TIDMGOOD

RNS Number : 8267M

Good Energy Group PLC

19 September 2023

19 September 2023

Good Energy Group PLC

("Good Energy" or the "Company")

Un-audited interim results for the six months ended 30 June

2023

Strong financial performance and delivery of strategy

Good Energy, the 100% renewable electricity supplier and

innovative energy services provider, today announces its interim

results for the six months ended 30 June 2023.

Financial highlights

-- Revenue increased 45.6% to GBP156.1m (H1 2022: GBP107.6m)

driven by rising wholesale costs leading to price rises throughout

the year.

-- Gross profit increased 168% to GBP32.7m (H1 2022: GBP12.2m)

with gross profit margin of 20.9% (H1 2022: 11.4%). 683

-- Gross profit increased due to a strong H1 2023 performance

and cost advantages from our power purchase agreements. However, we

anticipate a one-off loss in H2 2023 due to lagging commodity costs

and tariff reductions.

-- Operating profit of GBP14.1m (H1 2022: -GBP0.5m loss). Some

of this is expected to unwind in H2 given the falling commodity

cost environment since late last year.

-- Zapmap reported a loss of GBP1.1m for our 49.9% shareholding.

-- Reported profit after tax for the period of GBP12.0m (H1 2022: GBP0.3m).

-- Reported earnings per share of 72.0p (H1 2022: 7.4p).

-- Cash and cash equivalents of GBP34.9m (FY2022: GBP24.5m)

reflecting strong profitability in H1 and continued focus on

working capital management.

-- Following a good operational performance in H1 2023 and

reflecting our confidence in the ongoing business, the Board has

declared an interim dividend for 2023 of 1.00p per ordinary share

(H1 2022: 0.75p).

Operational highlights

The first half of 2023 demonstrates significant evidence that

our transition has accelerated and is beginning to scale.

Achievements made during the period include:

-- Launched new services to help scale our energy services offering.

-- A new market leading smart export tariff for households with

solar panels live in March 2023.

-- Rolled out smart export and Solar Savings propositions to

40,000 customers. Targeting 75,000 by end of 2023.

-- Further propositions for businesses planned to launch in H2 2023.

-- Growing our solar and heat installation footprint through two acquisitions of installers.

-- Acquisition of WessexECO Energy in June 2023, an established

UK based solar installation business for GBP2.5 million.

-- Wessex completed 155 installs in 2022 and is on track for 200

installs in 2023. The new business plan looks to double capacity by

the end of 2024.

-- The heat pump business will see 2023 as a year of investment

as we look to build out the acquired Igloo platform and

installation capacity. We are targeting 100 installs in 2023, with

increasing uptake in recent months. Earnings growth is expected

from H2 2024.

-- The balance of 2023 and the first half of 2024 are a period

of planned investment. Elevated installation capacity is expected

to drive material earnings accretion from 2025, leveraging

corporate overheads to deliver effective customer acquisition and

cost to serve. Performance since the acquisitions has been in line

with expectations.

-- Wessex will continue to operate under its own brand, whilst

the heat pump business has been rebranded to Good Energy Works.

-- Zapmap growth provides a pathway of electric vehicle (EV)

drivers for energy services propositions.

-- Registered users increased 52% to 683k and 80% of all EV

drivers registered on the platform.

-- Monthly active users increased to record number at 285k.

-- Subscriptions, data insights and B2B API tools continue to

drive growth ahead of planned fundraise.

-- Continued delivery of energy services enabling functions.

-- Smart meter rollout progressing, with 44,000 installed to date.

-- Maintaining excellent service quality with 4.7* Trustpilot

rating achieved in supply and installations.

Outlook highlights

-- Good Energy has successfully evolved into an energy services

business and much of this has been achieved over the past six

months.

-- We have acquired installation capability and launched new

services across the solar, heat pump and EV market during the

period and are rolling these out to our established customer

base.

-- Our established customer base is showing strong interest in

these new services, creating a strong pipeline for the future.

-- Impressive solar and EV market growth continues, and we are

well placed to capitalise on this.

