Annual Report (foreign Private Issuer) (40-f)

March 30 2020 - 4:30PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

☐REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the fiscal year ended December 31, 2019

|

|

Commission file number 001-38346

|

SPROTT PHYSICAL GOLD AND SILVER TRUST

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English (if applicable))

|

|

|

|

|

|

|

Province of Ontario, Canada

(Province or other jurisdiction

of incorporation or organization)

|

|

1040

(Primary Standard Industrial

Classification Code

Number (if applicable))

|

|

98-1399794

(I.R.S. Employer Identification

Number (if applicable))

|

Suite 2600, South Tower

Royal Bank Plaza

200 Bay Street

Toronto, Ontario

Canada, M5J 2J1

(Address and telephone number of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302) 738-6680

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Units

|

|

CEF

|

|

NYSE Arca

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual Information Form ☒ Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

194,827,300

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

On October 2, 2018, Sprott Inc. announced that it entered into an agreement with Central Fund of Canada Limited (“CFCL”), CFCL’s administrator (the “Administrator”), and the controlling shareholders of CFCL, to acquire the common shares of CFCL and the right to administer and manage CFCL’s assets by way of plan of arrangement (the “Arrangement”). In connection with the Arrangement, the Sprott Physical Gold and Silver Trust (the “Trust”) was established on October 26, 2018 under the laws of the Province of Ontario, Canada, pursuant to a trust agreement between the Trust's settlor, Sprott Asset Management LP (the “Manager”) and RBC Investor Services Trust (“RBC Investor Services” or the “Trustee”), as trustee, dated as of October 26, 2018 (the “Trust Agreement”).

On January 16, 2019, pursuant to the Arrangement Agreement, the Trust acquired all of the assets and assumed all of the liabilities of CFCL (other than CFCL’s administration agreement).

Pursuant to Rule 12g-3(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Trust is a “successor issuer” to CFCL, which historically filed periodic reports under the Exchange Act. CFCL’s Class A Shares were registered under Section 12(b) of the Exchange Act and, therefore, as of January 16, 2019, the Trust’s units (the “Units”) were deemed registered under that section of the Exchange Act. The Units issued in connection with the Arrangement were exempt from registration under the U.S. Securities Act of 1933, as amended, pursuant to Section 3(a)(10) thereof.

ANNUAL INFORMATION FORM

The Annual Information Form of the Registrant for the fiscal year ended December 31, 2019 is filed as Exhibit 99.5 to this annual report on Form 40-F, and is incorporated herein by reference.

AUDITED FINANCIAL STATEMENTS

The Audited Financial Statements of the Registrant for the fiscal year ended December 31, 2019 are filed as Exhibit 99.6 to this annual report on Form 40-F, and are incorporated herein by reference.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s Discussion and Analysis for the fiscal year ended December 31, 2019 is filed as Exhibit 99.6 to this annual report on Form 40-F, and is incorporated herein by reference.

CERTIFICATIONS

See Exhibits 99.1, 99.2, 99.3 and 99.4 to this Annual Report on Form 40-F.

DISCLOSURE CONTROLS AND PROCEDURES

As of the end of the period covered by this report, an evaluation was carried out under the supervision of and with the participation of the Registrant’s management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act). Based on that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the design and operation of these disclosure controls and procedures were effective in ensuring that information required to be disclosed by the Registrant in reports that it files with or submits to the U.S. Securities and Exchange Commission (the “Commission”) is recorded, processed, summarized and reported within the time periods required.

No changes were made in the Registrant’s internal control over financial reporting or in other factors during the period covered by this annual report on Form 40-F that have materially affected or are reasonably likely to materially affect the Registrant’s internal control over financial reporting.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management’s report on internal control over financial reporting is filed as Exhibit 99.7 to this annual report on Form 40-F, and is incorporated herein by reference.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

The attestation report of KPMG LLP on management’s internal control over financial reporting is filed as Exhibit 99.8 to this annual report on Form 40-F, and is incorporated herein by reference.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

None.

