false000080567600008056762025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 | | | | | |

| Date of Report (Date of earliest event reported) | January 23, 2025 |

| | |

| PARK NATIONAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Ohio | 1-13006 | 31-1179518 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | | | | |

| 50 North Third Street, | P.O. Box 3500, | Newark, | Ohio | 43058-3500 |

| (Address of principal executive offices) (Zip Code) |

| | | | | |

| (740) | 349-8451 |

| (Registrant’s telephone number, including area code) |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

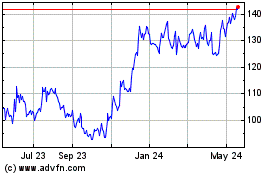

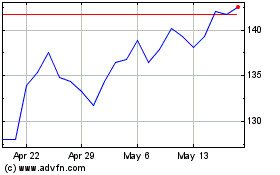

| Common shares, without par value | PRK | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On January 27, 2025, Park National Corporation (“Park”) issued a news release (the “Financial Results News Release”) announcing financial results for the three and twelve months ended December 31, 2024. A copy of the Financial Results News Release is included as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Non-U.S. GAAP Financial Measures

Item 7.01 of this Current Report on Form 8-K as well as the Financial Results News Release contain non-U.S. GAAP (generally accepted accounting principles in the United States or "U.S. GAAP") financial measures where management believes them to be helpful in understanding Park’s results of operations or financial position. Where non-U.S. GAAP financial measures are used, the comparable U.S. GAAP financial measures, as well as the reconciliation from the comparable U.S. GAAP financial measures, can be found in the Financial Results News Release.

Items Impacting Comparability of Period Results

From time to time, revenue, expenses and/or taxes are impacted by items judged by management of Park to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that their impact is believed by management of Park at that time to be infrequent or short-term in nature. Most often, these items impacting comparability of period results are due to merger and acquisition activities and revenue and expenses related to former Vision Bank loan relationships. In other cases, they may result from management's decisions associated with significant corporate actions outside of the ordinary course of business.

Even though certain revenue and expense items are naturally subject to more volatility than others due to changes in market and economic environment conditions, as a general rule, volatility alone does not result in the inclusion of an item as one impacting comparability of period results. For example, changes in the provision for credit losses (aside from those related to former Vision Bank loan relationships), gains (losses) on equity securities, net, and asset valuation adjustments, reflect ordinary banking activities and are, therefore, typically excluded from consideration as items impacting comparability of period results.

Management believes the disclosure of items impacting comparability of period results provides a better understanding of Park's performance and trends and allows management to ascertain which of such items, if any, to include or exclude from an analysis of Park's performance; i.e., within the context of determining how that performance differed from expectations, as well as how, if at all, to adjust estimates of future performance taking such items into account.

Items impacting comparability of the results of particular periods are not intended to be a complete list of items that may materially impact current or future period performance.

Non-U.S. GAAP Financial Measures

Park's management uses certain non-U.S. GAAP financial measures to evaluate Park's performance. Specifically, management reviews the return on average tangible equity, the return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income.

Management has included in the Financial Results News Release information relating to the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income for the three months ended and at December 31, 2024, September 30, 2024, and December 31, 2023 and for the twelve months ended December 31, 2024 and December 31, 2023. For the purpose of calculating the annualized return on average tangible equity, a non-U.S. GAAP financial measure, net income for each period is divided by average tangible equity during the period. Average tangible equity equals average shareholders' equity during the applicable period less average goodwill and other intangible assets during the applicable period. For the purpose of calculating the annualized return on average tangible assets, a non-U.S. GAAP financial measure, net income for each period is divided by average tangible assets during the period. Average tangible assets equals average assets during the applicable period less average goodwill and other intangible assets during the applicable period. For the purpose of calculating the tangible equity to tangible assets ratio, a non-U.S. GAAP financial measure, tangible equity is divided by tangible assets. Tangible equity equals total shareholders' equity less goodwill and other intangible assets, in each case at period end. Tangible assets equal total assets less goodwill and other intangible assets, in each case at period end. For the purpose of calculating tangible book value per common share, a non-U.S. GAAP financial measure, tangible equity is divided by the number of common shares outstanding, in each case at period end. For the purpose of calculating pre-tax, pre-provision net income, a non-U.S. GAAP financial measure, income taxes and the provision for credit losses are added back to net income, in each case during the applicable period.

Management believes that the disclosure of the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income presents additional information to the reader of the consolidated financial statements, which, when read in conjunction with the consolidated financial statements prepared in accordance with U.S. GAAP, assists in analyzing Park's operating performance, ensures comparability of operating performance from period to period, and facilitates comparisons with the performance of Park's peer financial holding companies and bank holding companies, while eliminating certain non-operational effects of acquisitions. In the Financial Results News Release, Park has provided a reconciliation of average tangible equity from average shareholders' equity, average tangible assets from average assets, tangible equity from total shareholders' equity, tangible assets from total assets, and pre-tax, pre-provision net income from net income solely for the purpose of complying with SEC Regulation G and not as an indication that the annualized return on average tangible equity, the annualized return on average tangible assets, the tangible equity to tangible assets ratio, tangible book value per common share and pre-tax, pre-provision net income are substitutes for the annualized return on average equity, the annualized return on average assets, the total shareholders' equity to total assets ratio, book value per common share and net income, respectively, as determined in accordance with U.S. GAAP.

FTE (fully taxable equivalent) Financial Measures

Interest income, yields, and ratios on a FTE basis are considered non-U.S. GAAP financial measures. Management believes net interest income on a FTE basis provides an insightful picture of the interest margin for comparison purposes. The FTE basis also allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The FTE basis assumes a corporate federal statutory tax rate of 21 percent. In the Financial Results News Release, Park has provided a reconciliation of FTE interest income solely for the purpose of complying with SEC Regulation G and not as an indication that FTE interest income, yields and ratios are substitutes for interest income, yields and ratios, as determined in accordance with U.S. GAAP.

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

| | | | | |

| (a) | On January 27, 2025, Mark R. Ramser, who currently serves in the class of directors of Park whose terms will expire at the 2025 Annual Meeting of Shareholders of Park (the "2025 Annual Meeting"), notified Park that he has decided to retire and not stand for re-election to the Board of Directors of Park. Mr. Ramser's term as a director of Park will expire immediately prior to the 2025 Annual Meeting, which will be held on April 28, 2025. In addition, Mark R. Ramser will retire as a director of Park's national bank subsidiary The Park National Bank ("PNB"), effective April 28, 2025 and will also retire as a member of the advisory board of the North Central Division of PNB. |

| |

| Mr. Ramser is not retiring from the Park Board of Directors as a result of a disagreement with Park on any matter related to Park's operations, policies or practices. |

| | | | | |

| (b) | Not applicable |

| (c) | Not applicable |

| (d) | Not applicable |

| (e) | The Compensation Committee of the Board of Directors (the "Compensation Committee") of Park met on January 23, 2025 to determine the 2025 base salaries (the “2025 Base Salaries”) for Park’s executive officers, the discretionary annual incentive compensation award for the twelve-month period ended December 31, 2024 (the "2024 Incentive Compensation") earned by each of Park’s executive officers and the equity-based award granted to each of Park's executive officers.

|

| |

| The 2025 Base Salaries are effective as of March 1, 2025 and the 2024 Incentive Compensation is expected to be paid in March 2025. |

| |

| The following table shows the 2025 Base Salaries and the 2024 Incentive Compensation award for each of Park's executive officers: |

| | | | | | | | |

| Name | 2025 Base Salaries | 2024 Incentive Compensation |

| David L. Trautman | $775,000 | $725,000 |

| Matthew R. Miller | $575,000 | $443,000 |

| Brady T. Burt | $425,000 | $322,000 |

Park National Corporation 2017 Long-Term Incentive Plan for Employees - Performance-Based Restricted Stock Unit Awards

On January 23, 2025, the Compensation Committee determined the dollar value of equity-based awards (the “2025 PBRSU Awards”) of performance-based restricted stock units (“PBRSUs”) to be granted to each of Messrs. Trautman, Miller and Burt based on Park's closing share price on January 30, 2025, which 2025 PBRSU Awards are subject to the terms and conditions of Park’s 2017 Long-Term Incentive Plan for Employees (the “2017 Employees LTIP”) and the award agreements evidencing the 2025 PBRSU Awards.

