UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number

811-490

Oppenheimer Equity Fund, Inc.

(Exact name of registrant as specified in charter)

6803 South

Tucson Way,

Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S.

Gabinet

OppenheimerFunds, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and

address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end:

December 31

Date of reporting period:

9/28/2012

Item 1. Schedule of Investments.

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Common Stocks–97.8%

|

|

|

|

|

|

|

|

|

|

Consumer Discretionary–12.6%

|

|

|

|

|

|

|

|

|

|

Auto Components–0.4%

|

|

|

|

|

|

|

|

|

|

Johnson Controls, Inc.

|

|

|

220,590

|

|

|

$

|

6,044,166

|

|

|

Automobiles–0.7%

|

|

|

|

|

|

|

|

|

|

Ford Motor Co.

|

|

|

969,260

|

|

|

|

9,556,904

|

|

|

Hotels, Restaurants & Leisure–1.7%

|

|

|

|

|

|

|

|

|

|

McDonald’s Corp.

|

|

|

171,180

|

|

|

|

15,705,765

|

|

|

Yum! Brands, Inc.

|

|

|

121,000

|

|

|

|

8,027,140

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,732,905

|

|

|

Household Durables–0.2%

|

|

|

|

|

|

|

|

|

|

Newell Rubbermaid, Inc.

|

|

|

184,840

|

|

|

|

3,528,596

|

|

|

Internet & Catalog Retail–0.7%

|

|

|

|

|

|

|

|

|

|

Amazon.com, Inc.

1

|

|

|

39,093

|

|

|

|

9,942,132

|

|

|

Media–2.4%

|

|

|

|

|

|

|

|

|

|

Comcast Corp., Cl. A

|

|

|

483,540

|

|

|

|

17,296,226

|

|

|

Viacom, Inc., Cl. B

|

|

|

69,020

|

|

|

|

3,698,782

|

|

|

Walt Disney Co. (The)

|

|

|

270,530

|

|

|

|

14,143,308

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35,138,316

|

|

|

Multiline Retail–1.7%

|

|

|

|

|

|

|

|

|

|

Target Corp.

|

|

|

376,930

|

|

|

|

23,923,747

|

|

|

Specialty Retail–3.1%

|

|

|

|

|

|

|

|

|

|

Lowe’s Cos., Inc.

|

|

|

518,360

|

|

|

|

15,675,206

|

|

|

O’Reilly Automotive, Inc.

1

|

|

|

129,180

|

|

|

|

10,802,032

|

|

|

Tiffany & Co.

|

|

|

100,720

|

|

|

|

6,232,554

|

|

|

TJX Cos., Inc. (The)

|

|

|

249,700

|

|

|

|

11,184,063

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43,893,855

|

|

|

Textiles, Apparel & Luxury Goods–1.7%

|

|

|

|

|

|

|

|

|

|

Coach, Inc.

|

|

|

152,455

|

|

|

|

8,540,529

|

|

|

Nike, Inc., Cl. B

|

|

|

102,820

|

|

|

|

9,758,646

|

|

|

Ralph Lauren Corp., Cl. A

|

|

|

40,680

|

|

|

|

6,152,036

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,451,211

|

|

|

Consumer Staples–11.4%

|

|

|

|

|

|

|

|

|

|

Beverages–4.6%

|

|

|

|

|

|

|

|

|

|

Brown-Forman Corp., Cl. B

|

|

|

132,680

|

|

|

|

8,657,370

|

|

|

Coca-Cola Co. (The)

|

|

|

619,420

|

|

|

|

23,494,601

|

|

|

Molson Coors Brewing Co., Cl. B, Non-Vtg.

|

|

|

263,680

|

|

|

|

11,878,784

|

|

|

PepsiCo, Inc.

|

|

|

145,250

|

|

|

|

10,279,343

|

|

|

SABMiller plc

|

|

|

247,200

|

|

|

|

10,857,687

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,167,785

|

|

|

Food & Staples Retailing–2.1%

|

|

|

|

|

|

|

|

|

|

Costco Wholesale Corp.

|

|

|

145,050

|

|

|

|

14,523,131

|

|

|

Walgreen Co.

|

|

|

436,900

|

|

|

|

15,920,636

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30,443,767

|

|

|

|

|

|

|

|

|

1

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Food Products–1.8%

|

|

|

|

|

|

|

|

|

|

Kellogg Co.

