Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 23 2024 - 5:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of July 2024

Commission File Number: 001-38164

CALEDONIA MINING CORPORATION PLC

(Translation of registrant's name into English)

B006 Millais House

Castle Quay

St Helier

Jersey JE2 3EF

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | CALEDONIA MINING CORPORATION PLC |

| | | (Registrant) |

| | | |

| | | |

| Date: July 23, 2024 | | /s/ JOHN MARK LEARMONTH |

| | | John Mark Learmonth |

| | | CEO and Director |

| | | |

EXHIBIT INDEX

EXHIBIT 99.1

Caledonia Mining Corporation Plc: Notification of relevant change to significant shareholder

ST HELIER, Jersey, July 23, 2024 (GLOBE NEWSWIRE) -- Caledonia Mining Corporation Plc (NYSE AMERICAN: CMCL; AIM: CMCL; VFEX: CMCL) ("Caledonia" or "the Company") announces that it received notification on July 22, 2024 from BlackRock, Inc. that on July 19, 2024 it had crossed a threshold for notification of a relevant change (as defined by the AIM Rules for Companies).

A copy of the notification is below.

Enquiries:

Caledonia Mining Corporation Plc

Mark Learmonth

Camilla Horsfall | Tel: +44 1534 679 800

Tel: +44 7817 841 793 |

| | |

Cavendish Capital Markets Limited (Nomad and Joint Broker)

Adrian Hadden

Pearl Kellie | Tel: +44 207 397 1965

Tel: +44 131 220 9775 |

| | |

Panmure Liberum (Joint Broker)

Scott Mathieson/Matt Hogg | Tel: +44 20 3100 2000 |

| | |

Camarco, Financial PR (UK)

Gordon Poole

Julia Tilley

Elfie Kent |

Tel: +44 20 3757 4980 |

| | |

3PPB (Financial PR, North America)

Patrick Chidley

Paul Durham | Tel: +1 917 991 7701

Tel: +1 203 940 2538 |

| | |

Curate Public Relations (Zimbabwe)

Debra Tatenda | Tel: +263 77802131 |

| | |

IH Securities (Private) Limited (VFEX Sponsor - Zimbabwe)

Lloyd Mlotshwa

| Tel: +263 (242) 745

119/33/39 |

| | |

TR-1: Standard form for notification of major holdings

| NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the FCA in Microsoft Word format if possible) i |

| | | | | | | | | | |

1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attached ii:

| CALEDONIA MINING CORPORATION PLC

|

1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate)

|

Non-UK issuer

| X |

2. Reason for the notification (please mark the appropriate box or boxes with an “X”)

|

An acquisition or disposal of voting rights

| X |

An acquisition or disposal of financial instruments

| |

An event changing the breakdown of voting rights

| |

Other (please specify) iii:

| |

3. Details of person subject to the notification obligation iv

|

Name

| BlackRock, Inc.

|

City and country of registered office (if applicable)

| Wilmington, DE, USA

|

4. Full name of shareholder(s) (if different from 3.) v

|

Name

| |

City and country of registered office (if applicable)

| |

5. Date on which the threshold was crossed or reached vi:

| 19/07/2024

|

6. Date on which issuer notified (DD/MM/YYYY):

| 22/07/2024

|

7. Total positions of person(s) subject to the notification obligation

|

| | % of voting rights

attached to shares

(total of 8. A)

| % of voting rights

through financial

instruments

(total of 8.B 1 + 8.B 2) | Total of both in %

(8.A + 8.B) | Total number of

voting rights held

in issuer (8.A +

8.B) vii |

Resulting situation on the date on which threshold was crossed or reached

| 4.50%

| 0.47% | 4.98% | 956,670 |

Position of previous notification (if applicable)

| 4.53%

| 0.47% | 5.01% | |

| 8. Notified details of the resulting situation on the date on which the threshold was crossed or reached viii |