The following table shows the minimum/target dollar value of PBRSUs which may be earned (the “Target Award”) and the maximum dollar value of PBRSUs which may be earned (the “Maximum Award”) in respect of the 2025

PBRSU Award to be granted to each of Messrs. Trautman, Miller and Burt. The actual number of PBRSUs awarded will be based on the dollar value approved and Park's closing share price on January 30, 2025.

| | | | | | | | |

| Name and Position | Target Award | Maximum Award |

David L. Trautman

Chairman of the Board and Chief Executive Officer of each Park and PNB | $675,000 | $1,012,500 |

| | |

Matthew R. Miller

President of each Park and PNB | $450,000 | $675,000 |

| | |

Brady T. Burt

Chief Financial Officer, Secretary and Treasurer of Park; Senior Vice President and Chief Financial Officer of PNB | $250,000 | $375,000 |

The number of PBRSUs earned and settled or, in the alternative, forfeited will be based upon Park’s performance, measured by Park’s cumulative return on average assets (“Cumulative ROA”) for the three-year performance period beginning January 1, 2025 and ending December 31, 2027 (the “Performance Period”), relative to the Cumulative ROA results for the Performance Period for the Industry Index of financial services holding companies (excluding corporations classified for federal income tax purposes as "S" corporations) in the United States with total consolidated assets of $5 billion to $15 billion (the "$5B to $15B Industry Index"). However, no PBRSUs will be earned by Messrs. Trautman, Miller and Burt if Park’s consolidated net income for each fiscal year during the Performance Period has not equaled or exceeded an amount equal to 110% of all cash dividends declared and paid by Park during such fiscal year.

Park’s performance at the 50th percentile and the 80th percentile of the performance of the $5B to $15B Industry Index will result in Messrs. Trautman, Miller and Burt earning PBRSUs representing the Target Award and the Maximum Award, respectively (interpolated on a straight line basis for performance at percentiles between these specified percentiles), covered by their respective grants.

Any PBRSUs earned based on Park’s performance relative to the performance of the $5B to $15B Industry Index will also be subject to a service-based vesting requirement. One-half of the PBRSUs earned in respect of the Performance Period will vest and be settled in Park common shares (on a one-for-one basis) on the date the Compensation Committee determines and certifies the number of PBRSUs earned in respect of the Performance Period (the “Certification Date”) if the executive officer earning such PBRSUs is still employed by Park or one of Park's subsidiaries on the Certification Date. On the first anniversary of the Certification Date, the other half of the PBRSUs earned in respect of the Performance Period will vest and be settled in Park common shares (on a one-for-one basis) if the executive officer earning such PBRSUs is still employed by Park or one of Park's subsidiaries on the first anniversary of the Certification Date. Subject to the terms of the award agreement evidencing each 2025 PBRSU Award, none of the Park common shares received by each of Messrs. Trautman, Miller and Burt upon settlement of earned and vested PBRSUs may be sold, transferred, assigned or otherwise similarly disposed of by him for a period of five years after the date of settlement.

Each award agreement evidencing a 2025 PBRSU Award also addresses the effect of termination of employment of the executive officer to whom the 2025 PBRSU Award is granted, the effect of a defined “Change in Control” for purposes of the 2017 Employees LTIP and events the occurrence of which will result in the forfeiture of the PBRSUs and any common shares delivered pursuant to the award agreement.

Item 7.01 - Regulation FD Disclosure

Financial Results

Highlights from the three-month and twelve-month periods ended December 31, 2024 and 2023 included:

•Net income for the three months ended December 31, 2024 of $38.6 million represented a $14.1 million, or 57.7%, increase compared to $24.5 million for the three months ended December 31, 2023. Pre-tax, pre-provision net income for the three months ended December 31, 2024 of $51.3 million represented a $19.7 million, or 62.5%, increase compared to $31.6 million for the three months ended December 31, 2023.

•Net income for the twelve months ended December 31, 2024 of $151.4 million represented a $24.7 million, or 19.5%, increase compared to $126.7 million for the twelve months ended December 31, 2023. Pre-tax, pre-provision net income for the twelve months ended December 31, 2024 of $199.3 million represented a $42.8 million, or 27.3%, increase compared to $156.5 million for the twelve months ended December 31, 2023.

•Park recognized a pension settlement gain of $365,000 and $6.1 million during the three months and twelve months ended December 31, 2024, respectively, due to a combination of lump sum payouts as well as the purchase of a nonparticipating annuity contract which will provide ongoing benefits to vested and retired participants. There was no pension settlement gain recognized during the three months or the twelve months ended December 31, 2023.

•During the three months and twelve months ended December 31, 2024, Park paid $1.7 million for special bonuses for associates, which had been accrued for during the three months ended September 30, 2024. There were no similar special bonuses paid or accrued during the three months or the twelve months ended December 31, 2023.

•During the twelve months ended December 31, 2024 and December 31, 2023, Park contributed $2.0 million and $1.0 million, respectively, to its charitable foundation. During the three months ended December 31, 2023, Park contributed $1.0 million to its charitable foundation. There was no contribution to its charitable foundation during the three months ended December 31, 2024.

•Park completed a series of debt security sale trades in November 2023, selling an aggregate of $291.0 million in AFS debt securities with a net loss of $7.9 million for the three months and twelve months ended December 31, 2023. Among the various objectives of the trade, the liquidity generated from the sale was used to reduce borrowing needs. A net loss on sale of debt securities of $128,000 and $526,000 was recognized during the three months and twelve months ended December 31, 2024, respectively.

Net income for each of the three months ended December 31, 2024, September 30, 2024 and December 31, 2023 and for the twelve months ended December 31, 2024 and December 31, 2023, included several items of income and expense that impacted comparability of period results. These items are detailed in the "Financial Reconciliations" section within the Financial Results News Release.

The following discussion provides additional information regarding Park.

Park National Corporation (Park)

The following table reflects the net income for each quarter of 2024, and for the years ended December 31, 2024, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | 2024 | 2023 | 2022 |

| Net interest income | $ | 103,445 | | $ | 101,114 | | $ | 97,837 | | $ | 95,623 | | $ | 398,019 | | $ | 373,113 | | $ | 347,059 | |

| Provision for credit losses | 3,935 | | 5,315 | | 3,113 | | 2,180 | | 14,543 | | 2,904 | | 4,557 | |

| Other income | 31,064 | | 36,530 | | 28,794 | | 26,200 | | 122,588 | | 92,634 | | 135,935 | |

| Other expense | 83,241 | | 85,681 | | 75,189 | | 77,228 | | 321,339 | | 309,239 | | 297,978 | |

| Income before income taxes | $ | 47,333 | | $ | 46,648 | | $ | 48,329 | | $ | 42,415 | | $ | 184,725 | | $ | 153,604 | | $ | 180,459 | |

| Income tax expense | 8,703 | | 8,431 | | 8,960 | | 7,211 | | 33,305 | | 26,870 | | 32,108 | |

| Net income | $ | 38,630 | | $ | 38,217 | | $ | 39,369 | | $ | 35,204 | | $ | 151,420 | | $ | 126,734 | | $ | 148,351 | |

Net interest income of $398.0 million for the twelve months ended December 31, 2024 represented a $24.9 million, or 6.7%, increase compared to $373.1 million for the twelve months ended December 31, 2023. The increase was a result of a $51.3 million increase in interest income, partially offset by a $26.4 million increase in interest expense.

The $51.3 million increase in interest income was due to a $67.8 million increase in interest income on loans, partially offset by a $16.5 million decrease in investment income. The $67.8 million increase in interest income on loans was primarily the result of a $404.9 million (or 5.61%) increase in average loans, from $7.22 billion for the twelve months ended December 31, 2023 to $7.63 billion for the twelve months ended December 31, 2024, as well as an increase in the yield on loans, which increased 59 basis points to 6.14% for the twelve months ended December 31, 2024, compared to 5.55% for the twelve months ended December 31, 2023. The $16.5 million decrease in investment income was primarily the result of a $490.8 million (or 25.18%) decrease in average investments, including money market investments, from $1.95 billion for the twelve months ended December 31, 2023 to $1.46 billion for the twelve months ended December 31, 2024. The decrease in average investments was partially offset by an increase in the yield on investments, including money market investments, which increased 6 basis points to 3.90% for the twelve months ended December 31, 2024, compared to 3.84% for the twelve months ended December 31, 2023.

