TIDMGCM

RNS Number : 9817F

GCM Resources PLC

25 March 2022

25 March 2022

GCM Resources plc

("GCM" or the "Company")

Interim Results for the 6 months ended 31 December 2021

GCM Resources plc (LON: GCM), an AIM quoted mining and energy

company , is pleased to report its interim results for the six

months ended 31 December 2021. The Chairman's Statement and the

full unaudited interim report are presented below and will shortly

be available at the Company's website www.gcmplc.com .

Chairman's Statement

The Company's performance over the six months ending 31 December

2021 continued to be hindered by the effects of the Coronavirus

Pandemic. Bangladesh, unlike most of Europe, did not move from the

rolling lock-downs until late August and the return to "business as

usual" has been slow.

Our commitment to delivering a return to shareholders in

recognition of their continued support is unrelenting. We have been

continuously reappraising the best way to present the Phulbari Coal

and Power Project ("the Project") so to maximise alignment with the

energy and power needs of the Government and People of Bangladesh.

Prime considerations in this appraisal have included:

-- World energy crisis that commenced in 2020;

-- Chinese President Xi Jinping delivered a pre-recorded address

to the United Nations General Assembly on 22 September 2021 where

he stated China would step up efforts to assist Developing

Countries access "green" and "low carbon" energy, and that China

would not build new coal-fired power projects abroad. The actual

ramifications of these statements are yet to be realised, given

that China itself has stated coal power remains in its energy/power

mix and that the long-term strategy is energy efficiency (more

power for less coal) and a pursuit of "Net Zero Carbon Emissions"

also involves carbon off-setting.

-- World energy crisis now exacerbated by turmoil unfolding in

Eastern Europe and timeframe for energy and power markets to return

to normality appear to be extensively protracted;

-- Supply chains are under enormous pressure and international

shipping freight rates are skyrocketing;

-- In response to the above, countries are trending towards

developing internal natural energy resources to enhance energy

security and control costs;

-- Bangladesh's gas reserves have depleted and the country

appears to be exposed to the growing uncertainties and risks of

supply and costs in the highly competitive world energy market.

The Project's core asset is the Phulbari coal deposit which

consists of 527 million tonnes (JORC 2004) of high-energy thermal

and metallurgical coal, capable of supporting over 6,600MW power

generation for at least 30-years. The fundamental consideration has

always been ensuring the coal mining operation's economic

sustainability. We have explored options with our international

development partners and believe the entire Phulbari Geologic Basin

should be declared an "Energy Park" of national significance for

Bangladesh. It is rich in natural energy resources and power

generating potentials, capable of supporting over 4,500MW Solar

Power and over 6,600MW thermal power, and in parallel producing

enormous volumes of valuable industrial mineral co-products from

the overburden material removed to access the coal.

In the reporting period we have continued to grow our

relationship with development partner Power Construction

Corporation of China, Ltd ("PowerChina"). On 23 November 2021, GCM

and PowerChina agreed to extend to 6 December 2022 a memorandum of

understanding ("MoU") focused on the Phulbari coal mine

development. The aim is to allow PowerChina and GCM to determine

the modality for PowerChina to become a Mine Development Partner.

The areas covered under the MoU include finance of the coal mine

development.

GCM is still in discussion with China Nonferrous Metal

Industry's Foreign Engineering and Construction Co., Ltd. ("NFC")

to extend involvement in the Phulbari coal mine development

following expiry of the Frame Work Agreement on 12 October

2021.

Beyond the reporting period:

-- On 2 March 2022, the Company announced it raised gross

proceeds of GBP2.13 million through a placing of 25,291,828 shares

and a subscription for 16,171,777 shares at a price of 5.14 pence

per share representing a discount of approximately 36.9% to the

closing mid-market share price on 1 March 2022. These funds will be

principally be used for Project development capital and are

sufficient to cover operating expenses through to Q2 2023.

-- On 11 March 2022, the Company announced extension of the

joint venture agreements with PowerChina covering phased

development of some 4,000MW of power generation, for a further two

years to 15 March 2024. GCM and PowerChina have reinforced their

belief that the High-Efficiency, Low-Emissions Coal-Fired Power

Generation planned under these Joint Venture Agreements should

remain an attractive option available to the Bangladesh Government.

This translates to more power for less coal consumed (higher energy

efficiency with reduced emissions) and increasing energy and power

security for Bangladesh as it continues to develop its economy and

at the same time move towards "Net Zero Emission" targets over the

coming decades.

