false

0001120970

0001120970

2025-02-28

2025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2025

COMSTOCK INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

(State or Other

Jurisdiction of Incorporation)

|

001-35200

(Commission File Number)

|

65-0955118

(I.R.S. Employer

Identification Number)

|

117 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.000666 per share

|

LODE

|

NYSE AMERICAN

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

Comstock Fuels will issue securities pursuant to the transaction documents described below. The material terms of such documents are summarized in Item 8.01 below and the contents of that summary are incorporated by reference into this Item 3.02.

Item 8.01 Other Events

Effective February 28, 2025 (“Effective Date”), Comstock Fuels Corporation (“Comstock Fuels”), a subsidiary of Comstock Inc. (the “Company”), entered into a series of definitive agreements with subsidiaries of Marathon Petroleum Corporation (“Marathon”), involving the purchase of $14,000,000 in Comstock Fuels equity as part of Comstock Fuels’ planned Series A preferred equity financing (“Series A Financing”), subject to a $700,000,000 valuation cap (“Investment”). The purchase price includes $1,000,000 in cash and $13,000,000 in payment-in-kind assets comprised of equipment, related intellectual properties, and other materials located at Marathon’s former renewable fuel demonstration facility in Madison, Wisconsin (“Payment-In-Kind Assets”), on and subject to the terms and conditions of the applicable transaction documents (“Investment Agreements”). The Payment-In-Kind Assets were transferred as of the Effective Date to Comstock Fuels. The cash portion of the Investment will be made within five business days of the execution by Comstock Fuels of third-party investment agreements for at least $25,000,000 in Series A equity financing.

Investment Agreements

The Investment Agreements included (i) a simple agreement for future equity governing the portion of the Investment issued in exchange for the Payment-In-Kind Assets (“Equity Agreement”); (ii) an asset transfer agreement to assign the Payment-In-Kind Assets (“Transfer Agreement”); (iii) a license agreement covering applicable intellectual properties (“License Agreement”); and (iv) a letter agreement to provide post-closing conditions (“Letter Agreement”). Ancillary agreements delivered in connection with the Investment Agreements included a board observer agreement executed as of the Effective Date by and between Comstock Fuels and MPC Investment LLC (“MPC”), a subsidiary of Marathon, under which Comstock Fuels granted MPC board observation rights in connection with the Investment (“Board Observer Agreement”).

Separately, Comstock is executing a commercial lease agreement for Marathon’s former renewable fuels facility located in Madison, Wisconsin (“Madison Facility”), executed by and between Comstock Fuels and McAllen Properties, Inc., with an effective date of March 1, 2025 (“Lease Agreement”). Monthly rent payments under the Lease Agreement are about $44,000.

License Agreement

Comstock Fuels will use the Madison Facility to increase Comstock Fuels’ current pilot production capabilities in Wausau, Wisconsin, with Comstock Fuels’ patented, patent pending, and proprietary lignocellulosic biomass refining technologies (“Comstock IP”). The License Agreement provides for the grant by Virent, Inc. (“Virent”) to Comstock Fuels of a non-exclusive, non-transferable, non-assignable, non-sublicensable, perpetual, royalty-free license under the Virent IP solely for research and development purposes associated with the Virent Equipment (“Included Virent IP”), excluding applications involving the heterogenous catalysis of biomass-derived sugars (“Reserved License Field”). The License Agreement provides for Virent and Comstock Fuels to coordinate in good faith to obtain an additional license for the Reserved License Field for research and development purposes. Comstock also granted Marathon a reciprocal royalty-free, non-exclusive, sublicensable worldwide license to any improvements or additional intellectual property related to the Included Virent IP, excluding improvements to Comstock IP. The parties additionally agreed to negotiate in good faith for a commercial license in the event that a commercial opportunity is identified for the Included Virent IP, and Virent granted Comstock Fuels a right of first refusal in the event that Virent transfers some or all of the Included Virent IP to a third party, subject to applicable pre-existing rights held by third parties.

Letter Agreement

The Letter Agreement requires the cash portion of the Investment to be made within five business days of the execution by Comstock Fuels of third-party investment agreements for at least $25,000,000 in Series A equity financing. The Letter Agreement additionally requires Comstock Fuels to grant Virent a lien on the Virent Equipment if Comstock Fuels does not complete $25,000,000 in the Series A equity financing within nine months of the Effective Date. The Letter Agreement additionally reiterated certain elements of the February 6, 2025, term sheet by and between Comstock, including agreement of the parties to execute on or about May 31, 2025, (i) a definitive offtake agreement under which Marathon or its affiliates will purchase advanced biomass-based intermediates and fuels from Comstock Fuels’ planned commercial demonstration facility; and (ii) a joint development agreement under which Marathon or its affiliates will provide support services to Comstock Fuels in exchange for a warrant which creates the option for Marathon to purchase additional equity in Comstock Fuels (collectively, the “Project Agreements”).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

COMSTOCK INC.

|

| |

|

|

|

Date: February 28, 2025

|

By:

|

/s/ Corrado De Gasperis

|

| |

|

Corrado De Gasperis

Executive Chairman and Chief Executive Officer

|

Exhibit 99.1

COMSTOCK FUELS COMPLETES FINANCING WITH MARATHON PETROLEUM

OKLAHOMA CITY, OKLAHOMA – FEBRUARY 28, 2025 – Comstock Inc. (NYSE: LODE) today announced a new investment and strategic collaboration with Marathon Petroleum Corporation (NYSE: MPC) to advance its lignocellulosic biomass refining solutions to commercial maturity. Comstock Fuels Corporation (“Comstock Fuels”), a subsidiary of Comstock Inc., has entered into a series of definitive agreements with subsidiaries of Marathon Petroleum Corporation (“Marathon”), involving the purchase of $14,000,000 in Comstock Fuels equity (“Investment”).

