SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES ACT OF 1934

Amendment No. 3

BATTALION OIL CORPORATION

(Name of the Issuer)

Battalion Oil Corporation

Luminus Management, LLC

Luminus Energy Partners Master Fund, Ltd.

Oaktree Capital Group, LLC

Oaktree Fund GP, LLC

OCM Holdings I, LLC

Oaktree Holdings, LLC

OCM HLCN Holdings, L.P.

Oaktree Fund GP I, L.P.

Oaktree Capital I, L.P.

Ruckus Energy Holdings, LLC

Fury Resources, Inc.

Richard H. Little

Gen IV Investment Opportunities, LLC

LSP Generation IV, LLC

LSP Investment Advisors, LLC

(Names of Persons Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

40537Q803

(CUSIP Number of Class of Securities)

| |

Battalion Oil Corporation

Two Memorial City Plaza

820 Gessner Road, Suite 1100

Houston, Texas 77024

Tel: (832) 538-0300

|

|

|

Luminus Management, LLC

Luminus Energy Partners Master Fund, Ltd.

c/o of Luminus Management, LLC

1811 Bering Drive, Suite 400

Houston, Texas 77057

Tel: (713) 826-6262

|

|

|

Oaktree Capital Group, LLC

Oaktree Fund GP, LLC

OCM Holdings I, LLC

Oaktree Holdings, LLC

OCM HLCN Holdings, L.P.

Oaktree Fund GP I, L.P.

Oaktree Capital I, L.P.

c/o Oak Tree Capital Group, LLC

333 S. Grand Avenue, 28th Floor

Los Angeles, California 90071

Tel: (213) 830-6300

|

|

|

Ruckus Energy Holdings, LLC

Fury Resources, Inc.

Richard H. Little

c/o K&L Gates LLP

1 Park Plaza, Twelfth Floor

Irvine, CA 92614

|

|

| |

Gen IV Investment Opportunities, LLC

LSP Generation IV, LLC

LSP Investment Advisors, LLC

c/o LSP Investment Advisors, LLC

1700 Broadway, 35th Floor

New York, New York 10019

|

|

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

| |

Bruce F. Perce

Ryan H. Ferris

Mayer Brown LLP

71 South Wacker Drive

Chicago, IL 60606

Tel: (312) 782-0600

|

|

|

David B. Cosgrove

Dechert LLP

300 South Tryon Street, Suite 800

Charlotte, NC 28202

Tel: (704) 339-3147

|

|

|

Michael A. Hedge

Jason C. Dreibelbis

K&L Gates LLP

1 Park Plaza, Twelfth Floor

Irvine, CA 92614

Tel: (949) 253-0900

|

|

This statement is filed in connection with (check the appropriate box):

a. ☒

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934.

b. ☐

The filing of a registration statement under the Securities Act of 1933.

c. ☐

A tender offer.

d. ☐

None of the above.

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☒

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on Schedule 13E-3. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Transaction Statement on Schedule 13E-3 (as amended, this “Transaction Statement”) is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”): (1) Battalion Oil Corporation, a Delaware corporation (“Battalion” or the “Company”) and the issuer of the common stock, par value $0.0001 per share (the “Company common stock”) that is the subject of the Rule 13e-3 transaction; (2) Luminus Management, LLC, a Delaware limited liability company; (3) Luminus Energy Partners Master Fund, Ltd., a Bermuda limited company; (4) Oaktree Capital Group, LLC, a Delaware limited liability company; (5) Oaktree Fund GP, LLC, a Delaware limited liability company; (6) OCM Holdings I, LLC, a Delaware limited liability company; (7) Oaktree Holdings, LLC, a Delaware limited liability company; (8) OCM HLCN Holdings, L.P., a Delaware limited partnership; (9) Oaktree Fund GP I, L.P., a Delaware limited partnership; (10) Oaktree Capital I, L.P., a Delaware limited partnership; (11) Ruckus Energy Holdings, LLC, a Delaware limited liability company; (12) Fury Resources, Inc., a Delaware corporation; (13) Richard H. Little, a resident of the State of Texas; (14) Gen IV Investment Opportunities, LLC, a Delaware limited liability company; (15) LSP Generation IV, LLC, a Delaware limited liability company; and (16) LSP Investment Advisors, LLC, a Delaware limited liability company.

This Transaction Statement relates to the Agreement and Plan of Merger, dated December 14, 2023 (including all exhibits and documents attached thereto, and as it may be amended, supplemented or modified, from time to time, the “Merger Agreement”), by and among the Company, Fury Resources, Inc., a Delaware corporation (“Parent”), and San Jacinto Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”). The Merger Agreement provides that, subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving the Merger and becoming a wholly owned subsidiary of Parent.

At the effective time of the Merger (the “Effective Time”), each issued and outstanding share of Company common stock (other than (i) shares that immediately prior to the Effective Time are owned by the Company (including as treasury stock), Parent or Merger Sub and (ii) shares of Company common stock that are owned by stockholders of the Company who did not vote in favor of the Merger Agreement or the Merger and who have perfected and not withdrawn a demand for appraisal rights pursuant to Section 262 of the General Corporation Law of the State of Delaware will be cancelled and converted into the right to receive $7.00 per share of Company common stock in cash, without interest (the “Merger Consideration”). Upon completion of the Merger, Company common stock will no longer be publicly traded, and the Company’s stockholders will cease to have any ownership interest in the Company.