Financials

GCM incurred a lower loss after tax of GBP763,000 for the six

months ended 31 December 2021 (31 December 2020: loss after tax of

GBP1,091,000). The most significant expenditure during the period

was pre-development expenditure, while administrative expenses for

the six months ended 31 December 2021 were GBP352,000 (31 December

2020: GBP329,000) and capitalised project expenditure for the

period was GBP273,000 (31 December 2020: GBP234,000).

On 2 March 2022, the Company announced it had secured Gross

Funding proceeds of GBP2.13 million through a placing and

subscription of new ordinary shares (See Note 7 for details). This

funding provides the Company with sufficient funds to cover its

corporate and project operating expenses through to Q2 2023. The

Company has at the date of this report drawn down GBP3.2 million of

the total short-term loan facility of GBP3.5 million with Polo

Resources Ltd, the terms of the facility are detailed in Note 5 of

the interim report.

Over the next 12 months, the Company will seek to further

strengthen GCM's financial position and provide future funding, and

the directors remain confident that sufficient funding will be

obtained as and when required. As such, the financial statements

have been prepared on a going concern basis. Please refer to the

accounting policy note on going concern (Note 1 to the Financial

Statements) for further information.

Outlook

The World energy crisis is intensifying and given Bangladesh has

become largely reliant on imported fuels, its economy is growingly

exposed to the vagaries of energy supply competition and price

escalations. All nations are now turning inward to maximise

recovery of their own naturally occurring energy resources to

off-set this crisis and somehow insulate their economies. GCM and

its main development partner working to demonstrate the importance

of the Project and the development of the 'Energy Park' for the

Government and people of Bangladesh.

I would like to thank our shareholders and stakeholders for

their continued commitment and support for GCM and our commitment

to deliver returns on your investment.

Mohd Najib Bin Abdul Aziz

Non-Executive Chairman

Interim Consolidated Income Statement

6 months 6 months Year ended

ended 31 ended 31 30 June

December December 2021

2021 2020 audited

unaudited unaudited GBP000

GBP000 GBP000

Operating expenses

Pre-development

expenditure (174) (587) (809)

Exploration and

evaluation costs 5 (7) 35

Administrative expenses (352) (329) (717)

------------------------------- ----------- ----------- -----------

Operating loss (521) (923) (1,491)

Finance costs (242) (168) (383)

------------------------------- ----------- ----------- -----------

Loss before tax (763) (1,091) (1,874)

Taxation - - -

Loss and total comprehensive

income for the period (763) (1,091) (1,874)

------------------------------- ----------- ----------- -----------

Earnings per share

Basic loss per share (pence) (0.6p) (0.9p) (1.5p)

Diluted loss per share (pence) (0.6p) (0.9p) (1.5p)

Interim Consolidated Statement of Changes in Equity

Share Share Share Accumulated Total

capital premium based losses

account payments

not settled

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 July 2020 11,256 53,534 1,706 (29,079) 37,417

Total comprehensive

loss - - - (1,874) (1,874)

Share issuances 792 2,155 (1,938) - 1,009

Share issuance costs - (78) - - (78)

Shares to be issued - - 809 - 809

Share based payments - - 6 - 6

Balance at 30 June 2021 12,048 55,611 583 (30,953) 37,289

Total comprehensive

loss - - - (763) (763)

Share issuances - - - - -

Shares to be issued - - 174 - 174

Share based payments - - 15 - 15

Balance at 31 December

2021 (unaudited) 12,048 55,611 772 (31,716) 36,715

------------------------- --------- --------- ------------- ------------ --------

Balance at 1 July 2020 11,256 53,534 1,706 (29,079) 37,417

Total comprehensive

loss - - - (1,091) (1,091)

Share issuances 602 675 (1,277) - -

Shares to be issued - - 587 - 587

Share based payments - - 5 - 5

Balance at 31 December

2020 (unaudited) 11,858 54,209 1,021 (30,170) 36,918

------------------------ ------- ------- -------- --------- --------

Interim Consolidated Balance Sheet

31 December 31 December 30 June

2021 2020 2021

Notes unaudited unaudited audited

GBP000 GBP000 GBP000

Current assets

Cash and cash equivalents 116 48 717

Receivables 48 35 13

--------------------------- -------- ------------- ------------ ---------

Total current assets 164 83 730

Non-current assets

Property, plant

and equipment 6 10 8

Right of use assets 37 19 59

Intangible assets 3 42,452 41,861 42,179

Receivables - - -

Total non-current

assets 42,495 41,890 42,246

Total assets 42,659 41,973 42,976

--------------------------- -------- ------------- ------------ ---------

Current liabilities

Payables 4 (1,457) (1,284) (1,422)