The $26.4 million increase in interest expense was due to a $27.9 million increase in interest expense on deposits, as well as a $1.5 million increase in interest expense on borrowings. The increase in interest expense on deposits was the result of a $150.2 million (or 2.71%) increase in average on-balance sheet interest bearing deposits from $5.55 billion for the twelve months ended December 31, 2023, to $5.70 billion for the twelve months ended December 31, 2024, as well as an increase in the cost of deposits of 45 basis points, from 1.52% for the twelve months ended December 31, 2023 to 1.97% for the twelve months ended December 31, 2024. The increase in on-balance sheet interest bearing deposits was due to an increase in brokered deposits, bid CD deposits and time deposits, which was partially offset by decreases in savings accounts and transaction accounts.

The provision for credit losses of $14.5 million for the twelve months ended December 31, 2024 represented an increase of $11.6 million, compared to $2.9 million for the twelve months ended December 31, 2023. Refer to the “Credit Metrics and Provision for Credit Losses” section for additional details regarding the level of the provision for credit losses recognized in each period presented.

The table below reflects Park's total other income for the twelve months ended December 31, 2024 and 2023.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | 2024 | 2023 | $ change | % change |

| Other income: | | | | |

| Income from fiduciary activities | $ | 42,489 | | $ | 35,474 | | $ | 7,015 | | 19.8 | % |

| Service charges on deposit accounts | 9,001 | | 8,445 | | 556 | | 6.6 | % |

| Other service income | 11,743 | | 10,300 | | 1,443 | | 14.0 | % |

| Debit card fee income | 25,873 | | 26,522 | | (649) | | (2.4) | % |

| Bank owned life insurance income | 7,770 | | 5,338 | | 2,432 | | 45.6 | % |

| ATM fees | 1,840 | | 2,178 | | (338) | | (15.5) | % |

| Pension settlement gain | 6,148 | | — | | 6,148 | | N.M. |

| Loss on sale of debt securities, net | (526) | | (7,875) | | 7,349 | | N.M. |

| Gain on equity securities, net | 3,080 | | 971 | | 2,109 | | 217.2 | % |

| Other components of net periodic benefit income | 9,263 | | 7,572 | | 1,691 | | 22.3 | % |

| Miscellaneous | 5,907 | | 3,709 | | 2,198 | | 59.3 | % |

| Total other income | $ | 122,588 | | $ | 92,634 | | $ | 29,954 | | 32.3 | % |

Other income of $122.6 million for the twelve months ended December 31, 2024 represented an increase of $30.0 million, or 32.3%, compared to $92.6 million for the twelve months ended December 31, 2023. The $7.0 million increase in income from fiduciary activities was largely due to an increase in the market value of assets under management as well as updates to the fee structure. The $1.4 million increase in other service income was mainly due to an increase in mortgage related other service income. The $649,000 decrease in debit card fee income was partially due to a decrease in the average blended interchange rate per transaction, which is influenced by various factors, including the average spend per transaction. The $2.4 million increase in bank owned life insurance income was primarily related to an increase in death benefits received during the twelve months ended December 31, 2024. The change in pension settlement gain was due to a $6.1 million pension settlement gain, which was related to a combination of lump sum payouts as well as the purchase of a nonparticipating annuity contract which will provide ongoing benefits to vested and retired participants. The change in loss on sale of debt securities, net was due to net losses on the sale of debt securities of $526,000 recorded during the twelve months ended December 31, 2024 compared to net losses on sale

of debt securities of $7.9 million during the twelve months ended December 31, 2023. The $2.1 million increase in the gain on equity securities, net, was due to a $2.4 million increase in the gain on equity securities carried at fair value, and a $97,000 increase in the gain on equity securities carried at net asset value. The $1.7 million increase in other components of net periodic benefit income was largely due to an increase in the expected return on plan assets. The increase in miscellaneous income was largely due to an increase in net gain on sale of assets.

The table below reflects Park's total other expense for the twelve months ended December 31, 2024 and 2023.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | 2024 | 2023 | $ change | % change |

| Other expense: | | | | |

| Salaries | $ | 147,311 | | $ | 139,237 | | $ | 8,074 | | 5.8 | % |

| Employee benefits | 41,724 | | 42,264 | | (540) | | (1.3) | % |

| Occupancy expense | 12,816 | | 13,114 | | (298) | | (2.3) | % |

| Furniture and equipment expense | 9,983 | | 12,233 | | (2,250) | | (18.4) | % |

| Data processing fees | 40,564 | | 37,637 | | 2,927 | | 7.8 | % |

| Professional fees and services | 31,146 | | 29,173 | | 1,973 | | 6.8 | % |

| Marketing | 6,318 | | 5,471 | | 847 | | 15.5 | % |

| Insurance | 6,735 | | 7,640 | | (905) | | (11.8) | % |

| Communication | 4,097 | | 4,210 | | (113) | | (2.7) | % |

| State tax expense | 4,500 | | 4,657 | | (157) | | (3.4) | % |

| Amortization of intangible assets | 1,215 | | 1,323 | | (108) | | (8.2) | % |

| Foundation contributions | 2,000 | | 1,000 | | 1,000 | | 100.0 | % |

| Miscellaneous | 12,930 | | 11,280 | | 1,650 | | 14.6 | % |

| Total other expense | $ | 321,339 | | $ | 309,239 | | $ | 12,100 | | 3.9 | % |

Total other expense of $321.3 million for the twelve months ended December 31, 2024 represented an increase of $12.1 million compared to $309.2 million for the twelve months ended December 31, 2023. The increase in salaries expense was primarily related to increases in base salary expense, incentive compensation expense and additional incentive compensation expense, that included a $1.7 million expense for a special incentive payment, partially offset by a decrease in share-based compensation expense. The decrease in employee benefit expense was primarily due to a decrease in group insurance expense, partially offset by an increase in retirement expense. The decrease in furniture and equipment expense was primarily due to decreases in depreciation expense and maintenance and repairs expense. The increase in data processing fees was mainly related to an increase in software related expenses, partially offset by a decrease in ATM and debit card processing expense. The increase in professional fees and services expense was primarily due to increases in consulting expenses, credit services expense, IntraFi deposit fee expense and temporary wage expense, partially offset by decreases in legal expenses and other fees expense. The increase in marketing expense was primarily due to increases in advertising expense. The decrease in insurance expense was primarily due to decreases in FDIC insurance expense. The increase in foundation contributions was the result of a $2.0 million contribution made during the twelve months ended December 31, 2024, compared to a $1.0 million contribution made during the twelve months ended December 31, 2023. The increase in miscellaneous expense is primarily due to an increase in expense for the allowance for unfunded credit losses and other non-loan related losses.

The table below provides certain balance sheet information and financial ratios for Park as of or for the year ended December 31, 2024 and 2023.

| | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2024 | December 31, 2023 | | % change from 12/31/23 |

| Loans | 7,817,128 | | 7,476,221 | | | 4.56 | % |

| Allowance for credit losses | 87,966 | | 83,745 | | | 5.04 | % |

| Net loans | 7,729,162 | | 7,392,476 | | | 4.55 | % |

| Investment securities | 1,100,861 | | 1,429,144 | | | (22.97) | % |

| Total assets | 9,805,350 | | 9,836,453 | | | (0.32) | % |

| Total deposits | 8,143,526 | | 8,042,566 | | | 1.26 | % |

Average assets (1) | 9,901,264 | | 9,957,554 | | | (0.57) | % |

Efficiency ratio (2) | 61.44 | % | 65.87 | % | | (6.73) | % |

| Return on average assets | 1.53 | % | 1.27 | % | | 20.47 | % |

(1) Average assets for each of the years ended December 31, 2024 and 2023.

(2) Efficiency ratio is calculated by dividing total other expense by the sum of fully taxable equivalent net interest income and other income. Fully taxable equivalent net interest income includes the effects of taxable equivalent adjustments using a 21% federal corporate income tax rate. The taxable equivalent adjustments were $2.4 million and $3.7 million, respectively, for the years ended December 31, 2024 and 2023.

