Cornerstone

Total Return Fund, Inc.

64,056,602

Rights for 21,352,201 Shares of Common Stock

Cornerstone

Total Return Fund, Inc. (the “Fund”) is issuing non-transferable rights (“Rights”) to its holders of record

of shares of common stock (“Common Stock”) (such holders hereinafter referred to as “Stockholders” and

the shares of Common Stock, the “Shares”) which Rights will allow Stockholders to subscribe for new Shares (the “Offering”).

For every three (3) Rights a Stockholder receives, such Stockholder will be entitled to buy one (1) new Share. Each Stockholder

will receive one Right for each outstanding Share it owns on April 18, 2022 (the “Record Date”). Fractional Shares

will not be issued upon the exercise of the Rights. Accordingly, the number of Rights to be issued to a Stockholder on the Record

Date will be rounded up to the nearest whole number of Rights evenly divisible by three. Stockholders on the Record Date may purchase

Shares not acquired by other Stockholders in this Rights offering, subject to certain limitations discussed in this Prospectus.

Additionally, if there are not enough unsubscribed Shares to honor all additional subscription requests, the Fund may, in its

sole discretion, issue additional Shares up to 50% of the Shares available in the Offering to honor additional subscription requests.

See “The Offering” below.

The

Rights are non-transferable, and may not be purchased or sold. Rights will expire without residual value at the Expiration Date

(defined below). The Rights will not be listed for trading on the NYSE American LLC (“NYSE American”), and there will

not be any market for trading Rights. The Shares to be issued pursuant to the Offering will be listed for trading on the NYSE

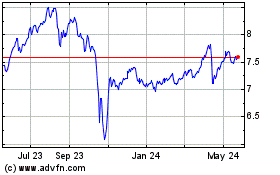

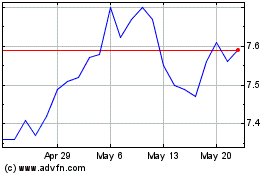

American, subject to the NYSE American being officially notified of the issuance of those Shares. On April 8, 2022, the last reported

net asset value (“NAV”) per Share was $8.65 and the last reported sales price per Share on the NYSE American was $13.61,

which represents a 57.34% premium to the Fund’s NAV per Share. The subscription price per Share (the “Subscription

Price”) will be the greater of (i) 112% of NAV per Share as calculated at the close of trading on the date of expiration

of the Offering and (ii) 65% of the market price per Share at such time. The considerable number of Shares that may be issued

as a result of the Offering may cause the premium above NAV at which the Fund’s Shares are currently trading to decline,

especially if Stockholders exercising the Rights attempt to sell sizeable numbers of shares immediately after such issuance.

STOCKHOLDERS

WHO CHOOSE TO EXERCISE THEIR RIGHTS WILL NOT KNOW THE SUBSCRIPTION PRICE PER SHARE AT THE TIME THEY EXERCISE SUCH RIGHTS BECAUSE

THE OFFERING WILL EXPIRE (I.E., CLOSE) PRIOR TO THE AVAILABILITY OF THE FUND’S NAV AND OTHER RELEVANT MARKET INFORMATION

ON THE EXPIRATION DATE. ONCE A STOCKHOLDER SUBSCRIBES FOR SHARES AND THE FUND RECEIVES PAYMENT, SUCH STOCKHOLDER WILL NOT BE ABLE

TO WITHDRAW HIS, HER OR ITS SUBSCRIPTION OR CHANGE HIS, HER OR ITS DECISION. THE OFFERING WILL EXPIRE AT 5:00 P.M., NEW YORK CITY

TIME, ON MAY 20, 2022 (THE “EXPIRATION DATE”), UNLESS EXTENDED, AS DISCUSSED IN THIS PROSPECTUS.

The

offering may substantially dilute the voting power of Stockholders who do not fully exercise their Rights since they will own

a smaller proportionate interest in the Fund upon completion of the offering.

The

Fund is a diversified, closed-end management investment company. The Fund’s investment objective is capital appreciation

with current income as a secondary objective. The Fund seeks to achieve its objectives by investing primarily in U.S. and non-U.S.

companies. There can be no assurance that the Fund’s objective will be achieved.

For

more information, please call AST Fund Solutions, LLC (the “Information Agent”) toll free at (866) 406-2285.

Investing

in the Fund involves risks. See “Risk Factors” on page 32

of this prospectus.

| |

Estimated

Subscription

Price (1) |

Estimated

Sales Load |

Estimated

Proceeds to

the Fund (2)(3) |

| Per

Share |

$9.69 |

None |

$206,902,824 |

| Total |

$9.69 |

None |

$206,902,824 |

| (1) |

Because the Subscription

Price will not be determined until after printing and distribution of this prospectus, the “Estimated Subscription Price”

above is an estimate of the subscription price based on the Fund’s per-Share NAV and market price at the close of trading

on April 8, 2022. See “The Offering - Subscription Price” and “The Offering - Payment for Shares.” |

| (2) |

Proceeds to the

Fund are before deduction of expenses incurred by the Fund in connection with the Offering, such expenses are estimated to

be approximately $249,409 or approximately $0.003 per Share, if fully subscribed. The calculation of the per Share amount

does not take into account the Over-Subscription Shares. Funds received prior to the final due date of this Offering will

be deposited in a segregated account pending allocation and distribution of Shares. Interest, if any, on subscription monies

will be paid to the Fund regardless of whether Shares are issued by the Fund; interest will not be used as credit toward the

purchase of Shares. |

| (3) |

Fees and expenses

incurred by the Fund in connection with the Offering are estimated to be approximately $249,409 or approximately $0.003 per

Share, if fully subscribed. Proceeds to the Fund, after deduction of such fees and expenses incurred by the Fund in connection

with the Offering, are estimated to be approximately $206,653,415 or approximately $2.42 per Share, if fully subscribed. The

calculation of the per Share amounts indicated above do not take into account the Over- Subscription Shares. |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is April 13, 2022.

The

Fund’s Shares are listed on the NYSE American under the ticker symbol “CRF.”

Investment

Adviser. Cornerstone Advisors, LLC (the “Investment Adviser”) acts as the Fund’s investment adviser.

See “Management of the Fund.” As of December 31, 2021, the Investment Adviser managed one other closed-end fund

with combined assets with the Fund of approximately $1,855.3 million. The Investment Adviser’s address is 1075

Hendersonville Road, Suite 250, Asheville, North Carolina, 28803. This prospectus sets forth concisely the information about

the Fund that you should know before deciding whether to invest in the Fund. A Statement of Additional Information, dated

April 13, 2022 (the “Statement of Additional Information”), and other materials, containing additional

information about the Fund, have been filed with the Securities and Exchange Commission (the “SEC”). The

Statement of Additional Information is incorporated by reference in its entirety into this prospectus, which means it is

considered to be part of this prospectus. You may obtain a free copy of the Statement of Additional Information, the table of

contents of which is on page 57 of this prospectus, and other

information filed with the SEC, by calling toll free (866) 406-2285 or by writing to the Fund c/o Ultimus Fund Solutions,

LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246, or by visiting the Fund’s website at

www.cornerstonetotalreturnfund.com. The Fund files annual and semi-annual stockholder reports, proxy statements and other

information with the SEC. You can obtain this information or the Fund’s Statement of Additional Information or any

information regarding the Fund filed with the SEC from the SEC’s website at www.sec.gov.

The

Fund’s Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured

depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board

or any governmental agency.

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to

provide you with different information. We are not making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus. The

Fund will amend this prospectus if, during the period this prospectus is required to be delivered, there are any material changes

to the facts stated in this prospectus subsequent to the date of this prospectus.

