0000701719false--12-31Q220230.01500000000000.016000000026924631P5YP5YP10YP5YP5Y00007017192023-01-012023-06-300000701719ela:ECHGMember2021-10-012021-10-290000701719ela:ECHGMember2021-10-290000701719ela:GatewayHoldingsMember2020-11-012020-11-040000701719ela:GaylordHoldingsMember2021-07-012021-07-300000701719ela:NWHHoldingsLLCMember2020-09-012020-09-140000701719ela:DGSEMember2020-07-012020-07-090000701719ela:GatewayHoldingsMember2020-11-040000701719ela:GaylordHoldingsMember2021-07-300000701719ela:NWHHoldingsLLCMember2020-09-140000701719ela:DGSEMember2020-07-090000701719ela:LoanMaturitiesMember2023-06-300000701719ela:SchedulePrincipalPaymentMember2023-06-300000701719ela:NotePayableAvailTransactionMember2023-06-300000701719ela:EnvelaMember2023-06-300000701719ela:TexasBankAndTrustMember2023-06-300000701719ela:NotePayableTexasBankAndTrustMemberela:ConsumerSegmentMember2023-06-300000701719ela:NotePayableTruistBankMemberela:ConsumerSegmentMember2023-06-300000701719ela:AvailTransactionNoteMember2023-01-012023-06-300000701719ela:RevolvingLineOfCreditMember2023-01-012023-06-300000701719ela:NotePayableTexasBankAndTrustOneMemberela:ConsumerMember2023-01-012023-06-300000701719ela:NotePayableTexasBankAndTrustMemberela:ConsumerMember2023-01-012023-06-300000701719ela:NotePayableTruistBankMemberela:ConsumerMember2023-01-012023-06-300000701719ela:NotePayableTexasBankTrustMemberus-gaap:CorporateMember2023-01-012023-06-300000701719ela:NotePayableFarmersBankMemberela:CommercialMember2023-01-012023-06-300000701719ela:NotePayableFarmersBankMemberela:ConsumerMember2023-01-012023-06-300000701719ela:AvailTransactionNoteMember2022-12-310000701719ela:AvailTransactionNoteMember2023-06-300000701719ela:NotePayableTexasBankAndTrustOneMemberela:ConsumerMember2022-12-310000701719ela:NotePayableTexasBankAndTrustOneMemberela:ConsumerMember2023-06-300000701719ela:RevolvingLineOfCreditMember2022-12-310000701719ela:RevolvingLineOfCreditMember2023-06-300000701719ela:NotePayableTexasBankAndTrustMemberela:ConsumerMember2022-12-310000701719ela:NotePayableTexasBankAndTrustMemberela:ConsumerMember2023-06-300000701719ela:NotePayableTruistBankMemberela:ConsumerMember2022-12-310000701719ela:NotePayableTruistBankMemberela:ConsumerMember2023-06-300000701719ela:NotePayableTexasBankTrustMemberus-gaap:CorporateMember2022-12-310000701719ela:NotePayableFarmersBankMemberela:CommercialMember2022-12-310000701719ela:NotePayableFarmersBankMemberela:ConsumerMember2022-12-310000701719us-gaap:CorporateMemberela:CurrentPortionMember2022-12-310000701719ela:NotePayableTexasBankTrustMemberus-gaap:CorporateMember2023-06-300000701719us-gaap:CorporateMemberela:CurrentPortionMember2023-06-300000701719ela:NotePayableFarmersBankMemberela:CommercialMember2023-06-300000701719ela:CorporateNetMember2022-12-310000701719ela:CorporateNetMember2023-06-300000701719ela:NotePayableFarmersBankMemberela:ConsumerMember2023-06-300000701719ela:BoardofDirectorsMember2023-03-140000701719ela:MayFirstToMayThirtyFirstTwentyTwentyThreeMember2023-01-012023-06-300000701719ela:AprilFirstToAprilThirtyTwentyTwentyThreeMember2023-01-012023-06-300000701719ela:JuneFirstToJuneThirtyTwentyTwentyThreeMember2023-01-012023-06-300000701719ela:CommercialMemberela:RecycledMember2022-04-012022-06-300000701719ela:CommercialMemberela:RecycledMember2022-01-012022-06-300000701719ela:CommercialMemberela:RecycledMember2023-04-012023-06-300000701719ela:CommercialMemberela:RecycledMember2023-01-012023-06-300000701719ela:CommercialMemberela:ResaleMember2022-04-012022-06-300000701719ela:CommercialMemberela:ResaleMember2022-01-012022-06-300000701719ela:CommercialMemberela:ResaleMember2023-04-012023-06-300000701719ela:CommercialMemberela:ResaleMember2023-01-012023-06-300000701719ela:ConsumerMemberela:RecycleMember2022-04-012022-06-300000701719ela:ConsumerMemberela:RecycleMember2022-01-012022-06-300000701719ela:ConsumerMemberela:RecycleMember2023-04-012023-06-300000701719ela:ConsumerMemberela:RecycleMember2023-01-012023-06-300000701719ela:ComsumerMemberela:ResaleMember2022-04-012022-06-300000701719ela:ComsumerMemberela:ResaleMember2022-01-012022-06-300000701719ela:ComsumerMemberela:ResaleMember2023-04-012023-06-300000701719ela:ComsumerMemberela:ResaleMember2023-01-012023-06-300000701719ela:CommercialMember2022-04-012022-06-300000701719ela:ConsumerMember2022-04-012022-06-300000701719ela:CommercialMember2022-01-012022-06-300000701719ela:CommercialMember2023-04-012023-06-300000701719ela:CommercialMember2023-01-012023-06-300000701719ela:ConsumerMember2023-01-012023-06-300000701719ela:ConsumerMember2022-01-012022-06-300000701719ela:ConsumerMember2023-04-012023-06-300000701719ela:CustomerRelationshipsOneMemberela:CommercialMember2023-06-300000701719ela:CustomerRelationshipsOneMemberela:CommercialMember2022-12-310000701719ela:TrademarksTradenameOneMemberela:CommercialMember2023-06-300000701719ela:TrademarksTradenameOneMemberela:CommercialMember2022-12-310000701719us-gaap:CustomerRelationshipsMemberela:CommercialMember2022-12-310000701719us-gaap:CustomerRelationshipsMemberela:CommercialMember2023-06-300000701719ela:TrademarksTradenameMemberela:CommercialMember2022-12-310000701719ela:TrademarksTradenameMemberela:CommercialMember2023-06-300000701719us-gaap:CustomerContractsMemberela:CommercialMember2022-12-310000701719us-gaap:CustomerContractsMemberela:CommercialMember2023-06-300000701719us-gaap:TrademarksMemberela:CommercialMember2022-12-310000701719us-gaap:TrademarksMemberela:CommercialMember2023-06-300000701719ela:PointofSaleSystemMemberela:ConsumerMember2022-12-310000701719ela:PointofSaleSystemMemberela:ConsumerMember2023-06-300000701719us-gaap:InternetDomainNamesMemberela:ConsumerMember2022-12-310000701719us-gaap:InternetDomainNamesMemberela:ConsumerMember2023-06-300000701719ela:RetailBuildindMember2023-05-012023-05-040000701719us-gaap:MachineryAndEquipmentMemberus-gaap:CorporateMember2022-12-310000701719us-gaap:MachineryAndEquipmentMemberus-gaap:CorporateMember2023-06-300000701719us-gaap:BuildingImprovementsMemberus-gaap:CorporateMember2022-12-310000701719us-gaap:BuildingImprovementsMemberus-gaap:CorporateMember2023-06-300000701719us-gaap:LandMemberus-gaap:CorporateMember2022-12-310000701719us-gaap:LandMemberus-gaap:CorporateMember2023-06-300000701719us-gaap:FurnitureAndFixturesMemberela:CommercialMember2022-12-310000701719us-gaap:FurnitureAndFixturesMemberela:CommercialMember2023-06-300000701719us-gaap:MachineryAndEquipmentMemberela:CommercialMember2022-12-310000701719us-gaap:VehiclesMemberela:CommercialMember2022-12-310000701719us-gaap:VehiclesMemberela:CommercialMember2023-06-300000701719us-gaap:MachineryAndEquipmentMemberela:CommercialMember2023-06-300000701719us-gaap:BuildingImprovementsMemberela:CommercialMember2022-12-310000701719us-gaap:BuildingImprovementsMemberela:CommercialMember2023-06-300000701719us-gaap:VehiclesMemberela:ConsumerMember2022-12-310000701719us-gaap:VehiclesMemberela:ConsumerMember2023-06-300000701719us-gaap:FurnitureAndFixturesMemberela:ConsumerMember2022-12-310000701719us-gaap:FurnitureAndFixturesMemberela:ConsumerMember2023-06-300000701719us-gaap:MachineryAndEquipmentMemberela:ConsumerMember2022-12-310000701719us-gaap:MachineryAndEquipmentMemberela:ConsumerMember2023-06-300000701719us-gaap:LeaseholdImprovementsMemberela:ConsumerMember2022-12-310000701719us-gaap:LeaseholdImprovementsMemberela:ConsumerMember2023-06-300000701719us-gaap:BuildingImprovementsMemberela:ConsumerMember2022-12-310000701719us-gaap:BuildingImprovementsMemberela:ConsumerMember2023-06-300000701719us-gaap:LandMemberela:ConsumerMember2022-12-310000701719us-gaap:LandMemberela:ConsumerMember2023-06-300000701719us-gaap:CorporateMember2022-12-310000701719us-gaap:CorporateMember2023-06-300000701719ela:CommercialMember2022-12-310000701719ela:CommercialMember2023-06-300000701719ela:CommercialMemberela:RecyclesMember2022-12-310000701719ela:CommercialMemberela:RecyclesMember2023-06-300000701719ela:CommercialMemberela:ResaleMember2022-12-310000701719ela:CommercialMemberela:ResaleMember2023-06-300000701719ela:ConsumerMember2022-12-310000701719ela:ConsumerMember2023-06-300000701719ela:ConsumerMemberela:RecycleMember2022-12-310000701719ela:ConsumerMemberela:RecycleMember2023-06-300000701719ela:ComsumerMemberela:ResaleMember2022-12-310000701719ela:ComsumerMemberela:ResaleMember2023-06-3000007017192022-01-012022-12-3100007017192022-05-3100007017192022-05-012022-05-3100007017192021-06-012021-06-090000701719us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000701719us-gaap:RetainedEarningsMember2023-04-012023-06-300000701719us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000701719us-gaap:PreferredStockMember2023-04-012023-06-300000701719us-gaap:CommonStockMember2023-04-012023-06-3000007017192023-03-310000701719us-gaap:RetainedEarningsMember2023-03-310000701719us-gaap:AdditionalPaidInCapitalMember2023-03-310000701719us-gaap:TreasuryStockCommonMember2023-03-310000701719us-gaap:PreferredStockMember2023-03-310000701719us-gaap:CommonStockMember2023-03-310000701719us-gaap:RetainedEarningsMember2023-06-300000701719us-gaap:AdditionalPaidInCapitalMember2023-06-300000701719us-gaap:TreasuryStockCommonMember2023-06-300000701719us-gaap:PreferredStockMember2023-06-300000701719us-gaap:CommonStockMember2023-06-300000701719us-gaap:TreasuryStockCommonMember2023-01-012023-06-300000701719us-gaap:RetainedEarningsMember2023-01-012023-06-300000701719us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300000701719us-gaap:PreferredStockMember2023-01-012023-06-300000701719us-gaap:CommonStockMember2023-01-012023-06-300000701719us-gaap:RetainedEarningsMember2022-12-310000701719us-gaap:AdditionalPaidInCapitalMember2022-12-310000701719us-gaap:TreasuryStockCommonMember2022-12-310000701719us-gaap:PreferredStockMember2022-12-310000701719us-gaap:CommonStockMember2022-12-310000701719us-gaap:TreasuryStockCommonMember2022-04-012022-06-300000701719us-gaap:RetainedEarningsMember2022-04-012022-06-300000701719us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000701719us-gaap:PreferredStockMember2022-04-012022-06-300000701719us-gaap:CommonStockMember2022-04-012022-06-3000007017192022-03-310000701719us-gaap:RetainedEarningsMember2022-03-310000701719us-gaap:AdditionalPaidInCapitalMember2022-03-310000701719us-gaap:TreasuryStockCommonMember2022-03-310000701719us-gaap:PreferredStockMember2022-03-310000701719us-gaap:CommonStockMember2022-03-310000701719us-gaap:RetainedEarningsMember2022-06-300000701719us-gaap:AdditionalPaidInCapitalMember2022-06-300000701719us-gaap:TreasuryStockCommonMember2022-06-300000701719us-gaap:PreferredStockMember2022-06-300000701719us-gaap:CommonStockMember2022-06-300000701719us-gaap:TreasuryStockCommonMember2022-01-012022-06-300000701719us-gaap:RetainedEarningsMember2022-01-012022-06-300000701719us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300000701719us-gaap:PreferredStockMember2022-01-012022-06-300000701719us-gaap:CommonStockMember2022-01-012022-06-300000701719us-gaap:RetainedEarningsMember2021-12-310000701719us-gaap:AdditionalPaidInCapitalMember2021-12-310000701719us-gaap:TreasuryStockCommonMember2021-12-310000701719us-gaap:PreferredStockMember2021-12-310000701719us-gaap:CommonStockMember2021-12-3100007017192022-06-3000007017192021-12-3100007017192022-12-3100007017192023-06-3000007017192022-01-012022-06-3000007017192022-04-012022-06-3000007017192023-04-012023-06-3000007017192023-08-02iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the quarterly period ended June 30, 2023 |