|

|

|

137,060

|

|

|

$

|

7,080,520

|

|

|

Mead Johnson Nutrition Co., Cl. A

|

|

|

103,940

|

|

|

|

7,616,723

|

|

|

Nestle SA

|

|

|

169,006

|

|

|

|

10,656,093

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,353,336

|

|

|

Household Products–1.8%

|

|

|

|

|

|

|

|

|

|

Church & Dwight Co., Inc.

|

|

|

156,200

|

|

|

|

8,433,238

|

|

|

Colgate-Palmolive Co.

|

|

|

90,920

|

|

|

|

9,748,442

|

|

|

Procter & Gamble Co.

|

|

|

103,650

|

|

|

|

7,189,164

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,370,844

|

|

|

Personal Products–0.5%

|

|

|

|

|

|

|

|

|

|

Estee Lauder Cos., Inc. (The), Cl. A

|

|

|

128,830

|

|

|

|

7,932,063

|

|

|

Tobacco–0.6%

|

|

|

|

|

|

|

|

|

|

Philip Morris International, Inc.

|

|

|

95,390

|

|

|

|

8,579,377

|

|

|

Energy–10.3%

|

|

|

|

|

|

|

|

|

|

Energy Equipment & Services–3.6%

|

|

|

|

|

|

|

|

|

|

Baker Hughes, Inc.

|

|

|

163,090

|

|

|

|

7,376,561

|

|

|

Cameron International Corp.

1

|

|

|

163,370

|

|

|

|

9,160,156

|

|

|

Ensco plc, Cl. A

|

|

|

149,060

|

|

|

|

8,132,714

|

|

|

National Oilwell Varco, Inc.

|

|

|

120,180

|

|

|

|

9,627,620

|

|

|

Oceaneering International, Inc.

|

|

|

59,150

|

|

|

|

3,268,038

|

|

|

Schlumberger Ltd.

|

|

|

179,730

|

|

|

|

12,999,871

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,564,960

|

|

|

Oil, Gas & Consumable Fuels–6.7%

|

|

|

|

|

|

|

|

|

|

Apache Corp.

|

|

|

68,180

|

|

|

|

5,895,525

|

|

|

Chevron Corp.

|

|

|

416,528

|

|

|

|

48,550,504

|

|

|

Exxon Mobil Corp.

|

|

|

246,350

|

|

|

|

22,528,708

|

|

|

Noble Energy, Inc.

|

|

|

95,030

|

|

|

|

8,810,231

|

|

|

Occidental Petroleum Corp.

|

|

|

66,010

|

|

|

|

5,680,821

|

|

|

Phillips 66

|

|

|

99,370

|

|

|

|

4,607,787

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

96,073,576

|

|

|

Financials–10.9%

|

|

|

|

|

|

|

|

|

|

Capital Markets–1.5%

|

|

|

|

|

|

|

|

|

|

BlackRock, Inc., Cl. A

|

|

|

39,100

|

|

|

|

6,971,530

|

|

|

Goldman Sachs Group, Inc. (The)

|

|

|

123,690

|

|

|

|

14,061,079

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,032,609

|

|

|

Commercial Banks–4.9%

|

|

|

|

|

|

|

|

|

|

M&T Bank Corp.

|

|

|

182,170

|

|

|

|

17,335,297

|

|

|

PNC Financial Services Group, Inc.

|

|

|

215,990

|

|

|

|

13,628,969

|

|

|

Standard Chartered plc

|

|

|

229,307

|

|

|

|

5,184,004

|

|

|

SunTrust Banks, Inc.

|

|

|

390,230

|

|

|

|

11,031,802

|

|

|

Wells Fargo & Co.

|

|

|

658,580

|

|

|

|

22,740,767

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69,920,839

|

|

|

Consumer Finance–0.5%

|

|

|

|

|

|

|

|

|

|

American Express Co.

|

|

|

137,460

|

|

|

|

7,815,976

|

|

|

|

|

|

|

|

|

2

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Diversified Financial Services–0.3%

|

|

|

|

|

|

|

|

|

|

Citigroup, Inc.

|

|

|

109,990

|

|

|

$

|

3,598,873

|

|

|

Insurance–3.7%

|

|

|

|

|

|

|

|

|

|

ACE Ltd.

|

|

|

226,160

|

|

|

|

17,097,696

|

|

|

Marsh & McLennan Cos., Inc.

|

|

|

607,950

|

|

|

|

20,627,744

|

|

|

MetLife, Inc.

|

|

|

196,790

|

|

|

|

6,781,383

|

|

|

Travelers Cos., Inc. (The)

|

|

|

124,800

|

|

|

|

8,518,848

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53,025,671

|

|

|

Health Care–13.9%

|

|

|

|

|

|

|

|

|

|

Biotechnology–1.2%

|

|

|

|

|

|

|

|

|

|

Alexion Pharmaceuticals, Inc.