TABLE

OF CONTENTS

| |

Page |

| SUMMARY |

1 |

| SUMMARY

OF FUND EXPENSES |

12 |

| THE

FUND |

13 |

| THE

OFFERING |

13 |

| FINANCIAL

HIGHLIGHTS |

22 |

| USE

OF PROCEEDS |

25 |

| INVESTMENT

OBJECTIVE AND POLICIES |

25 |

| RISK

FACTORS |

32 |

| LISTING

OF SHARES |

40 |

| MANAGEMENT

OF THE FUND |

40 |

| DETERMINATION

OF NET ASSET VALUE |

43 |

| DISTRIBUTION

POLICY |

44 |

| DISTRIBUTION

REINVESTMENT PLAN |

47 |

| CERTAIN

ADDITIONAL MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

49 |

| DESCRIPTION

OF CAPITAL STRUCTURE |

53 |

| LEGAL

MATTERS |

56 |

| REPORTS

TO STOCKHOLDERS |

56 |

| INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM |

56 |

| ADDITIONAL

INFORMATION |

56 |

| TABLE

OF CONTENTS OF THE STATEMENT OF ADDITIONAL INFORMATION |

57 |

SUMMARY

This

summary does not contain all of the information that you should consider before investing in the Fund. You should review the more

detailed information contained or incorporated by reference in this prospectus and in the Statement of Additional Information,

particularly the information set forth under the heading “Risk Factors.”

A

1-for-4 reverse stock split (the “Reverse Stock Split”) was announced on October 14, 2014 and became effective on

December 29, 2014. All share and per share amounts in this prospectus prior to December 29, 2014 have been adjusted to reflect

this Reverse Stock Split.

| The

Fund |

Cornerstone

Total Return Fund, Inc. is a diversified, closed-end management investment company. It was incorporated in New York on March

16, 1973 and commenced investment operations on May 15, 1973. The Fund’s Shares are traded on the NYSE American under

the ticker symbol “CRF.” As of December 31, 2021, the Fund had 63,297,395 Shares issued and outstanding. |

| The

Offering |

The

Fund is issuing non-transferable rights (“Rights”) to its Stockholders as

of the close of business on April 18, 2022 (the “Record Date”) which Rights

will allow Stockholders to subscribe for an aggregate of 21,352,201 Shares (the “Offering”).

For every three (3) Rights a Stockholder receives, such Stockholder will be entitled

to buy one (1) new Share at a subscription price equal to the greater of (i) 112% of

NAV of the Shares as calculated on the Expiration Date (or Extended Expiration Date,

as the case may be) and (ii) 65% of the market price at the close of trading on such

date. Each Stockholder will receive one Right for each outstanding Share he or she owns

on the Record Date (the “Basic Subscription”). Fractional Shares will not

be issued upon the exercise of the Rights. Accordingly, the number of Rights to be issued

to a Stockholder as of the Record Date will be rounded up to the nearest whole number

of Rights evenly divisible by three. Stockholders as of the Record Date may purchase

Shares not acquired by other Stockholders in this Rights offering, subject to certain

limitations discussed in this prospectus. Additionally, if there are not enough unsubscribed

Shares to honor all over-subscription requests, the Fund may, in its discretion, issue

additional Shares up to 50% of the Shares available in the Offering to honor additional

subscription requests.

Shares

will be issued within the 15-day period immediately following the record date of the Fund’s monthly distribution

and Stockholders exercising rights will not be entitled to receive such distribution with respect to the shares issued

pursuant to such exercise.

The

Fund previously conducted a rights offering that expired on May 14, 2021 (the “2021 Offering”) and included

similar terms and conditions as this Offering. Pursuant to the 2021 Offering, the Fund issued 20,584,726 Shares (6,833,697

Shares of which were Over-Subscription Shares) at a subscription price of $10.23 per Share, for a total offering of $210,581,747.

Prior

to the 2021 Offering, the Fund conducted a rights offering that expired on July 20, 2018 (the “2018 Offering”) and

included similar terms and conditions as this Offering. Pursuant to the 2018 Offering, the Fund issued 15,050,616 Shares (7,525,308

Shares of which were Over-Subscription Shares) at a subscription price of $13.09 per Share, for a total offering of $197,012,563. |

| |

Prior

to the 2018 Offering, the Fund conducted a rights offering that expired on August 25,

2017 (the “2017 Offering”) and included similar terms and conditions as this

Offering. Pursuant to the 2017 Offering, which was fully subscribed, the Fund issued

8,798,352 Shares (4,399,176 Shares of which were Over-Subscription Shares) at a subscription

price of $13.41 per Share, for a total offering of $117,985,900.

Prior

to the 2017 Offering, the Fund conducted a rights offering that expired on October 21, 2016 (the “2016 Offering”)

and included similar terms and conditions as this Offering. Pursuant to the 2016 Offering, which was fully subscribed,

the Fund issued 5,196,240 Shares (2,598,120 Shares of which were Over-Subscription Shares) at a subscription price of

$13.69 per Share, for a total offering of $71,136,525.

Prior

to the 2016 Offering, the Fund conducted a rights offering that expired on August 14, 2015 (the “2015 Offering”) and

included similar terms and conditions as this Offering. Pursuant to the 2015 Offering, which was fully subscribed, the Fund issued

3,027,098 Shares (1,513,549 Shares of which were Over-Subscription Shares) at a subscription price of $17.06 per Share, for a

total offering of $51,642,292. |

| |

Prior

to the 2015 Offering, the Fund conducted a rights offering that expired on November 29,

2013 (the “2013 Offering”) and included similar terms and conditions as this

Offering. Pursuant to the 2013 Offering, which was fully subscribed, the Fund issued

1,723,096 Shares (861,548 Shares of which were Over-Subscription Shares) at a subscription

prices of $21.36 per Share, for a total offering of $36,805,331.

Prior

to the 2013 Offering, the Fund conducted a rights offering that expired on December 21, 2012 (the “2012 Offering”)

and included similar terms and conditions as this Offering. Pursuant to the 2012 Offering, which was fully subscribed,

the Fund issued 841,130 Shares (279,448 Shares of which were Over-Subscription Shares) at a subscription price of $21.32

per Share, for a total offering of $17,932,897.

Prior

to the 2012 Offering, the Fund conducted a rights offering that expired on December 16, 2011 (the “2011 Offering”)

and included similar terms and conditions as this Offering. Pursuant to the 2011 Offering, which was fully subscribed,

the Fund issued 657,003 Shares (328,501 Shares of which were Over-Subscription Shares) at a subscription price of $22.16

per Share, for a total offering of $14,559,175.

Prior

to the 2011 Offering, the Fund conducted a rights offering that expired on December 10, 2010 (the “2010 Offering”)

and included similar terms and conditions as this Offering. Pursuant to the 2010 Offering, which was fully subscribed, the Fund

issued 251,596 Shares (11,588 Shares of which were Over-Subscription Shares) at a subscription price of $28.92 per Share, for

a total offering of $7,275,425. |

| |

Use

of Proceeds from the 2021 Offering, 2018 Offering, 2017 Offering, the 2016 Offering, the 2015 Offering, the 2013 Offering, the

2012 Offering, the 2011 Offering, and the 2010 Offering (collectively, the “Prior Rights Offerings”) have been used,

and the use of proceeds from the current Offering and any future rights offerings may be used, to maintain the Fund’s Distribution

Policy (as defined below) by providing funding for future distributions, which may constitute a return of its Stockholders’

capital.