| |

OR |

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the Transition Period From _____________ to _____________ |

Commission File Number 001-11048

ENVELA CORPORATION |

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) |

Nevada | | 88-0097334 |

(STATE OF INCORPORATION) | | (I.R.S. EMPLOYER IDENTIFICATION NO.) |

1901 GATEWAY DRIVE, STE 100, IRVING, TX 75038

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(972) 587-4049

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

www.envela.com

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of exchange on which registered |

COMMON STOCK, par value $0.01 per share | | ELA | | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 2, 2023, the registrant had 26,897,210 shares of common stock outstanding.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

ENVELA CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

(Unaudited) | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Revenue: | | | | | | | | | | | | |

Sales | | $ | 50,303,527 | | | $ | 42,639,718 | | | $ | 98,692,567 | | | $ | 90,054,816 | |

Cost of goods sold | | | 39,541,480 | | | | 31,161,718 | | | | 76,520,618 | | | | 68,865,782 | |

| | | | | | | | | | | | | | | | |

Gross margin | | | 10,762,047 | | | | 11,478,000 | | | | 22,171,949 | | | | 21,189,034 | |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Selling, General & Administrative Expenses | | | 8,362,554 | | | | 7,200,733 | | | | 16,267,857 | | | | 13,845,704 | |

Depreciation and Amortization | | | 336,174 | | | | 279,516 | | | | 690,525 | | | | 571,463 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 8,698,728 | | | | 7,480,249 | | | | 16,958,382 | | | | 14,417,167 | |

| | | | | | | | | | | | | | | | |

Operating income | | | 2,063,319 | | | | 3,997,751 | | | | 5,213,567 | | | | 6,771,867 | |

Other income | | | 153,652 | | | | 21,401 | | | | 364,431 | | | | 48,041 | |

Interest expense | | | 114,688 | | | | 121,042 | | | | 231,752 | | | | 244,281 | |

| | | | | | | | | | | | | | | | |

Income before income taxes | | | 2,102,283 | | | | 3,898,110 | | | | 5,346,246 | | | | 6,575,627 | |

Income tax expense | | | 498,574 | | | | 50,252 | | | | 1,216,220 | | | | 80,544 | |

| | | | | | | | | | | | | | | | |

Net income | | $ | 1,603,709 | | | $ | 3,847,858 | | | $ | 4,130,026 | | | $ | 6,495,083 | |

| | | | | | | | | | | | | | | | |

Basic earnings per share: | | | | | | | | | | | | | | | | |

Net income | | $ | 0.06 | | | $ | 0.14 | | | $ | 0.15 | | | $ | 0.24 | |

| | | | | | | | | | | | | | | | |

Diluted earnings per share: | | | | | | | | | | | | | | | | |

Net income | | $ | 0.06 | | | $ | 0.14 | | | $ | 0.15 | | | $ | 0.24 | |

| | | | | | | | | | | | | | | | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 26,916,648 | | | | 26,924,631 | | | | 26,920,618 | | | | 26,924,631 | |

Diluted | | | 26,931,648 | | | | 26,939,631 | | | | 26,935,618 | | | | 26,939,631 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ENVELA CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Assets | | (unaudited) | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 18,380,776 | | | $ | 17,169,969 | |

