Is the Party Over for Junk Bonds? - Analyst Blog

January 21 2013 - 8:20AM

Zacks

High-risk high-yield bonds a.k.a.

speculative bonds or junk bonds are those rated below BBB- by

Standard & Poor’s rating agency. The default rate for junk

bonds has been low at about 3.2% recently versus the historical

norm of 4.5%. The outlook for the default rate is favorable in the

near term.

Junk bonds have boomed following

the Fed’s decision to continue with its loose monetary policy with

$85 billion in monthly asset purchases. In fact, quantitative

easing, accompanied by rock-bottom interest rates, has been accused

of creating asset bubbles in places such as the treasury bond and

the junk bond markets.

With investors chasing higher yield

in the wake of low returns on other assets, high yield issuers

raised a record quantum of debt in 2012. Fund raising companies

have frequently used the proceeds to refinance higher

interest-bearing loans. Some of the money ended up with private

equity firms, such as Bain Capital, who borrow for leveraged

buyouts and then burden the company with debt. In any case, there

is no doubt that the boom in junk bonds has ensured access to

capital markets for even those companies with the lowest credit

ratings.

The chase for yield has driven down

the yield on junk bonds to record lows. In fact, the interest in

such bonds has been so great that some mutual funds have even

refused to take new investors. Junk bond yields recently fell below

6% for the first time (giving them about 500 basis points spread

over U.S. Treasury bills). From a historical perspective, junk bond

issuers have paid about 10% in interest charges. (It is noteworthy

that while yields may currently be low, spreads are nowhere near

their historical bottom.)

After several years of tidy

returns, returns from junk bonds came to over 15% in 2012. The

sharpest appreciation has been in the lowly CCC rated paper. With

good returns in the period following the financial crisis in 2008,

market mavens wonder if there is much room left for capital

appreciation or whether these bonds are to be held as a coupon play

only.

Risks to the high yield market

include a cyclical rotation into equities, firmer interest rates or

a weaker economy, which would increase corporate default. Even

without any recession, there is risk in the sense that should

earnings take off again, then investors may bail out of debt to

enter the stock market. Furthermore, investors face potential

losses in case of callable bonds.

T. Rowe Price High Yield Fund gave

an annual return of 15.2% in 2012 and a 3-year return of

10.8%. Prominent leveraged plays in this fund include

Sprint Nextel Corp. (S) and CIT Group

Inc. (CIT).

The Putnam High Yield Advantage

Fund gave an annual return of 15.1% in 2012 and a 3-year return of

10.4%. Noteworthy leveraged plays in this fund include HCA

Holdings, Inc. (HCA) and SLM Corporation

(SLM).

Besides high yield mutual funds,

investors may also select from the following two high yield bond

ETFs, both of which are well tracked, offer high liquidity and may

be considered to be a proxy for the junk bond market. The

iShares iBoxx $ High Yield Corporate Bd (HYG) and

SPDR Barclays High Yield Bond (JNK) are well known

junk bond ETFs.

CIT GROUP (CIT): Free Stock Analysis Report

HCA HOLDINGS (HCA): Free Stock Analysis Report

ISHARS-IBX HYCB (HYG): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

SPRINT NEXTEL (S): Free Stock Analysis Report

SLM CORP (SLM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

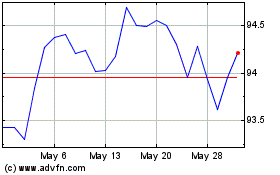

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Feb 2024 to Feb 2025