A “return of capital” is treated as a non-dividend

distribution for tax purposes and is not subject to current tax. A return of capital reduces a Stockholder’s tax cost basis

(but not below zero) in Fund shares.

|

| How

to Exercise Rights |

Stockholders

may exercise Rights by filling in and signing the reverse side of the Subscription Certificate and delivering the completed

and signed Subscription Certificate and payment for the Shares to the Subscription Agent, American Stock Transfer & Trust

Company, LLC. If you have any questions regarding the Rights, please contact the Information Agent (AST Fund Solutions, LLC)

at (866) 406-2285 or your broker or nominee. See “The Offering” |

| Purpose

of the Offering |

At

a meeting held on February 18, 2022, the Board of Directors considered, in addition to

other factors, the success of the Prior Rights Offerings, and determined that the current

Offering was in the best interests of the Fund and its Stockholders to increase the assets

of the Fund. The primary reasons include:

●

The Basic Subscription will provide existing Stockholders an opportunity to purchase additional Shares at a price that

is potentially below market value without incurring any commission or transaction charges.

●

Raising more cash will better position the Fund to take advantage of investment opportunities that exist or may arise,

however as has been the case with Prior Rights Offerings, a portion of the increase in the Fund’s assets will also

be used to maintain the Fund’s managed distribution policy (the “Distribution Policy”)(see discussion

below).

●

Increasing the Fund’s assets will provide the Fund additional flexibility in maintaining the Fund’s Distribution Policy.

This policy permits Stockholders to receive a predictable level of cash flow and some liquidity periodically with respect to their

Shares without having to sell Shares. Previously, the Fund’s investments have not provided adequate income to meet the requirements

of the Fund’s Distribution Policy, therefore, the Fund has made return of capital distributions to maintain the Fund’s

Distribution Policy. Specifically, Stockholders should be aware that a majority of the distributions that the Funds made to its

Stockholders for 2020 consisted of a return of its Stockholder’s capital, and not of income or gains generated from the

Fund’s investment portfolio, For the years 2018 and 2019 substantially all of the distributions that the Fund made to its

Stockholders consisted of a return of its Stockholders’ capital, and not of income or gains generated from the Fund’s

investment portfolio. For 2017 and 2021, a portion of the distributions that the Fund made to its Stockholders consisted of a

return of its Stockholders’ capital, and not of income or gains generated from the Fund’s investment portfolio. |

| |

●

Increasing Fund assets may lower the Fund’s expenses as a proportion of net assets

because the Fund’s fixed costs would be spread over a larger asset base. There

can be no assurance that by increasing the size of the Fund, the Fund’s expense

ratio will be lowered. However, increasing the Fund’s assets results in a benefit

to the Fund’s Investment Adviser because the Management fee that is paid to the

Investment Adviser increases as the Fund’s net assets increase.

●

Because the Offering will increase the Fund’s outstanding Shares, it may increase the number of Stockholders over

the long term, which could increase the level of market interest in and visibility of the Fund and improve the trading

liquidity of the Shares on the NYSE American.

●

The Offering is expected to be anti-dilutive with respect to the net asset value per share, but not to voting, to all Stockholders,

including those electing not to participate. The Offering is expected to be “anti-dilutive” with respect to net asset

value per share because it is expected that the net asset value per share will increase as a result of the Offering. This expectation

is based on the fact that all the costs of the Offering will be borne by the Stockholders whether or not they exercise their Rights,

because the Offering price is set at a premium to NAV and the estimated expenses incurred for the Offering will be more than offset

by the increase in the net assets of the Fund such that non- participating Stockholders will receive an increase in their net

asset value, so long as the number of Shares issued to participating Stockholders is not materially less than a full exercise

of the Basic Subscription amount. Historically, all Prior Rights Offerings have been anti-dilutive with respect to the net asset

value per share. Stockholders have exercised not only the basic subscription but also a significant percentage of the additional

subscription shares offered. The Offering is expected to be dilutive with respect to Stockholder’s voting percentages because

Stockholders electing not to participate in the Offering will own a smaller percentage of the total number of shares outstanding

after the completion of the Offering. |

| Investment

Objective and Policies |

The

Fund’s investment objective is capital appreciation with current income as a secondary

objective.

There

is no assurance that the Fund will achieve its investment objective. The Fund’s investment objective and some of

its investment policies are considered fundamental policies and may not be changed without Stockholder approval. The Statement

of Additional Information contains a list of the fundamental and non-fundamental investment policies of the Fund under

the heading “Investment Restrictions.”

During

periods of adverse market or economic conditions, the Fund may temporarily invest all or a substantial portion of its net assets

in cash or cash equivalents. |

| Investment

Strategies |

The

Fund’s portfolio, under normal market conditions, consists principally of the equity securities of large, mid and small-

capitalization companies. Equity securities in which the Fund may invest include common and preferred stocks, convertible

securities, warrants and other securities having the characteristics of common stocks, such as American Depositary Receipts

(“ADRs”) and International Depositary Receipts (“IDRs”). |

| |

The

Fund may invest without limitation in other closed-end investment companies and exchange-traded

funds (“ETFs”), provided that the Fund limits its investment in securities

issued by other investment companies so that not more than 3% of the outstanding voting

stock of any one investment company will be owned by the Fund. As a stockholder in any

investment company, the Fund will bear its ratable share of the investment company’s

expenses and would remain subject to payment of the Fund’s advisory and administrative

fees with respect to the assets so invested. The Fund will not invest in private investment

companies in excess of 15% of the Fund’s assets and any such investment will count

towards the calculation of the 20% limitation on investments in illiquid securities.

The

Fund may invest a portion of its assets in U.S. dollar denominated debt securities when the Investment Adviser believes

that it is appropriate to do so in order to achieve the Fund’s secondary investment objective (e.g., when interest

rates are high in comparison to anticipated returns on equity investments). Debt securities in which the Fund may invest

include U.S. dollar denominated bank, corporate or government bonds, notes, and debentures of any maturity determined

by the Investment Adviser to be suitable for investment by the Fund. The Fund may invest in the securities of issuers

that it determines to be suitable for investment by the Fund regardless of their rating, provided, however, that the Fund

may not invest directly in debt securities that are determined by the Investment Adviser to be rated below “BBB”

by Standard & Poor’s Rating Services, a division of The McGraw-Hill Companies (“S&P”) or Moody’s

Investor Services, Inc. (“Moody’s”), commonly referred to as “junk bonds.”

In

determining which securities to buy for the Fund’s portfolio, the Investment Adviser uses a balanced approach, including

“value” and “growth” investing by seeking out companies at reasonable prices, without regard to sector

or industry, which demonstrate favorable long-term growth characteristics. Valuation and growth characteristics may be considered

for purposes of selecting potential investment securities. In general, valuation analysis is used to determine the inherent value

of the company by analyzing financial information such as a company’s price to book, price to sales, return on equity, and

return on assets ratios; and growth analysis is used to determine a company’s potential for long-term dividends and earnings

growth due to market-oriented factors such as growing market share, the launch of new products or services, the strength of its

management and market demand. Fluctuations in these characteristics may trigger trading decisions to be made by the Investment

Adviser. |

| |

To

comply with provisions of the 1940 Act, on any matter upon which the Fund is solicited to vote as a shareholder in an investment

company in which it invests, the Investment Adviser votes such shares in the same general proportion as shares held by other

shareholders of that investment company. The Fund does not and will not invest in any other closed-end funds managed by the

Investment Adviser. |

| |

The

Fund may, without limitation, hold cash or invest in assets in money market instruments,

including U.S. and non-U.S. government securities, high grade commercial paper and certificates

of deposit and bankers’ acceptances issued by U.S. and non-U.S. banks having deposits

of at least $500 million.

The

Fund may invest up to 20% of its assets in illiquid U.S. securities. The Fund will invest only in such illiquid securities

that, in the opinion of the Investment Adviser, present opportunities for substantial growth over a period of two to five

years.

With

respect to 75% of its total assets, the Fund may not purchase a security, other than securities issued or guaranteed by

the U.S. Government, its agencies or instrumentalities, if as a result of such purchase, more than 5% of the value of

the Fund’s total assets would be invested in the securities of any one issuer, or the Fund would own more than 10%

of the voting securities of any one issuer.