In connection with execution of the Merger Agreement, two of our largest stockholders, Luminus Energy Partners Master Fund, Ltd. (which we refer to as “Luminus”) and OCM HLCN Holdings, L.P. (which we refer to as “Oaktree”), entered into a voting agreement (which we refer to as the “Voting Agreement”) with Parent pursuant to which such stockholders agreed to vote certain of their respective shares of capital stock of the Company in favor of the adoption of the Merger Agreement, subject to certain terms and conditions contained in the Voting Agreement. As of the date of the proxy statement, Luminus and Oaktree own approximately 61.6% of Company common stock, and the shares of Company common stock subject to the voting agreement are approximately 38.0% of the Company common stock. In addition, pursuant to an Amended and Restated Contribution, Rollover and Sale Agreement (which we refer to as the “Contribution Agreement”) between Luminus, Oaktree and Gen IV Investment Opportunities, LLC (which we refer to as “LS Power’ and, together with Luminus and Oaktree, the “Rollover Sellers” and the Company stockholders other than the Rollover Sellers as the “unaffiliated stockholders”) and Parent, and subject to the terms and conditions described in the section of the proxy statement captioned “Special Factors — Financing of the Merger”, among other things, the Rollover Sellers will contribute all shares of the preferred stock of the Company (which we refer to as the “Company preferred stock”) owned by the Rollover Sellers to Parent in exchange for preferred stock of Parent (which we refer to as the “Parent preferred stock”), which contribution and exchange will happen immediately prior to the closing of the Merger. As a result of the Merger, the shares of Company preferred stock contributed to Parent will be cancelled and extinguished without any conversion thereof or consideration paid therefor.

The Company Board of Directors formed a special committee of the Board comprised solely of independent and disinterested directors (which we refer to as the “special committee”) to consider potential value creation opportunities and to take other actions that the special committee deemed appropriate. The special committee evaluated the Merger. At the conclusion of its review, the special committee, among other things, unanimously (1) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are advisable, fair to, and in the best interests of the Company and the unaffiliated stockholders (as defined below), (2) recommended that the Company Board of Directors approve and adopt the Merger Agreement and the transactions contemplated thereby, including the Merger, and (3) resolved to recommend that the unaffiliated stockholders adopt the Merger Agreement. In addition, the special committee believes that the Merger is fair to the Company’s “unaffiliated security holders,” as such term is defined in Rule 13e-3 under the Exchange Act.

The Board, after considering the recommendation of the special committee, has unanimously (a) determined and declared that the Merger Agreement and the transactions contemplated by the Merger Agreement, including the Merger, are fair to the stockholders of the Company, including the unaffiliated stockholders, and are in the best interests of the Company and the stockholders of the Company, (b) declared advisable and approved the Merger Agreement and the transactions contemplated by the Merger Agreement, including the Merger, and the execution, delivery and performance of the Merger Agreement and (c) recommended that the stockholders of the Company vote for the adoption of the Merger Agreement.

Concurrently with the filing of this Transaction Statement, the Company is filing a revised preliminary proxy statement (the “Proxy Statement”) under Regulation 14A of the Exchange Act with the SEC, pursuant to which the Company will be soliciting proxies from the Company’s stockholders in connection with the Merger. The Proxy Statement is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached to the Proxy Statement as Annex A. Terms used but not defined in this Transaction Statement have the meanings assigned to them in the Proxy Statement.

Pursuant to General Instruction F to Schedule 13E-3, the information in the Proxy Statement, including all annexes thereto, is expressly incorporated by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the information contained in the Proxy Statement. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3.

While each of the Filing Persons acknowledges that the Merger is a “going private” transaction for purposes of Rule 13e-3 under the Exchange Act, the filing of this Transaction Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is “controlled” by any of the Filing Persons and/or their respective affiliates.

The information concerning the Company contained in, or incorporated by reference into, this Schedule 13E-3 and the Proxy Statement was supplied by the Company. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference into, this Schedule 13E-3 and the Proxy Statement was supplied by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other Filing Person.

SCHEDULE 13E-3 ITEMS

Item 1. Summary Term Sheet

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

Item 2. Subject Company Information

(a) Name and address. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet — Parties to the Merger”

“Parties to the Merger”

“Important Information Regarding the Company”

“Questions and Answers about the Merger and the Special Meeting”

(b) Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“The Special Meeting — Record Date and Quorum”

“The Special Meeting — Vote Required”

“Questions and Answers about the Merger and the Special Meeting”

“Security Ownership of Certain Beneficial Owners and Management”

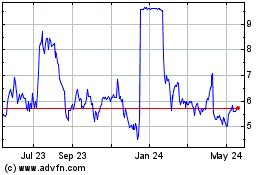

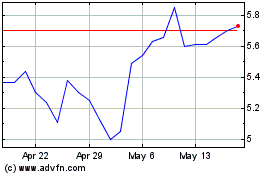

(c) Trading market and price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Important Information Regarding the Company”

(d) Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Important Information Regarding the Company”

(e) Prior public offerings. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Important Information Regarding the Company”

(f) Prior stock purchases. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Important Information Regarding the Company”

Item 3. Identity and Background of Filing Person

(a) – (c) Name and address; Business and background of entities; Business and background of natural persons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet — Parties to the Merger”

“Parties to the Merger”

“Important Information Regarding the Company”

“Important Information Regarding the Rollover Sellers”

“Important Information Regarding Parent, Ruckus and Certain Affiliates”

Item 4. Terms of the Transaction

(a)-(1) Material terms. Tender offers. Not applicable

(a)-(2) Material terms. Mergers or similar transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Special Factors — Material U.S. Federal Income Tax Consequences of the Merger”

“The Special Meeting — Vote Required”

“The Merger Agreement — Exchange and Payment Procedures”

“The Merger Agreement — Merger Consideration”

“The Merger Agreement — Conditions to the Merger”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

(c) Different terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Financing of the Merger”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“The Merger Agreement — Merger Consideration”

“The Merger Agreement — Exchange and Payment Procedures”

“The Merger Agreement — Employee Matters”

“The Merger Agreement — Indemnification; Directors’ and Officers’ Insurance”

“The Contribution Agreement”

“The Voting Agreement”

“Proposal 2: Advisory Vote on Merger-Related Compensation for the Company’s Named Executive Officers”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex D — Voting Agreement

Annex D — Amended and Restated Contribution, Rollover and Sale Agreement

(d) Appraisal rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet — Appraisal Rights”