1

|

|

|

50,520

|

|

|

|

5,779,488

|

|

|

Vertex Pharmaceuticals, Inc.

1

|

|

|

207,470

|

|

|

|

11,607,947

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,387,435

|

|

|

Health Care Equipment & Supplies–1.6%

|

|

|

|

|

|

|

|

|

|

Baxter International, Inc.

|

|

|

373,830

|

|

|

|

22,526,996

|

|

|

Health Care Providers & Services–3.5%

|

|

|

|

|

|

|

|

|

|

Humana, Inc.

|

|

|

446,330

|

|

|

|

31,310,050

|

|

|

UnitedHealth Group, Inc.

|

|

|

345,930

|

|

|

|

19,167,981

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,478,031

|

|

|

Health Care Technology–0.4%

|

|

|

|

|

|

|

|

|

|

Cerner Corp.

1

|

|

|

82,430

|

|

|

|

6,380,906

|

|

|

Life Sciences Tools & Services–0.4%

|

|

|

|

|

|

|

|

|

|

Mettler-Toledo International, Inc.

1

|

|

|

34,570

|

|

|

|

5,902,482

|

|

|

Pharmaceuticals–6.8%

|

|

|

|

|

|

|

|

|

|

Allergan, Inc.

|

|

|

151,210

|

|

|

|

13,847,812

|

|

|

Bristol-Myers Squibb Co.

|

|

|

321,320

|

|

|

|

10,844,550

|

|

|

Merck & Co., Inc.

|

|

|

555,760

|

|

|

|

25,064,776

|

|

|

Novo Nordisk AS, Cl. B

|

|

|

80,605

|

|

|

|

12,733,687

|

|

|

Perrigo Co.

|

|

|

57,860

|

|

|

|

6,721,596

|

|

|

Roche Holding AG

|

|

|

50,094

|

|

|

|

9,358,337

|

|

|

Teva Pharmaceutical Industries Ltd., Sponsored ADR

|

|

|

429,690

|

|

|

|

17,793,463

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

96,364,221

|

|

|

Industrials–11.1%

|

|

|

|

|

|

|

|

|

|

Aerospace & Defense–3.3%

|

|

|

|

|

|

|

|

|

|

Honeywell International, Inc.

|

|

|

419,390

|

|

|

|

25,058,553

|

|

|

Precision Castparts Corp.

|

|

|

55,490

|

|

|

|

9,063,737

|

|

|

TransDigm Group, Inc.

1

|

|

|

37,840

|

|

|

|

5,368,361

|

|

|

United Technologies Corp.

|

|

|

104,890

|

|

|

|

8,211,838

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47,702,489

|

|

|

Air Freight & Logistics–0.5%

|

|

|

|

|

|

|

|

|

|

United Parcel Service, Inc., Cl. B

|

|

|

95,950

|

|

|

|

6,867,142

|

|

|

Commercial Services & Supplies–1.0%

|

|

|

|

|

|

|

|

|

|

Tyco International Ltd.

|

|

|

258,440

|

|

|

|

14,539,834

|

|

|

Construction & Engineering–0.7%

|

|

|

|

|

|

|

|

|

|

Quanta Services, Inc.

1

|

|

|

373,280

|

|

|

|

9,220,016

|

|

|

|

|

|

|

|

|

3

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Industrial Conglomerates–0.8%

|

|

|

|

|

|

|

|

|

|

Danaher Corp.

|

|

|

207,690

|

|

|

$

|

11,454,104

|

|

|

Machinery–2.6%

|

|

|

|

|

|

|

|

|

|

AGCO Corp.

1

|

|

|

90,280

|

|

|

|

4,286,494

|

|

|

Caterpillar, Inc.

|

|

|

64,770

|

|

|

|

5,572,811

|

|

|

Cummins, Inc.

|

|

|

65,640

|

|

|

|

6,052,664

|

|

|

Eaton Corp.

|

|

|

55,340

|

|

|

|

2,615,368

|

|

|

Joy Global, Inc.

|

|

|

113,340

|

|

|

|

6,353,840

|

|

|

Navistar International Corp.

