3 Reasons to Consider the Crossover Bond ETF - ETF News And Commentary

November 15 2012 - 6:35AM

Zacks

In the past few quarters, the markets have witnessed speculation

about a number of events and their impact on the markets as we head

into 2013. ECB’s policy in order to tame the Euro zone crisis,

Fed’s implementation of QE3 and the impact of the presidential

election are all weighing on the markets as they struggle to find

their footing.

This global economic uncertainty coupled with a slowdown in the

domestic U.S. growth rate have for long led to a risk aversion

climate among investors and an expansionary monetary policy by the

Fed—both leading to a frustratingly low interest rate scenario in

the economy(read Inside The Two ETFs Up More Than 140% YTD).

On the other side of the ledger are the income-seeking investors

who have had to comply with ultra low yields for quite some time

now. While most of the high yielding sources from the ETF space

seems to be tapped out, there is one segment which has been pretty

much overlooked although it looks promising, ‘crossover bonds’

(read 3 Excellent ETFs with More than 4% Yield).

The SPDR BofA Merrill Lynch Crossover Corporate Bond ETF

(XOVR) is one such fund

that targets this corner of the U.S. bond market. Bonds in this

fund are basically fixed income securities that are highly rated in

the non-investment grade bond space or they are lower rated in the

investment grade bond space (see Market Vectors Files for

Innovative Bond ETF).

Launched in June of 2012, XOVR has been able to amass just about

$13 million till date and does a daily volume of just around 11,000

shares. This suggests that the product has been highly ignored by

the investors. However, below are three reasons that one may want

to consider giving this overlooked product a chance in their

portfolio:

1) Providing Parity in Risk-Return Tradeoff

Traditionally, high quality bond ETFs are associated with lower

yields and low quality (Junk) ones with higher yields. This is due

to the default (counterparty) risk premium that the investor takes

before investing in the lower rated (i.e. Junk) bond ETFs.

Investing in these two classes of ETFs require different types

of risk appetite and the risk-return tradeoff is demonstrated by 1)

high yields— high probability of default and 2) low yields—low

probability of default.

However, the crossover bond ETF XOVR, provides parity in the

risk-return tradeoff and captures the shades of grey between these

two scenarios. Thus they provide the opportunity for 1) higher

current income —as opposed to investment grade bond ETFs by taking

on 2) relatively lesser default risk —as opposed to non-investment

grade bond ETFs (see Forget China, Buy These Emerging Market ETFs

Instead).

XOVR has a 30 day SEC Yield of 3.40% and a majority of its

assets are allocated to investment grade securities, i.e. 55.16% of

its total assets are ‘Baa’ rated which is the

lowest rating among investment grade bonds.

2) Pricing Differentials During Bond Crossover can be

Advantageous

Among all fixed income securities, Crossover Bonds are the most

susceptible to being upgraded to investment grade or downgraded to

Junk due to their proximity to either rating. However, the rating

would depend on individual credit rating agencies.

Nevertheless, when a bond is downgraded to junk from investment

grade by one agency, the implied yield rises and the bond price

falls. This indicates an entry point at low levels. However, it

might happen that another agency after a brief period of time might

upgrade their rating on the same bond which pushes implied yield

lower, resulting in capital appreciation (see 3 Actively Managed

Bond ETFs for Stability and Income).

On the contrary, if a junk bond is upgraded to investment grade

by a rating agency, the price of the bond increases, indicating a

decent exit point. Now if another agency downgrades it to junk

again after a period of time, the capital loss can be avoided.

3) Probability of Potentially Higher Yields at Lower

Expenses

As we have already discussed, the crossover bond ETF, XOVR,

provides the potential for high yields due to the nature of its

target securities. Furthermore it comes at a relatively lower

expense especially compared to other high yielding avenues from the

Junk Bond ETF space (read HYEM: The Best Choice in Junk Bond

ETFs?).

XOVR charges just 30 basis points in fees and expenses compared

to a Morningstar category average of 0.51%. Compared to this, JNK

charges 40 basis points in annual fees and expenses, whereas HYG

charges an expense ratio of 50 basis points.

Other Features

XOVR tracks the BofA Merrill Lynch US Diversified Crossover

Corporate Index. The components in the index are mostly U.S. Dollar

denominated, thereby eliminating any currency risk. It targets the

intermediate end on the crossover bond yield curve suggested by an

average maturity of 7.90 years. Also it carries moderate interest

rate risk and has a weighted average duration of 5.72 years (see

more in the Zacks ETF Center).

Presently, it holds 158 securities in its portfolio and has a

30-Day SEC yield of 3.40%. XOVR has returned 4.35% since its

inception, as of 7th November 2012.

|

Data Point

|

XOVR

|

|

Returns (Since Inception)

|

4.35%

|

|

Average Duration

|

5.72 years

|

|

Average Maturity

|

7.90 Years

|

|

Assets Under Management

|

$13 million

|

|

Expense Ratio

|

0.30%

|

|

Average Credit Quality of the

Index

|

BA1

|

|

Average Daily Volume

|

11,000

|

|

30 Day SEC Yield

|

3.40%

|

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-IBX HYCB (HYG): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

SPDR-BAML CR CB (XOVR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

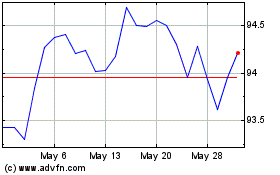

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Dec 2024 to Jan 2025

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Jan 2024 to Jan 2025