Should You Buy The Senior Loan ETF (BKLN)? - ETF News And Commentary

May 02 2012 - 5:34AM

Zacks

Although many investors shy away from bond ETFs in this low rate

environment, there are still a number of quality choices in the

fixed income ETF world. These products can help investors to reduce

dependence on equities while providing a nice regular payment far

above what most stocks can deliver at this time.

This is especially true if investors are willing to venture

outside of the investment grade market and into junk securities

instead. While these bonds are riskier, they give investors

outsized payouts which can help to greatly increase current income

for any portfolio (see Is The Bear Market For Bond ETFs Finally

Here?).

In the junk bond space, there is an often overlooked slice of

the market that could be an interesting choice for those with

minimal levels of exposure to the market. This corner is what is

known as senior loans or ‘leveraged loan’ market, a specific corner

of the below investment grade world.

These notes are, generally speaking, floating rate bonds which

see rates adjust on a monthly or quarterly basis. However, they are

often made by companies that are already heavily in debt suggesting

big risks. Nevertheless, these senior loans are, as you might

expect, ‘senior’ to other types of debt and are among the first to

be paid out in a liquidity event.

Given the interest rate resetting feature and the low credit

quality of the bonds in this segment, these loans can provide

investors with both a hedge against rising interest rates but also

higher levels of income than other types of floating rate

securities (read Do You Need A Floating Rate Bond ETF?).

Thanks to this, senior loans could be a nice mix between high

income and lower interest rate sensitivity making them ideal

investments for many investors.

Unfortunately, the senior loan market is still pretty small and

thus somewhat difficult for investors to buy into. However, there

is one dedicated ETF that is currently tracking the space the

PowerShares Senior Loan Portfolio (BKLN).

This relatively new bond ETF is currently the only way investors

have to play the senior loan market via the ETF structure. The

product tracks the S&P/LSTA U.S. Leveraged Loan 100 Index which

looks to act as a benchmark for the largest institutional leveraged

loans based on market weightings, spreads, and interest payments

(see more on ETFs at the Zacks ETF Center).

Currently, the ETF holds about 120 securities in total with the

vast majority maturing in between one and ten years. With this

approach, the fund has a SEC 30 Day Yield of about 4.8% while

interest rate risk is minimal; the average days to reset is just

over 33.5.

However, investors should note that the product is relatively

expensive when compared to other ETFs focused on the low end of the

debt market. The current expense ratio is 76 basis points a year,

triple some of the low cost junk bond ETFs.

Fortunately, the AUM is high at about $415 million, promoting

high levels of interest from traders. In fact, volume is generally

at 160,000 shares per day, giving the fund an extremely low bid ask

spread (also read ETF Investors: Beware The Coming ETN

Backlash).

Yet the real test for this product is when investors put it up

against one of the more popular junk bond ETFs on the market today,

the SPDR Barclays High Yield Bond ETF (JNK).

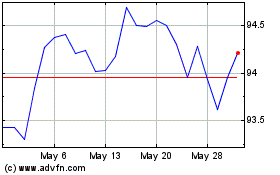

In terms of yield, JNK crushes its counterpart, paying out over

200 basis points more a year in income. Additionally, from a

performance perspective, JNK has easily beaten out its counterpart

over the past year:

With that being said, investors should note from

the chart above that JNK has been far more volatile than its bank

loan counterpart, experiencing greater moves in short time periods.

Thanks to this volatility, as well as the higher interest rate risk

in JNK, some investors might still want to consider BKLN for their

exposure (see Top Three High Yield Junk Bond ETFs).

That is because BKLN looks to a lower risk choice in the space

while still providing high income levels than many investment grade

products. So if investors are willing to forgo a little in income

and pay more in fees, BKLN could be an interesting choice for some

investors.

While it has trailed some of its counterparts in the past, the

product looks well poised to take advantage of a rising interest

rate environment in the future, especially when compared to its

peers in the junk bond ETF space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From May 2024 to Jun 2024

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Jun 2023 to Jun 2024