Trade receivables, net of allowances | | | 7,854,632 | | | | 7,949,775 | |

Notes receivable, net of allowances | | | - | | | | 578,250 | |

Inventories | | | 21,518,309 | | | | 18,755,785 | |

Prepaid expenses | | | 1,155,980 | | | | 1,231,817 | |

Other current assets | | | 125,217 | | | | 35,113 | |

| | | | | | | | |

Total current assets | | | 49,034,914 | | | | 45,720,709 | |

Property and equipment, net | | | 10,354,448 | | | | 9,393,802 | |

Right-of-use assets from operating leases | | | 5,039,806 | | | | 5,872,681 | |

Goodwill | | | 3,621,453 | | | | 3,621,453 | |

Intangible assets, net | | | 4,643,246 | | | | 4,993,545 | |

Deferred tax asset | | | 612,832 | | | | 1,488,258 | |

Other assets | | | 299,445 | | | | 186,761 | |

| | | | | | | | |

Total assets | | $ | 73,606,144 | | | $ | 71,277,209 | |

| | | | | | | | |

Liabilities and stockholders’ equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable-trade | | $ | 3,262,092 | | | $ | 3,358,881 | |

Notes payable | | | 1,251,747 | | | | 1,250,702 | |

Operating lease liabilities | | | 1,744,419 | | | | 1,686,997 | |

Accrued expenses | | | 2,164,751 | | | | 2,286,594 | |

Customer deposits and other liabilities | | | 348,430 | | | | 282,482 | |

| | | | | | | | |

Total current liabilities | | | 8,771,439 | | | | 8,865,656 | |

Notes payable, less current portion | | | 14,105,417 | | | | 14,726,703 | |

Operating lease liabilities, less current portion | | | 3,477,632 | | | | 4,368,400 | |

| | | | | | | | |

Total liabilities | | | 26,354,488 | | | | 27,960,759 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | | |

| | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $0.01 par value; 5,000,000 shares authorized; no shares issued and outstanding | | | - | | | | - | |

Common stock, $0.01 par value; 60,000,000 shares authorized; 26,924,631 shares issued and | | | | | | | | |

26,897,210 shares outstanding as of June 30, 2023; 26,924,631 shares issued and outstanding as of | | | | | | | | |

December 31, 2022 | | | 269,246 | | | | 269,246 | |

Treasury stock at cost, 27,421 and 0 shares, as of June 30, 2023 and December 31, 2022, respectively | | | (194,820 | ) | | | - | |

Additional paid-in capital | | | 40,173,000 | | | | 40,173,000 | |

Retained earnings | | | 7,004,230 | | | | 2,874,204 | |

| | | | | | | | |

Total stockholders’ equity | | | 47,251,656 | | | | 43,316,450 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 73,606,144 | | | $ | 71,277,209 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ENVELA CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Six Months Ended June 30, | | 2023 | | | 2022 | |

| | (Unaudited) | | | (Unaudited) | |

Operations | | | | | | |

Net income | | $ | 4,130,026 | | | $ | 6,495,083 | |

Adjustments to reconcile net income to net cash provided by operations: | | | | | | | | |

Depreciation, amortization, and other | | | 690,525 | | | | 571,463 | |

Bad debt expense | | | 173,196 | | | | 25,000 | |

Deferred taxes | | | 875,426 | | | | - | |

Changes in operating assets and liabilities: | | | | | | | | |

Trade receivables | | | (78,053 | ) | | | 1,452,651 | |

Inventories | | | (2,762,524 | ) | | | (3,755,662 | ) |

Prepaid expenses | | | 75,838 | | | | (981,616 | ) |

Other assets | | | (202,788 | ) | | | 754,759 | |

Accounts payable and accrued expenses | | | (218,632 | ) | | | 767,122 | |

Operating leases | | | (472 | ) | | | 14,478 | |

Customer deposits and other liabilities | | | 65,948 | | | | 1,019,363 | |

| | | | | | | | |

Net cash provided by operations | | | 2,748,490 | | | | 6,362,641 | |

| | | | | | | | |

Investing | | | | | | | | |

Investment in note receivable | | | 578,250 | | | | - | |

Purchase of property and equipment | | | (1,300,871 | ) | | | (203,929 | ) |

Adjustment to the purchase price of the Avail Transaction | | | - | | | | (216,988 | ) |

| | | | | | | | |

Net cash used in investing | | | (722,621 | ) | | | (420,917 | ) |

| | | | | | | | |

Financing | | | | | | | | |

Payments on notes payable | | | (620,242 | ) | | | (444,396 | ) |

Purchase of treasury stock | | | (194,820 | ) | | | - | |

Payments on line of credit | | | - | | | | (1,700,000 | ) |

| | | | | | | | |

Net cash used in financing | | | (815,062 | ) | | | (2,144,396 | ) |

| | | | | | | | |

Net change in cash and cash equivalents | | | 1,210,807 | | | | 3,797,328 | |

Cash and cash equivalents, beginning of period | | | 17,169,969 | | | | 10,138,148 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 18,380,776 | | | $ | 13,935,476 | |

| | | | | | | | |

Supplemental Disclosures | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 233,495 | | | $ | 252,431 | |

Income taxes | | $ | 162,000 | | | $ | 98,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ENVELA CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Three Months ended June 30, 2022 and 2023

(Unaudited)

| | Common Stock | | | Treasury Stock | | | Preferred Stock | | | Additional Paid-in | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at April 1, 2022 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | (10,167,704 | ) | | $ | 30,274,542 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 3,847,858 | | | | 3,847,858 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at June 30, 2022 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | (6,319,846 | ) | | $ | 34,122,400 | |

| | Common Stock | | | Treasury Stock | | | Preferred Stock | | | Additional Paid-in | | | Retained | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at April 1, 2023 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | 5,400,521 | | | $ | 45,842,767 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,603,709 | | | | 1,603,709 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares repurchased | | | - | | | | - | | | | (27,421 | ) | | $ | (194,820 | ) | | | - | | | | - | | | | - | | | | - | | | | (194,820 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at June 30, 2023 | | | 26,924,631 | | | $ | 269,246 | | | | (27,421 | ) | | $ | (194,820 | ) | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | 7,004,230 | | | $ | 47,251,656 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ENVELA CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Six Months ended June 30, 2022 and 2023

(Unaudited)

| | Common Stock | | | Treasury Stock | | | Preferred Stock | | | Additional Paid-in | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at January 1, 2022 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | (12,814,929 | ) | | $ | 27,627,317 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 6,495,083 | | | | 6,495,083 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at June 30, 2022 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | (6,319,846 | ) | | $ | 34,122,400 | |

| | Common Stock | | | Treasury Stock | | | Preferred Stock | | | Additional Paid-in | | | Retained | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at January 1, 2023 | | | 26,924,631 | | | $ | 269,246 | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | 2,874,204 | | | $ | 43,316,450 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 4,130,026 | | | | 4,130,026 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares repurchased | | | - | | | | - | | | | (27,421 | ) | | $ | (194,820 | ) | | | - | | | | - | | | | - | | | | - | | | | (194,820 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at June 30, 2023 | | | 26,924,631 | | | $ | 269,246 | | | | (27,421 | ) | | $ | (194,820 | ) | | | - | | | $ | - | | | $ | 40,173,000 | | | $ | 7,004,230 | | | $ | 47,251,656 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 — BASIS OF PRESENTATION

These unaudited interim condensed consolidated financial statements of Envela Corporation, a Nevada corporation, and its subsidiaries (together with its subsidiaries, the “Company” or “Envela”), included herein have been prepared in accordance with accounting principles generally accepted in the U.S. for interim financial information and with the instructions to Quarterly Reports on Form 10-Q and Article 10 of Regulation S-X prescribed by the Securities and Exchange Commission (the “SEC”). Pursuant to the SEC’s rules and regulations, they do not include all of the information and notes required by accounting principles generally accepted in the U.S. (“U.S. GAAP”) for complete financial statements. In the opinion of management, all adjustments, which are of a normal and recurring nature except those which have been disclosed elsewhere in this Quarterly Report on Form 10-Q (this “Form 10-Q”), necessary for a fair presentation of the consolidated financial statements for these interim periods, have been included. Operating results presented for these interim periods are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2023 (“fiscal 2023”). For further information, refer to the consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (“fiscal 2022”) of Envela filed with the SEC on March 16, 2023 (the “2022 Annual Report”).

Contemporaneously with filing our Quarterly Report Form 10-Q for the period ending March 31, 2023, we updated our two reportable segments by renaming the ECHG segment the “Commercial” segment and the DGSE segment the “Consumer” segment. The segment name changes did not result in any change to the composition of the Company’s operations and therefore did not result in any change to the historical results. Our operations conducted by each of our segments are more specifically described in the following notes to our condensed consolidated financial statements.

Starting January 1, 2023, expenses previously classified as other expenses related to the Company’s corporate campus overhead have been included in selling, general, and administrative expenses. Since the presentation of these expenses changed January 1, 2023, management believes the presentation of the 2022 corporate campus overhead should be reclassified to selling, general, and administrative expense for comparison purposes for the three and six months ended June 30, 2022.

