entity

level and are thus able to pay out most of their income (more than

90%) in the form of dividends like the REIT firms. Investors

looking for higher income levels outside the traditional bond

sources bet on these products (read: Boost Income and Growth with

MLP ETFs).

Following the ‘Taper’ announcement, interest rates started to show

an uptrend which in turn sent the bond yields higher. Though the

latest U.S. job report was shockingly weak and pushed the bond

yields lower instantly, this does not mean that the Fed will modify

its Taper plan only on the basis of one-month data.

In fact, barring this single data, all other economic indicators

are pointing to the rapid pickup in the economy which in turn

indicates further taper in the course of 2014. Also, even after a

downward correction due to the weak job data, yield on 10-year

treasury bonds again inched up to 2.84% as of January 13,

2014.

Quite expectedly, in a rising rate environment, MLPs fall out of

favor among yield-seeking investors. Plus, if interest rates rise,

MLPs will have to pay higher for the huge chunk of borrowed money

which may in turn force them to lower their dividend payout

ratio.

Is there Any Hope?

Probably Yes. First of all, if at all the nominal rate starts going

up, analysts believe that the rise in inflation-adjusted real rates

in 2014 might be lower than last year.

On the contrary, the Fed’s decision on further taper in 2014 will

depend on whether inflation and employment perk up at a desired

pace. That means that a gradual interest rate rise in a modestly

inflationary environment may not prove that bad for the

rate-sensitive sectors (read: REIT ETFs in Taper Aftermath: Any

Hope for Gains Now?).

MLPs are relatively safe and less risky options in the broader

energy space. This can be validated by the fact that when oil as

commodity was weak in most of 2013 thanks to the strength in the

greenback, oil producing ETFs especially those in the MLP ETF space

were better placed.

Further, with consistent growth in the energy industry expected

from new developments in the field of unconventional energy, energy

MLP ETFs should benefit considerably over the long term. After all,

rates do not always rise on tightening of monetary policy. A

growing economy and increased business activities may also push the

rates higher.

ETF Impact

In such a scenario, investors might want to pay close attention to

the MLP market in the near term. Below, we briefly highlight the

some funds in the space which could be great picks for 2014.

Some top MLP ETFs like Alerian MLP ETF

(AMLP), JP Morgan Alerian MLP Index

ETN (AMJ), UBS E-TRACS Alerian

MLP Infrastructure Index (MLPI) lost

0.46%, 0.31%, 0.36% in the first 10 days of January while

SPDR S&P 500 (SPY) added

0.17% during the same time frame (see more ETFs in the Zacks ETF

Center). One fund ETRACS Alerian MLP Index ETN

(AMU) however gained 0.11% in the short

period.

The return figures confirm the fact that MLPs were not severely

beaten down post taper announcement. The mild losses were in line

with the broader market and may be were reflections of pent-up

profit booking activity.

AMLP is an extremely popular choice in the space with more than $7

billion in assets, but funds like AMJ ($5.7 billion) and MLPI ($1.6

billion) also attract sufficient investments. Among these, AMU is a

slightly overlooked option with around $200 million of assets.

Investors should also note that all four funds currently have a

dividend yield of more than 3% (more than the 10-year Treasury bond

yield) with AMLP boasting as high as 6.09%.

Bottom Line

As the market has essentially priced in some cuts to the QE program

this year, we do not expect much disruption in the interest

rate world if the Fed pairs down its stimulus gradually. Though

some psychology-induced sell-offs will be there in MLPs with each

Fed announcement, the inherent fundamentals of the sector should

remain strong.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

JPM-ALERN MLP (AMJ): ETF Research Reports

ALERIAN-MLP (AMLP): ETF Research Reports

E-TRC ALRN MLP (AMU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

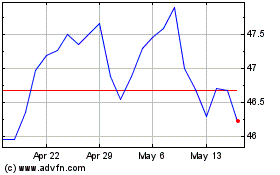

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Jan 2024 to Jan 2025