“Questions and Answers about the Merger and the Special Meeting”

“Appraisal Rights”

Annex C — Section 262 of the Delaware General Corporation Law

(e) Provisions for unaffiliated security holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Provisions for Unaffiliated Stockholders”

(f) Eligibility for listing or trading. Not applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements

(a)(1) – (2) Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Background of the Merger”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Special Factors — Financing of the Merger”

“The Merger Agreement”

“The Voting Agreement”

“The Contribution Agreement”

“Important Information Regarding the Company”

“Important Information Regarding the Rollover Sellers”

“Important Information Regarding Parent, Ruckus and Certain Affiliates”

“Proposal 2: Advisory Vote on Merger-Related Compensation for the Company’s Named Executive Officers”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex D — Voting Agreement

Annex D — Amended and Restated Contribution, Rollover and Sale Agreement

(b) – (c) Significant corporate events; Negotiations or contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“The Merger Agreement”

“The Voting Agreement”

“The Contribution Agreement”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex D — Voting Agreement

Annex E — Amended and Restated Contribution, Rollover and Sale Agreement

(e) Agreements involving the subject company’s securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Special Factors — Financing of the Merger”

“The Merger Agreement”

“The Special Meeting — Vote Required”

“The Contribution Agreement”

“The Voting Agreement”

“Proposal 2: Advisory Vote on Merger-Related Compensation for the Company’s Named Executive Officers”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024 and February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex D — Voting Agreement

Annex E — Amended and Restated Contribution, Rollover and Sale Agreement

Item 6. Purposes of the Transaction and Plans or Proposals

(b) Use of securities acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Delisting and Deregistration of the Company Common Stock”

“Special Factors — Financing of the Merger”

“The Merger Agreement — Merger Consideration”

“The Merger Agreement — Exchange and Payment Procedures”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

(c)(1) – (8) Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Special Factors — Financing of the Merger”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

“The Merger Agreement — Merger Consideration”

“The Voting Agreement”

“The Contribution Agreement”

“Important Information Regarding the Company”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex B — Opinion of Houlihan Lokey Capital, Inc.

Annex D — Voting Agreement

Item 7. Purposes, Alternatives, Reasons and Effects

(a) Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

Annex B — Opinion of Houlihan Lokey Capital, Inc.

(b) Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

(c) Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

“Special Factors — Unaudited Prospective Financial Information”

Annex B — Opinion of Houlihan Lokey Capital, Inc.

(d) Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Special Factors — Material U.S. Federal Income Tax Consequences of the Merger”

“Special Factors — Financing of the Merger”

“Delisting and Deregistration of the Company Common Stock”

“The Merger Agreement — Effects of the Merger; Directors and Officers”

“The Merger Agreement — Merger Consideration”

“The Merger Agreement — Financing of the Merger”

“The Merger Agreement — Indemnification; Directors’ and Officers’ Insurance”

“The Merger Agreement — Employee Matters”

“Appraisal Rights”

“Proposal 2: The Compensation Proposal”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex B — Opinion of Houlihan Lokey Capital, Inc.

Item 8. Fairness of the Transaction

(a) – (b) Fairness; Factors considered in determining fairness. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Directors and Executive Officers in the Merger”

Annex B — Opinion of Houlihan Lokey Capital, Inc.

(c) Approval of security holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Special Meeting — Record Date and Quorum”

“The Special Meeting — Vote Required”

“The Special Meeting — Voting, Proxies and Revocation”

“The Merger Agreement — Conditions to the Merger”

“Proposal 1: Vote on the Adoption of the Merger Agreement”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

(d) Unaffiliated representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

Annex B — Opinion of Houlihan Lokey Capital, Inc.

(e) Approval of directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

(f) Other offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

Item 9. Reports, Opinions, Appraisals and Negotiations

(a) – (b) Report, opinion or appraisal; Preparer and summary of the report, opinion or appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Where You Can Find Additional Information”

Annex B — Opinion of Houlihan Lokey Capital, Inc.

(c) Availability of documents. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Where You Can Find Additional Information”

The reports, opinions or appraisals referenced in this Item 9 will be made available for inspection and copying at the principal executive offices of the Company during its regular business hours by any interested equity holder of the Company common stock or by a representative who has been so designated in writing.

Item 10. Source and Amounts of Funds or Other Consideration

(a) – (b), (d) Source of funds; Conditions; Borrowed funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Financing of the Merger”

“The Merger Agreement — Conditions to the Merger”

“The Merger Agreement — Conduct of the Company’s Business Pending the Merger”

“The Merger Agreement — Financing of the Merger”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

(c) Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc — Miscellaneous”

“Special Factors — Company Costs of the Merger”

“The Merger Agreement — Expenses”

“The Special Meeting — Solicitation of Proxies”

“The Merger Agreement — Termination Fee”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Item 11. Interest in Securities of the Subject Company

(a) Securities ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“Security Ownership of Certain Beneficial Owners and Management”

“Security Ownership of Schedule 13e-3 Filing Persons”

“Important Information Regarding the Rollover Sellers”

“Important Information Regarding Parent, Ruckus and Certain Affiliates”

“The Contribution Agreement”

Annex E — Amended and Restated Contribution, Rollover and Sale Agreement

(b) Securities transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors — Background of the Merger”

“Important Information Regarding the Company”

“The Merger Agreement”

“The Contribution Agreement”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Annex E — Amended and Restated Contribution, Rollover and Sale Agreement

Item 12. The Solicitation or Recommendation

(d) Intent to tender or vote in a going-private transaction. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Opinion of Houlihan Lokey Capital, Inc.”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“The Special Meeting”

“The Voting Agreement”

“The Contribution Agreement”

Annex D — Voting Agreement

Annex E — Amended and Restated Contribution, Rollover and Sale Agreement

(e) Recommendation of others. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Proposal 1: Vote on the Adoption of the Merger Agreement”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

Item 13. Financial Information

(a) Financial statements. The audited consolidated financial statements set forth in Item 8 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and unaudited consolidated financial statements set forth in Item 1 of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 are incorporated herein by reference.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors — Unaudited Prospective Financial Information”

“Important Information Regarding the Company”

“Where You Can Find Additional Information”

(b) Pro forma information. Not applicable.