The preparation of interim condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

NOTE 2 — PRINCIPLES OF CONSOLIDATION AND NATURE OF OPERATIONS

Envela and its subsidiaries engage in diverse business activities within the recommerce sector. These activities include being one of the nation’s premier authenticated recommerce retailers of luxury hard assets; providing end-of-life asset recycling and resale to businesses, organization and retail consumers; offering data destruction and IT asset management; and providing products, services and solutions to industrial and commercial companies. Envela operates primarily via two operating and reportable segments. Our consumer segment, formerly known as the DGSE segment, operates DGSE, LLC (“DGSE”), Dallas Gold & Silver Exchange, Charleston Gold & Diamond Exchange, and Bullion Express brands. Our commercial segment, formerly known as the ECHG segment, operates ECHG, LLC (“ECHG”), Echo Environmental Holdings, LLC (“Echo”), ITAD USA Holdings, LLC (“ITAD USA”), Teladvance, LLC (“Teladvance”), CEX Holdings, LLC (“CEX”) and Avail Recovery Solutions, LLC (“Avail”). Envela is a Nevada corporation, headquartered in Irving, Texas.

Our consumer segment primarily buys and resells or recycles luxury hard assets like jewelry, diamonds, gemstones, fine watches, rare coins and related collectibles, precious-metal bullion products, gold, silver and other precious-metals. We operate seven jewelry stores at both the retail and wholesale levels throughout the United States via its facilities in Texas, South Carolina and Arizona. The Company purchased a new retail building in Arizona, but has yet to open. The consumer segment is continuing to promote and build the Bullion Express brand into a leading on-line seller of bullion. Buying and selling items for their precious-metals content is a major method by which we are marketed. The consumer segment also offers jewelry repair services, custom-made jewelry and consignment items, and maintains relationships with refiners for precious-metal items that are not retained for resale. We also maintain a presence in retail markets through websites, www.dgse.com, www.cgdeinc.com and www.bullionexpress.com.

Our commercial segment primarily buys electronic components from business and other organizations, such as school districts, for end-of-life recycling and resell, or to add life to electronic devices by data destruction and refurbishment for reuse. We also recycle and resale electronics at the retail level. We focus on end-of-life electronics recycling and sustainability and ITAD USA provides IT equipment disposition, including compliance and data sanitization services. Teladvance, CEX and Avail operate as value-added resellers by providing offerings and services to companies looking either to upgrade capabilities or dispose of equipment. Like the consumer segment, the commercial segment also maintains relationships with refiners or recyclers to which it sells valuable materials it extracts from electronics and IT equipment that are not appropriate for resale or reuse. The commercial segment’s customers are companies and organizations that are based domestically and internationally.

For additional information on the businesses of both the consumer and commercial segments, see “Item 1. Business – Operating Segments” in the Company’s 2022 Annual Report.

The interim condensed consolidated financial statements have been prepared in accordance with U.S. GAAP and include the accounts of the Company and its subsidiaries. All material intercompany transactions and balances have been eliminated.

NOTE 3 — ACCOUNTING POLICIES AND ESTIMATES

Financial Instruments

The carrying amounts reported in the condensed consolidated balance sheets for cash equivalents, trade receivables, prepaid expenses, other current assets, accounts payable, accrued expenses, customer deposits and other liabilities approximate fair value because of the immediate or short-term nature of these financial instruments. Notes payable approximate fair value due to the market interest rate charged.

Earnings Per Share

Basic earnings per share of our common stock, par value $0.01 per share (our “Common Stock”), is computed by dividing net earnings available to holders of the Company’s Common Stock by the weighted average number of shares of Common Stock outstanding for the reporting period. Diluted earnings per share reflect the potential dilution that could occur if securities or other contracts requiring the Company to issue Common Stock were exercised or converted into Common Stock. For the calculation of diluted earnings per share, the basic weighted average number of shares is increased by the dilutive effect of stock options and warrants outstanding determined using the treasury stock method.

Goodwill

Goodwill is not amortized but evaluated for impairment on an annual basis during the fourth quarter of our fiscal year, or earlier if events or circumstances indicate the carrying value may be impaired. The Company’s goodwill is related to the commercial segment only and not the entire Company. The commercial segment has its own, separate financial information to perform goodwill impairment testing. As a result of the current market and economic conditions related to surging inflation and the war between Ukraine and Russia, in accordance with step 1 of the guidelines set forth in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) 350-20-35-3A, management concluded there were no impairments of goodwill that resulted from those triggering events for the three and six months ended June 30, 2023. Management will continue to evaluate goodwill for the commercial segment. For tax purposes, goodwill is amortized and deductible over fifteen years.

Goodwill was allocated in connection with three acquisitions of the assets now held by Echo on May 20, 2019 (the “Echo Transaction”), of the assets now held by Teladvance on June 9, 2021 (the “CExchange Transaction”) and of the assets now held by Avail on October 29, 2021 (the “Avail Transaction”). The preliminary goodwill associated with the Avail Transaction was $3,491,285, which was the initial purchase price less the approximate fair value of the net assets purchased. On May 31, 2022, an additional cash payment was made of $216,988 due to certain conditions being met concerning the cash balance upon a certain date. The cash payment increased goodwill for the Avail Transaction to $3,708,273. During fiscal year 2022 management also identified $2,736,000 of intangibles that were not initially included in the fair value of Avail’s net assets. The separation of intangibles reduced the Avail Transaction goodwill to $972,272. There have been no other adjustments or impairment charges to goodwill. As of June 30, 2023 and December 31, 2022, goodwill as reported in the condensed consolidated balance sheets was $3,621,453.

Reclassifications

Prior period amounts included in current assets, for both right-of-use assets from operating leases and deferred tax asset, have been reclassified for current period presentation, to be included in non-current assets. The right-of-use assets from operating leases reclassified for December 31, 2022, amounted to 2.4% of the total assets at $1,683,060. The deferred tax asset reclassified for December 31, 2022, amounted to 2.0% of the total assets at $1,488,258.

Recent Accounting Pronouncements

In June 2016, the FASB issued a new credit loss accounting standard ASU 2016-13. The new accounting standard introduces the current expected credit losses methodology for estimating allowances for credit losses which will be based on expected losses rather than incurred losses. We will be required to use a forward-looking expected credit loss methodology for accounts receivable, loans and other financial instruments. The ASU is effective for the fiscal years beginning after December 15, 2022. We adopted this ASU as of January 1, 2023, which includes interim periods within the reporting period. ASU 2016-13 was adopted by using a modified retrospective transition approach to align our credit loss methodology with the new standard. There were no effects of this standard on our financial position, results of operations or cash flows.

There were no other new accounting standards that had a material impact on the Company’s consolidated financial statements during the three and six-month period ended June 30, 2023. There were no other new accounting standards or pronouncements that were issued but not yet effective as of June 30, 2023 that the Company expects to have a material impact on its consolidated financial statements.

NOTE 4 — INVENTORIES

A summary of inventories is as follows:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Consumer | | | | | | |

Resale | | $ | 20,507,017 | | | $ | 16,462,749 | |

Recycle | | | 38,251 | | | | 46,697 | |

| | | | | | | | |

Subtotal | | | 20,545,268 | | | | 16,509,446 | |

| | | | | | | | |

Commercial | | | | | | | | |

Resale | | | 624,720 | | | | 1,858,519 | |

Recycle | | | 348,321 | | | | 387,820 | |

| | | | | | | | |

Subtotal | | | 973,041 | | | | 2,246,339 | |

| | | | | | | | |

| | $ | 21,518,309 | | | $ | 18,755,785 | |

NOTE 5 — GOODWILL

The change in goodwill is as follows:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Opening balance | | $ | 3,621,453 | | | $ | 6,140,465 | |

Reductions (1) | | | - | | | | (2,519,012 | ) |

| | | | | | | | |

Goodwill | | $ | 3,621,453 | | | $ | 3,621,453 | |

(1) The reduction in goodwill of $2,519,012 for fiscal 2022, is a combination of an additional cash payment made on May 31, 2022 of $216,988, increasing goodwill for the Avail Transaction, offset by the effect of identifying $2,736,000 of intangible assets that was not initially included in the fair value of Avail’s net assets, reducing goodwill and increasing intangible assets.