Lease liabilities (31) (26) (40)

Borrowings 5 - (3,737) -

--------------------------- -------- ------------- ------------ ---------

Total current liabilities (1,488) (5,047) (1,462)

Non-current liabilities

Lease liabilities (11) (8) (22)

Borrowings (4,445) - (4,203)

--------------------------- -------- ------------- ------------ ---------

Total non-current

liabilities (4,456) (8) (4,225)

--------------------------- -------- ------------- ------------ ---------

Total liabilities (5,944) (5,055) (5,687)

--------------------------- -------- ------------- ------------ ---------

Net assets 36,715 36,918 37,289

--------------------------- -------- ------------- ------------ ---------

Equity

Share capital 6 12,048 11,858 12,048

Share premium account 6 55,611 54,209 55,611

Other reserves 772 1,021 583

Accumulated losses (31,716) (30,170) (30,953)

----------------------- --------- --------- ---------

Total equity 36,715 36,918 37,289

----------------------- --------- --------- ---------

Interim Consolidated Statement of Cash Flows

6 months 6 months Year ended

ended 31 ended 31 30 June

December December 2021

2021 2020 audited

unaudited unaudited GBP000

GBP000 GBP000

----------------------------------------- -----------

Cash flows used in operating

activities

Loss before tax (763) (1,091) (1,874)

Adjusted for:

Non-cash pre-development expenditure 174 587 809

Non-cash finance costs 242 168 383

Other non-cash expenses - - -

----------------------------------------- ----------- ----------- -----------

(347) (336) (682)

Movements in working

capital:

(Increase)/decrease in operating

receivables (34) (19) 2

Increase in operating payables 35 212 354

------------------------------------------ ----------- ----------- -----------

Cash used in operations (346) (143) (326)

Net cash used in operating activities (346) (143) (326)

Cash flows from investing activities

Payments for intangible

assets (255) (228) (557)

Payments for property, plant - - -

and equipment

------------------------------------------ ----------- ----------- -----------

Net cash generated from investing

activities (255) (228) (557)

Cash flows from financing activities

Issue of ordinary

share capital - - 1,009

Share issue costs - - (78)

Proceeds from borrowing - 350 600

Interest paid - - -

Net cash from financing activities - 350 1,531

Total (decrease)/increase in

cash and cash equivalents (601) (21) 648

Cash and cash equivalents at

the start of the period 717 69 69

------------------------------------------ ----------- ----------- -----------

Cash and cash equivalents at

the end of the period 116 48 717

------------------------------------------ ----------- ----------- -----------

Notes to the Interim Condensed Consolidated Financial

Statements

1. Accounting policies

GCM Resources plc (GCM) is domiciled in England and Wales, was

incorporated as a Public Limited Company on 26 September 2003 and

admitted to the London Stock Exchange Alternative Investment Market

(AIM) on 19 April 2004.

This unaudited interim report was authorised for issue by the

Board of Directors on 24 March 2022.

Basis of preparation

The annual consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRSs) as they apply to the financial statements of the Group for

the year ended 30 June 2021 and applied in accordance with the

Companies Act 2006.

The interim condensed consolidated financial statements for the

six months ended 31 December 2021 have been prepared using the same

policies and methods of computation as applied in the financial

statements for the year ended 30 June 2021. The financial

information contained herein does not constitute statutory accounts

within the meaning of Section 435 of the Companies Act 2006 and is

unaudited. The figures for the year ended 30 June 2021 have been

extracted from the statutory accounts for that year. Those accounts

have been delivered to the Registrar of Companies and contained an

unqualified auditors' report which included an emphasis of matter

concerning significant doubt over the ability for the Group to

continue as a going concern and did not include a statement under

section 498(2)(a) or (b), or section 498(3) of the Companies Act

2006.

Political and economic risks - carrying value of intangible

asset

The principal asset is in Bangladesh and accordingly subject to

the political, judicial, fiscal, social and economic risks

associated with operating in that country.

The Group's principal project relates to thermal coal and

semi-soft coking coal, the markets for which are subject to

international and regional supply and demand factors, and

consequently future performance will be subject to variations in

the prices for these products.

GCM, through its subsidiaries, is party to a Contract with the

Government of Bangladesh which gives it the right to explore,

develop and mine in respect of the licence areas. The Group holds a

mining lease and exploration licences in the Phulbari area covering

the prospective mine site. The mining lease has a 30-year term from

2004 and may be renewed for further periods of 10 years each, at

GCM's option.