Item 14. Persons/Assets, Retained, Employed, Compensated or Used

(a) – (b) Solicitations or recommendations; Employees and corporate assets. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers about the Merger and the Special Meeting”

“Special Factors — Background of the Merger”

“Special Factors — Recommendation of the Company Board of Directors; Reasons for the Merger”

“Special Factors — Rollover Sellers Reasons for the Merger; Fairness”

“Special Factors — Parent Group Reasons for the Merger; Fairness”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“The Merger Agreement — Expenses”

“The Special Meeting — Solicitation of Proxies”

Item 15. Additional Information

(b) Golden Parachute Compensation. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors — Interests of the Company’s Executive Officers and Directors in the Merger”

“The Merger Agreement — Merger Consideration”

“Proposal 2: Advisory Vote on Merger-Related Compensation for the Company’s Named Executive Officers”

Annex A — Agreement and Plan of Merger, as amended January 24, 2024, February 6, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024

(c) Other material information. The information set forth in the Proxy Statement, including all annexes thereto, is incorporated herein by reference.

Item 16. Exhibits

The following exhibits are filed herewith:

(a)(2)(i)

Preliminary Proxy Statement of the Company, Inc. (the “Proxy Statement”) (included in the Schedule 14A filed on October 2, 2024 and incorporated herein by reference).

(a)(2)(ii)

Form of Proxy Card (included in the Proxy Statement and incorporated herein by reference).

(a)(2)(iii)

Letter to Stockholders (included in the Proxy Statement and incorporated herein by reference).

(a)(2)(iv)

Notice of Special Meeting of Stockholders (included in the Proxy Statement and incorporated herein by reference).

(a)(2)(v)

Current Report on Form 8-K, dated December 14, 2023 (filed with the SEC on December 15, 2023 and incorporated herein by reference).

(a)(2)(vi)

Press release dated December 15, 2023 (included as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated December 14, 2023 and incorporated herein by reference).

(a)(2)(vii)

Current Report on Form 8-K dated January 24, 2024 (filed with the SEC on January 24, 2024 and incorporated herein by reference)

(a)(2)(viii)

Current Report on Form 8-K dated February 6, 2024 (filed with the SEC on February 6, 2024 and incorporated herein by reference)

(a)(2)(ix)

Current Report on Form 8-K dated February 16, 2024 (filed with the SEC on February 16, 2024 and incorporated herein by reference)

(a)(2)(x)

Current Report on Form 8-K dated April 10, 2024 (filed with the SEC on April 11, 2024 and incorporated herein by reference)

(a)(2)(xi)

Current Report on Form 8-K dated April 16, 2024 (filed with the SEC on April 17, 2024 and incorporated herein by reference)

(a)(2)(xii)

Current Report on Form 8-K dated April 26, 2024 (filed with the SEC on April 29, 2024 and incorporated herein by reference)

(a)(2)(xiii)

Current Report on Form 8-K dated May 3, 2024 (filed with the SEC on May 3, 2024 and incorporated herein by reference)

(a)(2)(xiv)

Current Report on Form 8-K dated June 10, 2024 (filed with the SEC on June 11, 2024 and incorporated herein by reference)

(a)(2)(xv)

Current Report on Form 8-K dated September 11, 2024 (filed with the SEC on September 11, 2024 and incorporated herein by reference)

(a)(2)(xvi)

Current Report on Form 8-K dated September 19, 2024 (filed with the SEC on September 19, 2024 and incorporated herein by reference)

(a)(2)(xvii)

Press release dated September 19, 2024 (included as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated September 19, 2024 and incorporated herein by reference).

(a)(2)(xvii)

Current Report on Form 8-K dated September 19, 2024 (filed with the SEC on September 23, 2024 and incorporated herein by reference)

(b)(i)

Debt Commitment Letter, dated October 27, 2023, executed by Fortress Capital Corp. and accepted and agreed to by Ruckus Energy Holdings, LLC.*

(b)(ii)

Debt Commitment Letter, dated October 30, 2023, executed by AI Partners Asset Management Co., Ltd and accepted and agreed to by Ruckus Energy Holdings, LLC.

(b)(iii)

Debt Commitment Letter, dated September 24, 2024, executed by AI Partners Asset Management Co., Ltd and accepted and agreed to by Ruckus Energy Holdings, LLC.

(c)(i)

Opinion of Houlihan Lokey Capital, Inc., dated September 18, 2024 (included as Annex B to the Proxy Statement and incorporated herein by reference).

(c)(ii)

Discussion Materials of Houlihan Lokey Capital, Inc., to the Board of Directors dated December 14, 2023.*

(c)(iii)

Discussion Materials of Houlihan Lokey Capital, Inc., to the Board of Directors dated December 14, 2023.*

(c)(iv)

Discussion Materials of Houlihan Lokey Capital, Inc. to the Board of Directors dated November 4, 2023*

(c)(v)

Discussion Materials of Houlihan Lokey Capital, Inc. to the Board of Directors dated November 4, 2023*

(c)(vi)

Discussion Materials of Houlihan Lokey Capital, Inc. to the Board of Directors dated September 18, 2024

(c)(vii)

Discussion Materials of Houlihan Lokey Capital, Inc. to the Board of Directors dated September 18, 2024

(d)(i)

Agreement and Plan of Merger, dated as of December 14, 2023, by and among the Company, Parent and Merger Sub as amended January 24, 2024, February 6, 2024, February 16, 2024, February 16, 2024, April 16, 2024, June 10, 2024, September 11, 2024 and September 19, 2024 (included as Annex A to the Proxy Statement and incorporated herein by reference).