NOTE 6 — PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Consumer | | | | | | |

Land | | $ | 1,640,219 | | | $ | 1,640,219 | |

Building and improvements | | | 4,030,125 | | | | 2,798,975 | |

Leasehold improvements | | | 1,450,695 | | | | 1,450,695 | |

Machinery and equipment | | | 1,149,891 | | | | 1,078,595 | |

Furniture and fixtures | | | 603,944 | | | | 603,944 | |

Vehicles | | | 22,859 | | | | 22,859 | |

| | | 8,897,733 | | | | 7,595,287 | |

Less: accumulated depreciation | | | (2,806,625 | ) | | | (2,651,832 | ) |

| | | | | | | | |

Sub-Total | | | 6,091,108 | | | | 4,943,455 | |

| | | | | | | | |

Commercial | | | | | | | | |

Building and improvements | | | 151,647 | | | | 151,647 | |

Machinery and equipment | | | 1,074,409 | | | | 1,082,026 | |

Vehicles | | | 98,610 | | | | 98,610 | |

Furniture and fixtures | | | 145,631 | | | | 145,950 | |

| | | 1,470,297 | | | | 1,478,233 | |

Less: accumulated depreciation | | | (657,093 | ) | | | (515,673 | ) |

| | | | | | | | |

Sub-Total | | | 813,204 | | | | 962,560 | |

| | | | | | | | |

Corporate | | | | | | | | |

Land | | | 1,106,664 | | | | 1,106,664 | |

Building and improvements | | | 2,502,216 | | | | 2,502,216 | |

Machinery and equipment | | | 28,627 | | | | 28,627 | |

| | | | | | | | |

| | | 3,637,507 | | | | 3,637,507 | |

Less: accumulated depreciation | | | (187,371 | ) | | | (149,720 | ) |

| | | | | | | | |

Sub-Total | | | 3,450,136 | | | | 3,487,787 | |

| | | | | | | | |

| | $ | 10,354,448 | | | $ | 9,393,802 | |

On May 4, 2023, DGSE closed the purchase of a new retail building located at 6030 North 19th Avenue in Phoenix, Arizona for $1,231,150. The purchase was paid through operating cash flow without the use of borrowed funds. The building will begin to be depreciated once it is put into use.

NOTE 7 — INTANGIBLE ASSETS

Intangible assets consist of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Consumer | | | | | | |

Domain names | | $ | 41,352 | | | $ | 41,352 | |

Point of sale system | | | 330,000 | | | | 330,000 | |

| | | 371,352 | | | | 371,352 | |

Less: accumulated amortization | | | (358,252 | ) | | | (335,502 | ) |

| | | | | | | | |

Subtotal | | | 13,100 | | | | 35,850 | |

| | | | | | | | |

Commercial | | | | | | | | |

Trademarks (1) | | | 1,483,000 | | | | 1,483,000 | |

Customer Contracts (1) | | | 1,873,000 | | | | 1,873,000 | |

Trademarks/Tradenames (2) | | | 114,000 | | | | 114,000 | |

Customer Relationships (2) | | | 345,000 | | | | 345,000 | |

Trademarks/Tradenames (3) | | | 1,272,000 | | | | 1,272,000 | |

Customer Relationships (3) | | | 1,464,000 | | | | 1,464,000 | |

| | | 6,551,000 | | | | 6,551,000 | |

Less: accumulated amortization | | | (1,920,854 | ) | | | (1,593,305 | ) |

| | | | | | | | |

Subtotal | | | 4,630,146 | | | | 4,957,695 | |

| | | | | | | | |

| | $ | 4,643,246 | | | $ | 4,993,545 | |

(1) Intangibles relate to the Echo Transaction on May 20, 2019.

(2) Intangibles relate to the CExchange Transaction on June 9, 2021.

(3) Intangibles relate to the Avail Transaction on October 29, 2021.

The following table outlines the estimated future amortization expense related to intangible assets held as of June 30, 2023:

| | Consumer | | | Commercial | | | Total | |

| | | | | | | | | |

2023 (excluding the six months ending June 30, 2023) | | | 7,600 | | | | 327,550 | | | | 335,150 | |

2024 | | | 5,500 | | | | 655,100 | | | | 660,600 | |

2025 | | | - | | | | 655,100 | | | | 655,100 | |

2026 | | | - | | | | 655,100 | | | | 655,100 | |

2027 | | | - | | | | 655,100 | | | | 655,100 | |

Thereafter | | | - | | | | 1,682,196 | | | | 1,682,196 | |

| | | | | | | | | | | | |

| | $ | 13,100 | | | $ | 4,630,146 | | | $ | 4,643,246 | |

NOTE 8— ACCRUED EXPENSES

Accrued expenses consist of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Consumer | | | | | | |

Accrued interest | | $ | 10,942 | | | $ | 11,624 | |

Payroll | | | 194,745 | | | | 146,817 | |

Property taxes | | | 132,700 | | | | 115,222 | |

Sales tax | | | 67,960 | | | | 153,039 | |

Other administrative expenses | | | 14,891 | | | | 424 | |

| | | | | | | | |

Subtotal | | | 421,238 | | | | 427,126 | |

| | | | | | | | |

Commercial | | | | | | | | |

Accrued interest | | | 7,562 | | | | 8,228 | |

Payroll | | | 354,072 | | | | 336,226 | |

Unvouchered payables - inventory/COGS | | | 859,970 | | | | 1,032,808 | |

Other accrued expenses | | | 22,261 | | | | 7,392 | |

| | | | | | | | |

Subtotal | | | 1,243,865 | | | | 1,384,654 | |

| | | | | | | | |

Corporate | | | | | | | | |

Accrued interest | | | 7,148 | | | | 7,543 | |

Payroll | | | 24,863 | | | | 25,179 | |

Professional fees | | | 89,759 | | | | 199,508 | |

Property Tax | | | 43,800 | | | | 87,275 | |

Federal & state Income tax | | | 334,078 | | | | 155,309 | |

| | | | | | | | |

Subtotal | | | 499,648 | | | | 474,814 | |

| | | | | | | | |

| | $ | 2,164,751 | | | $ | 2,286,594 | |

NOTE 9 — SEGMENT INFORMATION

As stated in Note 1 – Basis of Presentation, we updated our two reportable segments by renaming the ECHG segment to the “Commercial” segment and the DGSE segment to the “Consumer” segment. The segment name changes did not result in any change to the composition of the Company’s operations and therefore did not result in any changes to historical results. Our operations conducted by each of our segments are more specifically described below.

We determine our business segments based upon an internal reporting structure. The Company’s financial performance is based on the following segments: consumer and commercial.

The consumer segment includes Dallas Gold & Silver Exchange, which has six operating retail stores in the Dallas/Fort Worth Metroplex (“DFW”), one retail location in Phoenix, Arizona, as stated in a footnote to Note 6 – Property and Equipment, that has not yet opened, and Charleston Gold & Diamond Exchange, which has one retail store in Mt. Pleasant, South Carolina. The consumer segment also operates the on-line Bullion Express brand.

The commercial segment includes Echo, ITAD USA, Teladvance, CEX and Avail. These five companies are involved in recycling and the reuse of electronic components.

A portion of certain corporate costs and expenses is allocated, including information technology as well as rental income and expenses relating to our corporate headquarters, to the business segments. These income and expenses are included in selling, general and administrative (“SG&A”) expenses, depreciation and amortization, other income, interest expense and income tax expense. The management team evaluates each segment and makes decisions about the allocation of resources according to each segment’s profit. Allocation amounts are generally agreed upon by management and may differ from arms-length allocations.

The following separates the consumer and the commercial financial results of operations for the three months ended June 30, 2023 and 2022:

| | For The Three Months Ended June 30, | |

| | 2023 | | | 2022 | |

| | Consumer | | | Commercial | | | Consolidated | | | Consumer | | | Commercial | | | Consolidated | |

| | | | | | | | | | | | | | | | | | |

Revenue: | | | | | | | | | | | | | | | | | | |

Sales | | $ | 39,641,434 | | | $ | 10,662,093 | | | $ | 50,303,527 | | | $ | 30,339,127 | | | $ | 12,300,591 | | | $ | 42,639,718 | |

Cost of goods sold | | | 35,546,792 | | | | 3,994,688 | | | | 39,541,480 | | | | 26,150,543 | | | | 5,011,175 | | | | 31,161,718 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 4,094,642 | | | | 6,667,405 | | | | 10,762,047 | | | | 4,188,584 | | | | 7,289,416 | | | | 11,478,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative expenses (1) | | | 2,472,973 | | | | 5,889,581 | | | | 8,362,554 | | | | 2,252,909 | | | | 4,947,824 | | | | 7,200,733 | |

Depreciation and amortization | | | 79,408 | | | | 256,766 | | | | 336,174 | | | | 101,434 | | | | 178,082 | | | | 279,516 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2,552,381 | | | | 6,146,347 | | | | 8,698,728 | | | | 2,354,343 | | | | 5,125,906 | | | | 7,480,249 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 1,542,261 | | | | 521,058 | | | | 2,063,319 | | | | 1,834,241 | | | | 2,163,510 | | | | 3,997,751 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income/expense: | | | | | | | | | | | | | | | | | | | | | | | | |

Other income (1) | | | 23,929 | | | | 129,723 | | | | 153,652 | | | | 9,397 | | | | 12,004 | | | | 21,401 | |

Interest expense | | | 58,209 | | | | 56,479 | | | | 114,688 | | | | 61,663 | | | | 59,379 | | | | 121,042 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 1,507,981 | | | | 594,302 | | | | 2,102,283 | | | | 1,781,975 | | | | 2,116,135 | | | | 3,898,110 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income tax expense | | | 339,672 | | | | 158,902 | | | | 498,574 | | | | 15,391 | | | | 34,861 | | | | 50,252 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,168,309 | | | $ | 435,400 | | | $ | 1,603,709 | | | $ | 1,766,584 | | | $ | 2,081,274 | | | $ | 3,847,858 | |

(1) Starting January 1, 2023, expenses previously classified as other expenses related to the Company’s corporate campus overhead have been included in selling, general, and administrative expenses. Since the presentation of these expenses changed January 1, 2023, management believes the presentation of the 2022 corporate campus overhead should be reclassified to selling, general, and administrative expense for comparison purposes for the three and six months ended June 30, 2022.