The

Fund’s annual portfolio turnover rate is expected to continue to be relatively low, normally ranging between 10% and 90%. |

| Investment

Adviser and Fee |

Cornerstone

Advisors, LLC. (the “Investment Adviser”), the investment adviser of the

Fund, is registered with the Securities and Exchange Commission (“SEC”) as

an investment adviser under the Investment Advisers Act of 1940, as amended. As of December

31, 2021, the Investment Adviser managed one other closed-end fund with combined assets

with the Fund, of approximately $1,855.3 million.

The

Investment Adviser is entitled to receive a monthly fee at the annual rate of 1.00% of the Fund’s average weekly net assets.

See “Management of the Fund.” |

| Administrator

and Fund Accounting Agent |

Ultimus

Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH (“Ultimus”) serves as the Fund’s administrator

and accounting agent. Under the fund accounting and administration agreement with the Fund, Ultimus is responsible for generally

managing the administrative affairs of the Fund, including supervising the preparation of reports to Stockholders, reports

to and filings with the SEC and materials for meetings of the Board. Ultimus is also responsible for calculating the net asset

value per share and maintaining the financial books and records of the Fund. Ultimus is entitled to receive a base fee of

$5,000 per month plus an asset-based fee of 0.05% of the first $250 million of average daily net assets, 0.04% of such assets

greater than $250 million to $1 billion, 0.03% of such assets greater than $1 billion to $2 billion and 0.02% of such assets

in excess of $2 billion. |

| Custodian

and Transfer Agent |

U.S.

Bank National Association serves as the Fund’s custodian and American Stock Transfer and Trust Company, LLC serves as

the Fund’s transfer agent. See “Management of the Fund”. |

| Closed-End

Fund Structure |

Closed-end

funds differ from open-end management investment companies (commonly referred to as mutual funds) in that closed- end funds

do not redeem their shares at the option of the stockholder and generally list their shares for trading on a securities exchange.

By comparison, mutual funds issue securities that are redeemable daily at net asset value at the option of the stockholder

and typically engage in a continuous offering of their shares. Mutual funds are subject to continuous asset in-flows and out-flows

that can complicate portfolio management, whereas closed-end funds generally can stay more fully invested in securities consistent

with the closed-end fund’s investment objectives and policies. In addition, in comparison to open-end funds, closed-end

funds have greater flexibility in the employment of financial leverage and in the ability to make certain types of investments,

including investments in illiquid securities. |

| |

Although

the Fund’s Shares have frequently traded at a premium to its net asset value during

the past several years, shares of closed-end funds frequently trade at a discount from

their net asset value. In recognition of the possibility that the Shares might trade

at a discount to net asset value and that any such discount may not be in the interest

of Stockholders, the Fund’s Board of Directors, in consultation with the Investment

Adviser, may, from time to time, review possible actions to reduce any such discount,

including considering open market repurchases or tender offers for the Fund’s Shares.

There can be no assurance that the Board of Directors will decide to undertake any of

these actions or that, if undertaken, such actions would result in the Shares trading

at a price equal to or close to net asset value per Share.

In

addition, the Fund’s Distribution Policy may continue to be an effective action to counter a trading discount. See

“Distribution Policy.”

The

Board of Directors may also consider the conversion of the Fund to an open-end investment company. The Board of Directors believes,

however, that the closed-end structure is desirable, given the Fund’s investment objective and policies. Investors should

assume, therefore, that it is highly unlikely that the Board of Directors would vote to convert the Fund to an open-end investment

company. |

| Summary

of Principal Risks |

Investing

in the Fund involves risks, including the risk that you may receive little or no return

on your investment or that you may lose part or all of your investment. Therefore, before

investing you should consider carefully the following principal risks that you assume

when you invest in the Fund.

Stock

Market Volatility. Stock markets can be volatile. In other words, the prices of stocks can rise or fall rapidly

in response to developments affecting a specific company or industry, or to changing economic, political or market conditions.

The Fund is subject to the general risk that the value of its investments may decline if the stock markets perform poorly.

There is also a risk that the Fund’s investments will underperform either the securities markets generally or particular

segments of the securities markets.

Market

Disruption and Geopolitical Risk. The Fund is subject to the risk that geopolitical events will disrupt securities markets

and adversely affect global economies and markets. The current novel coronavirus (“COVID-19”) global pandemic and

the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel,

and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational

changes to, many retail and other businesses, have had and may continue to have negative impacts, and in many cases severe negative

impacts, on markets worldwide. War, terrorism, and related geopolitical events (and their aftermath) have led, and in the future

may lead, to increased short-term market volatility and may have adverse long-term effects on U.S. and world economies and markets

generally. Likewise, natural and environmental disasters, such as, for example, earthquakes, fires, floods, hurricanes, tsunamis

and weather-related phenomena generally, as well as the spread of infectious illness or other public health issues, including

widespread epidemics or pandemics such as the COVID-19 outbreak in 2020, and systemic market dislocations can be highly disruptive

to economies and markets. Those events as well as other changes in non-U.S. and domestic economic and political conditions also

could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, credit ratings, inflation,

investor sentiment, and other factors affecting the value of Fund investments. |

| |

Issuer

Specific Changes. Changes in the financial condition of an issuer, changes in

the specific economic or political conditions that affect a particular type of security

or issuer, and changes in general economic or political conditions can affect the credit

quality or value of an issuer’s securities. Lower-quality debt securities tend

to be more sensitive to these changes than higher-quality debt securities.

Closed-End

Fund Risk. Closed-end investment companies are subject to the risks of investing in the underlying securities. The Fund,

as a holder of the securities of the closed-end investment company, will bear its pro rata portion of the closed-end investment

company’s expenses, including advisory fees. These expenses are in addition to the direct expenses of the Fund’s own

operations. |

| |

Common

Stock Risk. The Fund will invest a significant portion of its net assets in common

stocks. Common stocks represent an ownership interest in a company. The Fund may also

invest in securities that can be exercised for or converted into common stocks (such

as convertible preferred stock). Common stocks and similar equity securities are more

volatile and more risky than some other forms of investment. Therefore, the value of

your investment in the Fund may sometimes decrease instead of increase. Common stock

prices fluctuate for many reasons, including changes in investors’ perceptions

of the financial condition of an issuer, the general condition of the relevant stock

market or when political or economic events affecting the issuers occur. In addition,

common stock prices may be sensitive to rising interest rates, as the costs of capital

rise for issuers. Because convertible securities can be converted into equity securities,

their values will normally increase or decrease as the values of the underlying equity

securities increase or decrease. The common stocks in which the Fund will invest are

structurally subordinated to preferred securities, bonds and other debt instruments in

a company’s capital structure in terms of priority to corporate income and assets

and, therefore, will be subject to greater risk than the preferred securities or debt

instruments of such issuers.

Defensive

Positions. During periods of adverse market or economic conditions, the Fund may temporarily invest all or a substantial

portion of its net assets in cash or cash equivalents. The Fund would not be pursuing its investment objective in these

circumstances and could miss favorable market developments.

Foreign

Securities Risk. Investments in securities of non-U.S. issuers involve special risks not presented by investments in securities

of U.S. issuers, including the following: less publicly available information about companies due to less rigorous disclosure

or accounting standards or regulatory practices; the impact of political, social or diplomatic events, including war; possible

seizure, expropriation or nationalization of the company or its assets; possible imposition of currency exchange controls; and

changes in foreign currency exchange rates. These risks are more pronounced to the extent that the Fund invests a significant

amount of its investments in companies located in one region. These risks may be greater in emerging markets and in less developed

countries. F or example, prior governmental approval for foreign investments may be required in some emerging market countries,

and the extent of foreign investment may be subject to limitation in other emerging countries. With respect to risks associated

with changes in foreign currency exchange rates, the Fund does not expect to engage in foreign currency hedging transactions. |

| |

Global

Market Risk. An investment in Fund shares is subject to investment risk, including

the possible loss of the entire principal amount invested. The Fund is subject to the

risk that geopolitical and other similar events will disrupt the economy on a national

or global level. For instance, war, terrorism, market manipulation, government defaults,

government shutdowns, political changes or diplomatic developments, public health emergencies

(such as the spread of infectious diseases, pandemics and epidemics) and natural/environmental

disasters can all negatively impact the securities markets.