Loans

Loans outstanding at December 31, 2024 were $7.82 billion, compared to $7.48 billion at December 31, 2023, an increase of $340.9 million. The table below breaks out the change in loans outstanding, by loan type.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2024 | December 31, 2023 | | $ change from 12/31/23 | % change from 12/31/23 | |

| Home equity | $ | 203,927 | | $ | 174,621 | | | $ | 29,306 | | 16.8 | % | |

| Installment | 1,927,168 | | 1,950,304 | | | (23,136) | | (1.2) | % | |

| Real estate | 1,452,833 | | 1,340,169 | | | 112,664 | | 8.4 | % | |

| Commercial | 4,230,399 | | 4,007,941 | | | 222,458 | | 5.6 | % | |

| Other | 2,801 | | 3,186 | | | (385) | | (12.1) | % | |

Total loans | $ | 7,817,128 | | $ | 7,476,221 | | | $ | 340,907 | | 4.6 | % | |

Park's allowance for credit losses was $88.0 million at December 31, 2024, compared to $83.7 million at December 31, 2023, an increase of $4.2 million, or 5.0%. Refer to the “Credit Metrics and Provision for Credit Losses” section for additional information regarding Park's loan portfolio and the level of provision for credit losses recognized in each period presented.

Deposits

Total deposits at December 31, 2024 were $8.14 billion, compared to (i) $8.21 billion at September 30, 2024, a decrease of $71.1 million and (ii) $8.04 billion at December 31, 2023, an increase of $101.0 million. Total deposits including off balance sheet deposits at December 31, 2024 were $8.26 billion, compared to (i) $8.21 billion at September 30, 2024, an increase of $44.0 million and (ii) $8.04 billion at December 31, 2023, an increase of $215.0 million.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2024 | September 30, 2024 | December 31, 2023 | | $ change from 9/30/24 | % change from 9/30/24 | | $ change from 12/31/23 | % change from 12/31/23 |

| Non-interest bearing deposits | $ | 2,612,708 | | $ | 2,516,722 | | $ | 2,628,234 | | | $ | 95,986 | | 3.8 | % | | $ | (15,526) | | (0.6) | % |

| Transaction accounts | 1,939,755 | | 2,141,208 | | 2,064,512 | | | (201,453) | | (9.4) | % | | (124,757) | | (6.0) | % |

| Savings | 2,679,280 | | 2,743,507 | | 2,543,220 | | | (64,227) | | (2.3) | % | | 136,060 | | 5.3 | % |

| Certificates of deposit | 735,297 | | 722,236 | | 641,615 | | | 13,061 | | 1.8 | % | | 93,682 | | 14.6 | % |

| Brokered and bid CD deposits | 176,486 | | 90,998 | | 164,985 | | | 85,488 | | 93.9 | % | | 11,501 | | 7.0 | % |

| Total deposits | $ | 8,143,526 | | $ | 8,214,671 | | $ | 8,042,566 | | | $ | (71,145) | | (0.9) | % | | $ | 100,960 | | 1.3 | % |

| Off balance sheet deposits | $ | 115,186 | | $ | — | | $ | 1,185 | | | 115,186 | | N.M. | | 114,001 | | N.M. |

| Total deposits including off balance sheet deposits | $ | 8,258,712 | | $ | 8,214,671 | | $ | 8,043,751 | | | 44,041 | | 0.5 | % | | 214,961 | | 2.7 | % |

Park's deposits grew during the COVID pandemic and declined toward pre-pandemic levels throughout 2022 and 2023. In order to manage the impact of deposit growth on its balance sheet, Park utilizes a program where certain deposit balances are transferred off balance sheet while maintaining the customer relationship. Park is able to increase or decrease the amount of deposit balances transferred off balance sheet based on its balance sheet management strategies and liquidity needs.

The table below breaks out the change in deposit balances, by deposit type, for Park.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2024 | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

| Retail deposits | $ | 4,035,351 | | $ | 4,080,372 | | $ | 4,388,394 | | $ | 4,416,228 | | $ | 4,025,852 | | $ | 3,748,039 | |

| Commercial deposits | 3,931,689 | | 3,797,209 | | 3,846,321 | | 3,488,300 | | 3,535,578 | | 3,233,269 | |

| Brokered and bid CD deposits | 176,486 | | 164,985 | | — | | — | | 10,928 | | 71,304 | |

| Total deposits | $ | 8,143,526 | | $ | 8,042,566 | | $ | 8,234,715 | | $ | 7,904,528 | | $ | 7,572,358 | | $ | 7,052,612 | |

| Off balance sheet deposits | 115,186 | | 1,185 | | 195,937 | | 983,053 | | 710,101 | | — | |

| Total deposits including off balance sheet deposits | $ | 8,258,712 | | $ | 8,043,751 | | $ | 8,430,652 | | $ | 8,887,581 | | $ | 8,282,459 | | $ | 7,052,612 | |

| $ change from prior period end | $ | 214,961 | | $ | (386,901) | | $ | (456,929) | | $ | 605,122 | | $ | 1,229,847 | | |

| % change from prior period end | 2.7 | % | (4.6) | % | (5.1) | % | 7.3 | % | 17.4 | % | |

| | | | | | |

| Noninterest bearing deposits to total deposits | 32.1 | % | 32.7 | % | 37.3 | % | 38.8 | % | 36.0 | % | 27.8 | % |

During the year ended December 31, 2024, total deposits including off balance sheet deposits increased by $215.0 million, or 2.7%. This increase consisted of a $134.5 million increase in total commercial deposits, a $114.0 million increase in off balance sheet deposits and a $11.5 million increase in brokered and bid CD deposits, partially offset by a $45.0 million decrease in total retail deposits. The majority of off balance sheet deposits are commercial and thus impact the change in commercial deposits as the deposits are moved on or off the balance sheet.

Included in the total commercial deposits and off balance sheet deposits shown in the previous tables are public fund deposits. These balances fluctuate based on seasonality and the cycle of collection and remittance of tax funds. Public funds are also

included in Bid Ohio CDs. The following table details the change in public funds held on Park's balance sheet.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | December 31, 2024 | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

| Public funds included in commercial deposits | $ | 1,278,325 | | $ | 1,198,418 | | $ | 1,335,400 | | $ | 1,548,217 | | $ | 1,406,101 | | $ | 1,293,090 | |

| Bid Ohio CDs | 76,497 | | 15,000 | | — | | — | | — | | — | |

| Total public fund deposits | $ | 1,354,822 | | $ | 1,213,418 | | $ | 1,335,400 | | $ | 1,548,217 | | $ | 1,406,101 | | $ | 1,293,090 | |

| $ change from prior period end | $ | 141,404 | | $ | (121,982) | | $ | (212,817) | | $ | 142,116 | | $ | 113,011 | | |

| % change from prior period end | 11.7 | % | (9.1) | % | (13.7) | % | 10.1 | % | 8.7 | % | |

| | | | | | |

| Cost of public fund deposits | 2.36 | % | 2.24 | % | 0.60 | % | 0.11 | % | 0.52 | % | 1.77 | % |

| Cost of total interest bearing deposits | 1.97 | % | 1.52 | % | 0.39 | % | 0.12 | % | 0.41 | % | 1.01 | % |

As of December 31, 2024, Park had approximately $1.4 billion of uninsured deposits, which was 17.6% of total deposits. Uninsured deposits of $1.4 billion included $395.4 million of deposits that were over $250,000, but were fully collateralized by Park's investment securities portfolio.

Credit Metrics and Provision for Credit Losses

Park reported a provision for credit losses for the year ended December 31, 2024 of $14.5 million, compared to $2.9 million for the year ended December 31, 2023. Net charge-offs were $10.3 million, or 0.14%, of total average loans, for the year ended December 31, 2024, compared to $4.9 million, or 0.07%, of total average loans, for the year ended December 31, 2023. Included in net charge-offs for the year ended December 31, 2024 was $4.2 million in charge-offs related to two relationships that previously carried a specific reserve.