The following separates the consumer and the commercial financial results of operations for the six months ended June 30, 2023 and 2022:

| | For The Six Months Ended June 30, | |

| | 2023 | | | 2022 | |

| | Consumer | | | Commercial | | | Consolidated | | | Consumer | | | Commercial | | | Consolidated | |

| | | | | | | | | | | | | | | | | | |

Revenue: | | | | | | | | | | | | | | | | | | |

Sales | | $ | 76,345,831 | | | $ | 22,346,736 | | | $ | 98,692,567 | | | $ | 66,121,999 | | | $ | 23,932,817 | | | $ | 90,054,816 | |

Cost of goods sold | | | 68,266,221 | | | | 8,254,397 | | | | 76,520,618 | | | | 57,709,953 | | | | 11,155,829 | | | | 68,865,782 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 8,079,610 | | | | 14,092,339 | | | | 22,171,949 | | | | 8,412,046 | | | | 12,776,988 | | | | 21,189,034 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative expenses (1) | | | 4,868,998 | | | | 11,398,859 | | | | 16,267,857 | | | | 4,433,466 | | | | 9,412,238 | | | | 13,845,704 | |

Depreciation and amortization | | | 177,542 | | | | 512,983 | | | | 690,525 | | | | 208,397 | | | | 363,066 | | | | 571,463 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 5,046,540 | | | | 11,911,842 | | | | 16,958,382 | | | | 4,641,863 | | | | 9,775,304 | | | | 14,417,167 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 3,033,070 | | | | 2,180,497 | | | | 5,213,567 | | | | 3,770,183 | | | | 3,001,684 | | | | 6,771,867 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income/expense: | | | | | | | | | | | | | | | | | | | | | | | | |

Other income (1) | | | 47,463 | | | | 316,968 | | | | 364,431 | | | | 24,014 | | | | 24,027 | | | | 48,041 | |

Interest expense | | | 117,827 | | | | 113,925 | | | | 231,752 | | | | 122,904 | | | | 121,377 | | | | 244,281 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 2,962,706 | | | | 2,383,540 | | | | 5,346,246 | | | | 3,671,293 | | | | 2,904,334 | | | | 6,575,627 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income tax expense | | | 657,513 | | | | 558,707 | | | | 1,216,220 | | | | 28,568 | | | | 51,976 | | | | 80,544 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2,305,193 | | | $ | 1,824,833 | | | $ | 4,130,026 | | | $ | 3,642,725 | | | $ | 2,852,358 | | | $ | 6,495,083 | |

(1) Starting January 1, 2023, expenses previously classified as other expenses related to the Company’s corporate campus overhead have been included in selling, general, and administrative expenses. Since the presentation of these expenses changed January 1, 2023, management believes the presentation of the 2022 corporate campus overhead should be reclassified to selling, general, and administrative expense for comparison purposes for the three and six months ended June 30, 2022.

NOTE 10 — REVENUE RECOGNITION

ASC 606 provides guidance to identify performance obligations for revenue-generating transactions. The initial step is to identify the contract with a customer created with the sales invoice or a repair ticket. Secondly, to identify the performance obligations in the contract as we promise to deliver the purchased item or promised repairs in return for payment or future payment as a receivable. The third step is determining the transaction price of the contract obligation as in the full ticket price, negotiated price or a repair price. The next step is to allocate the transaction price to the performance obligations as we designate a separate price for each item. The final step in the guidance is to recognize revenue as each performance obligation is satisfied.

The following disaggregation of total revenue is listed by sales category and segment for the three months ended June 30, 2023 and 2022:

CONSOLIDATED | | Three Months Ended June 30, | |

| | 2023 | | | 2022 | |

| | Revenues | | | Gross Profit | | | Margin | | | Revenues | | | Gross Profit | | | Margin | |

Consumer | | | | | | | | | | | | | | | | | | |

Resale | | $ | 36,645,641 | | | $ | 3,353,835 | | | | 9.2 | % | | $ | 28,165,026 | | | $ | 3,719,954 | | | | 13.2 | % |

Recycled | | | 2,995,793 | | | | 740,807 | | | | 24.7 | % | | | 2,174,101 | | | | 468,630 | | | | 21.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 39,641,434 | | | | 4,094,642 | | | | 10.3 | % | | | 30,339,127 | | | | 4,188,584 | | | | 13.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Commercial | | | | | | | | | | | | | | | | | | | | | | | | |

Resale | | | 7,566,236 | | | | 5,051,337 | | | | 66.8 | % | | | 9,102,001 | | | | 5,566,507 | | | | 61.2 | % |

Recycled | | | 3,095,857 | | | | 1,616,068 | | | | 52.2 | % | | | 3,198,590 | | | | 1,722,909 | | | | 53.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 10,662,093 | | | | 6,667,405 | | | | 62.5 | % | | | 12,300,591 | | | | 7,289,416 | | | | 59.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 50,303,527 | | | $ | 10,762,047 | | | | 21.4 | % | | $ | 42,639,718 | | | $ | 11,478,000 | | | | 26.9 | % |

The following disaggregation of total revenue is listed by sales category and segment for the six months ended June 30, 2023 and 2022:

CONSOLIDATED | | Six Months Ended June 30, | |

| | 2023 | | | 2022 | |

| | Revenues | | | Gross Profit | | | Margin | | | Revenues | | | Gross Profit | | | Margin | |

Consumer | | | | | | | | | | | | | | | | | | |

Resale | | $ | 70,365,601 | | | $ | 6,658,767 | | | | 9.5 | % | | $ | 61,842,159 | | | $ | 7,462,806 | | | | 12.1 | % |

Recycled | | | 5,980,230 | | | | 1,420,843 | | | | 23.8 | % | | | 4,279,840 | | | | 949,240 | | | | 22.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 76,345,831 | | | | 8,079,610 | | | | 10.6 | % | | | 66,121,999 | | | | 8,412,046 | | | | 12.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Commercial | | | | | | | | | | | | | | | | | | | | | | | | |

Resale | | | 16,124,326 | | | | 10,850,463 | | | | 67.3 | % | | | 18,681,858 | | | | 10,140,775 | | | | 54.3 | % |

Recycled | | | 6,222,410 | | | | 3,241,876 | | | | 52.1 | % | | | 5,250,959 | | | | 2,636,213 | | | | 50.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 22,346,736 | | | | 14,092,339 | | | | 63.1 | % | | | 23,932,817 | | | | 12,776,988 | | | | 53.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 98,692,567 | | | $ | 22,171,949 | | | | 22.5 | % | | $ | 90,054,816 | | | $ | 21,189,034 | | | | 23.5 | % |

For the consumer segment, revenue for monetary transactions (i.e., cash and receivables) with wholesale dealers and the retail public are recognized when the merchandise is delivered, and payment has been made either by immediate payment or through a receivable obligation at one of our over-the-counter retail stores. Revenue is recognized upon the shipment of goods when retail and wholesale customers have fulfilled their obligation to pay, or promise to pay, through e-commerce or phone sales. Shipping and handling costs are accounted for as fulfillment costs after the customer obtains control of the goods.

Crafted-precious-metal items at the end of their useful lives are sold for its precious metal contained. The metal is assayed to determine the precious metal content, a price is agreed upon and payment is made usually within two days. Revenue is recognized from the sale once the performance obligation is satisfied.

