Corn ETF Jumps on Weather Forecast - ETF News And Commentary

April 29 2013 - 12:38PM

Zacks

It was a great day for the beaten down Corn ETF

(CORN) to open up the week, as worries over weather caused

traders to buy up contracts of the important agricultural

commodity. The ETF surged by over 6.6% on the session, with volume

that was roughly three times normal.

Fears that caused this spike centered around weather in key corn

growing states in the Midwest, specifically Iowa and Illinois. Wet

and cold weather is forecast for these areas of the country later

this week and some are worrying that it will delay plantings by

farmers of this year’s crop (Read Corn ETF Continues Plunge).

This was a bit surprising to those of us in the Midwest, as

recent weather has been quite balmy with reasonable temperatures, a

trend that was a sharp departure from what had been seen

for much of April. However, it does appear that a continuation of

the poor April weather trend could be spilling into May, as

temperatures look to approach the low 40s(F) after a bout of

rain.

This apparently caught many off guard, leading to some short

covering in the commodity which had broadly been trending lower for

the past few months, helping to account for the magnitude of

today’s surge. "You caught all those people leaning the wrong way,"

said Jim Gerlach, president of A/C Trading Co., a Fowler, Ind.,

commodities brokerage in a WSJ article. "You're definitely getting

a knee-jerk reaction based off that."

Longer term though, this is a bit troubling as the USDA shows

that at this point in the year, roughly 16% of the crop has been

planted, at least when looking at the five year average. This

contrasts with this year’s plantings which only come in at 4% of

the total, suggesting that farmers are falling a little behind, a

situation that could result in a reduced supply (see Should You

Avoid These Agricultural ETFs in 2013?).

Still, there isn’t a panic just yet, as there is still a great

deal of time to get the process underway, especially if the weather

turns more favorable next week. And, it is important to remember

that many were already expecting a bumper crop this year for corn,

so we could be going lower once more after a round of short

covering.

Corn ETF in focus

For those seeking to play the commodity in ETF form, the apt

ticker of CORN from Teucrium could be an interesting play. The fund

is the only ETF on the market that targets this

important commodity, and it utilizes a novel procedure in

order to divide up exposure to various contracts (also read

Teucrium Launches New Basket Agriculture ETF).

The fund looks to reduce contango by spreading out exposure

across the curve, as opposed to just rolling over from front month

to front month. The fund will be using the second-to-expire

contract (35%), the third-to-expire contract (30%), and the

December contract that is following the third-to-expire contract

(35%).

This process looks to reduce the impact of contango on the

overall return picture, though it could add to the total costs in

the fund. It is also worth noting that this will result in the fund

deviating a bit from spot prices and even from front-month

contracts, so headline returns might not always match up.

Outlook

It is also worth pointing out that our models view CORN very

unfavorably at this point in time, as we have assigned the fund a

Zacks ETF Rank of 5 or ‘Strong Sell’. This means we look for it to

underperform in the next year, a situation that could materialize

if CORN falls back after this recent move higher.

Instead of CORN, we view a few other commodities as better picks

in the agricultural space, specifically in the coffee market with

JO. Coffee isn’t suffering the same issues as its

counterpart CORN, and could thus be a better pick for investors at

this time (see USCF Launches Agricultural Commodity ETF).

That is why we have assigned the ETN a Zacks ETF Rank of 1 or

‘Strong Buy’, suggesting that it will outperform. So for investors

seeking to get out of corn now, or for those looking to make a long

play in the agricultural market, coffee could be a better pick,

especially if this latest move higher by corn turns out to be a

mirage, much like the past moves higher have been in this volatile

commodity.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

TEUCRM-CORN FD (CORN): ETF Research Reports

PWRSH-DB AGRIC (DBA): ETF Research Reports

ELEMT-MLCX BIOF (FUE): ETF Research Reports

IPATH-DJ-A COFE (JO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

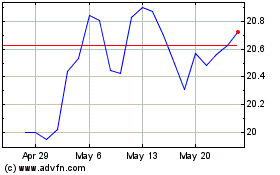

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Dec 2024 to Jan 2025

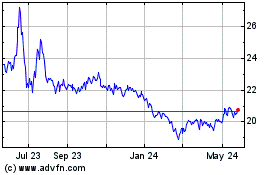

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Jan 2024 to Jan 2025