The Investment includes $1,000,000 in cash and $13,000,000 in payment-in-kind assets (“Payment-In-Kind Assets”) by Marathon, comprised of equipment, related intellectual properties, and other materials located at a Marathon renewable fuel demonstration facility in Madison, Wisconsin (“Madison Facility”). Comstock Fuels will use the Madison Facility to increase Comstock Fuels’ current pilot production capabilities in Wausau, Wisconsin.

Comstock Fuels’ advanced lignocellulosic biomass refining solutions are designed to align with oil producers by converting massive supplies of historically inaccessible biomass feedstock into “drop-in” hydrocarbon fuels for use in existing petroleum-based infrastructure.

Most current forms of renewable fuel draw from the same pool of conventional feedstocks, including corn, soy and various vegetable oils in the U.S., and the entire universe of those feedstocks only represents a tiny fraction of the domestic fuel demand. In contrast, the U.S. Department of Energy has previously estimated that America can produce upwards of one billion tons per year of biomass for conversion into fuel. That’s enough untapped feedstock to produce more than 3 billion barrels of fuel per year with Comstock Fuels’ refining solutions.

“We’re excited to collaborate with Marathon’s team as we work to integrate the Madison Facility and advance our unique renewable fuels technology to commercial maturity,” said Kevin Kreisler, Comstock Fuels’ chief technology officer.

The transaction documents included Comstock Fuels’ board observation rights for Marathon and reiterated the parties’ commitment to finalize an offtake agreement, joint development agreement, and warrant agreement on or before May 31, 2025.

Additional information on the transaction documents is available online in Comstock’s February 28, 2025, Current Report on Form 8-K.

About Comstock Fuels Corporation

Comstock Fuels Corporation (“Comstock Fuels”) delivers advanced lignocellulosic biomass refining solutions that set industry benchmarks for production of cellulosic ethanol, gasoline, renewable diesel, sustainable aviation fuel (“SAF”), and other renewable Bioleum™ fuels, with extremely low carbon intensity scores of 15 and market-leading yields of up to 140 gallons per dry metric ton of feedstock (on a gasoline gallon equivalent basis, or “GGE”), depending on feedstock, site conditions, and other process parameters. Comstock Fuels additionally holds the exclusive rights to intellectual properties developed by Hexas Biomass Inc. (“Hexas”) for production of purpose grown energy crops in liquid fuels applications with proven yields exceeding 25 to 30 dry metric tons per acre per year. The combination of Comstock Fuels’ high yield Bioleum refining platform and Hexas’ high yield energy crops allows for the production of enough feedstock to produce upwards of 100 barrels of fuel per acre per year, effectively transforming marginal agricultural lands with regenerative practices into perpetual “drop-in sedimentary oilfields” with the potential to dramatically boost regional energy security and rural economies.

Comstock Fuels plans to contribute to domestic energy dominance by directly building, owning, and operating a network of Bioleum Refineries in the U.S. to produce about 200 million barrels of renewable fuel per year by 2035, starting with its planned first 400,000 barrel per year commercial demonstration facility in Oklahoma. Comstock Fuels also licenses its advanced feedstock and refining solutions to third parties for additional production in the U.S. and global markets, including several recently announced and other pending projects. To learn more, please visit www.comstockfuels.com.

About Comstock Inc.

Comstock Inc. (NYSE: LODE) innovates and commercializes technologies that are deployable across entire industries to contribute to energy abundance by efficiently extracting and converting under-utilized natural resources, such as waste and other forms of woody biomass into renewable fuels, and end-of-life electronics into recovered electrification metals. Comstock’s innovations group is also developing and using artificial intelligence technologies for advanced materials development and mineral discovery for sustainable mining. To learn more, please visit www.comstock.inc.

Comstock Social Media Policy

Comstock Inc. has used, and intends to continue using, its investor relations link and main website at www.comstock.inc in addition to its X.com, LinkedIn and YouTube accounts, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Contacts

For investor inquiries:

RB Milestone Group LLC

Tel (203) 487-2759

ir@comstockinc.com

For media inquiries or questions:

Colby Korsun

Comstock Fuels Corporation

fuels@comstockinc.com

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future market conditions; future explorations or acquisitions; future changes in our research, development and exploration activities; future financial, natural, and social gains; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land and asset sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; business opportunities, growth rates, future working capital, needs, revenues, variable costs, throughput rates, operating expenses, debt levels, cash flows, margins, taxes and earnings. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our filings with the SEC and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious and other metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; challenges to, or potential inability to, achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology and efficacy, quantum computing and generative artificial intelligence supported advanced materials development, development of cellulosic technology in bio-fuels and related material production; commercialization of cellulosic technology in bio-fuels and generative artificial intelligence development services; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Neither this press release nor any related calls or discussions constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund, or any other issuer.

v3.25.0.1

Document And Entity Information

|

Feb. 28, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

COMSTOCK INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 28, 2025

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-35200

|

| Entity, Tax Identification Number |

65-0955118

|

| Entity, Address, Address Line One |

117 American Flat Road

|

| Entity, Address, City or Town |

Virginia City

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89440

|

| City Area Code |

775

|

| Local Phone Number |

847-5272

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LODE

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001120970

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

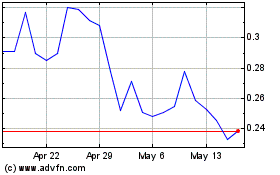

Comstock (AMEX:LODE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Mar 2025