1

|

|

|

131,900

|

|

|

|

2,781,771

|

|

|

Parker Hannifin Corp.

|

|

|

109,160

|

|

|

|

9,123,593

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36,786,541

|

|

|

Road & Rail–1.7%

|

|

|

|

|

|

|

|

|

|

Hunt (J.B.) Transport Services, Inc.

|

|

|

106,210

|

|

|

|

5,527,168

|

|

|

Kansas City Southern, Inc.

|

|

|

89,210

|

|

|

|

6,760,334

|

|

|

Union Pacific Corp.

|

|

|

99,360

|

|

|

|

11,794,032

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,081,534

|

|

|

Trading Companies & Distributors–0.5%

|

|

|

|

|

|

|

|

|

|

AerCap Holdings NV

1

|

|

|

580,541

|

|

|

|

7,256,763

|

|

|

Information Technology–19.3%

|

|

|

|

|

|

|

|

|

|

Communications Equipment–4.2%

|

|

|

|

|

|

|

|

|

|

Cisco Systems, Inc.

|

|

|

724,420

|

|

|

|

13,829,178

|

|

|

Juniper Networks, Inc.

1

|

|

|

1,007,490

|

|

|

|

17,238,154

|

|

|

QUALCOMM, Inc.

|

|

|

458,230

|

|

|

|

28,634,793

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59,702,125

|

|

|

Computers & Peripherals–5.4%

|

|

|

|

|

|

|

|

|

|

Apple, Inc.

|

|

|

111,400

|

|

|

|

74,332,764

|

|

|

SanDisk Corp.

1

|

|

|

83,650

|

|

|

|

3,632,920

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

77,965,684

|

|

|

Electronic Equipment, Instruments & Components–1.0%

|

|

|

|

|

|

|

|

|

|

Corning, Inc.

|

|

|

541,080

|

|

|

|

7,115,202

|

|

|

TE Connectivity Ltd.

|

|

|

206,480

|

|

|

|

7,022,385

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,137,587

|

|

|

Internet Software & Services–2.6%

|

|

|

|

|

|

|

|

|

|

eBay, Inc.

1

|

|

|

250,740

|

|

|

|

12,138,323

|

|

|

Google, Inc., Cl. A

1

|

|

|

32,720

|

|

|

|

24,687,240

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36,825,563

|

|

|

IT Services–2.0%

|

|

|

|

|

|

|

|

|

|

Fiserv, Inc.

1

|

|

|

55,380

|

|

|

|

4,099,781

|

|

|

International Business Machines Corp.

|

|

|

18,950

|

|

|

|

3,931,178

|

|

|

Teradata Corp.

1

|

|

|

139,680

|

|

|

|

10,533,269

|

|

|

Visa, Inc., Cl. A

|

|

|

71,170

|

|

|

|

9,556,708

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,120,936

|

|

|

Semiconductors & Semiconductor Equipment–2.4%

|

|

|

|

|

|

|

|

|

|

Analog Devices, Inc.

|

|

|

188,110

|

|

|

|

7,372,031

|

|

|

|

|

|

|

|

|

4

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Avago Technologies Ltd.

|

|

|

122,480

|

|

|

$

|

4,270,265

|

|

|

Broadcom Corp., Cl. A

|

|

|

253,824

|

|

|

|

8,777,234

|

|

|

Texas Instruments, Inc.

|

|

|

199,450

|

|

|

|

5,494,848

|

|

|

Xilinx, Inc.

|

|

|

253,400

|

|

|

|

8,466,094

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,380,472

|

|

|

Software–1.7%

|

|

|

|

|

|

|

|

|

|

Intuit, Inc.

|

|

|

138,180

|

|

|

|

8,136,038

|

|

|

Salesforce.com, Inc.

1

|

|

|

57,230

|

|

|

|

8,738,449

|

|

|

VMware, Inc., Cl. A

1

|

|

|

76,500

|

|

|

|

7,400,610

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,275,097

|

|

|

Materials–4.6%

|

|

|

|

|

|

|

|

|

|

Chemicals–3.7%

|

|

|

|

|

|

|

|

|

|

Celanese Corp., Series A

|

|

|

91,164

|

|

|

|

3,456,027

|

|

|

Ecolab, Inc.

|

|

|

135,440

|

|

|

|

8,777,866

|

|

|

Monsanto Co.

|

|

|

124,290

|

|

|

|

11,312,876

|

|

|

Mosaic Co. (The)

|

|

|

255,800

|

|

|

|

14,736,638

|

|

|

PPG Industries, Inc.

|

|

|

60,690

|

|

|

|

6,969,640

|

|

|

Praxair, Inc.