Managed

Distribution Risk. Under the Fund’s Distribution Policy, the Fund makes monthly distributions to Stockholders at

a rate that may include periodic distributions of its net income and net capital gains (“Net Earnings”), or from return-of-capital.

For any fiscal year where total cash distributions exceeded Net Earnings (the “Excess”), the Excess would decrease

the Fund’s total assets and, as a result, would have the likely effect of increasing the Fund’s expense ratio. There

is a risk that the total Net Earnings from the Fund’s portfolio would not be great enough to offset the amount of cash distributions

paid to Stockholders. If this were to be the case, the Fund’s assets would be depleted, and there is no guarantee that the

Fund would be able to replace the assets. In addition, in order to make such distributions, the Fund may have to sell a portion

of its investment portfolio, including securities purchased with the proceeds of the Offering, at a time when independent investment

judgment might not dictate such action. Furthermore, such assets used to make distributions will not be available for investment

pursuant to the Fund’s investment objective. The Fund adopted the Distribution Policy in 2002, and during recent years the

Fund’s distributions have exceeded its Net Earnings. The Fund may use the proceeds of the Offering to maintain the Distribution

Policy by providing funding for future distributions, which may constitute a return of capital to Stockholders and lower the tax

basis in their Shares which, for the taxable Stockholders, will defer any potential gains until the Shares are sold. For the taxable

Stockholders, the portion of distribution that constitutes ordinary income and/or capital gains is taxable to such Stockholders

in the year the distribution is declared. A return of capital is non-taxable to the extent of the Stockholder’s basis in

the shares. The Stockholders would reduce their basis (but not below zero) in the Shares by the amount of the distribution and

therefore may result in an increase in the amount of any taxable gain on a subsequent disposition of such Shares, even if such

Shares are sold at a loss to the Stockholder’s original investment amount. Any return of capital will be separately identified

when Stockholders receive their tax statements. Any return of capital that exceeds cost basis may be treated as capital gain.

Stockholders are advised to consult with their own tax advisers with respect to the tax consequences of their investment in the

Fund. Furthermore, the Fund may need to raise additional capital in order to maintain the Distribution Policy. |

| |

Management

Risk. The Fund is subject to management risk because it is an actively managed

portfolio. The Fund’s successful pursuit of its investment objective depends upon

the Investment Manager’s ability to find and exploit market inefficiencies with

respect to undervalued securities. Such situations occur infrequently and sporadically

and may be difficult to predict and may not result in a favorable pricing opportunity

that allows the Investment Manager to fulfill the Fund’s investment objective.

The Investment Manager’s security selections and other investment decisions might

produce losses or cause the Fund to underperform when compared to other funds with similar

investment goals. If one or more key individuals leave the employ of the Investment Manager,

the Investment Manager may not be able to hire qualified replacements or may require

an extended time to do so. This could prevent the Fund from achieving its investment

objective.

Other

Investment Company Securities Risk. The Fund invests in the securities of other closed-end investment companies and in

ETFs. Investing in other investment companies and ETFs involves substantially the same risks as investing directly in the underlying

instruments, but the total return on such investments at the investment company level may be reduced by the operating expenses

and fees of such other investment companies, including advisory fees. To the extent the Fund invests a portion of its assets in

investment company securities, those assets will be subject to the risks of the purchased investment company’s portfolio

securities, and a Stockholder in the Fund will bear not only his proportionate share of the expenses of the Fund, but also, indirectly

the expenses of the purchased investment company. There can be no assurance that the investment objective of any investment company

or ETF in which the Fund invests will be achieved. |

| Managed

Distribution Policy |

Effective

June 25, 2002, the Fund initiated a fixed monthly distribution to Stockholders. On November 29, 2006, the Distribution Policy

was updated to provide for the annual resetting of the monthly distribution amount per share based on the Fund’s net

asset value on the last business day in October. The terms of the Distribution Policy will be reviewed and approved at least

annually by the Fund’s Board of Directors and can be modified at the Board’s discretion. To the extent that these

distributions exceed the current earnings of the Fund, the balance will be generated from sales of portfolio securities held

by the Fund, and will be distributed as either short-term or long-term capital gains or a tax-free return-of-capital. To the

extent these distributions are not represented by net investment income and capital gains, they will not represent yield or

investment return on the Fund’s investment portfolio. As shown on page 35

in the table which identifies the constituent components of the Fund’s distributions under its Managed Distribution

Policy for years 2017-2021, a majority of the distributions that the Fund made to its Stockholders for 2020 consisted of a

return of its Stockholders’ capital, and not of income or gains generated from the Fund’s investment portfolio,

and substantially all of the distributions that the Fund made to its Stockholders for the years 2018 and 2019 consisted of

a return of its Stockholders’ capital, and not of income or gains generated from the Fund’s investment portfolio.

For 2017 and 2021, a portion of the distributions that the made to its Stockholders consisted of a return of its Stockholders’

capital, and not of income or gains generated from the Fund’s investment portfolio. Although return of capital distributions

may not be taxable, such distributions may reduce a Stockholder’s cost basis on his or her Shares, and therefore may

result in an increase in the amount of any taxable gain on a subsequent disposition of such Shares, even if such Shares are

sold at a loss to the Stockholder’s original investment amount. The Fund plans to maintain the Distribution Policy even

if a return-of-capital distribution would exceed an investor’s tax basis and therefore be a taxable distribution. |

| |

On

August 6, 2021, the Board of Directors of the Fund determined that the distribution percentage

for the calendar year 2022 would remain at 21%, which was the same distribution percentage

used in 2021, which was then applied to the net asset value of the Fund at the end of

October 2021 to determine the distribution amounts for calendar year 2022. During 2022,

the Board of Directors of the Fund will make a determination regarding the distribution

percentage for 2023 which will then be applied to the net asset value of the Fund at

the end of October 2022 to determine the distribution amounts for calendar year 2023.

The distribution percentage is not a function of, nor is it related to, the investment

return on the Fund’s portfolio.

To

the extent necessary to meet the amounts distributed under the Fund’s Distribution Policy, portfolio securities,

including those purchased with the proceeds of this Offering, may be sold to the extent adequate income is not available.

Sustaining the Distribution Policy could require the Fund to raise additional capital in the future.

Although

it has no current intention to do so, the Board may terminate this Distribution Policy at any time, and such termination may have

an adverse effect on the market price for the Fund’s Shares. The Fund determines annually whether to distribute any net

realized long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any.

