In the early part of the summer, commodity investors were zeroed

in on grains like wheat and corn thanks to the drought. This was

for good reason, as both of these commodities had incredible

returns during the time period, far outpacing index returns for

broad stock and commodity benchmarks.

In fact, ETNs tracking Corn (CORN) and

Wheat (WEET) are among the best performing in the

commodity world on a year-to-date basis, adding double digits in

the time frame, while the iPath Dow Jones-UBS Grains ETN

(JJG) is actually the best performing commodity product in

the entire ETP world from a year-to-date look, adding more than 37%

since January 1st (see Beyond Corn: Three Commodity ETFs

Surging This Summer).

Thanks to these impressive moves and the ubiquitous nature of

corn and wheat, many investors have overlooked another key staple

product that has not only had a great year, but has been storming

higher in recent sessions as well; soybeans. This product, as

represented by the Teucrium Soybean ETF (SOYB) is

quietly up 25% YTD and it could continue to march higher in the

near term thanks to unfavorable crop reports.

This could be especially true given the latest USDA crop

projections that just hit the market, sending soybean futures

higher yet again. In this latest release, American soybean

production will be down 14% from 2011 and will be at the lowest

level since 2003, possibly pushing U.S. output below Brazil for the

first time ever in the key crop (read Buy American with these Three

Commodity ETFs).

Furthermore, the USDA prediction was less than the Bloomberg

News analyst prediction, and is roughly 60 million bushels less

than what the USDA thought just a month ago. The situation becomes

even worse when investors add in a soybean-hungry Asia into the

mix, as China, the biggest importer of the staple, looks to see

demand rise to just over 75 million tons for the year, the ninth

straight increase, according to Bloomberg Businessweek.

Clearly the supply situation has baked into soybean futures and

ETFs an incredible price increase over the past few months. SOYB is

actually now one of the top five commodity ETPs on a year-to-date

look, while the commodity product is currently sporting a double

digit return since the start of August as well.

However, some believe that prices are starting to top out for

the commodity, or that the product is due for a breather in the

near term. Still, the futures curve is in heavy backwardation at

least until 2015—at time of writing—so investors could see some

gains in the near term before the product pulls back (see USAG in

Focus As Agricultural Commodity ETFs Soar).

Additionally, a slowdown in China could curtail demand for

soybean and one of its main uses, as a feed for hogs. Should this

take place, the high projections for Chinese demand could be a

little off base and may give soybeans some room on the

supply/demand front heading into 2013.

Lastly, it is also important to note how SOYB’s structure could

influence returns going forward. After all, the product, unlike

many commodity ETFs, doesn’t just cycle into the next month as

expiration approaches, rather it uses a much more in-depth

approach.

The ETF uses three futures contracts for soybeans, all of which

are traded on the CBOT. The three contracts include (1) the

2nd-to-expire contract, weighted 35%, (2) the 3rd-to-expire

contract, weighted 30%, and (3) the contract expiring in the

November following the expiration month of the 3rd-to-expire

contract, weighted 35%.

Teucrium believes that this spread out approach can reduce

contango and thus help investors achieve better returns during

unfavorable commodity environments. However, this strategy could

backfire in rare times like this in which the market is extremely

backwardated, as the product could gain less from the roll as it

might if it was just shifting from one month to the next (see Is

USCI The Best Commodity ETF?).

Thanks to this, SOYB could be an interesting short-term play,

but it might not do as well as some investors might expect over the

longer term. Not only will the futures curve not be as helpful, but

a slowdown in China or recent rains in the heartland could help to

boost the supply/demand balance in favor of production.

Given this reality, investors should use caution when investing

in this commodity ETF, although the short term trend is definitely

bullish and could provide quick traders with gains before September

is over. After all, the company’s Corn ETF, while a top performer

from earlier in the summer, has been flat to negative in the

trailing one month period despite the relatively favorable supply

picture (also see What Happened to the Sugar ETF?).

Although CORN is still up significantly on the year, there

should be some concern among agricultural ETF investors that a

comparable situation is happening in the soybean market as well.

SOYB’s current performance is eerily similar to what CORN saw

earlier in the year, so while the curve may be favorable and

supplies tight, investors should definitely proceed with caution

before taking a dive on soybeans to close out 2012.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

TEUCRM-CORN FD (CORN): ETF Research Reports

IPATH-DJ-A GRNS (JJG): ETF Research Reports

TEUCRM-SOYBEAN (SOYB): ETF Research Reports

IPATH-PB GRAINS (WEET): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

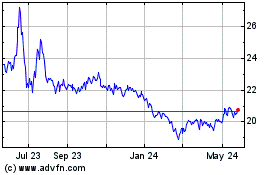

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Dec 2024 to Jan 2025

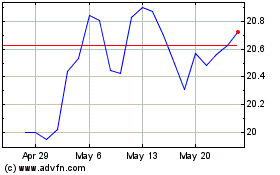

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Jan 2024 to Jan 2025