(d)(ii)

Amended and Restated Contribution, Rollover and Sale Agreement, dated as of September 19, 2024 (included as Annex E to the Proxy Statement and incorporated herein by reference).

(d)(iii)

Voting Agreement, dated as of December 14, 2023 (included as Annex D to the Proxy Statement and incorporated herein by reference).

(f)

Section 262 of the Delaware General Corporation Law (included as Annex C to the Proxy Statement and incorporated herein by reference).

107

Filing Fee Table.*

*

Previously filed

SIGNATURES

After due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 2, 2024

| |

BATTALION OIL CORPORATION

|

|

|

|

|

| |

By:

|

|

|

/s/ Walter R. Mayer

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Walter R. Mayer

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

After due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 2, 2024

| |

LUMINUS ENERGY PARTNERS MASTER FUND, LTD.

|

|

|

|

|

| |

By:

|

|

|

/s/ Jonathan Barrett

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Jonathan Barrett

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

President of Luminus Management, LLC

|

|

|

|

|

| |

LUMINUS MANAGEMENT, LLC

|

|

|

|

|

| |

By:

|

|

|

/s/ Jonathan Barrett

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Jonathan Barrett

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

President

|

|

|

|

|

After due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 2, 2024

OCM HLCN HOLDINGS, L.P.

By: Oaktree Fund GP, LLC

Its: General Partner

By: Oaktree Fund GP I, L.P.

Its: Managing Member

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE FUND GP, LLC

By: Oaktree Fund GP I, L.P.

Its: Managing Member

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE FUND GP I, L.P.

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE CAPITAL I, L.P.

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OCM HOLDINGS I, LLC

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE HOLDINGS, LLC

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE CAPITAL GROUP, LLC

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

OAKTREE CAPITAL GROUP HOLDINGS GP, LLC

| |

By:

|

|

|

/s/ Henry Orren

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Henry Orren

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Senior Vice President

|

|

|

|

|

After due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 2, 2024

RUCKUS ENERGY HOLDINGS, LLC

| |

By:

|

|

|

/s/ Ariella Fuchs

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Ariella Fuchs

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

President and General Counsel

|

|

|

|

|

FURY RESOURCES, INC.

| |

By:

|

|

|

/s/ Ariella Fuchs

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Ariella Fuchs

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

President and General Counsel

|

|

|

|

|

RICHARD H. LITTLE

| |

|

|

|

/s/ Richard H. Little

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Richard H. Little

|

|

|

|

|

After due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: October 2, 2024

GEN IV INVESTMENT OPPORTUNITIES, LLC

| |

By:

|

|

|

/s/ Jeff Wade

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Jeff Wade

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Chief Compliance Officer

|

|

|

|

|

LSP GENERATION IV, LLC

| |

By:

|

|

|

/s/ Jeff Wade

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Jeff Wade

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Chief Compliance Officer

|

|

|

|

|

LSP INVESTMENT ADVISORS, LLC

| |

By:

|

|

|

/s/ Jeff Wade

|

|

|

|

|

| |

|

|

|

Name:

|

|

|

Jeff Wade

|

|

|

|

|

| |

|

|

|

Title:

|

|

|

Chief Compliance Officer and Associate General Counsel

|

|

|

|

|

Exhibit 99.(b)(ii)

|

Execution Version |

CONFIDENTIAL

October 30, 2023

Ruckus Energy Holdings, LLC

17503 La Cantera Parkway, Suite 104-603

San Antonio, Texas 78257

Attn: Avi Mirman

Commitment Letter

Ladies and Gentlemen:

Reference is made to that

certain Exclusivity and Expense Reimbursement Letter, dated September 22, 2023 (a copy of which is attached hereto as Exhibit B,

the “Exclusivity and Reimbursement Letter”), to Ruckus Energy Holdings, LLC, a Delaware limited liability company

(“Ruckus” or “you”), from the Investors (as defined therein).

You

have advised AI Partners Asset Management Co., Ltd (“AI Partners” and together with its affiliates, managed

funds and accounts, collectively, the “Commitment Parties”, “we” or “us”)

that Ruckus, which directly or indirectly controls San Jacinto Acquisition Corp., a Delaware corporation (“Merger Sub”),

intends to acquire by merger Battalion Oil Corporation, a Delaware corporation (the “Company”), and its subsidiaries,

including, without limitation, Halcón Holdings, LLC, a Delaware limited liability company (the “Borrower”).

You have further advised us that, in connection with the foregoing, you intend to consummate the other Transactions described in the Transaction

Description attached hereto as Exhibit A (the “Transaction Description”). Capitalized terms used

but not defined herein shall have the meanings assigned to them in the Transaction Description or the Exclusivity and Reimbursement Letter

or the Summary of Indicative Terms attached as Annex A to the Exclusivity and Reimbursement Letter (as amended pursuant to the

Fortress Commitment Letter (as defined below), the “Term Sheet”;

this commitment letter, the Transaction Description, the Term Sheet, the Conditions Precedent to Initial Borrowing attached hereto as

Exhibit C, and the Meritz Commitment Letter (as defined below) attached hereto as Exhibit D, collectively, the

“Commitment Letter”), as applicable. In the case of any such capitalized term that is subject to multiple and

differing definitions, the appropriate meaning thereof in this letter agreement shall be determined by reference to the context in which

it is used.