To the extent that the Fund’s taxable income in any calendar year exceeds the aggregate amount distributed pursuant to the

Distribution Policy, an additional distribution may be made to avoid the payment of a 4% U.S. federal excise tax, and to the extent

that the aggregate amount distributed in any calendar year exceeds the Fund’s taxable income, the amount of that excess

may constitute a return-of-capital for tax purposes. Dividends and distributions to Stockholders are recorded by the Fund on the

ex-dividend date. |

| Distribution

Reinvestment Plan |

Unless

a Stockholder elects otherwise, the Stockholder’s distributions will be reinvested in additional Shares under the Fund’s

distribution reinvestment plan. Stockholders who elect not to participate in the Fund’s distribution reinvestment plan

will receive all distributions in cash paid to the Stockholder of record (or, if the Shares are held in street or other nominee

name, then to such nominee). See “Distribution Reinvestment Plan.” |

| Stock

Purchases and Tenders |

The

Board of Directors may consider repurchasing the Fund’s Shares in the open market or in private transactions, or tendering

for Shares, in an attempt to reduce or eliminate a market value discount from net asset value, if one should occur. There

can be no assurance that the Board of Directors will determine to effect any such repurchase or tender or that it would be

effective in reducing or eliminating any market value discount |

SUMMARY

OF FUND EXPENSES

The

following table shows Fund expenses that you as an investor in the Fund’s Shares will bear directly or indirectly.

| Stockholder

Transaction Expenses |

|

| Sales

load |

None |

| Offering

expenses (1) |

0.05% |

| Distribution

Reinvestment Plan fees |

None |

| Annual

Expenses (as a percentage of net assets attributable to the Shares) |

|

| Management

fees |

1.00% |

| Other

expenses (2) |

0.15% |

| Acquired

Fund fees and expenses (3) |

0.18% |

| Total

Annual Expenses |

1.33% |

Example

(4)

The

following example illustrates the hypothetical expenses (including estimated expenses with respect to year 1 of this Offering

of approximately $249,409) that you would pay on a $1,000 investment in the Shares, assuming (i) annual expenses of 1.33% of net

assets attributable to the Shares and (ii) a 5% annual return:

| |

1

Year |

3

Years |

5

Years |

10

Years |

| You

would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

$14 |

$42 |

$73 |

$160 |

| (1) |

Assuming the Fund

will have 85,408,803 Shares outstanding if fully subscribed and Offering expenses to be paid by the Fund are estimated to

be approximately $249,409 or approximately $0.003 per Share. If the Offering is not fully subscribed, the Offering expenses

percentage (and per Share amount) may increase. |

| (2) |

“Other Expenses”

are based upon gross estimated amounts for the current fiscal year and include, among other expenses, administration and fund

accounting fees. The Fund has no current intention to borrow money for investment purposes and has adopted a fundamental policy

against selling securities short. |

| (3) |

The Fund invests

in other closed-end investment companies and ETFs (collectively, the “Acquired Funds”). The Fund’s stockholders

indirectly bear a pro rata portion of the fees and expenses of the Acquired Funds in which the Fund invests. Acquired Fund

fees and expenses are based on estimated amounts for the current fiscal year. |

| (4) |

The example assumes

that the estimated “Other Expenses” set forth in the Annual Expenses table remain the same each year and that

all dividends and distributions are reinvested at net asset value. Actual expenses may be greater or less than those assumed.

The example further assumes that the Fund uses no leverage, as currently intended and the Fund does not intend to utilize

any leverage within one year from the effective date of this Registration Statement. Moreover, the Fund’s actual rate

of return will vary and may be greater or less than the hypothetical 5% annual return. |

The purpose of the above table is to help a Stockholder understand

the fees and expenses that such Stockholder would bear directly or indirectly. The example should not be considered a representation

of actual future expenses. Actual expenses may be higher or lower than those shown.

THE

FUND

The

Fund is a diversified, closed-end management investment company. The Fund was organized as a New York corporation on March 16,

1973. The Fund’s principal office is located c/o Ultimus Fund Solutions, LLC at 225 Pictoria Drive, Suite 450, Cincinnati,

OH 45246, and its telephone number is (866) 668-6558.

THE

OFFERING

Terms

of the Offering. The Fund is issuing to Record Date Stockholders (i.e., Stockholders who hold Shares on the Record Date)

non-transferable Rights to subscribe for Shares. Each Record Date Stockholder is being issued one non-transferable Right for every

one Share owned on the Record Date. The Rights entitle a Record Date Stockholder to acquire one Share at the Subscription Price

for every three Rights held. Fractional Shares will not be issued upon the exercise of the Rights. Accordingly, the number of

Rights to be issued to a Record Date Stockholder on the Record Date will be rounded up to the nearest whole number of Rights evenly

divisible by three. Rights may be exercised at any time during the Subscription Period which commences on or about April 29, 2022

and ends at 5:00 p.m., New York City time, on May 20, 2022, unless extended by the Fund. See “Expiration of the Offering.”

The right to acquire one additional Share for every three Rights held during the Subscription Period at the Subscription Price

is hereinafter referred to as the “Basic Subscription.”

In

addition to the Basic Subscription, Record Date Stockholders who exercise all of their Rights are entitled to subscribe for Shares

which were not otherwise subscribed for by others in the Basic Subscription (the “Additional Subscription Privilege”).

If sufficient Shares are not available to honor all requests under the Additional Subscription Privilege, the Fund may, in its

discretion, issue additional Shares up to 50% of the Shares available in the Offering (or 10,676,100 Shares for a total of 32,028,301

Shares) (the “Over-Subscription Shares”) to honor additional subscription requests, with such Shares subject to the

same terms and conditions of this Offering. See “Additional Subscription Privilege” below. For purposes of determining

the maximum number of Shares a Stockholder may acquire pursuant to the Offering, broker-dealers whose Shares are held of record

by any Nominee will be deemed to be the holders of the Rights that are issued to such Nominee on their behalf. The term “Nominee”

shall mean, collectively, CEDE & Company (“Cede”), as nominee for the Depository Trust Company (“DTC”),

or any other depository or nominee. Shares acquired pursuant to the Additional Subscription Privilege are subject to allotment

and will be distributed on a pro rata basis if allotment does not exist to fulfill all requests, which is more fully discussed

below under “Additional Subscription Privilege.”

SHARES

WILL BE ISSUED WITHIN THE 15-DAY PERIOD IMMEDIATELY FOLLOWING THE RECORD DATE OF THE FUND’S MONTHLY DISTRIBUTION AND STOCKHOLDERS

EXERCISING RIGHTS WILL NOT BE ENTITLED TO RECEIVE SUCH DISTRIBUTION WITH RESPECT TO THE SHARES ISSUED PURSUANT TO SUCH EXERCISE.

Rights

will be Evidenced by Subscription Certificates. The number of Rights issued to each Record Date Stockholder will be stated

on the Subscription Certificates delivered to the Record Date Stockholder. The method by which Rights may be exercised and Shares

paid for is set forth below in “Method of Exercising Rights” and “Payment for Shares.” A RIGHTS HOLDER

WILL HAVE NO RIGHT TO RESCIND A PURCHASE AFTER THE SUBSCRIPTION AGENT HAS RECEIVED PAYMENT. See “Payment for Shares”

below.

The

Rights are non-transferable and may not be purchased or sold. Rights will expire without residual value at the Expiration Date

(or Extended Expiration Date, as the case may be). The Rights will not be listed for trading on the NYSE American, and there will

not be any market for trading Rights. The Shares to be issued pursuant to the Offering will be listed for trading on the NYSE

American, subject to the NYSE American being officially notified of the issuance of those Shares.