In accordance with the terms of the Contract, GCM submitted a

combined Feasibility Study and Scheme of Development report on 2

October 2005 to the Government of Bangladesh. Approval of the

Scheme of Development from the Government of Bangladesh is

necessary to proceed with development of the mine. GCM continues to

await approval.

The Group has received no notification from the Government of

Bangladesh (Government) of any changes to the terms of the

Contract. GCM has received legal opinion that the Contract is

enforceable under Bangladesh and International law, and will

consequently continue to endeavour to receive approval for

development.

Accordingly, the Directors are confident that the Phulbari Coal

and Power Project (Project) will ultimately receive approval,

although the timing of approval remains in the hands of the

Government. To enhance the prospects of the Project, GCM has

engaged in a strategy to align the Project with the needs and

objectives of the Government. The Government seeks to rapidly

expand the country's power generation, including the increase in

coal fired power generation from the current 250MW to approximately

20,000MW. The Group's strategy is to work with the Government of

Bangladesh and its international development partners to develop

the planned coal mine together with power plants and supply chains

to utilise the full coal production which can support over 6,600MW

power generation.

Until approval of the Scheme of Development from the Government

of Bangladesh is received there is continued uncertainty over the

recoverability of the intangible mining assets. The Directors

consider that it is appropriate to continue to record the

intangible mining assets at cost, however if for whatever reason

the Scheme of Development is not ultimately approved the Group

would impair all of its intangible mining assets, totalling

GBP42,452,000 as at 31 December 2021.

Going concern

As at 31 December 2021, the Group had GBP116,000 in cash and

GBP1,324,000 in net current liabilities. The directors and

management have prepared a cash flow forecast to March 2023, which

showed that the Group would require further funds to cover

operating costs to advance the Phulbari Coal and Power Project and

meet its liabilities as and when they fall due. Based on the

current forecast, additional funding would need to be either raised

from third parties or drawn down under the GBP3.5million loan

facility with Polo Resources Limited ("Polo Loan Facility"), which

currently has GBP300,000 available to, in order to meet current

operating cost projections.

The Company on 2 March 2022, announced it had secured Gross

Funding proceeds of GBP2.13million through a placing and

subscription of new ordinary shares (See Note 7 for details). This

funding provides the Company with sufficient funds to cover its

corporate and project operating expenses through to Q2 2023.

In forming the conclusion that it is appropriate to prepare the

condensed consolidated financial statements on a going concern

basis the Directors have made the following assumptions that are

relevant to the next twelve months:

- In the event that the Polo Loan Facility becomes payable,

sufficient funding can be obtained; and

- In the event that operating expenditure increases

significantly as a result of successful progress with regards to

the Phulbari Coal and Power Project, sufficient funding can be

obtained.

Upon achieving approval of the Phulbari Coal and Power Project,

significant additional financial resources will be required to

proceed to development.

2. Segment analysis

The Group operates in one segment being the exploration and

evaluation of energy related projects. The only significant project

within this segment is the Phulbari Coal and Power Project in

Bangladesh.

3. Intangibles

During the period intangibles increased by GBP273,000. The

increase is due to capitalised mining exploration and evaluation

expenditure relating to the Phulbari Coal and Power Project in

Bangladesh.

4. Payables

31 December 31 December 30 June

2021 2020 2021

unaudited unaudited audited

GBP000 GBP000 GBP000

-----------------------

Trade payables 663 590 579

Related party accrued

payable 794 694 843

Transaction costs - - -

payable

1,457 1,284 1,422

----------------------- ------------- ------------ ---------

The related party accrued payable of GBP794,000 at 31 December

2021 relates to accrued fees owing to the management services

company of the Executive Chairman of the Company, Datuk Michael

Tang PJN.

5. Borrowings

31 December 31 December 30 June

2021 2020 2021

unaudited unaudited audited

GBP000 GBP000 GBP000

Short-term loan facility from

related party 4,445 3,737 4,203

4,445 3,737 4,203

------------------------------- ------------- ------------ ---------

GCM is party to a GBP3,500,000 short-term loan facility with its

largest shareholder, Polo Resources Limited ("Polo"). As at 31

December 2021, the Company owed GBP4,445,000, comprising

GBP3,200,000 loan balance and accrued finance costs on borrowings

of GBP1,245,000. The Company on 26 March 2021, as part of the

completed equity placing, extended and amended the terms of the

loan facility provided by Polo Resources Limited (the "Facility")

