TIDMCAML

RNS Number : 5520F

Central Asia Metals PLC

11 July 2023

11 July 2023

CENTRAL ASIA METALS PLC

('CAML' or the 'Company')

H1 2023 Operations Update

Central Asia Metals plc (AIM: CAML) today provides a H1 2023

operations update for the Kounrad dump leach, solvent extraction

and electro-winning ('SX-EW') copper recovery plant in Kazakhstan

('Kounrad') and the Sasa zinc-lead mine in North Macedonia

('Sasa').

H1 2023 operational summary

- Zero lost time injuries ('LTIs') at Kounrad

- One LTI at Sasa

- Kounrad copper production, 6,716 tonnes

- Sasa zinc in concentrate production, 9,764 tonnes

- Sasa lead in concentrate production, 13,734 tonnes

Group cash

- Cash in the bank on 30 June 2023, $50.6 million

Outlook

- On track to achieve 2023 full year guidance:

o Copper: 13,000 to 14,000 tonnes

o Zinc in concentrate: 19,000 to 21,000 tonnes

o Lead in concentrate: 27,000 to 29,000 tonnes

CAML production summary

Metal production Q2 2023 Q1 2023 H1 2023 H1 2022

(tonnes)

Copper 3,380 3,336 6,716 6,617

-------- -------- -------- --------

Zinc 4,847 4,917 9,764 10,465

-------- -------- -------- --------

Lead 7,116 6,618 13,734 13,827

-------- -------- -------- --------

Nigel Robinson, Chief Executive Officer, commented:

"We are pleased to report a positive start to 2023 with strong

production across the Group, meaning we are on track to meet

guidance. I am particularly proud to mention that Kounrad achieved

over 4 million LTI free hours by the end of H1 2023, an outstanding

achievement for an operation with a relatively small workforce.

"On 27 May 2023, we witnessed the joining of the Central Decline

at Sasa which was developed both from surface and the 910 metre

level. Wet commissioning of the Paste Backfill Plant has begun and

the ground works for the Dry Stack Tailings Plant are underway.

"Benefitting from our low production costs, CAML continues to

generate enviable cash flow and has a strong balance sheet with

US$50.6 million in cash and no debt. This enables us to continue to

pay some of the highest dividends in the sector whilst actively

considering various business development opportunities."

"Our H1 2023 financial results will be released on 13 September

2023, when we will also announce our interim dividend."

Health and Safety

At the end of H1 2023, Kounrad had achieved 1,870 LTI-free days.

There was one LTI recorded at Sasa during Q2 2023.

Kounrad

Kounrad Q2 2023 copper production of 3,380 tonnes brings output

for the first six months of 2023 to 6,716 tonnes. Copper sales

during H1 2023 were 6,315 tonnes.

Solid progress on the construction of the 4.77MW solar farm was

achieved during H1 2023. At the end of the period, all

project-related equipment and materials had been received at site.

Levelling earthworks are complete, the perimeter security fence

installed, sub-station concrete bases poured, and installation of

the Photo-Voltaic support frames had commenced. CAML remains on

track for completion of this project during Q4 2023.

Sasa

Production

In Q2 2023, mined and processed ore were 199,731 tonnes and

200,705 tonnes respectively, bringing the H1 2023 total to 396,234

tonnes mined and 396,673 tonnes processed. The average head grades

for the Q2 2023 period were 2.85% zinc and 3.85% lead, and for H1

2023 were on average 2.90% and 3.72% respectively. The average H1

2023 metallurgical recoveries were 84.9% for zinc and 93.1% for

lead.

Sasa produces a zinc concentrate and a separate lead

concentrate. In Q2 2023, 9,541 tonnes of concentrate containing

50.8% zinc and 10,020 tonnes of concentrate containing 71.0% lead

were produced. This brings total production for H1 2023 to 19,257

tonnes of zinc concentrate at a grade of 50.7% and 19,302 tonnes of

lead concentrate at a grade of 71.2%.

Sasa typically receives from smelters approximately 84% of the

value of its zinc in concentrate and approximately 95% of the value

of its lead in concentrate. Accordingly, Q2 2023 payable production

was 4,083 tonnes of zinc and 6,760 tonnes of lead, bringing total

payable production for H1 2023 to 8,223 tonnes of zinc and 13,047

tonnes of lead.