|

|

|

69,090

|

|

|

|

7,177,069

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52,430,116

|

|

|

Containers & Packaging–0.9%

|

|

|

|

|

|

|

|

|

|

Rock-Tenn Co., Cl. A

|

|

|

180,140

|

|

|

|

13,002,505

|

|

|

Telecommunication Services–1.9%

|

|

|

|

|

|

|

|

|

|

Diversified Telecommunication Services–1.9%

|

|

|

|

|

|

|

|

|

|

AT&T, Inc.

|

|

|

285,008

|

|

|

|

10,744,802

|

|

|

Verizon Communications, Inc.

|

|

|

354,250

|

|

|

|

16,143,173

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26,887,975

|

|

|

Utilities–1.8%

|

|

|

|

|

|

|

|

|

|

Electric Utilities–1.1%

|

|

|

|

|

|

|

|

|

|

American Electric Power Co., Inc.

|

|

|

206,410

|

|

|

|

9,069,655

|

|

|

Edison International

|

|

|

156,240

|

|

|

|

7,138,606

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,208,261

|

|

|

Multi-Utilities–0.7%

|

|

|

|

|

|

|

|

|

|

NiSource, Inc.

|

|

|

156,200

|

|

|

|

3,979,976

|

|

|

Public Service Enterprise Group, Inc.

|

|

|

189,530

|

|

|

|

6,099,067

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,079,043

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks (Cost $1,072,695,818)

|

|

|

|

|

|

|

1,396,055,366

|

|

|

Investment Company–2.4%

|

|

|

|

|

|

|

|

|

|

Oppenheimer Institutional Money Market Fund, Cl. E, 0.18%

2

,3

(Cost $33,494,459)

|

|

|

33,494,459

|

|

|

|

33,494,459

|

|

|

|

|

|

|

|

|

5

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

Total Investments, at Value (Cost $1,106,190,277)

|

|

|

100.2

|

%

|

|

$

|

1,429,549,825

|

|

|

Liabilities in Excess of Other Assets

|

|

|

(0.2

|

)

|

|

|

(2,545,205

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets

|

|

|

100.0

|

%

|

|

$

|

1,427,004,620

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes to Statement of Investments

|

*

|

September 28, 2012 represents the last business day of the Fund’s quarterly period. See accompanying Notes.

|

|

1.

|

Non-income producing security.

|

|

2.

|

Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended September 28, 2012, by virtue of the Fund owning at least

5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

December 30, 2011

a

|

|

|

Gross

Additions

|

|

|

Gross

Reductions

|

|

|

Shares

September 28, 2012

|

|

|

Oppenheimer Institutional Money Market Fund, Cl. E

|

|

|

40,412,584

|

|

|

|

292,287,913

|

|

|

|

299,206,038

|

|

|

|

33,494,459

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value

|

|

|

Income

|

|

|

Oppenheimer Institutional Money Market Fund, Cl. E

|

|

|

|

|

|

|

|

|

|

$

|

33,494,459

|

|

|

$

|

48,816

|

|

|

a.

|

December 30, 2011 represents the last business day of the Fund’s 2011 fiscal year. See accompanying Notes.

|

|

3.

|

Rate shown is the 7-day yield as of September 28, 2012.

|

|

|

|

|

|

|

|

6

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

Notes to Statement of Investments

Quarterly and Annual Periods.

The last day of the Fund’s quarterly period was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been

presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

The

last day of the Fund’s fiscal year was the last day the New York Stock Exchange was open for trading. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value

calculations used for shareholder transactions.

Investment in Oppenheimer Institutional Money Market Fund.

The Fund is permitted to

invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity.

IMMF is a registered open-end management investment company, regulated as a money market fund under the Investment Company Act of 1940, as amended. The Manager is also the investment adviser of IMMF. When applicable, the Fund’s investment in

IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The

Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Foreign Currency Translation.

The Fund’s accounting records are maintained in U.S. dollars. The values of securities denominated in foreign currencies and amounts related to the purchase and

sale of foreign securities and foreign investment income are translated into U.S. dollars as of the close of the Exchange, normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading. Foreign exchange rates may be valued primarily

using a reliable bank, dealer or service authorized by the Board of Directors.

Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M.

Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s

securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for

any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled

meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

|

|

|

|

|

|

|

7

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by

third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of

securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than

futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued

at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer

traded on a foreign exchange but not listed on a registered U.S. securities exchange is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the

Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or

official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not

available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority); (1) using a bid from the exchange, (2) the mean between the bid and asked price as

provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an

exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign

issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing

evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which

approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing

services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in

determining their evaluated prices is provided below.

|

|

|

|

|

|

|

8

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

Security Type

|

|

Standard inputs generally considered by third-party pricing

vendors

|

|

Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities

|

|

Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate

factors.

|

|

|

|

|

Loans

|

|

Information obtained from market participants regarding reported trade data and broker-dealer price quotations.

|

|

|

|

|

Event-linked bonds

|

|

Information obtained from market participants regarding reported trade data and broker-dealer price quotations.

|

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the

“good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the

security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in

good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a

security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair

valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate

securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted

quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be

assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing

appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and

challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation

determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such

|

|

|

|

|

|

|

9

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset

or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting

period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

|

1)

|

Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

|

|

2)

|

Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market

corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

|

|

3)

|

Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or

liability).

|

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in

those securities.

The table below categorizes amounts as of September 28, 2012 based on valuation input level:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1—

Unadjusted

Quoted Prices

|

|

|

Level 2—

Other

Significant

Observable

Inputs

|

|

|

Level 3—

Significant

Unobservable

Inputs

|

|

|

Value

|

|

|

Assets Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at Value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Discretionary

|

|

$

|

180,211,832

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

180,211,832

|

|

|

Consumer Staples

|

|

|

162,847,172

|

|

|

|

—

|

|

|

|

—

|

|

|

|

162,847,172

|

|

|

Energy

|

|

|

146,638,536

|

|

|

|

—

|

|

|

|

—

|

|

|

|

146,638,536

|

|

|

Financials

|

|

|

155,393,968

|

|

|

|

—

|

|

|

|

—

|

|

|

|

155,393,968

|

|

|

Health Care

|

|

|

199,040,071

|

|

|

|

—

|

|

|

|

—

|

|

|

|

199,040,071

|

|

|

Industrials

|

|

|

157,908,423

|

|

|

|

—

|

|

|

|

—

|

|

|

|

157,908,423

|

|

|

Information Technology

|

|

|

275,407,464

|

|

|

|

—

|

|

|

|

—

|

|

|

|

275,407,464

|

|

|

Materials

|

|

|

65,432,621

|

|

|

|

—

|

|

|

|

—

|

|

|

|

65,432,621

|

|

|

Telecommunication Services

|

|

|

26,887,975

|

|

|

|

—

|

|

|

|

—

|

|

|

|

26,887,975

|

|

|

Utilities

|

|

|

26,287,304

|

|

|

|

—

|

|

|

|

—

|

|

|

|

26,287,304

|

|

|

Investment Company

|

|

|

33,494,459

|

|

|

|

—

|

|

|

|

—

|

|

|

|

33,494,459

|

|

|

|

|

|

|

|

|

10

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1—

Unadjusted

Quoted Prices

|

|

|

Level 2—

Other

Significant

Observable

Inputs

|

|

|

Level 3—

Significant

Unobservable

Inputs

|

|

|

Value

|

|

|

Total Assets

|

|

$

|

1,429,549,825

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,429,549,825

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency contracts and forwards, if any, are reported at their unrealized appreciation/depreciation at measurement date,

which represents the change in the contract’s value from trade date. Futures, if any, are reported at their variation margin at measurement date, which represents the amount due to/from the Fund at that date. All additional assets and

liabilities included in the above table are reported at their market value at measurement date.

The table below shows the transfers between

Level 1 and Level 2. The Fund’s policy is to recognize transfers in and transfers out as of the beginning of the reporting period.

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfers

into Level

1*

|

|

|

Transfers out

of Level 2*

|

|

|

Assets Table

|

|

|

|

|

|

|

|

|

|

Investments, at Value:

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

|

|

|

|

|

|

|

|

Consumer Staples

|

|

$

|

9,546,859

|

|

|

$

|

(9,546,859

|

)

|

|

Financials

|

|

|

4,128,842

|

|

|

|

(4,128,842

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

13,675,701

|

|

|

$

|

(13,675,701

|

)

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Transferred from Level 2 to Level 1 due to the presence of a readily available unadjusted quoted market price.

|

There have been no significant changes to the fair valuation methodologies of the Fund during the period.

Risk Exposures and the Use of Derivative Instruments

The Fund’s investment objectives not only permit the Fund to purchase investment securities, they also allow the Fund to enter into various types of derivatives contracts, including, but not limited

to, futures contracts, forward foreign currency exchange contracts, credit default swaps, interest rate swaps, total return swaps, and purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit it

to increase, decrease, or change the level or types of exposure to market risk factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity and debt securities: they require

little or no initial cash investment, they can focus exposure on only certain selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Fund to

pursue its objectives more quickly and efficiently than if it were to make direct purchases or sales of securities capable of effecting a similar response to market factors.

|

|

|

|

|

|

|

11

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

Market Risk Factors.