-- We will continue to capitalise on this market growth by

building our installation capabilities and increasing our presence

across the UK. We continue to invest across energy services through

a clear buy and build strategy.

-- Our FY23 expectations remain unchanged, with a strong H1

performance partly offset with an expected one-off loss in H2 due

to lagging commodity costs and tariff reductions

-- The strong cash generated during the period positions us well

to meet our working capital requirements and to invest for further

growth.

Nigel Pocklington, Chief Executive Officer of Good Energy,

said:

"Good Energy has hit an inflection point in the past six months.

The company is now more than an energy supplier, it's a heat pump

and solar installer with over 40,000 customers live on smart export

tariffs. Combined with continued strong growth in Zapmap, we are

delivering our strategy and well on our way to achieving our

mission of helping one million homes and businesses cut their

carbon.

"We have made great strides through acquisitions to offer new

hardware services and launching new services whilst delivering a

positive performance for the first half of the year as we continue

to navigate a volatile energy market. Our robust cash position

serves dual purposes: enabling strategic growth initiatives and

providing a buffer against market uncertainties. Whilst we expect

some of the energy trading factors which have bolstered profit to

unwind through the remainder of the year, we are in a very positive

financial position for Good Energy to continue to grow and

capitalise on its untapped potential.

"With its legacy as a truly renewable supplier serving one of

the UK's largest solar microgenerator customer bases, Good Energy

is uniquely positioned to continue to launch and grow services that

make it easy for customers to go green. Our goal is to be a

one-stop solution for green-minded customers, offering a suite of

products that help them reduce carbon, save money, and stay with us

longer. By focusing on multiple product areas that function

harmoniously, we aim to lower churn rates, cut acquisition costs,

cross-sell services and boost the overall lifetime value of our

growing number of customers."

A briefing for Analysts will be held at 9:00am today. Analysts

wishing to attend the presentation either in person or virtually

should register their interest by emailing

investor.relations@goodenergy.co.uk or telephoning 0124 976

5573.

An investor presentation and Q&A will be held today at

11:00am. Investors can sign up to Investor Meet Company for free

and add to meet Good Energy via:

https://www.investormeetcompany.com/good-energy-group-plc/register-investor

.

A video overview of the results from the Chief Executive

Officer, Nigel Pocklington, is available to watch here

https://www.fmp-tv.co.uk/2023/09/15/good-energy-h1-results/ .

Enquiries

Good Energy Group PLC

Nigel Pocklington, Chief Executive

Charlie Parry, Director of Corporate Strategy

& Investor Relations

Ian McKee, Head of Communications Email: press@goodenergy.co.uk

SEC Newgate UK Email: GoodEnergy@secnewgate.co.uk

Elisabeth Cowell / Molly Gretton Tel: +44 (0)7900 248213

Investec Bank plc (Nominated Adviser and Joint

Broker)

Henry Reast / James Rudd / Maria Gomez de Olea Tel: +44 (0) 20 7597 5970

Canaccord Genuity Limited (Joint Broker)

Henry Fitzgerald - O'Connor / Harry Rees Tel: +44 (0) 20 7523 4617

About Good Energy www.goodenergy.co.uk

Good Energy is a supplier of 100% renewable power and an

innovator in energy services. It has long term power purchase

agreements with a community of 1,700 independent UK generators.

Since it was founded over 20 years ago, the Company has been at

the forefront of the charge towards a cleaner, distributed energy

system. Its mission is to power a cleaner, greener world and make

it simple to generate, share, store, use and travel by clean power.

Its ambition is to support one million homes and businesses to cut

carbon from their energy and transport used by 2025.

Good Energy is recognised as a leader in this market, through

green kite accreditation with the London Stock Exchange, Which? Eco

Provider status and Gold Standard Uswitch Green Tariff

Accreditation for all tariffs.