Purpose

of the Offering. At a meeting held on February 18, 2022, the Board considered, in addition to other factors, the success

of the Prior Rights Offerings, and determined that the current Offering was in the best interests of the Fund and its existing

Stockholders to increase the assets of the Fund and approved the current Offering. The primary reasons include:

| - |

The Basic Subscription

will provide existing Stockholders an opportunity to purchase additional Shares at a price that is potentially below market

value without incurring any commission or transaction charges. |

| - |

Raising more cash

will better position the Fund to take advantage of investment opportunities that exist or may arise, however as has been the

case with Prior Rights Offerings, a portion of the increase in the Fund’s assets will also be used to maintain the Fund’s

Distribution Policy. Since the Fund adopted the Distribution Policy, the Fund’s investments have failed to provide adequate

net income or net capital gains to meet the requirements of the Fund’s Distribution Policy and the Fund has made return

of capital distributions to maintain its Distribution Policy. |

| - |

Increasing the Fund’s

assets will provide the Fund additional flexibility in maintaining the Fund’s Distribution Policy. The Distribution

Policy permits Stockholders to receive a predictable level of cash flow and some liquidity periodically with respect to their

Shares without having to sell Shares. Stockholders should be aware that a majority of the distributions that the Fund made

to its Stockholders for 2020 consisted of a return of its Stockholder’s capital, and not of income or gains generated

from the Fund’s investment portfolio. For the years 2018 and 2019 substantially all of the distributions that the Fund

made to its Stockholders consisted of a return of its Stockholders’ capital, and not of income or gains generated from

the Fund’s investment portfolio. For 2017 and 2021, a portion of the distributions that the Fund made to its Stockholders

consisted of a return of its Stockholders’ capital, and not of income or gains generated from the Fund’s investment

portfolio. |

| - |

Increasing Fund

assets may lower the Fund’s expenses as a proportion of net assets because the Fund’s fixed costs would be spread

over a larger asset base. There can be no assurance that by increasing the size of the Fund, the Fund’s expense ratio

will be lowered. However, increasing the Fund’s assets results in a benefit to the Fund’s Investment Adviser because

the Management fee that is paid to the Investment Adviser increases as the Fund’s net assets increase. |

| - |

Because the Offering

will increase the Fund’s outstanding Shares, it may increase the number of Stockholders over the long term, which could

increase the level of market interest in and visibility of the Fund and improve the trading liquidity of the Shares on the

NYSE American. |

| - |

The Board expects

the Offering to be anti-dilutive with respect to net asset value per share, but not to voting, to all Stockholders. Those

Stockholders electing not to participate will not be diluted, notwithstanding the fact that all the costs of the Offering

will be borne by the Stockholders whether or not they exercise their Rights, because the Offering price is set at a premium

to NAV and the estimated expenses incurred for the Offering will be more than offset by the increase in the net assets of

the Fund such that non-participating Stockholders will receive an increase in their net asset value, so long as the number

of Shares issued to participating Stockholders is not materially less than a full exercise of the Basic Subscription amount.

Historically, all Prior Rights Offerings have been anti-dilutive with respect to the net asset value per share. Stockholders

have exercised not only the basic subscription but also a significant percentage of the additional subscription shares offered.

The Offering is expected to be dilutive with respect to Stockholder’s voting percentages because Stockholders electing

not to participate in the Offering will own a smaller percentage of the total number of shares outstanding after the completion

of the Offering. |

Board

Considerations in Approving the Offering. At a meeting held on February 18, 2022, the Board considered the approval of

the Offering. In considering whether or not to approve the Offering, the Board relied on materials and information prepared and

presented by the Fund’s management at such meeting and discussions at that time. Based on such materials and their deliberations

at this meeting, the Board determined that it would be in the best interests of the Fund and its Stockholders to conduct the Offering

in order to increase the assets of the Fund available for current and future investment opportunities. In making its determination,

the Board considered the various factors set forth in “The Offering - Purpose of the Offering”. The Board also considered

a number of other factors, including the success of the 2010 Offering, the 2011 Offering, the 2012 Offering, the 2013 Offering,

the 2015 Offering, the 2016 Offering, the 2017 Offering, the 2018 Offering and the 2021 Offering (collectively, the “Prior

Rights Offerings”) and that the Prior Rights Offerings were anti-dilutive to Stockholders with respect to value, the ability

of the Investment Adviser to invest the proceeds of the Offering, the Fund’s assets, including those resulting from Prior

Rights Offerings, have been used to maintain the Fund’s Distribution Policy because a portion of the assets raised in the

rights offering may be utilized to maintain monthly distributions and the potential effect of the Offering on the Fund’s

stock price and adherence to the terms of the Fund’s exemptive relief, which restricts a public offering of its common stock.

The Board considered that, during the course of each of the Prior Rights Offerings, the Fund’s market price declined; however

the Board noted that the Fund continued at all times during the 2021 Offering and all of the time since the 2021 Offering’s

conclusion to sell at a premium to NAV, and the current market price, after adjusting for distributions, exceeded the level that

it was prior to the 2021 Offering. When considering the potential effect of the Offering on the Fund’s stock price, the

Board took into account the 2021 Rights Offering, including the positive impact it had on the Fund’s net asset value per

share and the short-term price effect. The Board concluded that the impact on the Fund’s price was uncertain and, regardless

of the potential impact, the Offering was in the best interests of the Stockholders. As a result of these considerations, the

Board determined that it was appropriate and in the best interest of the Fund and its Stockholders to proceed with the Offering,

while continuing with the Distribution Policy.

At

a meeting held on February 18, 2022, the Board voted to approve the terms of the Offering. Two of the Fund’s Directors are

affiliated with the Investment Adviser and, therefore, could benefit indirectly from the Offering. The other six directors are

not “interested persons” of the Fund within the meaning of the 1940 Act. The Investment Adviser may also benefit from

the Offering because its fee is based on the assets of the Fund. It is not possible to state precisely the amount of additional

compensation the Investment Adviser might receive as a result of the Offering because it is not known how many Shares will be

subscribed for and the proceeds of the Offering will be invested in additional portfolio securities, which will fluctuate in value.

It is likely that affiliates of the Investment Adviser who are also Stockholders will participate in the Offering and, accordingly,

will receive the same benefits of acquiring Shares as other Stockholders.

There

can be no assurance that the Fund or its Stockholders will achieve any of the foregoing objectives or benefits through the Offering.

The

Fund may, in the future, choose to make additional rights offerings from time to time for a number of Shares and on terms that

may or may not be similar to this Offering. Any such future rights offerings will be made in accordance with the then applicable

requirements of the 1940 Act and the Securities Act.

Notice

of NAV Decline. If the Shares begin to trade at a discount, the Board may make a determination whether to discontinue

the Offering, provided that the Fund, as required by the SEC’s registration form, will suspend the Offering until it amends

this prospectus if, subsequent to the date of this prospectus, the Fund’s NAV declines more than 10% from its NAV as of

that date. Accordingly, the Expiration Date would be extended and the Fund would notify Record Date Stockholders of the decline

and permit Stockholders to cancel their exercise of Rights.

The

Subscription Price. The Subscription Price for the Shares to be issued under the Offering will be equal to the greater

of (i) 112% of NAV per Share as calculated at the close of trading on the Expiration Date (or Extended Expiration Date, as the

case may be) or (ii) 65% of the market price per Share at such time. For example, if the Offering were held using the “Estimated

Subscription Price” (i.e., an estimate of the Subscription Price based on the Fund’s per-share NAV and market price

at the end of business on April 8, 2022 ($8.65 and $13.61, respectively), the Subscription Price would be $9.69 per share (112%

of $8.65).

Additional

Subscription Privilege. If all of the Rights initially issued are not exercised, any Shares for which subscriptions have

not been received will be offered, by means of the Additional Subscription Privilege, to Record Date Stockholders who have exercised

all of the Rights initially issued to them and who wish to acquire more than the number of Shares for which the Rights held by

them are exercisable. Record Date Stockholders who exercise all of their Rights will have the opportunity to indicate on the Subscription

Certificate how many unsubscribed Shares they are willing to acquire pursuant to the Additional Subscription Privilege.