Payable base metal in concentrate sales for H1 2023 were 8,382

tonnes of zinc and 12,416 tonnes of lead. At the end of Q2 2023,

the additional lead concentrate stocks relate to material loaded

for shipment at Burgas that had not departed. Departure of this

stock is scheduled in the next fortnight.

During H1 2023, Sasa sold 167,919 ounces of payable silver to

Osisko Gold Royalties, in accordance with its streaming

agreement.

Units Q 2 2023 Q 1 2023 H1 2023 H 1 2022

Ore mined t 199,731 196,503 396,234 4 02,208

--------- --------- --------- -------- ---------

Plant feed t 200,705 195,968 396,673 4 04,391

--------- --------- --------- -------- ---------

Zinc grade % 2 .85 2.95 2 .90 3. 07

--------- --------- --------- -------- ---------

Zinc recovery % 8 4.7 85.2 8 4.9 8 4.3

--------- --------- --------- -------- ---------

Lead grade % 3 .85 3.59 3 .72 3. 66

--------- --------- --------- -------- ---------

Lead recovery % 9 2.1 94.2 9 3.1 9 3.5

--------- --------- --------- -------- ---------

Zinc concentrate t (dry) 9,541 9,716 19,257 20,959

--------- --------- --------- -------- ---------

* Grade % 50.8 50.6 5 0.7 49.9

--------- --------- --------- -------- ---------

* Contained zinc t 4,847 4,917 9,764 10,465

--------- --------- --------- -------- ---------

Lead concentrate t (dry) 1 0,020 9,282 19,302 19,507

--------- --------- --------- -------- ---------

* Grade % 7 1.0 71.3 7 1.2 70.9

--------- --------- --------- -------- ---------

* Contained lead t 7, 116 6,618 13,734 13,827

--------- --------- --------- -------- ---------

Transition to Paste Fill - Development Projects

On 27 May 2023, the new Central Decline tunnelling 'holed

through'. The tunnel was developed both from surface and the 910

metre level to complete Phase 1. This will be a major improvement

to the ventilation and efficient transportation of ore to the

surface in future years.

Construction of the Paste Backfill Plant and underground

reticulation system is now materially complete and wet

commissioning of the plant is underway. Ground works for the Dry

Stack Tailings Plant have commenced.

Group cash and debt position

As of 30 June 2023, CAML had cash in the bank of $50.6 million

and no debt.

For further information contact:

Central Asia Metals Tel: +44 (0) 20 7898 9001

Nigel Robinson

CEO

Gavin Ferrar

CFO

Louise Wrathall louise.wrathall@centralasiametals.com

Director of Corporate Development

Emma Chetwynd Stapylton emma.chetwyndstapylton@centralasiametals.com

Investor Relations Manager

Peel Hunt (Nominated Advisor and Tel: +44 (0) 20 7418 8900

Joint Broker)

Ross Allister

David McKeown

BMO Capital Markets (Joint Broker) Tel: +44 (0) 20 7236 1010

Thomas Rider

Pascal Lussier Duquette

BlytheRay (PR Advisors) Tel: +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

Rachael Brooks

Note to editors:

Central Asia Metals, an AIM-listed UK company based in London,

owns 100% of the Kounrad SX-EW copper project in central Kazakhstan

and 100% of the Sasa zinc-lead mine in North Macedonia.

For further information, please visit www.centralasiametals.com

and follow CAML on Twitter at @CamlMetals and on LinkedIn at

Central Asia Metals Plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQBLFFXDLBBBZ

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

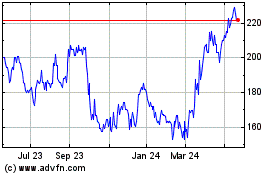

Central Asia Metal (AQSE:CAML.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

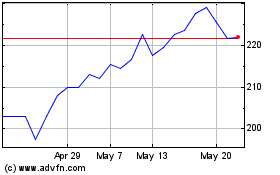

Central Asia Metal (AQSE:CAML.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024