CEO's review

Overview

Good Energy's direction is crystal clear: we're on a journey to

become the UK's leading green energy services company in a future

where energy is decentralised, digitised, and green. This vision

gained urgency in 2022, as the flaws of our current fossil

fuel-based system became painfully obvious and in 2023 we have made

great strides delivering against this. As one of the UK's largest

administrators of the Feed-in-Tariff (FiT) serving a large

microgenerator customer base, we're already a major player in this

future grid. With a greater number of our customers generating

their own power than buying ours, we hold a c. 20% market share in

the UK's largest decentralised energy scheme, setting us up for a

transformative role in the energy landscape.

Strong financial performance and continuing to invest

The first six months of 2023 have seen Good Energy focus on

delivering against our exciting growth strategy in energy services.

We have continued the expansion of our energy services portfolio,

launched new services for customers and acquired a further solar

installation business, following the acquisition of a heat pump

installation business in December 2022. These businesses will help

to build out installation capacity in solar PV, storage and heat

pumps. We have launched new export tariffs, as well as trialled

innovative new solutions for our business customers.

Throughout the energy crisis over the past 18 to 24 months, our

energy supply business had remained robust despite the market

volatility surrounding us. With clear communication to customers,

we maintained and even built on the trust we have secured over

years - essential as we expand our green energy services business.

However, as the energy market has stabilised, wider macroeconomic

uncertainty has grown, with rising inflation rates demanding an

elevated interest rate environment. We are conscious of the impact

this could have on many of our customers and we continue to work

closely with them.

Earlier this year, we were pleased to have signed our largest

ever deal with renewable energy giant Ørsted to provide clean power

to UK homes and businesses. Utilising the power from one of the

world's largest offshore windfarms, Ørsted's Hornsea 1 offshore

windfarm in the North Sea, the three year deal will provide 110GWh

per annum, the most significant in terms of volume in Good Energy's

history - and enough to supply almost 38,000 homes. This is

testament to the strong working relationship we have built with

Ørsted and speaks to the partnership approach we have.

We remain in robust financial health and have continued to

invest throughout the period, both organically in new product

launches and inorganically through our acquisitions. Our financial

performance in the first half of the year has been excellent, and

whilst we expect to see some of this unwind in the second half

given the falling commodity cost environment since late last year,

we foresee closing the year in a strong position. We have a strong

cash balance and are committed to investing to accelerate the

growth across our energy services offering.

Capital allocation

Our substantially debt free position and strong cash balance

allows us to continue to invest for sustainable growth, including

further acquisitions in energy services and our capital allocation

policy reflects this. However, we recognise the importance of a

dividend to many shareholders.

Following a good operational performance in 2023 and reflecting

our confidence in the ongoing business, the Board has therefore

declared an interim dividend for 2023 of 1.00p per ordinary share.

This dividend will be paid on 27 October 2023 to shareholders on

the register at the close of business on 29 September 2023.

Outlook

Good Energy is now well on its way to becoming the UK's top

green energy services company. We're expanding solar services and

heat installations and eyeing further M&A to boost our

capabilities. Zapmap's Series B fundraise is on the horizon, which

will set the stage for its B2B and international growth. Our FY23

expectations remain unchanged, with a strong H1 performance partly

offset with an expected one-off loss in H2 due to lagging commodity

costs and tariff reductions.

Nigel Pocklington, CEO

Strategic update - our transition to a green energy services

company

Good Energy's purpose is to power a cleaner, greener world by

making it simple to generate, share, store, use and travel by clean

power. We work towards this purpose by supporting one million homes

and businesses cut carbon from their energy and transport use by

2025.

The first half of 2023 has been a critical period in which that

shift has truly begun to take place, as we have delivered new

services, underpinned by energy supply.

Clean energy services operate as a harmonious 'virtuous circle'.

For example for many customers, electric vehicles are the starting

point. According to Zapmap data, if you drive an EV, you're seven

times more likely to have solar panels installed than the national

average. And with our investment in Zapmap, the UK's leading EV

mapping platform, we're positioned to take advantage of this. To

build on this insight, our installation partner data shows that

over 80% of our solar installs now include a battery storage

system. Continuing the trend, historic MCS data shows that around

60% of new heat pump installations are in homes that already have

solar. We're launching smart tariffs and this Winter we will be

participating in the upcoming demand flexibility events with the

National Grid to make all of this as cost-effective and

carbon-friendly as possible. Helping our customers go green, cut

carbon and save money.