of which, as was announced on 7 January 2021, there is GBP300,000

of the initial GBP3.5 million facility remaining undrawn as at the

date of this report. The lender has agreed that it will not serve a

repayment request on the Company for 5 years from the date of the

agreement replacing the previous provision that it was payable on

demand with 90 days' notice. The Company and Polo Resources Limited

have agreed an increase in the interest rate from 12% to 15% per

annum rising by 1.5% on the third anniversary and by a subsequent

1.5% on each anniversary thereafter. Furthermore, the lender may

request conversion by the issuance of new ordinary shares in the

Company at 7.5 pence per share (being the Issue Price) subject to

any necessary regulatory approvals. The Company may elect to repay

all or part of the outstanding loan at any time giving 60 days'

notice and with the agreement of Polo Resources Limited. Any share

issue to the Lender is conditional upon the Lender's interest,

together with the interest of any parties with which it is in

concert, remaining below 30% of the Company's issued capital. All

other principal terms of the loan facility remain unchanged. As

noted below, on 2 March 2022, the Company agreed to amend the issue

price of the shares from 7.5p to 5.14p as part of Polo's

participation in the subscription and fund raising on that date,

all other terms as above remained unchanged.

6. Share issues

There were no shares issued during the period.

7. Post-balance sheet events

On 2 March 2022, the Company announced that the Company had

raised gross proceeds of GBP2.13million through a placing (the

"Placing") of 25,291,828 shares and a subscription for 16,171,777

shares (the "Subscription") of new ordinary 1p shares in the

Company ("Fundraising Shares") at a price of 5.14 pence per share

("the Placing Price"), representing a discount of approximately

36.9% to the closing mid-market share price on 1 March 2022 (being

the last business day prior to this announcement).

-- The Company raised gross proceeds of approximately

GBP1,300,000 by means of a placing (the "Placing") of 25,291,828

new Ordinary Shares (the "Placing Shares") at the Placing Price

through ETX Capital, which is the trading name of Monecor (London)

Limited. ETX Capital is acting as broker in connection with the

Placing.

-- The Company also announced that it had appointed ETX Capital

as joint broker, as part of the Placing.

-- An issue of 16,171,777 new ordinary shares of 1p each in the

capital of the Company (the "Subscription Shares") to certain

individuals including Polo Resources Ltd at the Issue Price to

raise GBP830,000 (the "Subscription") at an issue price of 5.14p

("the issue price").

-- The Company as part of the proposed subscription, agreed to

amend the terms of the loan facility provided by Polo Resources

Limited (the "Facility") of which, as announced on 26 March 2021,

there is GBP300,000 of the initial GBP3.5 million facility

remaining undrawn. The lender may request conversion by the

issuance of new ordinary shares in the Company at 5.14 pence per

share (being the Issue Price) subject to any necessary regulatory

approvals. All other terms of the agreement remained unchanged.

On 11 March 2022, the Company announced that further to the

announcement of 19 January 2021, it had completed the extension of

the joint venture agreements announced on 17 January 2019 and 13

January 2020 ("First JV Agreement") and 15 March 2019 ("Second JV

Agreement") with Power Construction Corporation of China

("PowerChina"). The joint venture agreements which were both due to

expire on 15 March 2021 have both been extend for a further two

years to 15 March 2024.

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information:

GCM Resources plc WH Ireland Ltd

Keith Fulton James Joyce

Finance Director Andrew de Andrade

+44 (0) 20 7290 1630 +44 (0) 20 7220 1666

GCM Resources plc

Tel: +44 (0) 20 7290 1630

info@gcmplc.com; www.gcmplc.com

About GCM Resources

GCM Resources plc (LON:GCM), the AIM listed mining and energy

company, has identified a high-quality coal resource of 572 million

tonnes (JORC 2004 compliant) at the Phulbari Coal and Power Project

(the "Project") in north-west Bangladesh.

Utilising the latest highly energy efficient power generating

technology, the Phulbari coal mine is capable of supporting over

6,000MW power generation. GCM is awaiting approval from the

Government of Bangladesh to develop the Project. The Company,

together with credible, internationally recognised strategic

partners, has a strategy of positioning its proposed coal to supply

power plants at the mine-mouth and other coal-fired power projects

in Bangladesh. GCM aims to deliver a practical power solution to

provide the cheapest electricity in the country, in a manner

amenable to the Government of Bangladesh.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VZLFLLXLEBBV

(END) Dow Jones Newswires

March 25, 2022 03:00 ET (07:00 GMT)

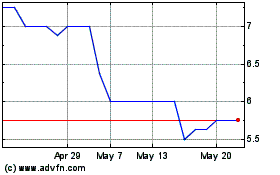

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024