1. Commitment.

In connection with the

Transactions, AI Partners is pleased to advise you of its commitment to provide fifty percent (50%) (i.e., $100 million) of a senior

secured first lien term loan facility in the aggregate principal amount of $200 million (the “Credit

Facility”), upon the terms and conditions set forth in this Commitment Letter (including, without limitation, the last

sentence of this paragraph) and subject only to (a) the satisfaction (or written waiver by the Commitment Parties) of the

conditions set forth or referenced in the section entitled “Conditions Precedent to Initial Borrowing” in Exhibit C

hereto and (b) adjustment of the Credit Facility size as set forth in that certain Commitment Letter, dated as of the date

hereof, between Fortress Credit Corp. (“Fortress”) and Ruckus (the “Fortress Commitment

Letter”). The commitment of the Commitment Parties are several and not joint with any other Investor or any other

Lender (as defined in the Term Sheet). You agree that no advisors, co-advisors, other agents, co-agents, arrangers, co-arrangers,

bookrunners, co-bookrunners, managers or co-managers will be appointed, no other titles will be awarded and no compensation (other

than compensation expressly contemplated by this Commitment Letter) will be paid in connection with the Credit Facility unless you

and we shall so agree.

2. Acknowledgement

of Term Sheet Amendments. The parties hereby acknowledge and ratify the amendments to the Term Sheet set forth in the Fortress

Commitment Letter.

3. Information.

You hereby represent and warrant

(prior to the date of the consummation of the Acquisition and the funding of the initial borrowing under the Credit Facility (the date

of such borrowing, the “Closing Date”), to your knowledge with respect to the Company and its subsidiaries,

including the Borrower) that (a) all written information and written data (other than (i) financial estimates, forecasts, projections

and other forward-looking information (the “Projections”) and (ii) information of a general economic or

industry specific nature) (the “Information”), that has been or will be made available to any Commitment Party,

directly or indirectly, by you, the Company, the Borrower, or by any of your or its respective representatives on your behalf in connection

with the transactions contemplated hereby, when taken as a whole, is or will be, when furnished, complete and correct in all material

respects and does not or will not, when furnished, contain any untrue statement of a material fact or omit to state a material fact necessary

in order to make the statements contained therein not materially misleading in light of the circumstances under which such statements

are made (after giving effect to all supplements and updates thereto from time to time) and (b) the Projections that have been, or

will be, made available to any Commitment Party, directly or indirectly, by you, the Company, the Borrower, or by any of your or its respective

representatives on your behalf in connection with the transactions contemplated hereby have been, or will be, prepared in good faith based

upon assumptions that are believed by you to be reasonable at the time such Projections are so furnished to the Commitment Parties; it

being understood that the Projections are as to future events and are not to be viewed as facts, that the Projections are subject to significant

uncertainties and contingencies, many of which are beyond your control, and that no assurance can be given that any particular Projections

will be realized and that actual results during the period or periods covered by any such Projections may differ significantly from the

projected results and such differences may be material. You agree that, if at any time prior to the Closing Date, you become aware that

any of the representations and warranties in the preceding sentence would be incomplete or incorrect in any material respect if the Information

and the Projections were being furnished, or such representations were being made, at such time, then you will promptly inform us thereof

and will (or, with respect to the Information and Projections relating to the Company and its subsidiaries, including the Borrower, prior

to the Closing Date, will use commercially reasonable efforts to) promptly supplement the Information and such Projections such that such

representations and warranties are so complete and correct in all material respects. In arranging the Credit Facility, each of the Commitment

Parties (x) will be entitled to use and rely on the Information and the Projections without responsibility for independent verification

thereof and (y) assume no responsibility for the accuracy or completeness of the Information or the Projections.

4. Conditions.

The commitment of the Commitment

Parties hereunder to fund the Credit Facility on the Closing Date are subject solely to the conditions set forth herein and in Exhibit C

hereto, and upon satisfaction (or written waiver by the Commitment Parties) of such conditions, the initial funding of the Credit Facility

on the Closing Date shall occur.

Notwithstanding anything to

the contrary in this Commitment Letter (including each of the exhibits attached hereto), the Facility Documentation or any other letter

agreement or other undertaking concerning the financing of the Transactions to the contrary, the terms of the Facility Documentation shall

be in a form such that they do not impair the availability of the Credit Facility on the Closing Date if the conditions set forth in Exhibit C

hereto are satisfied (or are waived by the Commitment Parties). For the avoidance of doubt, in no event shall the Company or any of its

subsidiaries be required to execute any Facility Documentation, or any other document or instruments (other than customary authorization

letters), prior to, or that become effective prior to the consummation of the Acquisition and the funding of the Credit Facility and it

being understood that, to the extent any collateral is not provided on the Closing Date (as defined in the Acquisition Agreement) after

your use of commercially reasonable efforts to do so (other than (x) the filing of Uniform Commercial Code financing statements,

and (y) the filing of intellectual property security agreements for intellectual property that is registered as of the Closing Date,

the providing of such collateral shall not constitute a condition precedent to the availability of the Credit Facility on the Closing

Date but shall be required to be provided after the Closing Date pursuant to arrangements to be mutually agreed upon. This paragraph,

and the provisions herein, shall be referred to as the “Certain Funds Provisions”.

5. Exclusivity,

Expense Reimbursement and Indemnity.

To induce the Commitment Parties

to enter into this Commitment Letter and to proceed with the documentation of the Credit Facility, you agree that Section 2 (Exclusivity),

Section 3 (Expense Reimbursement) and Section 5 (Indemnification) of the Exclusivity and Reimbursement Letter are incorporated

herein mutatis mutandis.

6. Sharing

of Information, Absence of Fiduciary Relationships, Affiliate Activities.

You acknowledge that the Commitment

Parties and their respective affiliates may be providing debt financing, equity capital or other services (including, without limitation,

financial advisory services) to other persons in respect of which you, the Company, and your and their respective affiliates, may have

conflicting interests regarding the transactions described herein and otherwise. None of the Commitment Parties or their respective affiliates

will use confidential information obtained from you, the Company, or your or their respective affiliates by virtue of the transactions

contemplated by this Commitment Letter or their other relationships with you, the Company, or your or their respective affiliates in connection

with the performance by them of services for other persons, and none of the Commitment Parties nor their respective affiliates will furnish

any such information to other persons, except to the extent permitted below. You also acknowledge that none of the Commitment Parties

or their respective affiliates has any obligation to use in connection with the transactions contemplated by this Commitment Letter, or

to furnish to you, confidential information obtained by them from other persons.