The table below provides additional information related to Park's allowance for credit losses as of December 31, 2024 and December 31, 2023.

| | | | | | | | |

| (Dollars in thousands) | 12/31/2024 | 12/31/2023 |

| Total allowance for credit losses | $ | 87,966 | | $ | 83,745 | |

| Allowance on accruing purchased credit deteriorated ("PCD") loans | — | | — | |

| Specific reserves on individually evaluated loans | 1,299 | | 4,983 | |

| General reserves on collectively evaluated loans | $ | 86,667 | | $ | 78,762 | |

| | |

| Total loans | $ | 7,817,128 | | $ | 7,476,221 | |

| Accruing PCD loans | 2,174 | | 2,835 | |

| Individually evaluated loans | 53,149 | | 45,215 | |

| Collectively evaluated loans | $ | 7,761,805 | | $ | 7,428,171 | |

| | |

| Total allowance for credit losses as a % of total loans | 1.13 | % | 1.12 | % |

| | |

| General reserve as a % of collectively evaluated loans | 1.12 | % | 1.06 | % |

The total allowance for credit losses of $88.0 million at December 31, 2024 represented a $4.2 million, or 5.0%, increase compared to $83.7 million at December 31, 2023. The increase was due to a $7.9 million increase in general reserves partially offset by a $3.7 million decrease in specific reserves. The $7.9 million increase in general reserves included a $757,000 additional reserve related to Hurricane Helene which impacted borrowers in Park's Carolina region. This reserve considers the overall population of loans to borrowers in this area. Management will continue to evaluate potential losses as a result of Hurricane Helene as additional information becomes available.

As part of its quarterly allowance process, Park evaluates certain industries which are more likely to be under economic stress in the current environment. The office sector continues to face challenges as it adjusts to the new normal of work from home brought on by the pandemic. Nationally, office properties in downtown and urban business districts are seeing the most stress. As of December 31, 2024, Park had $247.2 million of loans which were fully or partially secured by non-owner-occupied office space, $244.0 million of which were accruing. This portfolio is not currently exhibiting signs of stress, but Park continues to monitor this portfolio, and others, for signs of deterioration.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Park cautions that any forward-looking statements contained in this Current Report on Form 8-K or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements.

Risks and uncertainties that could cause actual results to differ materially include, without limitation:

◦Park's ability to execute our business plan successfully and within the expected timeframe as well as our ability to manage strategic initiatives;

◦current and future economic and financial market conditions, either nationally or in the states in which Park and our subsidiaries do business, that may reflect deterioration in business and economic conditions, including the effects of higher unemployment rates or labor shortages, the impact of persistent inflation, the impact of continued elevated interest rates, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, U.S. fiscal debt, budget and tax matters, geopolitical matters, and any slowdown in global economic growth, any of which may result in adverse impacts on the demand for loan, deposit and other financial services, delinquencies, defaults and counterparties' inability to meet credit and other obligations and the possible impairment of collectability of loans;

◦factors that can impact the performance of our loan portfolio, including changes in real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers and the success of construction projects that we finance;

◦the effect of monetary and other fiscal policies (including the impact of money supply, ongoing increasing market interest rate policies and policies impacting inflation, of the Federal Reserve Board, the U.S. Treasury and other governmental agencies) as well as disruption in the liquidity and functioning of U.S. financial markets, may adversely impact prepayment penalty income, mortgage banking income, income from fiduciary activities, the value of securities, deposits and other financial instruments, in addition to the loan demand and the performance of our loan portfolio, and the interest rate sensitivity of our consolidated balance sheet as well as reduce net interest margins;

◦changes in the federal, state, or local tax laws may adversely affect the fair values of net deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio and otherwise negatively impact our financial performance;

◦the impact of the changes in federal, state and local governmental policy, including the regulatory landscape, capital markets, elevated government debt, potential changes in tax legislation that may increase tax rates, government shutdown, infrastructure spending and social programs;

◦changes in laws or requirements imposed by Park's regulators impacting Park's capital actions, including dividend payments and stock repurchases;

◦changes in consumer spending, borrowing and saving habits, whether due to changes in retail distribution strategies, consumer preferences and behaviors, changes in business and economic conditions, legislative and regulatory initiatives, or other factors may be different than anticipated;

◦changes in customers', suppliers', and other counterparties' performance and creditworthiness, and Park's expectations regarding future credit losses and our allowance for credit losses, may be different than anticipated due to the continuing impact of and the various responses to inflationary pressures and continued elevated interest rates;

◦Park may have more credit risk and higher credit losses to the extent there are loan concentrations by location or industry of borrowers or collateral;

◦the volatility from quarter to quarter of mortgage banking income, whether due to interest rates, demand, the fair value of mortgage loans, or other factors;

◦the adequacy of our internal controls and risk management program in the event of changes in the market, economic, operational (including those which may result from our associates working remotely), asset/liability repricing, legal, compliance, strategic, cybersecurity, liquidity, credit and interest rate risks associated with Park's business;

◦competitive pressures among financial services organizations could increase significantly, including product and pricing pressures (which could in turn impact our credit spreads), changes to third-party relationships and revenues, changes in the manner of providing services, customer acquisition and retention pressures, and Park's ability to attract, develop and retain qualified banking professionals;

◦uncertainty regarding the nature, timing, cost and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight structure of the financial services industry and changes in laws and regulations concerning taxes, FDIC insurance premium levels, pensions, bankruptcy, consumer protection, rent regulation and housing, financial accounting and reporting, environmental protection, insurance, bank products and services, bank and bank holding company capital and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry;

◦Park's ability to meet heightened supervisory requirements and expectations;

◦the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, may adversely affect Park's reported financial condition or results of operations;

◦Park's assumptions and estimates used in applying critical accounting policies and modeling which may prove unreliable, inaccurate or not predictive of actual results;

◦the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions;

◦Park's ability to anticipate and respond to technological changes and Park's reliance on, and the potential failure of, a number of third-party vendors to perform as expected, including Park's primary core banking system provider, which can impact Park's ability to respond to customer needs and meet competitive demands;

◦operational issues stemming from and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems on which Park and our subsidiaries are highly dependent;

◦Park's ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks, including those of Park's third-party vendors and other service providers, which may prove inadequate, and could adversely affect customer confidence in Park and/or result in Park incurring a financial loss;

◦a failure in or breach of Park's operational or security systems or infrastructure, or those of our third-party vendors and other service providers, resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems, including as a result of cyber attacks;

◦the impact on Park's business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of the adequacy of Park's intellectual property protection in general;

◦the existence or exacerbation of general geopolitical instability and uncertainty as well as the effect of trade policies (including the impact of potential or imposed tariffs, a U.S. withdrawal from or significant renegotiation of trade agreements, trade wars and other changes in trade regulations, closing of border crossings and changes in the relationship of the U.S. and its global trading partners);

◦the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the growth rates and financial stability of certain sovereign governments, supranationals and financial institutions in Europe and Asia and the risk they may face difficulties servicing their sovereign debt;

◦the effect of a fall in stock market prices on Park's asset and wealth management businesses;

◦our litigation and regulatory compliance exposure, including the costs and effects of any adverse developments in legal proceedings or other claims, the costs and effects of unfavorable resolution of regulatory and other governmental examinations or other inquiries, and liabilities and business restrictions resulting from litigation and regulatory investigations;

◦continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends;

◦the impact on Park's business, personnel, facilities or systems of losses related to acts of fraud, scams and schemes of third parties;

◦the impact of widespread natural and other disasters, pandemics, dislocations, regional or national protests and civil unrest (including any resulting branch closures or damages), military or terrorist activities or international hostilities on the economy and financial markets generally and on us or our counterparties specifically;

◦the potential further deterioration of the U.S. economy due to financial, political, or other shocks;

◦the effect of healthcare laws in the U.S. and potential changes for such laws which may increase our healthcare and other costs and negatively impact our operations and financial results;

◦the impact of larger or similar-sized financial institutions encountering problems which may adversely affect the banking industry and/or Park's business generation and retention, funding and liquidity, including potential increased regulatory requirements and increased reputational risk and potential impacts to macroeconomic conditions;

◦Park's continued ability to grow deposits or maintain adequate deposit levels due to changing customer behaviors;

◦unexpected outflows of deposits which may require Park to sell assets at a loss; and

◦other risk factors included in the current and periodic reports filed by Park with the SEC from time to time.

Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Item 8.01 - Other Events

Declaration of Cash Dividend

As reported in the Financial Results News Release, on January 27, 2025, the Park Board declared a $1.07 per common share quarterly cash dividend in respect of Park's common shares. The cash dividend is payable on March 10, 2025 to common shareholders of record as of the close of business on February 14, 2025. A copy of the Financial Results News Release is included as Exhibit 99.1 and the portion thereof addressing the declaration of the quarterly cash dividend by the Park Board is incorporated by reference herein.