In limited circumstances, merchandise is exchanged for similar merchandise and/or monetary consideration with both dealers and retail customers, for which revenue is recognized in accordance with ASC 845, Nonmonetary Transactions. When merchandise is exchanged for similar merchandise and there is no monetary component to the exchange, there is no revenue recognized. Instead, the basis of the merchandise relinquished becomes the basis of the merchandise received, less any indicated impairment of value of the merchandise relinquished. When merchandise is exchanged for similar merchandise and there is a monetary component to the exchange, revenue is recognized to the extent of the monetary assets received that determines the cost of sale based on the ratio of monetary assets received to monetary and non-monetary assets received multiplied by the cost of the assets surrendered.

The Company offers the option of third-party financing for customers wishing to borrow money for the purchase. The customer applies on-line with the third party and upon going through the credit check will be approved or denied. If accepted, the customer is allowed to purchase according to the limits set by the finance company. Revenue is recognized from the sale upon the promise of the financing company to pay.

Our return policy covers retail transactions. In some cases, customers may return a product purchased within 30 days of the receipt of the items for a full refund. Also, in some cases customers may cancel the sale within 30 days of making a commitment to purchase the items. Additionally, a customer may return an item for full refund if they can demonstrate that the item is not authentic, or there was an error in the description of the piece. Returns are accounted for as a reversal of the original transaction, with the effect of reducing revenues, and cost of sales, and returning the merchandise to inventory. The consumer segment has established an allowance for estimated returns based on our review of historical returns experience and reduces our reported revenues and cost of sales accordingly. For the three and six months ended June 30, 2023 and 2022, the allowance for returns remained the same at approximately $28,000.

A significant amount of revenue stems from sales to two precious metal refining and bullion partners. One partner constitutes 24.5% and 28.9% of the revenues for the three and six months ended June 30, 2023, respectively. The second partner constitutes 23.7% and 10.4%, of the revenues for the three and six months ended June 30, 2023, respectively. However, the Company believes that the products it sells is marketable to numerous sources at competitive prices.

The commercial segment has several revenue streams and recognize revenue according to ASC 606 at an amount that reflects the consideration to which the entities expect to be entitled in exchange for transferring goods or services to the customer. The revenue streams are as follows:

Outright sales are recorded when product is shipped and title transferred. Once the price is established and the terms are agreed to and the product is shipped and title is transferred, the revenue is recognized. The commercial segment has fulfilled its performance obligation with an agreed upon transaction price, payment terms and shipping the product.

We recognize refining revenue when our inventory arrives at the destination port and the performance obligation is satisfied by transferring the control of the promised goods that are identified in the customer contract. The initial invoice is recognized in full when our performance obligation is satisfied, as stated in the first sentence. Under the guidance of ASC 606, an estimate of the variable consideration that are expected to be entitled is included in the transaction price stated at the current precious metal spot price and weight of the precious metal. An adjustment to revenue is made in the period once the underlying weight and any precious metal spot price movement is resolved, which is usually around six (6) weeks. Any adjustment from the resolution of the underlying uncertainty is netted with the settlement due from the original contract.

The commercial segment also provides recycling services according to a Scope of Work (“SOW”). Services are recognized based on the number of units processed by a preset price per unit. Activity reports are produced weekly with the counts and revenue is recognized based on the billing from the weekly reports. Recycling services can be conducted at our facility, or the recycling services can be performed at the client’s facility. The SOW will determine the charges and whether the service will be completed at our facility or at the client’s facility. Payment terms are also dictated in the SOW.

Accounts Receivable: We record trade receivables when revenue is recognized. The new accounting standard introduces a new expected credit losses methodology for estimating allowances for credit losses which is based on expected losses rather than incurred losses. We are required to use a forward-looking expected credit loss methodology for accounts receivable. This new methodology is effective for the fiscal years beginning January 1, 2023. We will record an allowance for doubtful accounts, which is primarily determined by an analysis of our trade receivables aging, using the new expected losses methodology. The allowance is determined based on historical experience of collecting past due amounts, based on the degree of their aging. In addition, specific accounts that are considered and expected to be uncollectable are included in the allowance. These provisions are reviewed to determine the adequacy of the allowance for doubtful accounts. Trade receivables are charged off when there is certainty as to their being uncollectible. Trade receivables are considered delinquent when payment has not been made within contract terms. The consumer segment had no allowance for doubtful accounts balance as of June 30, 2023 and December 31, 2022. Some of commercial segment’s customers are on payment terms, and although low risk, occasionally the need may arise to record an allowance for receivables that are deemed high risk using the new expected loss methodology. The commercial segment’s allowance for doubtful accounts, as of June 30, 2023 and December 31, 2022 was $186,288 and $51,734, respectively. The increase in allowance for doubtful accounts ending June 30, 2023, as compared to December 31, 2022 is primarily due to the commercial segment and the new forward looking methodology of estimating future expected losses.

Income Taxes: Income taxes are accounted for under the asset and liability method prescribed by ASC 740, Income Taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recorded to reduce the carrying amounts of deferred tax assets unless it is more likely than not such assets will be realized. During fiscal 2022, management determined that it was more likely than not the tax asset would be reduced by future taxable income, therefore, the remaining valuation allowance at December 31, 2022, was released. As of June 30, 2023, we had a deferred tax asset of $612,832 with $0 offsetting valuation allowance. As of December 31, 2022, the Company had a deferred tax asset of $1,488,258 with an offsetting valuation allowance of $0.

We account for our position in tax uncertainties in accordance with ASC 740, Income Taxes. The guidance establishes standards for accounting for uncertainty in income taxes. The guidance provides several clarifications related to uncertain tax positions. Most notably, a “more likely-than-not” standard for initial recognition of tax positions, a presumption of audit detection and a measurement of recognized tax benefits based on the largest amount that has a greater than 50 percent likelihood of realization. The guidance applies a two-step process to determine the amount of tax benefit to be recognized in the financial statements. First, we must determine whether any amount of the tax benefit may be recognized. Second, we determine how much of the tax benefit should be recognized (this would only apply to tax positions that qualify for recognition.) We have not taken a tax position that, if challenged, would have a material effect on the financial statements or the effective tax rate for the three and six months ended June 30, 2023 and 2022.

NOTE 11 — LEASES

In determining our right-of-use assets and lease liabilities, we apply a discount rate to the minimum lease payments within each lease agreement. ASC 842 requires us to use the interest rate that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. If we cannot readily determine the discount rate implicit in lease agreements, we utilize our incremental borrowing rate.

The Company has nine operating leases as of June 30, 2023—five in DFW, two in Mt. Pleasant, South Carolina and two in Chandler, Arizona. The leases for the consumer segment are: 1) the flagship store located at 13022 Preston Road, Dallas, Texas expiring on January 31, 2027, with an option to extend the lease for an additional five years, at the prevailing market rate for comparable space in comparable buildings in the vicinity; 2) the Grand Prairie, Texas lease expiring June 30, 2027, with an option to extend the lease for an additional five years; 3) the two leases for the Mt. Pleasant, South Carolina location expiring on April 30, 2025, with no additional renewal options; and 4) the lease for the Euless, Texas location expiring June 30, 2025, with an option to extend the lease for an additional five years. The leases for the commercial segment are: 1) the Echo location on W. Belt Line Road, in Carrollton, Texas, expiring January 31, 2026, with an option to extend the lease an additional five years: 2) the lease for the Teladvance location, which also houses ITAD USA and CEX, on Realty Road in Carrollton, Texas expiring January 31, 2027, with no additional renewal options; and 3) the two leases for the Avail location in Chandler, Arizona expiring on May 31, 2025, with no additional renewal options. All of the Company’s nine leases as of June 30, 2023 are triple net, for which it pays its proportionate share of common area maintenance, property taxes and property insurance. Leasing costs for the three months ended June 30, 2023 and 2022 were $705,365 and $659,860 respectively, comprised of a combination of minimum lease payments and variable lease costs. Leasing costs for the six months ended June 30, 2023 and 2022 were $1,361,885 and $1,282,723, respectively, comprised of a combination of minimum lease payments and variable lease costs.

As of June 30, 2023, the weighted average remaining lease term and weighted average discount rate for operating leases was 2.8 years and 4.4%, respectively. For the three months ended June 30, 2023 and 2022, the Company’s cash paid for operating lease liabilities was $706,372 and $650,606 respectively. For the six months ended June 30, 2023 and 2022, the Company’s cash paid for operating lease liabilities was $1,362,892 and $1,266,703, respectively.