NOTICE PURSUANT TO REGULATION BTR

None.

AUDIT COMMITTEE FINANCIAL EXPERT

Pursuant to the provisions of Rule 10A-3 under the Exchange Act and Rule 5.3 of NYSE Arca, the Registrant is not required to have, and does not have, an audit committee.

CODE OF ETHICS

Under the applicable provisions of Rule 5.3 of NYSE Arca, the Registrant is not required to adopt, and the Registrant has not adopted, a code of ethics.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

KPMG LLP have been the auditors of the Registrant since October 26, 2017. The following table presents fees for professional services rendered by KPMG LLP to the Registrant for the audit of the Registrant's financial statements for the year ended December 31, 2019 and the period ended Decemebr 31, 2018, and fees billed for other services rendered by KPMG LLP during periods from January 1, 2019 to December 31, 2019, and from January 1, 2018 to December 31, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

Period Ended

|

|

|

|

|

December 31,

|

|

December 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Audit Fees(1)

|

|

|

181,250

|

|

|

129,00

|

|

|

Audit-related Fees

|

|

|

-

|

|

|

-

|

|

|

Tax Fees(2)

|

|

|

7,610

|

|

|

3,000

|

|

|

All Other Fees

|

|

|

-

|

|

|

-

|

|

|

Total

|

|

|

188,860

|

|

|

132,000

|

|

NOTES:

|

|

(1)

|

|

Consist of fees related to statutory audits, related audit work in connection with registration statements, prospectus filings and other filings with various regulatory authorities, quarterly reviews of interim financial statements, French translation and performing inventory count procedures.

|

|

|

(2)

|

|

Consist of fees for tax consultation and compliance services, including indirect taxes.

|

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant has no off-balance sheet arrangements as defined by Form 40-F under the Exchange Act.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The Registrant has no long-term contractual obligations to be disclosed pursuant to General Instruction B.12 of Form 40-F.

IDENTIFICATION OF THE AUDIT COMMITTEE

Pursuant to the provisions of Rule 10A-3 under the Exchange Act and Rule 5.3 of NYSE Arca, the Registrant is not required to have, and does not have, an audit committee.

FORWARD-LOOKING STATEMENTS

A number of statements in the documents incorporated by reference in this Form 40-F constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Please refer to disclosure under the heading “Cautionary Statement Regarding Forward-Looking Statements” in the Annual Information Form of the Registrant for the year ended December 31, 2019, dated March 30, 2020, incorporated herein and forming an integral part of this document, for a discussion of risks, uncertainties and assumptions that could cause actual results to vary from those forward-looking statements.

INTERACTIVE DATA FILE

The Interactive Data File for the fiscal year ended December 31, 2019 is filed as Exhibit 101 to this annual report on Form 40-F, and is incorporated herein by reference.

MINE SAFETY DISCLOSURE

The Registrant is not required to disclose the information required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed a Form F-X in connection with the class of securities in relation to which the obligation to file this annual report arises.

Any changes to the name or address of the agent for service of process of the Registrant shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

SPROTT PHYSICAL GOLD AND SILVER TRUST

|

|

|

By:

|

Sprott Asset Management LP, by its general partner

Sprott Asset Management GP Inc., as manager of

Sprott Physical Gold and Silver Trust

|

|

|

|

|

|

Date: March 30, 2020

|

By:

|

/s/ John Ciampaglia

|

|

|

|

John Ciampaglia

|

|

|

|

Chief Executive Officer

|

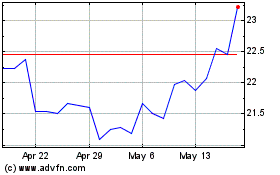

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Jan 2025 to Feb 2025

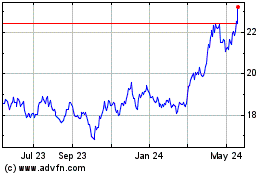

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Feb 2024 to Feb 2025