| A: Voting rights attached to shares |

Class/type of

shares

ISIN code (if possible) | Number of voting rights ix | % of voting rights |

Direct

(DTR5.1) | Indirect

(DTR5.2.1) | Direct

(DTR5.1) | Indirect

(DTR5.2.1) |

| JE00BF0XVB15 | | 864,641 | | 4.50% |

| | | | | |

| | | | | |

| SUBTOTAL 8. A | 864,641 | 4.50% |

| | | | | |

| B 1: Financial Instruments according to DTR5.3.1R (1) (a) |

Type of financial

instrument | Expiration

date x | Exercise/

Conversion Period xi | Number of voting rights

that may be acquired if

the instrument is

exercised/converted. | % of voting rights |

| | | | | |

| | | | | |

| | | | | |

| | | SUBTOTAL 8. B 1 | | |

| |

| B 2: Financial Instruments with similar economic effect according to DTR5.3.1R (1) (b) |

Type of financial

instrument | Expiration

date x | Exercise/

Conversion

Period xi | Physical or

cash

Settlement xii | Number of

voting rights | % of voting rights |

| CFD | N/A | N/A | Cash | 92,029 | 0.47% |

| | | | | | |

| | | | | | |

| | | | SUBTOTAL 8.B.2 | 92,029 | 0.47% |

| |

| 9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”) |

| Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuer xiii | |

| Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entity (please add additional rows as necessary) xiv | X |

| Name xv | % of voting rights if

it equals or is higher

than the notifiable

threshold | % of voting rights

through financial

instruments if it equals

or is higher

than the notifiable

threshold | Total of both if it

equals or is higher

than the notifiable

threshold

|

| | | | |

| BlackRock, Inc. | | | |

| Trident Merger, LLC | | | |

| BlackRock Investment Management, LLC | | | |

| | | | |

| BlackRock, Inc. | | | |

| BlackRock Holdco 2, Inc. | | | |

| BlackRock Financial Management, Inc. | | | |

| BlackRock Holdco 4, LLC | | | |

| BlackRock Holdco 6, LLC | | | |

| BlackRock Delaware Holdings Inc. | | | |

| BlackRock Institutional Trust Company, National Association | | | |

| | | | |

| BlackRock, Inc. | | | |

| BlackRock Holdco 2, Inc. | | | |

| BlackRock Financial Management, Inc. | | | |

| BlackRock Holdco 4, LLC | | | |

| BlackRock Holdco 6, LLC | | | |

| BlackRock Delaware Holdings Inc. | | | |

| BlackRock Fund Advisors | 3.00% | 0.00% | 3.00%

|

| | | | |

| BlackRock, Inc. | | | |

| BlackRock Holdco 2, Inc. | | | |

| BlackRock Financial Management, Inc. | | | |

| | | | |

| BlackRock, Inc. | | | |

| BlackRock Holdco 2, Inc. | | | |

| BlackRock Financial Management, Inc. | | | |

| BlackRock Capital Holdings, Inc. | | | |

| BlackRock Advisors, LLC | | | |

| | | | |

| |

| 10. In case of proxy voting, please identify: |

| Name of the proxy holder | |

| The number and % of voting rights held | |

| The date until which the voting rights will be held | |

| | | | | |

| 11. Additional information xvi |

BlackRock Regulatory Threshold Reporting Team

Jana Blumenstein

020 7743 3650

|

| Place of completion | 12 Throgmorton Avenue, London, EC2N 2DL, U.K. |

| Date of completion | 22 July 2024 |

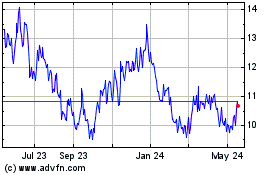

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Oct 2024 to Nov 2024

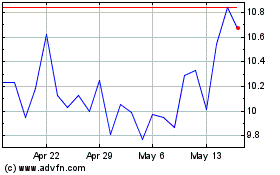

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Nov 2023 to Nov 2024