Item 9.01 - Financial Statements and Exhibits.

(a)Not applicable

(b)Not applicable

(c)Not applicable

(d)Exhibits. The following exhibits are included with this Current Report on Form 8-K:

Exhibit No. Description

99.1 News Release issued by Park National Corporation on January 27, 2025 addressing financial results for the three months and twelve months ended December 31, 2024 and declaration of quarterly cash dividend

104 Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PARK NATIONAL CORPORATION |

| | | |

| Dated: January 27, 2025 | By: | /s/ Brady T. Burt |

| | | Brady T. Burt |

| | | Chief Financial Officer, Secretary and Treasurer |

| | | |

January 27, 2025 Exhibit 99.1

Park National Corporation reports 2024 results

NEWARK, Ohio ‒ Park National Corporation (Park) (NYSE American: PRK) today reported financial results for the fourth quarter and full year of 2024. Park's board of directors declared a quarterly cash dividend of $1.07 per common share, payable on March 10, 2025, to common shareholders of record as of February 14, 2025.

“Our consistent and measured growth stems from our team’s absolute focus on meeting customer needs to produce meaningful results,” said Park Chairman and Chief Executive Officer David Trautman. “Helping customers flourish remains our primary goal.”

Park’s net income for the fourth quarter of 2024 was $38.6 million, a 57.7 percent increase from $24.5 million for the fourth quarter of 2023. Fourth quarter 2024 net income per diluted common share was $2.37, compared to $1.51 for the fourth quarter of 2023. Park's net income for the full year of 2024 was $151.4 million, a 19.5 percent increase from $126.7 million for the full year of 2023. Net income per diluted common share for the full year of 2024 was $9.32 compared to $7.80 for the full year of 2023.

Park’s total loans increased 4.6 percent during 2024. Park's total deposits increased 1.3 percent during 2024, with an increase of 2.7 percent including off balance sheet deposits. The combination of solid loan growth and steady deposits contributed to Park's success in 2024.

“As we enter the new year, we look forward to the opportunity to deepen relationships with our customers, communities and all stakeholders,” said Park President Matthew Miller. “Our bankers are dedicated to helping all those we serve achieve their financial goals and thrive in 2025,” said Park President Matthew Miller.

Headquartered in Newark, Ohio, Park National Corporation has $9.8 billion in total assets (as of December 31, 2024). Park's banking operations are conducted through its subsidiary The Park National Bank. Other Park subsidiaries are Scope Leasing, Inc. (d.b.a. Scope Aircraft Finance), Guardian Financial Services Company (d.b.a. Guardian Finance Company) and SE Property Holdings, LLC.

Complete financial tables are listed below.

Category: Earnings

Media contact: Michelle Hamilton, 740.349.6014, media@parknationalbank.com

Investor contact: Brady Burt, 740.322.6844, investor@parknationalbank.com

Park National Corporation, 50 N. Third Street, Newark, Ohio 43055

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Park cautions that any forward-looking statements contained in this news release or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties, including those described in Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by our filings with the SEC. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements.

Risks and uncertainties that could cause actual results to differ materially include, without limitation: (1) Park's ability to execute our business plan successfully and within the expected timeframe; (2) adverse changes in future economic and financial market conditions; (3) adverse changes in real estate values and liquidity in our primary market areas; (4) the financial health of our commercial borrowers; (5) adverse changes in federal, state and local governmental law and policy, including the regulatory landscape, capital markets, elevated government debt, potential changes in tax legislation, government shutdown, infrastructure spending and social programs; (6) changes in consumer spending, borrowing and saving habits; (7) our litigation and regulatory compliance exposure; (8) increased credit risk and higher credit losses resulting from loan concentrations; (9) competitive pressures among financial services organizations; (10) changes in accounting policies and practices as may be adopted by regulatory agencies; (11) Park's assumptions and estimates used in applying critical accounting policies and modeling which may prove unreliable, inaccurate or not predictive of actual results; (12) Park's ability to anticipate and respond to technological changes and Park's reliance on, and the potential failure of, a number of third-party vendors to perform as expected; (13) failures in or breaches of Park's operational or security systems or infrastructure, or those of our third-party vendors and other service providers; (14) negative impacts on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the growth rates and financial stability of certain sovereign governments, supranationals and financial institutions in Europe and Asia; (15) effects of a fall in stock market prices on Park's asset and wealth management businesses; (16) continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; (17) the impact on Park's business, personnel, facilities or systems of losses related to acts of fraud, scams and schemes of third parties; (18) the impact of widespread natural and other disasters, pandemics, dislocations, regional or national protests and civil unrest (including any resulting branch closures or damages), military or terrorist activities or international hostilities on the economy and financial markets generally and on us or our counterparties specifically; (19) the potential further deterioration of the U.S. economy due to financial, political, or other shocks; (20) the effect of healthcare laws in the U.S. and potential changes for such laws that may increase our healthcare and other costs and negatively impact our operations and financial results; (21) the impact of larger or similar-sized financial institutions encountering problems that may adversely affect the banking industry; and (22) other risk factors relating to the financial services industry.

Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | | | | | | | |

| PARK NATIONAL CORPORATION |

| Financial Highlights |

| As of or for the three months ended December 31, 2024, September 30, 2024 and December 31, 2023 | | | | | |

| | | | | | | |

| | 2024 | 2024 | 2023 | | Percent change vs. |

| (in thousands, except common share and per common share data and ratios) | 4th QTR | 3rd QTR | 4th QTR | | 3Q '24 | 4Q '23 |

| INCOME STATEMENT: | | | | | | |

| Net interest income | $ | 103,445 | | $ | 101,114 | | $ | 95,074 | | | 2.3 | % | 8.8 | % |

| Provision for credit losses | 3,935 | | 5,315 | | 1,809 | | | (26.0) | % | 117.5 | % |

| Other income | 31,064 | | 36,530 | | 15,519 | | | (15.0) | % | 100.2 | % |

| Other expense | 83,241 | | 85,681 | | 79,043 | | | (2.8) | % | 5.3 | % |

| Income before income taxes | $ | 47,333 | | $ | 46,648 | | $ | 29,741 | | | 1.5 | % | 59.2 | % |

| Income taxes | 8,703 | | 8,431 | | 5,241 | | | 3.2 | % | 66.1 | % |

| Net income | $ | 38,630 | | $ | 38,217 | | $ | 24,500 | | | 1.1 | % | 57.7 | % |

| | | | | | | |

| MARKET DATA: | | | | | | |

| Earnings per common share - basic (a) | $ | 2.39 | | $ | 2.37 | | $ | 1.52 | | | 0.8 | % | 57.2 | % |

| Earnings per common share - diluted (a) | 2.37 | | 2.35 | | 1.51 | | | 0.9 | % | 57.0 | % |

| Quarterly cash dividend declared per common share | 1.06 | | 1.06 | | 1.05 | | | — | % | 1.0 | % |

| Special cash dividend declared per common share | 0.50 | | — | | — | | | N.M. | N.M. |

| Book value per common share at period end | 76.98 | | 76.74 | | 71.06 | | | 0.3 | % | 8.3 | % |

| Market price per common share at period end | 171.43 | | 167.98 | | 132.86 | | | 2.1 | % | 29.0 | % |

| Market capitalization at period end | 2,770,134 | | 2,713,152 | | 2,141,235 | | | 2.1 | % | 29.4 | % |

| | | | | | | |

| Weighted average common shares - basic (b) | 16,156,827 | | 16,151,640 | | 16,113,215 | | | — | % | 0.3 | % |

| Weighted average common shares - diluted (b) | 16,283,701 | | 16,264,393 | | 16,216,562 | | | 0.1 | % | 0.4 | % |

| Common shares outstanding at period end | 16,158,982 | | 16,151,640 | | 16,116,479 | | | — | % | 0.3 | % |

| | | | | | | |

| PERFORMANCE RATIOS: (annualized) | | | | | | |

| Return on average assets (a)(b) | 1.54 | % | 1.53 | % | 0.98 | % | | 0.7 | % | 57.1 | % |

| Return on average shareholders' equity (a)(b) | 12.32 | % | 12.56 | % | 8.81 | % | | (1.9) | % | 39.8 | % |