In accordance with its investment objectives, the Fund may use derivatives

to increase or decrease its exposure to one or more of the following market risk factors:

Commodity Risk.

Commodity

risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude

oil, heating oil, metals, livestock, and agricultural products.

Credit Risk.

Credit risk relates to the ability of the

issuer to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield bonds are subject to credit risk to a greater extent than lower-yield, higher-quality bonds.

Equity Risk.

Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the

general market.

Foreign Exchange Rate Risk.

Foreign exchange rate risk relates to the change in the U.S. dollar value

of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar

depreciates against the currency.

Interest Rate Risk.

Interest rate risk refers to the fluctuations in value of

fixed-income securities resulting from the inverse relationship between price and yield. For example, an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline in general

interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with

shorter maturities.

Volatility Risk.

Volatility risk refers to the magnitude of the movement, but not the direction of

the movement, in a financial instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative time period typically indicate greater volatility risk, while small increases or

decreases in its price typically indicate lower volatility risk.

The Fund’s actual exposures to these market risk factors during the

period are discussed in further detail, by derivative type, below.

Risks of Investing in Derivatives.

The Fund’s use of

derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Fund is using derivatives to decrease, or hedge, exposures to market risk factors for securities held by the

Fund, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions.

Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses

in excess of their cost. This use of embedded leverage allows the Fund to increase

|

|

|

|

|

|

|

12

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Fund. Typically, the associated risks are not

the risks that the Fund is attempting to increase or decrease exposure to, per its investment objectives, but are the additional risks from investing in derivatives. Examples of these associated risks are liquidity risk, which is the risk that the

Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund. Associated risks can be different for each type of

derivative and are discussed by each derivative type in the notes that follow.

Counterparty Credit Risk.

Certain

derivative positions are subject to counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund. The Fund’s derivative counterparties are financial institutions who are subject to market

conditions that may weaken their financial position. The Fund intends to enter into financial transactions with counterparties that the Manager believes to be creditworthy at the time of the transaction.

Credit Related Contingent Features.

The Fund’s agreements with derivative counterparties have several credit related

contingent features that if triggered would allow its derivatives counterparties to close out and demand payment or additional collateral to cover their exposure from the Fund. Credit related contingent features are established

between the Fund and its derivatives counterparties to reduce the risk that the Fund will not fulfill its payment obligations to its counterparties. These triggering features include, but are not limited to, a percentage decrease in the Fund’s

net assets and or a percentage decrease in the Fund’s Net Asset Value or NAV. The contingent features are established within the Fund’s International Swap and Derivatives Association, Inc. master agreements which govern certain

positions in swaps, over-the-counter options and swaptions, and forward currency exchange contracts for each individual counterparty.

Foreign Currency Exchange Contracts

The

Fund may enter into foreign currency exchange contracts (“forward contracts”) for the purchase or sale of a foreign currency at a negotiated rate at a future date.

Forward contracts are reported on a schedule following the Statement of Investments. The unrealized appreciation (depreciation) is reported in the Statement of Assets and Liabilities in the annual and

semiannual reports as a receivable or payable and in the Statement of Operations in the annual and semiannual reports within the change in unrealized appreciation (depreciation).

|

|

|

|

|

|

|

13

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

At contract close, the difference between the original cost of the contract and the value at the close

date is recorded as a realized gain (loss) in the Statement of Operations in the annual and semiannual reports.

The Fund has purchased and

sold certain forward foreign currency exchange contracts of different currencies in order to acquire currencies to pay for or sell currencies to acquire related foreign securities purchase and sale transactions, respectively, or to convert foreign

currencies to U.S. dollars from related foreign securities transactions. These foreign currency exchange contracts are negotiated at the current spot exchange rate with settlement typically within two business days thereafter.

During the period ended September 28, 2012, the Fund had daily average contract amounts on forward foreign currency contracts to buy and sell of

$28,322 and $404,014, respectively.

Additional associated risk to the Fund includes counterparty credit risk. Counterparty credit risk arises

from the possibility that the counterparty will default.

As of September 28, 2012, the Fund had no outstanding forward contracts.