We see ourselves as not an energy supply firm that offers energy

services but as an energy services firm, of which energy supply is

just one part of what we can offer our customers. In 2023, we have

made good progress delivering against this strategy to date.

We have rolled out solar services and export tariffs for our

microgeneration customers, including launching smart export for our

Feed-in-Tariff customers and piloted Solar Savings (formerly Power

for Good) at a market leading 10p/kwh export rate. As Solar Savings

now comes out of its beta phase, we are bolstering the rates to

15p/kWh with an even more attractive 20p/kWh rate for customers who

install their solar PV with us through Wessex ECOEnergy. This

positions our export tariffs among the best rate on the market,

level with the highest per unit payments for flat rate tariffs

available.

We intend to launch a time of use tariff for electric vehicles

in the final quarter of 2023, to help EV drivers charge at cheaper

and greener times. We have developed our capability to install both

solar and heat pumps and are looking to double this by the end of

2024. We acquired Wessex Eco Energy in June to increase our solar

installation capability and expect to acquire further businesses to

help increase our installation capacity. We have supported Zapmap

on its journey as to launch new B2B API services, simplified and

grow its B2C subscription offering and built a strong data business

relied on across the industry. We are pleased with how we are

executing our vision.

We believe that this is both the future of energy and makes us a

better business in the long term. We're excited about the road

ahead, not just because we're targeting a GBP5 billion market that

could grow to GBP10 billion (company research and MCS data), but

because we're doing it in sectors like solar, heat pumps, and EVs

that offer fast growth, good margins, and low working capital

requirements. This positions us well for both short-term and

long-term returns, especially compared to the lower margin and more

working capital intense energy supply markets. Our research

indicated that our already engaged, green-minded customer base is

showing strong interest in these new services, reinforcing our role

in accelerating the transition to renewables. We're eager to share

updates in what promises to be another transformative year for Good

Energy.

By offering multiple harmonious cleaner energy products, we aim

to lower churn rates, cut acquisition costs, and boost customer

lifetime value. We are carving out a suite of services that can

allow our customers to become energy efficient in every aspect of

their lives.

A targeted energy supply offering

We continue to operate in both the domestic and business UK

energy supply markets but remain a premium provider for

green-minded customers. We provide a range of import and export

services, which underpin our overall offering. Our import services

provide 100% real renewable electricity to domestic, small

businesses and smaller half hourly business customers. We do not

focus on large scale industrial customers. Our export services

provide power purchase agreements (PPAs), Feed-in-Tariff

administration services and smart generation offers for domestic

and business customers. For generators who take both services, our

intention is to make it cheaper than a comparable standard supply

contract without generation. We want to incentivise people to go

green and save money.

In domestic supply, we are witnessing a market with limited

growth potential with the introduction of the market stabilisation

charge, high wholesale costs and increased working capital

requirements for purchasing power. We have continued to make

progress with our smart meter roll out and now have nearly 44,000

installed to date. Earlier this year, we achieved a 5* Trust pilot

rating, making us one of the most trusted energy suppliers in the

country.

In business supply, we have a clear size and sectoral targeting.

Small, medium sized enterprises (SMEs), and half hourly metered

business sites, with a focus on purpose driven businesses looking

for a truly green supply product. Where possible we are also

starting to offer smart export and solar installation propositions

to our business customers. We have recently launched innovative new

services for business customers to match their hourly energy use to

time-based renewable generation, giving them even greater

transparency on their carbon footprint.

Our purchasing of PPA's is what sets us apart and allows us to

provide 100% renewable electricity. This is sourced from over 1,700

individual generators including a mix of wind, solar, hydro and

anaerobic digestion.

We believe it is important that we have the right type of

customers. Those individuals and businesses that support our

mission and are more likely to go on this journey with us.

