false000150237700015023772024-11-292024-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 29, 2024 |

Contango Ore, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35770 |

27-3431051 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

516 2nd Avenue Suite 401 |

|

Fairbanks, Alaska |

|

99701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (907) 888-4273 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

CTGO |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On November 21, 2024, Contango Ore, Inc. (the “Company”) issued a press release, announcing guidance for its 30% interest in the Peak Gold JV, including reaffirmation of anticipated 2025 gold production and updated anticipated all-in sustaining costs for the mine and 2025 cash distributions from the Peak Gold JV. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is available on the Company’s website at www.contangoore.com..

The information included herein and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Cautionary Note Regarding Forward-Looking Statements

Many of the statements included or incorporated in this Current Report on Form 8-K and the furnished exhibit constitute “forward-looking statements.” In particular, they include statements relating to future actions, strategies, future operating and financial performance, ability to realize the anticipated benefits of various transactions and the Company’s future financial results. These forward-looking statements are based on current expectations and projections about future events. Readers are cautioned that forward-looking statements are not guarantees of future operating and financial performance or results and involve substantial risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual performance of the Company may differ materially from that expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, factors described from time to time in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CONTANGO ORE, INC. |

|

|

|

|

Date: |

November 29, 2024 |

By: |

/s/ Mike Clark |

|

|

|

Mike Clark

Chief Financial Officer and Secretary |

NEWS RELEASE

CONTANGO ORE, INC.

Contango Reaffirms and Updates 2025 Manh Choh Guidance

FAIRBANKS, AK -- (November 29, 2024) -- Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American: CTGO) announced guidance today for its 30% interest in the Peak Gold JV, including reaffirmation of anticipated 2025 gold production and updated anticipated all-in sustaining costs (“AISC”) for the mine and 2025 cash distributions from the Peak Gold JV. In addition, the Company provided an update on its credit facility (the “Facility”) and related hedge contracts.

The Company anticipates that its share of 2025 gold production from the Manh Choh mine will be approximately 60,000 ounces (“oz”) of gold. The estimated AISC for the life-of-mine (“LOM”) is projected to increase to approximately $1,400 per oz of gold equivalent (“AuEq”) sold compared to $1,116 per oz of AuEq sold, as estimated in the Manh Choh Technical Report Summary1 (the “TRS”), while the estimated AISC for 2025 on a standalone basis is expected to be approximately $1,625 per oz of AuEq sold. A main factor leading to the AISC increase relates to recent weight restrictions on the Chena Flood Plain Bridge, a bridge along the Manh Choh ore haul route, as well as higher than anticipated moisture content in the Manh Choh ore, which limits the overall amount of ore being transported annually by approximately 20% compared to what was originally projected in the TRS. In addition, the AISC is being impacted by higher processing costs. At current hauling rates, the Company expects the LOM to be four to five years. At assumed spot gold prices of $2,500 per oz, Contango projects that the 2025 cash distributions from the Peak Gold JV to Contango will be approximately $50 million (“M”).

The Company is working with its lenders to restructure a portion of the Facility principal repayments and related hedge contracts to better match the production schedule of the Manh Choh production campaigns.

Gold Production Guidance (Estimates)

1 See press release announcing TRS: https://www.contangoore.com/press-release/contango-ore-announces-completion-of-s-k-1300-technical-report-summary-for-its-manh-choh-project-in-alaska. To view a copy of the TRS, see: https://cdn.prod.website-files.com/5fc5d36fd44fd675102e4420/6470afdaf94d2ac9f93d93e0_SIMS%20Contango%20Manh%20Choh%20Project%20S-K%201300%20TRS%20FINAL%2020230524%20(1)-compressed.pdf. The information contained in, or otherwise accessible through, the links are not part of, and are not incorporated by reference into this release.

