Most ETFs Are Tax Smart, Is Yours? - ETF News And Commentary

March 28 2014 - 10:57AM

Zacks

ETFs are revolutionizing

the way we invest and the reasons for their popularity are not

difficult to understand. They combine the flexibility, ease and

liquidity of stock trading with the benefits of traditional index

fund investing. Further, they are generally less expensive, more

transparent as well as more tax-efficient than mutual funds.

Mutual funds are infamous for causing tax headaches to unsuspecting

investors. ETFs on the other hand are tax smart due to the way they

are structured. However, there are some ETF structures that are not

very tax efficient and investors need to be aware of the issues

associated with them.

ETF Structure Creates Tax Efficiency

Since most ETFs track well-known market indexes, they usually

experience lower turnover compared with actively managed funds and

thus create lower tax liabilities.

But more importantly, ETFs are generally more tax efficient

compared with similar passively managed mutual funds, due to the

way they are structured.

In other words, if an investor holds an ETF and a similar mutual

fund in a taxable account, the ETF will most likely result in less

tax liability for the investor.

The creation of an ETF begins with the sponsor, also known as the

manager filing a plan with the SEC, and on approval of the plan

executing an agreement with an authorized participant (AP), also

known as a market maker or specialist. AP in turn assembles the

appropriate basket of constituent stocks and sends them to a

specially designated custodian bank for placing them in a

trust.

The custodian forwards the ETF shares (which represent legal claims

on tiny slivers of the basket of shares held in the trust) on to

the authorized participant. This is a

so-called in-kind trade of equivalent items and

thus there are no tax implications.

On the other hand, when an investor purchases shares of a mutual

fund, the mutual fund has to create new shares by actually

buying the shares of the constituent stocks.

Similarly when an investor redeems his/her investment, the mutual

fund has to sell the constituent shares.

The sale of stocks by the mutual fund (shareholder redemption or

portfolio turnover) may create capital gains for the shareholders.

So, the mutual fund investors may have to pay capital gains taxes

even if they have unrealized losses on their investments.

According to WSJ, 26% of equity mutual funds paid out capital gains

in 2011, compared with just 2% of equity ETFs.

ETFs are however not tax free. Dividends from

ETFs are taxed like dividends from mutual funds or stocks. Capital

gains at the time of sale also receive similar treatment.

But overall ETFs—in particularly stock ETFs--are much more

tax-efficient than mutual funds and by creating lower tax

liabilities, ETFs result in higher long-term returns for

investors.

However not all ETFs are tax-efficient. Below we have highlighted

some specific situations that can cause some headaches for

investors.

Commodity ETFs

Commodity ETFs that hold commodity futures (futures backed) are

structured as “limited partnerships” and are required to report an

investor’s allocated share of a fund’s income, gains, losses and

deductions on a Schedule K-1 instead of 1099. These are somewhat

difficult to handle.

Further gains or losses realized by ETFs are taxable events even

without any distributions being paid to shareholder. These funds

are subject to the so called “60/40” rule--60% of the gain is

subject to the long-term gains rate and 40% to the short-term

rate.

Precious Metals ETFs

Commodity ETFs that hold the precious metals (physically backed)

like GLD and SLV are treated same as holding the bullion itself.

These ETFs are structured as “grantor trust” for income tax

purposes. Owners (shareholders) of the trust are treated as if they

owned a corresponding share of the assets of the trust.

IRS treats precious metals as “collectible” for long-term capital

gains and as such gains are taxed at the rate of long-term capital

gains on collectibles if held for more than one year.

MLP ETFs

MLPs come with complicated tax issues and many investors avoid

investing in them only due to daunting tax requirements. Thankfully

for the investors, some of the tax complexities can be avoided by

owning them in ETP form. The payouts by the ETPs are reported as

ordinary income on Form 1099, and therefore the K-1 forms are not

required.

Funds that have more than 25% of their assets invested in MLPs are

treated as C corporations for tax purposes. Further, assets are

required to be marked to market and a deferred tax liability for

the unrealized gains needs to be recorded.

As a result, MLP ETFs have significant tracking errors. The most

popular MLP ETF AMLP has a gross expense ratio of 4.85% thanks

mainly to deferred tax liabilities.

Some ETFs avoid these adverse issues by limiting their exposure to

MLPs below 25%. ETNs also typically eliminate some of these complex

tax consequences, as they do actually not hold any securities. But

they come with credit risk of the issuer.

Bottom Line

ETFs are generally "Extremely Tax Favorable" due to the way they

are structured, but some ETFs are structured differently and have

some tax issues that invetors should be aware of before they decide

to invest.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7

Best Stocks for the Next 30 Days. Click

to get this free report >>

ALERIAN-MLP (AMLP): ETF Research Reports

GRNHVN-CONT CMD (GCC): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

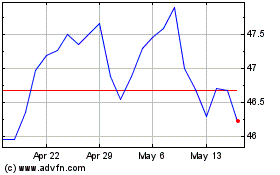

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Mar 2025 to Apr 2025

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Apr 2024 to Apr 2025