| Yield on loans | 6.21 | % | 6.24 | % | 5.84 | % | | (0.5) | % | 6.3 | % |

| Yield on investment securities | 3.46 | % | 3.74 | % | 3.88 | % | | (7.5) | % | (10.8) | % |

| Yield on money market instruments | 4.75 | % | 5.38 | % | 5.30 | % | | (11.7) | % | (10.4) | % |

| Yield on interest earning assets | 5.82 | % | 5.88 | % | 5.48 | % | | (1.0) | % | 6.2 | % |

| Cost of interest bearing deposits | 1.90 | % | 2.06 | % | 1.84 | % | | (7.8) | % | 3.3 | % |

| Cost of borrowings | 3.86 | % | 3.97 | % | 4.42 | % | | (2.8) | % | (12.7) | % |

| Cost of paying interest bearing liabilities | 1.99 | % | 2.15 | % | 2.01 | % | | (7.4) | % | (1.0) | % |

| Net interest margin (g) | 4.51 | % | 4.45 | % | 4.17 | % | | 1.3 | % | 8.2 | % |

| Efficiency ratio (g) | 61.60 | % | 61.98 | % | 70.93 | % | | (0.6) | % | (13.2) | % |

| | | | | | | |

| OTHER DATA (NON-GAAP) AND BALANCE SHEET INFORMATION: | | | | | | |

| Tangible book value per common share (d) | $ | 66.89 | | $ | 66.62 | | $ | 60.87 | | | 0.4 | % | 9.9 | % |

| Average interest earning assets | 9,176,540 | | 9,100,594 | | 9,120,407 | | | 0.8 | % | 0.6 | % |

| Pre-tax, pre-provision net income (j) | 51,268 | | 51,963 | | 31,550 | | | (1.3) | % | 62.5 | % |

| | | | | | |

| Note: Explanations for footnotes (a) - (k) are included at the end of the financial tables in the "Financial Reconciliations" section. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| PARK NATIONAL CORPORATION |

| Financial Highlights (continued) |

| As of or for the three months ended December 31, 2024, September 30, 2024 and December 31, 2023 | | | | | |

| | | | | | |

| | | | | Percent change vs. |

| (in thousands, except ratios) | December 31, 2024 | September 30, 2024 | December 31, 2023 | | 3Q '24 | 4Q '23 |

| BALANCE SHEET: | | | | | | |

| Investment securities | $ | 1,100,861 | | $ | 1,233,297 | | $ | 1,429,144 | | | (10.7) | % | (23.0) | % |

| Loans | 7,817,128 | | 7,730,984 | | 7,476,221 | | | 1.1 | % | 4.6 | % |

| Allowance for credit losses | 87,966 | | 87,237 | | 83,745 | | | 0.8 | % | 5.0 | % |

| Goodwill and other intangible assets | 163,032 | | 163,320 | | 164,247 | | | (0.2) | % | (0.7) | % |

| Other real estate owned (OREO) | 938 | | 1,119 | | 983 | | | (16.2) | % | (4.6) | % |

| Total assets | 9,805,350 | | 9,903,049 | | 9,836,453 | | | (1.0) | % | (0.3) | % |

| Total deposits | 8,143,526 | | 8,214,671 | | 8,042,566 | | | (0.9) | % | 1.3 | % |

| Borrowings | 280,083 | | 306,964 | | 517,329 | | | (8.8) | % | (45.9) | % |

| Total shareholders' equity | 1,243,848 | | 1,239,413 | | 1,145,293 | | | 0.4 | % | 8.6 | % |

| Tangible equity (d) | 1,080,816 | | 1,076,093 | | 981,046 | | | 0.4 | % | 10.2 | % |

| Total nonperforming loans | 69,932 | | 71,541 | | 61,118 | | | (2.2) | % | 14.4 | % |

| Total nonperforming assets | 70,870 | | 72,660 | | 62,101 | | | (2.5) | % | 14.1 | % |

| | | | | | | |

| ASSET QUALITY RATIOS: | | | | | | |

| Loans as a % of period end total assets | 79.72 | % | 78.07 | % | 76.01 | % | | 2.1 | % | 4.9 | % |

| Total nonperforming loans as a % of period end loans | 0.89 | % | 0.93 | % | 0.82 | % | | (4.3) | % | 8.5 | % |

| Total nonperforming assets as a % of period end loans + OREO + other nonperforming assets | 0.91 | % | 0.94 | % | 0.83 | % | | (3.2) | % | 9.6 | % |

| Allowance for credit losses as a % of period end loans | 1.13 | % | 1.13 | % | 1.12 | % | | — | % | 0.9 | % |

| Net loan charge-offs | $ | 3,206 | | $ | 4,653 | | $ | 2,666 | | | (31.1) | % | 20.3 | % |

| Annualized net loan charge-offs as a % of average loans (b) | 0.16 | % | 0.24 | % | 0.14 | % | | (33.3) | % | 14.3 | % |

| | | | | | | |

| CAPITAL & LIQUIDITY: | | | | | | |

| Total shareholders' equity / Period end total assets | 12.69 | % | 12.52 | % | 11.64 | % | | 1.4 | % | 9.0 | % |

| Tangible equity (d) / Tangible assets (f) | 11.21 | % | 11.05 | % | 10.14 | % | | 1.4 | % | 10.6 | % |

| Average shareholders' equity / Average assets (b) | 12.47 | % | 12.20 | % | 11.16 | % | | 2.2 | % | 11.7 | % |

| Average shareholders' equity / Average loans (b) | 16.08 | % | 15.76 | % | 14.94 | % | | 2.0 | % | 7.6 | % |

| Average loans / Average deposits (b) | 93.00 | % | 92.69 | % | 89.48 | % | | 0.3 | % | 3.9 | % |

| | | | | | |

| Note: Explanations for footnotes (a) - (k) are included at the end of the financial tables in the "Financial Reconciliations" section. | | | |

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | |

| PARK NATIONAL CORPORATION |

| Financial Highlights |

| Year months ended December 31, 2024 and December 31, 2023 | | | |

| | | | | |

| | | | | |

| (in thousands, except common share and per common share data and ratios) | 2024 | 2023 | | Percent change vs '23 |

| INCOME STATEMENT: | | | | |

| Net interest income | $ | 398,019 | | $ | 373,113 | | | 6.7 | % |

| Provision for credit losses | 14,543 | | 2,904 | | | 400.8 | % |

| Other income | 122,588 | | 92,634 | | | 32.3 | % |

| Other expense | 321,339 | | 309,239 | | | 3.9 | % |

| Income before income taxes | $ | 184,725 | | $ | 153,604 | | | 20.3 | % |

| Income taxes | 33,305 | | 26,870 | | | 23.9 | % |

| Net income | $ | 151,420 | | $ | 126,734 | | | 19.5 | % |

| | | | | |

| MARKET DATA: | | | | |

| Earnings per common share - basic (a) | $ | 9.38 | | $ | 7.84 | | | 19.6 | % |

| Earnings per common share - diluted (a) | 9.32 | | 7.80 | | | 19.5 | % |

| Quarterly cash dividend declared per common share | 4.24 | | 4.20 | | | 1.0 | % |

| Special cash dividend declared per common share | 0.50 | | — | | | N.M. |

| | | | | |

| Weighted average common shares - basic (b) | 16,143,708 | | 16,163,500 | | | (0.1) | % |

| Weighted average common shares - diluted (b) | 16,244,797 | | 16,250,019 | | | — | % |

| | | | | |

| PERFORMANCE RATIOS: | | | | |

| Return on average assets (a)(b) | 1.53 | % | 1.27 | % | | 20.5 | % |

| Return on average shareholders' equity (a)(b) | 12.65 | % | 11.55 | % | | 9.5 | % |

| Yield on loans | 6.14 | % | 5.55 | % | | 10.6 | % |

| Yield on investment securities | 3.74 | % | 3.73 | % | | 0.3 | % |

| Yield on money market instruments | 5.16 | % | 5.00 | % | | 3.2 | % |

| Yield on interest earning assets | 5.78 | % | 5.18 | % | | 11.6 | % |

| Cost of interest bearing deposits | 1.97 | % | 1.52 | % | | 29.6 | % |

| Cost of borrowings | 4.05 | % | 3.79 | % | | 6.9 | % |

| Cost of paying interest bearing liabilities | 2.08 | % | 1.67 | % | | 24.6 | % |