Future annual minimum lease payments as of June 30, 2023:

| | Operating | |

| | Leases | |

Consumer | | | |

2023 (excluding the six months ending June 30, 2023) | | | 271,657 | |

2024 | | | 552,414 | |

2025 | | | 434,274 | |

2026 | | | 355,000 | |

2027 and thereafter | | | 50,114 | |

| | | | |

Total minimum lease payments | | | 1,663,459 | |

Less imputed interest | | | (110,394 | ) |

| | | | |

Consumer Sub-Total | | | 1,553,065 | |

| | | | |

Commercial | | | | |

2023 (excluding the six months ending June 30, 2023) | | | 679,530 | |

2024 | | | 1,396,129 | |

2025 | | | 1,321,297 | |

2026 | | | 474,326 | |

2027 and thereafter | | | 33,455 | |

| | | | |

Total minimum lease payments | | | 3,904,737 | |

Less imputed interest | | | (235,751 | ) |

| | | | |

Commercial Sub-Total | | | 3,668,986 | |

| | | | |

Total | | | 5,222,051 | |

| | | | |

Current portion | | | 1,744,419 | |

| | | | |

| | $ | 3,477,632 | |

NOTE 12 — BASIC AND DILUTED AVERAGE SHARES

A reconciliation of basic and diluted weighted average common shares for the three months ended June 30, 2023 and 2022 is as follows:

| | For the Three Months Ended | |

| | June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Basic weighted average shares | | | 26,916,648 | | | | 26,924,631 | |

Effect of potential dilutive securities | | | 15,000 | | | | 15,000 | |

Diluted weighted average shares | | | 26,931,648 | | | | 26,939,631 | |

For the three months ended June 30, 2023 and 2022, there was a total of 15,000 common stock options, warrants, and Restricted Stock Units (RSUs) unexercised. For the three months ended June 30, 2023 and 2022, there were no anti-dilutive shares.

A reconciliation of basic and diluted weighted average common shares for the six months ended June 30, 2023 and 2022 is as follows:

| | For the Six Months Ended | |

| | June 30, | |

| | 2023 | | | 2022 | |

| | | | | | |

Basic weighted average shares | | | 26,920,618 | | | | 26,924,631 | |

Effect of potential dilutive securities | | | 15,000 | | | | 15,000 | |

Diluted weighted average shares | | | 26,935,618 | | | | 26,939,631 | |

For the six months ended June 30, 2023 and 2022, there was a total of 15,000 common stock options, warrants, and Restricted Stock Units (RSUs) unexercised. For the six months ended June 30, 2023 and 2022, there were no anti-dilutive shares.

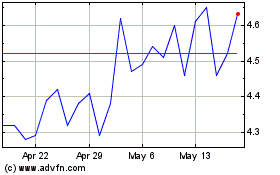

On March 14, 2023, a stock repurchase program was unanimously approved by the Company’s Board of Directors (the “Board”), that gave management authorization to purchase up to one million (1,000,000) shares of the Company’s stock, of a per-share price not to exceed $9, on the open market. The plan expires on March 31, 2026.

The following lists the repurchase of Company shares for the three and six months ended June 30, 2023:

| | | | | | | | | | | Shares available | |

| | Total Number of | | | Average Price | | | | | | to purchase under | |

Fiscal Period | | Shares Purchased | | | Paid per Share | | | Total $ Purchase | | | the plan | |

| | | | | | | | | | | | |

April 1 - 30, 2023 | | | - | | | | - | | | | - | | | | 1,000,000 | |

May 1 - 31, 2023 | | | 17,029 | | | $ | 6.73 | | | $ | 114,621 | | | | 982,971 | |

June 1 - 30, 2023 | | | 10,392 | | | $ | 7.72 | | | $ | 80,199 | | | | 972,579 | |

| | | | | | | | | | | | | | | | |

Total | | | 27,421 | | | $ | 7.10 | | | $ | 194,820 | | | | 972,579 | |

NOTE 13 — LONG-TERM DEBT

Long-term debt consists of the following:

| | Outstanding Balance | | | | | | | |

| | June 30, | | | December 31, | | | Current | | | | |

| | 2023 | | | 2022 | | | Interest Rate | | | Maturity | |

Consumer | | | | | | | | | | | | |

Note payable, Farmers Bank (1) | | $ | 2,616,114 | | | $ | 2,668,527 | | | | 3.10 | % | | November 15, 2026 | |

Note payable, Truist Bank (2) | | | 856,547 | | | | 874,418 | | | | 3.65 | % | | July 9, 2030 | |

Note payable, Texas Bank & Trust (3) | | | 447,000 | | | | 456,187 | | | | 3.75 | % | | September 14, 2025 | |

Note payable, Texas Bank & Trust (4) | | | 1,659,344 | | | | 1,691,020 | | | | 3.75 | % | | July 30, 2031 | |

| | | | | | | | | | | | | | | |

Consumer Sub-Total | | | 5,579,005 | | | | 5,690,152 | | | | | | | | |

| | | | | | | | | | | | | | | |

Commercial | | | | | | | | | | | | | | | |

Note payable, Farmers Bank (1) | | | 5,935,648 | | | | 6,054,565 | | | | 3.10 | % | | November 15, 2026 | |

Line of Credit (5) | | | - | | | | - | | | | 3.10 | % | | November 15, 2024 | |

Avail Transaction note (6) | | | 1,166,667 | | | | 1,500,000 | | | | 0.00 | % | | April 1, 2025 | |

| | | | | | | | | | | | | | | |

Commercial Sub-Total | | | 7,102,315 | | | | 7,554,565 | | | | | | | | |

| | | | | | | | | | | | | | | |

Corporate | | | | | | | | | | | | | | | |

Note payable, Texas Bank & Trust (7) | | | 2,675,844 | | | | 2,732,688 | | | | 3.25 | % | | Novemeber 4, 2025 | |

| | | | | | | | | | | | | | | |

Sub-Total | | | 15,357,164 | | | | 15,977,405 | | | | | | | | |

| | | | | | | | | | | | | | | |

Current portion | | | 1,251,747 | | | | 1,250,702 | | | | | | | | |

| | | | | | | | | | | | | | | |

| | $ | 14,105,417 | | | $ | 14,726,703 | | | | | | | | |

(1) On November 23, 2021, Farmers State Bank of Oakley, Kansas (“FSB”) refinanced prior related party notes held by the consumer segment and the commercial segment. The commercial segment note was refinanced with a remaining and outstanding balance of $6,309,962, is a five-year promissory note amortized over 20 years at 3.1% annual interest rate. The note has monthly principal and interest payments of $35,292. The consumer segment note was refinanced with a remaining and outstanding balance of $2,781,087, is a five-year promissory note amortized over 20 years at 3.1% annual interest rate. The note has monthly principal and interest payments of $15,555.

(2) On July 9, 2020, the consumer segment closed the purchase of a retail building located at 610 E. Round Grove Road in Lewisville, Texas for $1.195 million. The purchase was partly financed through a $956,000, ten-year loan, bearing an annual interest rate of 3.65%, amortized over 20 years, payable to Truist Bank (f/k/a BB&T Bank). The note has monthly interest and principal payments of $5,645.

(3) On September 14, 2020, the consumer segment closed on the purchase of a retail building located at 1106 W. Northwest Highway in Grapevine, Texas for $620,000. The purchase was partly financed through a $496,000, five-year loan, bearing an annual interest rate of 3.75%, amortized over 20 years, payable to Texas Bank & Trust. The note has monthly interest and principal payments of $2,941.

(4) On July 30, 2021, the consumer segment closed the purchase of a new retail building located at 9166 Gaylord Parkway in Frisco, Texas for $2,215,500. The purchase was partly financed through a $1,772,000, five-year loan (the “TB&T Frisco Loan”), bearing an annual interest rate of 3.75%, amortized over 20 years, payable to Texas Bank and Trust. The note has monthly interest and principal payments of $10,509.

(5) On November 23, 2021, the Company secured a 36-month line of credit from FSB for $3,500,000 at 3.1% annual interest rate. As of June 30, 2023 and December 31, 2022, the outstanding balance of the line of credit was $0.

(6) On October 29, 2021, the commercial segment entered into the Avail Transaction to purchase all of the assets, liabilities and rights and interests of Avail AZ, for $4.5 million. The purchase was facilitated by an initial payment of $2.5 million at closing, and the remaining $2.0 million to be paid out by 12 quarterly payments starting April 1, 2022, of $166,667 each. The Installment note payable for the Avail Transaction imputed at 3.1%

(7) On November 4, 2020, 1901 Gateway Holdings, LLC, a wholly owned subsidiary of Envela Corporation, closed on the purchase of its corporate office building located at 1901 Gateway Drive, Irving, Texas for $3.521 million. The building was partially financed through a $2.96 million, five-year loan, bearing an interest rate of 3.25%, amortized over 20 years, payable to Texas Bank & Trust. The note has monthly interest and principal payments of $16,792.

Future scheduled principal payments of our notes payable as of June 30, 2023 are as follows:

Note payable, Farmers State Bank | | | |

| | | |

Year Ending December 31, | | Amount | |

| | | |