Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 29 2024 - 9:24AM

Edgar (US Regulatory)

DEFA 14A

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT

TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT

NO. ____)

Filed by the Registrant [X]

Filed by a Party other than the [_]

Registrant

Check the appropriate box:

[ ] Preliminary

Proxy Statement

[_] Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2))

[_] Definitive Proxy Statement

[ ] Definitive

Additional Materials

[x] Soliciting Materials under

Rule 14a-12

BNY Mellon Municipal Income Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[_] Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11:

(4) Proposed maximum aggregate value of transaction:

(5) Total Fee Paid:

[_] Fee paid previously with

preliminary materials.

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0- 11(a)(2) and identify the filing for which the offsetting

fee was paid previously. |

Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

BNY Mellon Municipal Income, Inc. (NYSE: DMF)

PROTECT YOUR FUND

VOTE ON THE WHITE PROXY CARD – FOR – THE BOARD RECOMMENDED PROPOSALS |

|

Ahead of the Annual Meeting on June 12, 2024

at 11:00 a.m. ET, we are asking you to help defend your Fund and preserve your ability to make the best long-term decisions

to help meet your financial goals. PROTECT YOUR INVESTMENT from two activist hedge funds, Saba Capital and Bulldog Investors, who

are seeking to take steps that could imperil your Fund’s ability to deliver the consistent income you count on.

|

|

On the WHITE proxy card, you will see two proposals.

Your Board recommends voting:

ü

FOR your

qualified, elected Board members

X

AGAINST the

Board declassification proposal |

|

IMPORTANT: PLEASE DISCARD ANY PROXY CARD YOU RECEIVE FROM SABA OR BULLDOG.

|

|

Your qualified Board is best positioned to continue protecting

your interests.

Your vote will allow you to maintain your long-term investment

and the consistent income that matters most.

|

|

|

136

Years of collective board experience prioritizing shareholder

interest in BNY Mellon closed-end funds.

|

|

Your Fund continues to deliver consistent distributions and

outperform its benchmark.

$4.4005

Distributions per share over past 10 years

3.08%

Total returns compared to Bloomberg U.S. Municipal Bond Index

of –1.62% year-to-date*

|

| |

|

| |

Your Fund is structured to promote stability,

continuity, and the preservation of capital over the full life if the Fund.

|

*As of 4/30/24

DON’T WAIT TO PROTECT YOUR INVESTMENT

VOTE today FOR the Board recommended Proposals on the WHITE proxy card |

Important Information about the Fund

This material is not an advertisement and

is intended for existing shareholder use only. This document and the information contained herein relates solely to BNY Mellon Municipal

Income, Inc. (DMF). The information contained herein does not relate to, and is not relevant to, any other fund or product advised by

BNY Mellon Investment Adviser, Inc. or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation

of an offer to buy any securities.

Common shares for the closed-end fund identified

above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund's dividend yield, market

price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does

not constitute a solicitation of an offer to buy or sell Fund shares.

Performance results reflect past performance

and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume

reinvestment of all dividends. The market value and net asset value of a fund's shares will fluctuate with market conditions. Closed-end

funds may trade at a premium to NAV but often trade at a discount.

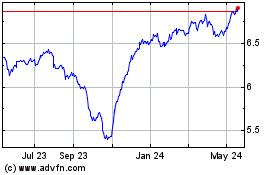

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Nov 2024 to Dec 2024

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Dec 2023 to Dec 2024