Copper Mining ETFs Head-to-Head - ETF News And Commentary

February 03 2012 - 5:01AM

Zacks

The weak economy in the second half of 2011 wasn’t exactly

welcomed news for those in the copper industry. Prices for the red

metal slumped from just under $4.5/lb. in late July to just over

$3.0/lb. in early Autumn. Yet, thanks to some encouraging data on

the housing front, as well as hopes for a soft landing in China—or

more construction related stimulus in the nation—copper prices have

come storming back in recent months, pushing prices back up close

to the key $4/lb. level to start the year.

While obviously this has been good news for those who are

holding onto copper ETNs such as JJC—prices of this note have

gained close to 21% in the past three months—copper mining equities

have also been huge beneficiaries as well. Most securities in

this space have seen double digit gains as well, spurred by the

prospect of higher profit margins and increased demand for copper

if the economy continues to rebound. Thanks to this, a closer look

at some of the copper mining ETFs could be an intriguing investment

for those seeking to gain exposure to the sector but do not have a

strong opinion on any particular stock in the industry (read Time

To Consider The Silver Miners ETF).

For these investors, there are currently two options available;

the First Trust ISE Global Copper Index Fund (CU) and the Global X

Copper Miners ETF (COPX). Both of these funds could represent a

cost effect way to gain diversified exposure to the broad sector

while limiting the holdings in firms that do a great deal of

business in the other corners of the mining world (also read Is HAP

The Best Commodity Producer ETF?). However, while they may appear

to be similar at first glance, the funds actually have some key

differences that investors should be aware of before making their

decision. Below, we highlight COPX and CU in greater detail and

discuss some of the key similarities and distinctions between the

two.

ISE Global Copper Index Fund (CU)

CU tracks the ISE Global Copper Index which is designed to give

investors access to firms that are active in the copper mining

industry be it in refining, exploration, or mining. Interestingly,

the fund doesn’t use a pure market cap weighted system to assign

values to component securities. Instead, the product uses a

modified linear weighted methodology adjusted by revenue exposure

to copper production, where component securities are grouped into

linearly weighted quartiles and then equally weighted within each

quartile. The resulting distribution allows smaller, more copper

focused companies to be adequately represented in the index. This

also produces a fund that charges 70 basis points a year in fees

and one that has 26 stocks in its basket (read Time To Buy The Rare

Earth Metals ETF?).

In terms of holdings, only three countries make up more than 11%

of assets with Canada (42.8%) the UK (20.8%) combining to make up

more than three-fifths of assets and American firms taking up

another tenth. For individual securities, First Quantum Minerals

(FM) takes the top spot, but it closely trailed by Rio Tinto (RIO)

and Southern Copper (SCCO). Investors should also note that every

security in the top ten receives at least 4.3% of total assets

suggesting a pretty good breakdown among securities. Performance

figures have been more encouraging as of late as CU has gained

15.4% in the past months alone. This combined with the

product’s solid dividend payout, the low P/E below 9, and the

improving sentiment in the industry, could make the fund a star

performer later this year.

Global X Copper Miners ETF (COPX)

COPX follows a similar benchmark as its First Trust counterpart,

tracking the Solactive Global Copper Miners Index. This benchmark

looks to select companies globally that are actively engaged in

some aspect of the copper mining industry, be it in mining,

refining, or exploration. This gives the fund roughly 32 stocks in

total while charging investors 65 basis points a year in fees (see

Top Three Precious Metal Mining ETFs).

Top individual holdings contain three Canadian-based firms

including; Quadra FNX Mining, Lundin Mining (LUNMF), and First

Quantum Minerals, all of which make up at least 5.5% of total

assets. Given this focus on Canada in the top spots, it shouldn’t

come as much of a surprise that Canada makes up nearly half of

total assets, while this is followed by a nearly 20% weighting to

the UK, and a 10.5% allocation to the USA. In terms of capital

appreciation, COPX has outperformed CU over the past one month

period gaining about 16.7% in that time. However, the fund has also

led CU lower on the downside, suggesting that greater volatility

could be inherent in this product from Global X. With that being

said, this product also has a P/E below 9 and a dividend above

2.25% so there is some value in the underlying securities in this

fund too.

|

Category

|

CU

|

COPX

|

|

Volume

|

161,800

|

119,000

|

|

AUM

|

$58.4 million

|

$39.9 million

|

|

Assets in top ten holdings

|

56%

|

52.9%

|

|

Expenses

|

.70%

|

.65%

|

|

Performance (1mo/TTM)

|

+15.4%/-19.6%

|

+16.7%/-22.6%

|

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

LUNDIN MINING (LUNMF): Free Stock Analysis Report

RIO TINTO-ADR (RIO): Free Stock Analysis Report

SOUTHERN COPPER (SCCO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

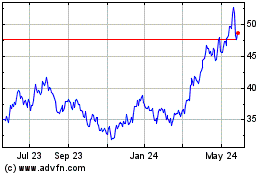

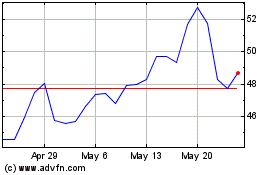

Global X Copper Miners (AMEX:COPX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Global X Copper Miners (AMEX:COPX)

Historical Stock Chart

From Feb 2024 to Feb 2025