As you know, certain of the

Commitment Parties may be full service securities firms engaged, either directly or through their affiliates, in various activities,

including securities trading, commodities trading, investment management, financing and brokerage activities and financial planning and

benefits counseling for both companies and individuals. In the ordinary course of these activities, such Commitment Parties and certain

of their respective affiliates may actively engage in commodities trading or trade the debt and equity securities (or related derivative

securities) and financial instruments (including bank loans and other obligations) of you, the Company and other companies which may

be the subject of the arrangements contemplated by this Commitment Letter for their own account or for the accounts of their customers

and may at any time hold long and short positions in such securities. Certain of the Commitment Parties or their respective affiliates

may also co-invest with, make direct investments in, and invest or co-invest monies in or with funds or other investment vehicles managed

by other parties, and such funds or other investment vehicles may trade or make investments in securities of you, the Company or other

companies which may be the subject of the arrangements contemplated by this Commitment Letter or engage in commodities trading with any

thereof. With respect to any securities and/or financial instruments so held by the Commitment Parties, their respective affiliates or

any of their respective customers, all rights in respect of such securities and financial instruments, including any voting rights, will

be exercised by the holder of the rights in its sole discretion.

The Commitment Parties and

their respective affiliates may have economic interests that conflict with those of you and may be engaged in a broad range of transactions

that involve interests that differ from yours and those of your affiliates, and the Commitment Parties have no obligation to disclose

any of such interests to you or your affiliates. You agree that the Commitment Parties will act under this Commitment Letter as independent

contractors, and that nothing in this Commitment Letter will be deemed to create an advisory, fiduciary or agency relationship or fiduciary

or other implied duty between the Commitment Parties and you, the Company, or your respective equity holders or affiliates. You acknowledge

and agree that (i) the transactions contemplated by this Commitment Letter are arm’s-length commercial transactions between

the Commitment Parties and, if applicable, their affiliates, on the one hand, and you, on the other, (ii) in connection therewith

and with the process leading to such transaction each Commitment Party and its applicable affiliates (as the case may be) is acting solely

as a principal and has not been, is not and will not be acting as an advisor, agent or fiduciary of you, the Company, or your or their

management, equity holders, creditors, affiliates, or any other person, (iii) the Commitment Parties and their applicable affiliates

(as the case may be) have not assumed an advisory or fiduciary responsibility or any other obligation in favor of you or your affiliates

with respect to the transactions contemplated hereby or the process leading thereto (irrespective of whether the Commitment Parties or

any of their respective affiliates have advised or are currently advising you on other matters) except the obligations expressly set forth

in this Commitment Letter and (iv) you have consulted your own legal and financial advisors to the extent you deemed appropriate.

You further acknowledge and agree that (a) you are responsible for making your own independent judgment with respect to such transactions

and the process leading thereto, (b) you are capable of evaluating and understand and accept the terms, risks and conditions of the

transactions contemplated hereby, and (c) we have provided no legal, accounting, regulatory or tax advice, and you contacted your

own legal, accounting, regulatory and tax advisors to the extent you have deemed appropriate. You agree that you will not claim that the

Commitment Parties or their applicable affiliates, as the case may be, have rendered advisory services of any nature or respect, or owe

a fiduciary or similar duty to you or your affiliates, in connection with such transaction or the process leading thereto and no Commitment

Party, nor any of their respective affiliates, shall have any responsibility or liability to you with respect thereto. You hereby waive

any claims that you or any of your affiliates may have against each of the Commitment Parties and their respective affiliates for breach

of fiduciary duty or alleged breach of fiduciary duty in connection with the Transactions and agree that no Commitment Party, nor any

of their respective affiliates, shall have any liability (whether direct or indirect) to you in respect of such a fiduciary claim or to

any person asserting a fiduciary duty claim on behalf of or in right of you, including your equity holders, employees or creditors, in

connection with the Transactions.

Without limiting the generality

of this section, you hereby acknowledge that the Indemnified Persons may be engaged in such roles and that such roles may involve interests

that differ from your interests and those of the Company and you, and you hereby waive any claims that you or your affiliates may have

against the Commitment Parties’ Indemnified Persons (as defined in the Exclusivity and Reimbursement Letter) relating to this Commitment

Letter or the Transaction as a result of any such conflict of interest and agree that such Indemnified Persons shall not have any liability

(whether direct or indirect) to your or your affiliates in respect of any such claim or to any person asserting any such claim on behalf

of you or your affiliates, including your equity owners.

7. Confidentiality.

You agree that you will not

disclose, directly or indirectly, this Commitment Letter, including the Term Sheet and the other exhibits and attachments hereto or the

contents of any of the foregoing, or the activities of any Commitment Party pursuant hereto or thereto, to any person or entity without

prior written approval of AI Partners, except (a) to the Equity Investors and your and their respective officers, directors, agents,

employees, attorneys, accountants, advisors, controlling persons or equity holders, in each case, who are informed of the confidential

nature thereof, on a confidential and need-to-know basis, (b) if the Commitment Parties consent in writing to such proposed disclosure

(such consent not to be unreasonably withheld, delayed or conditioned), (c) pursuant to the order of any court or administrative

agency in any pending legal, judicial, regulatory, or administrative proceeding, or otherwise as required by applicable law, rule or

regulation or compulsory legal process or to the extent requested or required by governmental and/or regulatory authorities, in each case

based on the reasonable advice of your legal counsel (and in each such case you agree (i) to the extent practicable and not prohibited

by applicable law, rule or regulation to inform us promptly thereof and, to the extent practicable, prior to such disclosure and

(ii) to use commercially reasonable efforts to ensure that any such information so disclosed is accorded confidential treatment),