If

enough unsubscribed Shares remain after the Basic Subscriptions have been exercised, all additional subscription requests will

be honored in full. If there are not enough unsubscribed Shares to honor all additional subscription requests, the Fund may, in

its discretion, issue additional Shares up to 50% of Shares available in the Offering to honor Additional Subscription Privilege

requests (defined above as the “Over-Subscription Shares”), with such Shares subject to the same terms and conditions

of the Offering. In the event that the Subscription Price is less than the Estimated Subscription Price, Over-Subscription Shares

may be used by the Fund to fulfill any Shares subscribed for under the Basic Subscription. The method by which any unsubscribed

Shares or Over-Subscription Shares (collectively, the “Excess Shares”) will be distributed and allocated pursuant

to the Additional Subscription Privilege is as follows:

| (i) |

If there are sufficient

Excess Shares to satisfy all additional subscriptions by Stockholders exercising their rights under the Additional Subscription

Privilege, each such Stockholder shall be allotted the number of Shares which the Stockholder requested. |

| (ii) |

If the aggregate

number of Shares subscribed for under the Additional Subscription Privilege exceeds the number of Excess Shares, the Excess

Shares will be allocated to Record Date Stockholders who have exercised all of their Rights in accordance with their Additional

Subscription Privilege request. |

| (iii) |

If there are not

enough Excess Shares to fully satisfy all Additional Subscription Privilege requests by Record Date Stockholders pursuant

to paragraph (ii) above, the Excess Shares will be allocated among Record Date Stockholders who have exercised all of their

Rights in proportion, not to the number of Shares requested pursuant to the Additional Subscription Privilege, but to the

number of Rights exercised by them under their Basic Subscription Rights; provided, however, that no Stockholder shall be

allocated a greater number of Excess Shares than such Record Date Stockholder paid for and in no event shall the number of

Shares allocated in connection with the Additional Subscription Privilege exceed 50% of the Shares available in the Offering.

The formula to be used in allocating the Excess Shares under this paragraph is as follows: (Rights Exercised by over-subscribing

Record Date Stockholder divided by Total Rights Exercised by all over-subscribing Record Date Stockholders) multiplied by

Excess Shares remaining. |

The

percentage of Excess Shares each over-subscriber may acquire will be rounded up to result in delivery of whole Shares (fractional

Shares will not be issued).

The

foregoing allocation process may involve a series of allocations in order to assure that the total number of Shares available

for over-subscription are distributed on a pro-rata basis. The Fund will not offer or sell any Shares which are not subscribed

for under the Basic Subscription or the Additional Subscription Privilege. The Additional Subscription Privilege may result in

additional dilution of a Stockholder’s ownership percentage and voting rights.

The

Fund will not offer or sell any Shares which are not subscribed for under the Basic Subscription or the Additional Subscription

Privilege.

Expiration

of the Offering. The Offering will expire at 5:00 p.m., New York City time, on the Expiration Date (May 20, 2022), unless

extended by the Fund (the “Extended Expiration Date”). Rights will expire on the Expiration Date or Extended Expiration

Date, as the case may be, and thereafter may not be exercised.

Method

of Exercising Rights. Rights may be exercised by filling in and signing the reverse side of the Subscription Certificate

and mailing it in the envelope provided, or otherwise delivering the completed and signed Subscription Certificate to the Subscription

Agent, together with payment for the Shares as described below under “Payment for Shares.” Rights may also be exercised

through a Rights holder’s broker, who may charge the Rights holder a servicing fee in connection with such exercise.

In

the event that the Estimated Subscription Price is more than the Subscription Price on the Expiration Date (or Extended Expiration

Date, as the case may be), any resulting excess amount paid by a Stockholder towards the purchase of Shares in the Offering will

be applied by the Fund towards the purchase of additional Shares under the Basic Subscription or, if such Stockholder has exercised

all of the Rights initially issued to such Stockholder under the Basic Subscription, towards the purchase of an additional number

of Shares pursuant to the Additional Subscription Privilege. Any Stockholder who desires that such excess not be treated by the

Fund as a request by the Stockholder to acquire additional Shares in the Offering and that such excess be refunded to the Stockholder

must so indicate in the space provided on the Subscription Certificate.

Completed

Subscription Certificates must be received by the Subscription Agent prior to 5:00 p.m., New York City time, on the Expiration

Date (or Extended Expiration Date as the case may be). The Subscription Certificate and payment should be delivered to the Subscription

Agent at the following address:

| If by first class mail: |

If by mail or overnight

courier: |

American

Stock Transfer & Trust Company, LLC

6201

15th Avenue

Brooklyn,

New York 11219

Attn:

Corporate Actions |

American

Stock Transfer & Trust Company, LLC

6201

15th Avenue

Brooklyn,

New York 11219

Attn:

Corporate Actions |

Subscription

Agent. The Subscription Agent is American Stock Transfer & Trust Company, LLC, with an address at 6201 15th Avenue,

Brooklyn, New York 11219. The Subscription Agent will receive from the Fund an amount estimated to be $27,500, comprised of the

fee for its services and the reimbursement for certain expenses related to the Offering. INQUIRIES BY ALL HOLDERS OF RIGHTS SHOULD

BE DIRECTED TO THE INFORMATION AGENT, AST FUND SOLUTIONS, LLC, AT (866) 406-2285; HOLDERS MAY ALSO CONSULT THEIR BROKERS OR NOMINEES.

Payment

for Shares. Payment for Shares shall be calculated by multiplying the Estimated Subscription Price by the sum of (i) the

number of Shares intended to be purchased in the Basic Subscription (e.g., the number of Rights exercised divided by three), plus

(ii) the number of additional Shares intended to be over-subscribed under the Additional Subscription Privilege. For example,

based on the Estimated Subscription Price of $9.69 per Share, if a Stockholder receives 300 Rights and wishes to subscribe for

100 Shares in the Basic Subscription, and also wishes to over-subscribe for 50 additional Shares under the Additional Subscription

Privilege, such Stockholder would remit payment in the amount of $1,453.50 ($969.00 plus $484.50).

Record

Date Stockholders who wish to acquire Shares in the Basic Subscription or pursuant to the Additional Subscription Privilege must,

together with the properly completed and executed Subscription Certificate, send payment for the Shares acquired in the Basic

Subscription and any additional Shares subscribed for pursuant to the Additional Subscription Privilege, to the Subscription Agent

based on the Estimated Subscription Price of $10.04 per Share. To be accepted, such payment, together with the Subscription Certificate,

must be received by the Subscription Agent prior to 5:00 p.m., New York City time, on the Expiration Date, or Extended Expiration

Date, as the case may be.

If

the Estimated Subscription Price is greater than the actual per Share purchase price, the excess payment will be applied toward

the purchase of unsubscribed Shares to the extent that there remain sufficient unsubscribed Shares available after the Basic Subscription

and Additional Subscription Privilege allocations are completed. To the extent that sufficient unsubscribed Shares are not available

to apply all of the excess payment toward the purchase of unsubscribed Shares, available Shares will be allocated in the manner

consistent with that described in the section entitled “Additional Subscription Privilege” above.

PAYMENT

MUST ACCOMPANY ANY SUBSCRIPTION CERTIFICATE FOR SUCH SUBSCRIPTION CERTIFICATE TO BE ACCEPTED.

Within

five (5) business days following the Expiration Date or Extended Expiration Date, as the case may be, a confirmation will be sent

by the Subscription Agent to each Stockholder (or, if the Shares on the Record Date are held by Cede or any other depository or

nominee, to Cede or such other depository or nominee). The date of the confirmation is referred to as the “Confirmation

Date.” The confirmation will show (i) the number of Shares acquired pursuant to the Basic Subscription; (ii) the number

of Shares, if any, acquired pursuant to the Additional Subscription Privilege; (iii) the per Share and total purchase price for

the Shares; and (iv) any additional amount payable by such Stockholder to the Fund (i.e., if the Estimated Subscription Price

was less than the Subscription Price on the Expiration Date, as the case may be) or any excess to

be refunded by the Fund to such Stockholder (i.e., if the Estimated Subscription Price was more than the Subscription Price on

the Expiration Date (or Extended Expiration Date, as the case may be) and the Stockholder indicated on the Subscription Certificate

that such excess not be treated by the Fund as a request by the Stockholder to acquire additional Shares in the Offering). Any

additional payment required from a Stockholder must be received by the Subscription Agent prior to 5:00 p.m., New York City time,