BHP's Disappointing Half-Year - Analyst Blog

February 21 2013 - 6:50AM

Zacks

Australia based diversified

minerals company, BHP Billiton Ltd. (BHP) reported

its financial results for the first half of fiscal 2013, ended Dec

31, 2012. Earnings per share stood at 79 cents, down 58.0% from

$1.88 in the year-ago period. Lower selling prices and cost

inflation hurt earnings in the quarter.

Revenue

Revenues for the reported period

dropped 14.1% year over year to $32.2 billion from $37.5 billion as

a result of challenging global industry as well as lower prices of

commodities. Underlying EBIT was recorded at $9.8 billion, down

38.3% year over year, as a result of lower commodity prices and

inflation.

Balance Sheet

Cash and cash equivalents, at the

end of the period, were recorded at $5.1 billion, up from $4.8

billion in the preceding half year. Net debt, comprising interest

bearing liabilities less cash, was $30.4 billion, up from $23.6

billion as of June 30, 2012.

Cash Flow

Net operating cash flows decreased

47.9% to $6.4 billion from $12.3 billion in the corresponding

period last year. Capital and exploration expenditure totaled $12.2

billion for the half year ended Dec 31, 2012. Expenditure on major

growth projects came in at $9.7 billion, which includes $3.4

billion on Petroleum projects and $6.3 billion on Minerals

projects.

BHP Billiton announced an interim

dividend of 57 cents to be paid on Mar 28, 2013, to shareholders on

record on Mar 8, 2013. Moreover, in line with the company’s

strategy to trim its portfolio, BHP divested around $4.3 billion

assets in the reported half year, which are either complete or

awaiting closures.

Outlook

As on the closure of half year

2013, BHP had roughly 20 projects in progress, which are expected

to yield revenue by 2015. BHP expects the economy to start reviving

in the coming quarters; thereby boosting demand and prices.

However, low cost supply by other players in many markets is more

likely to hamper the rise in prices.

BHP currently holds a Zacks Rank #3

(Hold). Other stocks worth a look at in the industry are

Denison Mines Corp. (DNN), Xstrata

Plc. (XSRAY) and Aluminum Corporation Of

China (ACH); each carrying a Zacks Rank #2 (Buy).

ALUMINUM CP-ADR (ACH): Free Stock Analysis Report

BHP BILLITN LTD (BHP): Free Stock Analysis Report

DENISON MINES (DNN): Free Stock Analysis Report

(XSRAY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

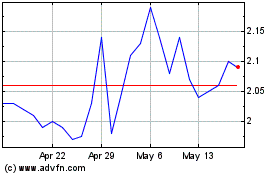

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Jun 2024 to Jul 2024

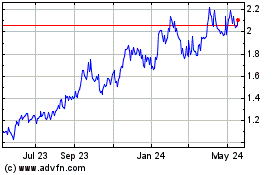

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Jul 2023 to Jul 2024