|

|

|

|

|

Contango's Share (30% basis) |

|

|

|

2025 Gold Production |

|

|

60,000 |

oz |

2025 AISC |

$ |

1,625 |

oz AuEq |

LOM AISC |

$ |

1,400 |

oz AuEq |

2025 Cash Distribution from Peak Gold JV |

$ |

$50 M |

|

Rick Van Nieuwenhuyse, the Company’s President and CEO commented, “Overall, we are very pleased with the ramp up of Manh Choh production, expecting to produce 38,500 ounces of gold on Contango’s account for 2024 and 60,000 ounces of gold for 2025. While we are disappointed with these new weight restrictions impacting Manh Choh trucking operations, which has an impact on AISC, the Manh Choh Project is expected to be very profitable over its current four to five year mine life, generating significant free cash flow to Contango. As a Company, our focus remains steadfast on continuing to pay down our credit facility, with our next objective of advancing the Lucky Shot and Johnson Tract projects forward, to further demonstrate the success of the direct ship ore (DSO) model. We will continue to provide updates as more information is made available.”

WEBINAR

If you have any questions regarding this news release, please join CEO, Rick Van Nieuwenhuyse, for a live webinar today at 3:00pm EST / 12:00pm PST: https://6ix.com/event/contango-ore-corporate-update-1.

Mr. Van Nieuwenhuyse will be available to take live questions following a brief discussion.

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in exploration for gold and associated minerals in Alaska. Contango holds a 30% interest in the Peak Gold JV, which leases approximately 675,000 acres of land for exploration and development on the Manh Choh project, with the remaining 70% owned by KG Mining (Alaska), Inc., an indirect subsidiary of Kinross Gold Corporation, operator of the Peak Gold JV. The Company and its subsidiaries also have (i) a lease on the Johnson Tract project from the underlying owner, CIRI Native Corporation, (ii) a lease on the Lucky Shot project from the underlying owner, Alaska Hardrock Inc., (iii) 100% ownership of approximately 8,600 acres of peripheral State of Alaska mining claims and (iv) a 100% interest in approximately 145,000 acres of State of Alaska mining claims that give Contango the exclusive right to explore and develop minerals on these lands. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding Contango that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995, based on Contango’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as “expects”, “projects”, “anticipates”, “plans”, “estimates”, “potential”, “possible”, “probable”, or “intends”, or stating that certain actions, events or results “may”, “will”, “should”, or “could” be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for and developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by Contango or the Peak Gold JV; ability to realize the anticipated benefits of the Peak Gold JV; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; Contango’s inability to retain or maintain its relative ownership interest in the Peak Gold JV; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; the extent of disruptions caused by an outbreak of disease, such as the COVID-19 pandemic; and the possibility that government policies may change, political developments may occur or governmental approvals may be delayed or withheld, including as a result of presidential and congressional elections in the U.S. or the inability to obtain mining permits. Additional information on these and other factors which could affect Contango’s exploration program or financial results are included in Contango’s other reports on file with the U.S. Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Contango does not assume any obligation to update forward-looking statements should circumstances or management’s estimates or opinions change.

CONTACTS:

Contango ORE, Inc.

Rick Van Nieuwenhuyse

(907) 888-4273

www.contangoore.com

v3.24.3

Document And Entity Information

|

Nov. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 29, 2024

|

| Entity Registrant Name |

Contango Ore, Inc.

|

| Entity Central Index Key |

0001502377

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35770

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

27-3431051

|

| Entity Address, Address Line One |

516 2nd Avenue

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

Fairbanks

|

| Entity Address, State or Province |

AK

|

| Entity Address, Postal Zip Code |

99701

|

| City Area Code |

(907)

|

| Local Phone Number |

888-4273

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 per share

|

| Trading Symbol |

CTGO

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

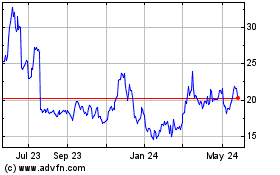

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

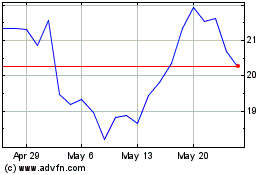

Contango Ore (AMEX:CTGO)

Historical Stock Chart

From Jan 2024 to Jan 2025