| Net interest margin (g) | 4.41 | % | 4.11 | % | | 7.3 | % |

| Efficiency ratio (g) | 61.44 | % | 65.87 | % | | (6.7) | % |

| | | | | |

| ASSET QUALITY RATIOS: | | | | |

| Net loan charge-offs | $ | 10,322 | | $ | 4,921 | | | 109.8 | % |

| Net loan charge-offs as a % of average loans (b) | 0.14 | % | 0.07 | % | | 100.0 | % |

| | | | |

| CAPITAL & LIQUIDITY | | | | |

| Average shareholders' equity / Average Assets (b) | 12.09 | % | 11.02 | % | | 9.7 | % |

| Average shareholders' equity / Average loans (b) | 15.69 | % | 15.19 | % | | 3.3 | % |

| Average loans / Average deposits (b) | 92.34 | % | 86.39 | % | | 6.9 | % |

| | | | |

| OTHER DATA (NON-GAAP) AND BALANCE SHEET INFORMATION: | | | | |

| Average interest earning assets | 9,085,850 | | 9,171,721 | | | (0.9) | % |

| Pre-tax, pre-provision net income (j) | 199,268 | | 156,508 | | | 27.3 | % |

| | | | |

| Note: Explanations for footnotes (a) - (k) are included at the end of the financial tables in the "Financial Reconciliations" section. |

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PARK NATIONAL CORPORATION |

| Consolidated Statements of Income |

| | | | | | | | |

| | Three Months Ended | | Twelve Month Ended |

| | December 31 | | December 31 |

| (in thousands, except share and per share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Interest income: | | | | | | | | |

| Interest and fees on loans | | $ | 120,870 | | | $ | 108,495 | | | $ | 467,602 | | | $ | 399,795 | |

| Interest on debt securities: | | | | | | | | |

| Taxable | | 8,641 | | | 13,055 | | | 41,718 | | | 52,786 | |

| Tax-exempt | | 1,351 | | | 2,248 | | | 5,524 | | | 10,966 | |

| Other interest income | | 2,751 | | | 1,408 | | | 8,121 | | | 8,123 | |

| Total interest income | | 133,613 | | | 125,206 | | | 522,965 | | | 471,670 | |

| | | | | | | | |

| Interest expense: | | | | | | | | |

| Interest on deposits: | | | | | | | | |

| Demand and savings deposits | | 19,802 | | | 19,467 | | | 82,789 | | | 71,776 | |

| Time deposits | | 7,658 | | | 6,267 | | | 29,594 | | | 12,677 | |

| Interest on borrowings | | 2,708 | | | 4,398 | | | 12,563 | | | 14,104 | |

| Total interest expense | | 30,168 | | | 30,132 | | | 124,946 | | | 98,557 | |

| | | | | | | | |

| Net interest income | | 103,445 | | | 95,074 | | | 398,019 | | | 373,113 | |

| | | | | | | | |

| Provision for credit losses | | 3,935 | | | 1,809 | | | 14,543 | | | 2,904 | |

| | | | | | | | |

| Net interest income after provision for credit losses | | 99,510 | | | 93,265 | | | 383,476 | | | 370,209 | |

| | | | | | | | |

| Other income | | 31,064 | | | 15,519 | | | 122,588 | | | 92,634 | |

| | | | | | | | |

| Other expense | | 83,241 | | | 79,043 | | | 321,339 | | | 309,239 | |

| | | | | | | | |

| Income before income taxes | | 47,333 | | | 29,741 | | | 184,725 | | | 153,604 | |

| | | | | | | | |

| Income taxes | | 8,703 | | | 5,241 | | | 33,305 | | | 26,870 | |

| | | | | | | | |

| Net income | | $ | 38,630 | | | $ | 24,500 | | | $ | 151,420 | | | $ | 126,734 | |

| | | | | | | | |

| Per common share: | | | | | | | | |

| Net income - basic | | $ | 2.39 | | | $ | 1.52 | | | $ | 9.38 | | | $ | 7.84 | |

| Net income - diluted | | $ | 2.37 | | | $ | 1.51 | | | $ | 9.32 | | | $ | 7.80 | |

| | | | | | | | |

| Weighted average common shares - basic | | 16,156,827 | | | 16,113,215 | | | 16,143,708 | | | 16,163,500 | |

| Weighted average common shares - diluted | | 16,283,701 | | | 16,216,562 | | | 16,244,797 | | | 16,250,019 | |

| | | | | | | | |

| Cash dividends declared: | | | | | | | | |

| Quarterly dividend | | $ | 1.06 | | | $ | 1.05 | | | $ | 4.24 | | | $ | 4.20 | |

| Special dividend | | $ | 0.50 | | | $ | — | | | $ | 0.50 | | | $ | — | |

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | |

| |

| PARK NATIONAL CORPORATION |

| Consolidated Balance Sheets |

| | | |

| (in thousands, except share data) | December 31, 2024 | December 31, 2023 |

| | | |

| Assets | | |

| | | |

| Cash and due from banks | $ | 122,363 | | $ | 160,477 | |

| Money market instruments | 38,203 | | 57,791 | |

| Investment securities | 1,100,861 | | 1,429,144 | |

| Loans | 7,817,128 | | 7,476,221 | |

| Allowance for credit losses | (87,966) | | (83,745) | |

| Loans, net | 7,729,162 | | 7,392,476 | |

| Bank premises and equipment, net | 69,522 | | 74,211 | |

| Goodwill and other intangible assets | 163,032 | | 164,247 | |

| Other real estate owned | 938 | | 983 | |

| Other assets | 581,269 | | 557,124 | |

| Total assets | $ | 9,805,350 | | $ | 9,836,453 | |

| | | |

| Liabilities and Shareholders' Equity | | |

| | | |

| Deposits: | | |

| Noninterest bearing | $ | 2,612,708 | | $ | 2,628,234 | |

| Interest bearing | 5,530,818 | | 5,414,332 | |

| Total deposits | 8,143,526 | | 8,042,566 | |

| Borrowings | 280,083 | | 517,329 | |

| Other liabilities | 137,893 | | 131,265 | |

| Total liabilities | $ | 8,561,502 | | $ | 8,691,160 | |

| | | |

| | | |

| Shareholders' Equity: | | |

| Preferred shares (200,000 shares authorized; no shares outstanding at December 31, 2024 and December 31, 2023) | $ | — | | $ | — | |

| Common shares (No par value; 20,000,000 shares authorized; 17,623,104 shares issued at December 31, 2024 and December 31, 2023) | 463,706 | | 463,280 | |

| Accumulated other comprehensive loss, net of taxes | (46,175) | | (66,191) | |

| Retained earnings | 977,599 | | 903,877 | |

| Treasury shares (1,464,122 shares at December 31, 2024 and 1,506,625 shares at December 31, 2023) | (151,282) | | (155,673) | |

| Total shareholders' equity | $ | 1,243,848 | | $ | 1,145,293 | |

| Total liabilities and shareholders' equity | $ | 9,805,350 | | $ | 9,836,453 | |

Park National Corporation

50 N. Third Street, Newark, Ohio 43055

www.parknationalcorp.com

| | | | | | | | | | | | | | | | | |

| | | | |

| PARK NATIONAL CORPORATION |

| Consolidated Average Balance Sheets |

| | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| (in thousands) | 2024 | 2023 | | 2024 | 2023 |

| | | | | | |

| Assets | | | | | |

| | | | | | |

| Cash and due from banks | $ | 122,949 | | $ | 134,593 | | | $ | 129,070 | | $ | 147,414 | |

| Money market instruments | 230,591 | | 105,425 | | | 157,292 | | 162,544 | |

| Investment securities | 1,167,467 | | 1,544,942 | | | 1,265,680 | | 1,716,037 | |

| Loans | 7,757,229 | | 7,387,512 | | | 7,627,419 | | 7,222,479 | |

| Allowance for credit losses | (87,608) | | (85,493) | | | (85,930) | | (87,002) | |

| Loans, net | 7,669,621 | | 7,302,019 | | | 7,541,489 | | 7,135,477 | |

| Bank premises and equipment, net | 70,615 | | 76,718 | | | 72,689 | | 79,443 | |

| Goodwill and other intangible assets | 163,221 | | 164,466 | | | 163,669 | | 164,960 | |