Option Activity

The Fund

may buy and sell put and call options, or write put and call options. When an option is written, the Fund receives a premium and becomes obligated to sell or purchase the underlying security at a fixed price, upon exercise of the option.

Options are valued daily based upon the last sale price on the principal exchange on which the option is traded. The difference between the premium

received or paid, and market value of the option, is recorded as unrealized appreciation or depreciation. The net change in unrealized appreciation or depreciation is reported in the Statement of Operations in the annual and semiannual reports. When

an option is exercised, the cost of the security purchased or the proceeds of the security sale are adjusted by the amount of premium received or paid. Upon the expiration or closing of the option transaction, a gain or loss is reported in the

Statement of Operations in the annual and semiannual reports.

The Fund has purchased put options on individual equity securities and/or

equity indexes to decrease exposure to equity risk. A purchased put option becomes more valuable as the price of the underlying financial instrument depreciates relative to the strike price.

The Fund has purchased call options on volatility indexes to increase exposure to volatility risk. A purchased call option becomes more valuable as the level of the underlying volatility index

increases relative to the strike price.

|

|

|

|

|

|

|

14

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Oppenheimer Equity Fund, Inc.

STATEMENT OF INVESTMENTS September 28, 2012* (Unaudited)

During the period ended September 28, 2012, the Fund had an ending monthly average market value of

$87,590 and $12,242 on purchased call options and purchased put options, respectively.

Options written, if any, are reported in a schedule

following the Statement of Investments and as a liability in the Statement of Assets and Liabilities in the annual and semiannual reports. Securities held in collateralized accounts to cover potential obligations with respect to outstanding written

options are noted in the Statement of Investments.

The risk in writing a call option is that the Fund gives up the opportunity for profit if

the market price of the security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is

that the Fund pays a premium whether or not the option is exercised. The Fund also has the additional risk that there may be an illiquid market where the Fund is unable to close the contract.

As of September 28, 2012, the Fund had no outstanding written or purchased options.

Federal Taxes.

The approximate aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation

of securities and other investments for federal income tax purposes as of September 28, 2012 are noted below. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is

attributable to the tax deferral of losses.

|

|

|

|

|

|

|

Federal tax cost of securities

|

|

$

|

1,125,139,973

|

|

|

|

|

|

|

|

|

Gross unrealized appreciation

|

|

$

|

325,525,443

|

|

|

Gross unrealized depreciation

|

|

|

(21,115,591

|

)

|

|

|

|

|

|

|

|

Net unrealized appreciation

|

|

$

|

304,409,852

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15

|

|

|

|

Oppenheimer Equity Fund, Inc.

|

Item 2. Controls and Procedures.

|

|

(a)

|

Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940 (17 CFR

270.30a-3(c)) as of 9/28/2012, the registrant’s principal executive officer and principal financial officer found the registrant’s disclosure controls and procedures to provide reasonable assurances that information required to be

disclosed by the registrant in the reports that it files under the Securities Exchange Act of 1934 (a) is accumulated and communicated to the registrant’s management, including its principal executive officer and principal financial

officer, to allow timely decisions regarding required disclosure, and (b) is recorded, processed, summarized and reported, within the time periods specified in the rules and forms adopted by the U.S. Securities and Exchange Commission.

|

|

|

(b)

|

There have been no significant changes in the registrant’s internal controls over financial reporting that occurred during the registrant’s last fiscal

quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

|

Item 3. Exhibits.

Exhibits attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Oppenheimer Equity Fund, Inc.

|

|

|

|

|

By:

|

|

/s/ William F. Glavin, Jr.

|

|

|

|

William F. Glavin, Jr.

|

|

|

|

Principal Executive Officer

|

|

|

|

|

Date:

|

|

11/12/2012

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report

has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By:

|

|

/s/ William F. Glavin, Jr.

|

|

|

|

William F. Glavin, Jr.

|

|

|

|

Principal Executive Officer

|

|

|

|

|

Date:

|

|

11/12/2012

|

|

|

|

|

|

By:

|

|

/s/ Brian W. Wixted

|

|

|

|

Brian W. Wixted

|

|

|

|

Principal Financial Officer

|

|

|

|

|

Date:

|

|

11/12/2012

|

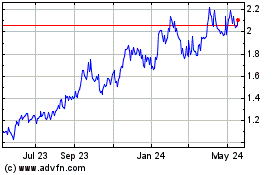

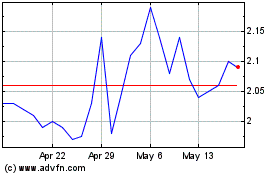

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Jul 2023 to Jul 2024