(d) to the extent reasonably necessary or advisable in connection with the exercise of any remedy or enforcement of any right under

this Commitment Letter, (e) to the Company, the subsidiaries of the Company, including the Borrower, and the respective officers,

directors, employees, agents, attorneys, accountants, advisors, controlling persons and equity holders of each of the foregoing, on a

confidential and need-to-know basis (provided that, until after the Closing Date any disclosure of the Term Sheet or its contents

to the Company, the subsidiaries of the Company, including the Borrower, or their respective officers, directors, employees, agents, attorneys,

accountants, advisors, controlling persons and equity holders shall be redacted in a customary manner (as reasonably agreed by the Commitment

Parties), including in respect of the amounts, percentages and basis points of compensation set forth therein, unless the Commitment Parties

otherwise consent); provided that (i) you may disclose the Commitment Letter and its contents (but not the Term Sheet or the

contents thereof (other than its existence)) in connection with any public or regulatory filing relating to the Transactions and (ii) you

may disclose the aggregate fee amount contained in the Term Sheet (but not the Term Sheet) as part of Projections, pro forma information

or a generic disclosure of aggregate sources and uses related to fee amounts related to the Transactions to the extent required in any

regulatory filing relating to the Transactions. You agree to inform all such persons who receive information concerning this Commitment

Letter that such information is confidential on the terms set forth herein. The restrictions on disclosure set forth in this paragraph

(other than with respect to the Term Sheet and the contents thereof) shall expire and shall be of no further effect after the first anniversary

of the date hereof.

The Commitment Parties reserve

the right to review and approve, in advance, all materials, press releases, advertisements and disclosures by the Borrower or its affiliates

that contain the name of the Commitment Parties or any of their affiliates or describe the Commitment Parties’ financing commitment,

role or activities with respect to the Credit Facility.

The Commitment Parties

and their affiliates will use all information provided to them or such affiliates by or on behalf of you hereunder or in connection

with the Credit Facility and the related Transactions solely for the purpose of providing the services which are the subject of this

Commitment Letter and negotiating, evaluating and consummating the transactions contemplated hereby and shall treat confidentially

all such information and shall not publish, disclose or otherwise divulge, such information; provided that nothing herein

shall prevent any Commitment Party and their affiliates from disclosing any such information (a) pursuant to the order of any

court or administrative agency or in any pending legal, judicial, regulatory or administrative proceeding, or otherwise as required

by applicable law, rule or regulation or compulsory legal process (in which case the Commitment Parties agree (except with

respect to any routine audit or examination conducted by auditing accountants or any regulatory authority exercising examination or

regulatory authority), (i) to the extent practicable and not prohibited by applicable law, rule or regulation, to inform

you promptly thereof prior to disclosure and (ii) to use commercially reasonable efforts to ensure that any such information so

disclosed is accorded confidential treatment), (b) upon the request or demand of any regulatory authority having or asserting

jurisdiction over the Commitment Parties or any of their respective affiliates (in which case the Commitment Parties agree (except

with respect to any routine audit or examination conducted by auditing accountants or any regulatory authority exercising

examination or regulatory authority), (i) to the extent practicable and not prohibited by applicable law, rule or

regulation, to inform you promptly thereof prior to disclosure and (ii) to use commercially reasonable efforts to ensure that

any such information so disclosed is accorded confidential treatment), (c) to the extent that such information becomes publicly

available other than by reason of improper disclosure by such Commitment Party or any of its affiliates or any related parties

thereto in violation of any confidentiality obligations owing to you, the Equity Investors, the Company or any of your or their

respective subsidiaries or affiliates or related parties (including those set forth in this paragraph), as determined by a court of

competent jurisdiction in a final and non-appealable decision, (d) to the extent that such information is received by such

Commitment Party or any of its affiliates from a third party that is not, to such Commitment Party’s knowledge, subject to any

contractual or fiduciary confidentiality obligations owing to you, the Equity Investors, the Company or any of your or their

respective subsidiaries or affiliates or related parties, (e) to the extent that such information is independently developed by

the Commitment Parties or any of their affiliates, (f) to such Commitment Party’s affiliates and to its and their

respective directors, officers, employees, legal counsel, independent auditors, rating agencies, professionals and other experts or

agents who need to know such information in connection with the Transactions and who are informed of the confidential nature of such

information and are or have been advised of their obligation to keep information of this type confidential, (g) to its and its

affiliates potential or prospective partners and lenders, other Investors, Lenders, participants or assignees and to any direct or

indirect contractual counterparty to any loan, swap or derivative transaction relating to you or any of your subsidiaries, in each

case who agree to be bound by the terms of this paragraph (or language substantially similar to this paragraph); provided that

the disclosure of any such information to any partners, lender, Investors, Lenders or prospective Lenders or participants or

prospective participants referred to above shall be made subject to the acknowledgment and acceptance by such person that such

information is being disseminated on a confidential basis (on substantially the terms set forth in this paragraph or as is otherwise

reasonably acceptable to you and each Commitment Party, including, without limitation, as agreed in any information materials or

other marketing materials) in accordance with the standard processes of such Commitment Party or customary market standards for

dissemination of such type of information, (h) to the extent you shall have consented to such disclosure in writing (such

consent not to be unreasonably withheld, conditioned or delayed) or (i) for purposes of enforcing its rights hereunder in any

legal proceedings and for purposes of establishing a defense in any legal proceedings. The Commitment Parties’ and their

affiliates’, if any, obligations under this paragraph shall terminate automatically and be superseded by the confidentiality

provisions in the Facility Documentation upon the initial funding thereunder. Otherwise, the confidentiality provisions set forth in

this paragraph shall survive the termination of this Commitment Letter and expire and shall be of no further effect after the first

anniversary of the date hereof.

8. Miscellaneous.

This Commitment Letter

and the commitments hereunder shall not be assignable by any party hereto without the prior written consent of each other party

hereto (and any attempted assignment without such consent shall be null and void). This Commitment Letter and the commitments