UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of March 2022

Commission

File Number: 001-39164

INDONESIA

ENERGY CORPORATION LIMITED

(Translation

of registrant’s name into English)

GIESMART

PLAZA 7th Floor

Jl.

Raya Pasar Minggu No. 17A

Pancoran

– Jakarta 12780 Indonesia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): -.

L1

Capital Financing Amendment

Background

As

previously reported via Form 6-K filed on January 25, 2022 (the “January 2022 6-K”), on January 21, 2022, the Company

closed an initial $5,000,000 million tranche (the “First Tranche”) of a total then anticipated $7,000,000 million

private placement with L1 Capital Global Opportunities Master Fund, Ltd. (the “Investor”) pursuant to the terms of

Securities Purchase Agreement, dated January 21, 2022, between the Company and the Investor (the “Purchase Agreement”).

In

connection with the closing of the First Tranche, the Company issued to the Investor (i) a Senior Convertible Promissory Note in a principal

amount of up to $7,000,000 carrying the material terms described in the January 2022 6-K (the “Original Note”) and

(ii) a five year Ordinary Share Purchase Warrant carrying the material terms described in the January 2022 6-K (the “Initial

Warrant”) to purchase up to 383,620 ordinary shares of the Company (the “Ordinary Shares”) at an

exercise price of $6.00 per share, subject to adjustment as described in the January 2022 6-K.

A

second tranche of funding (the “Second Tranche”) under the Original Note, in the principal amount of $2,000,000 (subject

to potential reduction as described in the January 2022 6-K, the “Second Tranche Amount”) was to be funded two (2)

trading days following the declaration of effectiveness a registration statement covering the resale of the Ordinary Shares underlying

the Original Note and Warrants (as defined below) (the “Registration Statement”), subject to the satisfaction of certain

conditions precedent. At the closing of the Second Tranche, the Investor was to be entitled to receive an additional Ordinary Share Purchase

Warrant (carrying the same terms as the Initial Warrant) (the “Second Warrant”, and collectively with the Initial

Warrant, the “Warrants”) to purchase up to 153,450 Ordinary Shares, if the full amount of the Second Tranche was funded,

at an exercise price of $6.00 per share, subject to adjustment as disclosed in the January 2022 6-K.

Amendment

to Purchase Agreement and Note

On

March 4, 2022, the Company and the Investor entered into a First Amendment to the Purchase Agreement (the “SPA Amendment”)

and an Amended and Restated Senior Convertible Promissory Note, which amends and restates the Original Note in its entirety (the “Replacement

Note”), to memorialize the following amendments to the terms of the financing transaction:

1. The Second Tranche Amount was increased from $2,000,000 to $5,000,000 (less a 6% original issuance discount as provided for in the Original

Note) (the “New Second Tranche Amount”).

2. Because of the increase in the Second Tranche Amount, at the closing of the Second Tranche, the Investor will be entitled to receive

a Second Warrant to purchase up to 383,620 Ordinary Shares (rather than 153,450 Ordinary Shares per the initial Purchase Agreement terms,

and assuming the full New Second Tranche Amount is funded) at an exercise price of $6.00 per share, subject to adjustment as described

in the January 2022 6-K.

3. Without the prior approval of the Investor, the Company will be restricted in issuing new Ordinary Shares or Ordinary Share equivalents

(subject to certain exceptions) during the period from March 4, 2022 through the date that is seven (7) trading days after the Registration

Statement is declared effective; provided that this restriction will not apply if then trading price of the Ordinary Shares is over $9.00

with average five (5) day trading volume of 500,000 shares.

4. The New Second Tranche Amount, and the corresponding number of Ordinary Shares underlying the Second Warrant, is subject to reduction

if the principal amount of the Replacement Note (after funding the Second Tranche) would be 20% (as opposed to 25% as provided for in

the Original Note) of the market capitalization of the Company on the trading following the date of effectiveness of the Registration

Statement.

5. The deadline for the Company to file the Registration Statement was extended from March 4, 2022 to March 9, 2022.

6.

The Company shall be obligated to pay $9,000 of the Investor’s legal expense for preparing the SPA Amendment and the Replacement

Note.

The

foregoing description of the SPA Amendment and the Replacement Note is a summary only, does not purport to be complete, and is qualified

in its entirety by reference to the full text of such documents, the forms of which is attached hereto as Exhibit 10.1 and 10.2, respectively,

and incorporated herein by reference.

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Indonesia

Energy Corporation Limited |

| |

|

|

| Dated:

March 9, 2022 |

By: |

/s/

Dr. Wirawan Jusuf |

| |

Name: |

Dr.

Wirawan Jusuf |

| |

Title: |

Chairman

& Chief Executive Officer |

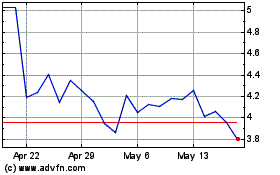

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Dec 2023 to Dec 2024