Delivering a leading position in electric vehicles through

Zapmap

The electric vehicle market saw continued growth into 2023,

following impressive growth in recent years. Total EVs on the road

now totals almost 1.4m as of August 2023, with over 60% of these

being battery electric vehicles (Zapmap and SMMT data 2023). These

battery electric vehicles are Zapmap's core market.

The Battery EV market grew 60% to over 817,000 in the 12 months

to June 2023 and has a 2-year CAGR of 71% (June 2021 to June 2023).

Cumulatively, Zapmap now has over 1.2 million downloads of the app

and over 683,000 registered users, up over 50% in 2023 and a 2 year

CAGR of 70%. It continues to retain its position as the market

leader in the high growth electric vehicle market, with registered

user penetration at 80% of all electric vehicle drivers.

Zapmap: Building scale and recurring revenue

Zapmap has made good progress against its business plan

throughout 2023, and since their GBP9m series A fundraise in August

2022. Zapmap has seen both registered users (683k +51%) and monthly

active users (285k +16%) rise, and they are on track to more than

double revenue in 2023, and close Q4 2023 on a GBP2m annual

recurring revenue run rate.

Alongside a refreshed brand and website, subscriptions were

simplified and relaunched earlier in the year. This allows drivers

to access everything needed for simple EV charging, including the

location and live availability of chargers on the move using

Android Auto or Apple CarPlay. Zapmap plus and premium were

combined to one premium offer at a lower monthly price of GBP2.99 /

month, or GBP29.99 / year. This led to material increases in

subscriber numbers.

Zapmap Spark was launched to enable third party digital

platforms with EV charging search, plan and payment services and

has a strong pipeline of commercial customers. The data and

insights business has expanded significantly with new products and

channel revenues driving strong performance in 2023.

In 2024 and beyond, Zapmap will focus on four key areas. First,

the consumer app aims to simplify charging solutions in the UK,

with plans to expand internationally, including the EU and North

America. Second, B2B services will offer comprehensive charging

data and insights. Third, Zapmap Spark plans to scale through

API-enabled tech solutions. Finally, a Series B funding round in

2024 will enable further growth and scaling of these services into

new markets. We expect to participate in this round to support

Zapmap's growth plan. Our collaboration with Zapmap will also

extend to developing energy services products, aimed at helping the

UK's EV drivers cut carbon and save money.

Solar and generation

Impressive solar market growth continues whilst heat market is

slower

The UK solar market saw near record levels of growth through

2022 as energy prices remained high. Installs increased over 125%

to over 130,000 rising to the near the record highs of 2015. In

2023 H1 sales started strongly, with sales in the first six months

rising to over 90k installs and forecast to increase over 18% year

on year (Company research and MCS database 2023).

We anticipate cumulative capacity on the grid to be 7.5GWh by

2030 in order to be on track with net zero targets, which outlines

a 9.9% CAGR to 2030. This requires a 2.9% annual growth in install

levels to c. 167k per year, with almost that number expected to be

achieved in 2023. With energy costs unlikely to be falling quickly

in the short term, we see this as the main driver for install

growth, which will continue to build momentum.

New services for generators

In early 2023 we launched a beta market leading smart export

tariff for a limited number of households with solar panels. 'Solar

Savings' (formerly Power for Good) pays a 10p per kWh variable

export tariff rate, materially better than the standard rates

offered under the Government's Smart Export Guarantee. Solar

Savings is Good Energy's first tariff available to generators that

installed their solar panels after the Feed-in-Tariff scheme closed

in 2019.

It is now moving out of beta, with enhanced rates of 15p/kWh and

20p/kWh for customers who install their solar through Good Energy,

positioning Solar Savings amongst the best flat rate export tariffs

available on the market. We are targeting rolling this out to c.

5,000 customers by the end of 2023.

This is in addition to our new smart export services for

existing FiT customers, allowing them to receive an export payment

based on the actual amount of power that they provide to the grid,

rather than the volume they are deemed to have exported. Our data

shows that at times many customers have exported around 20% more

than the deemed amount, meaning that smart export provides an

opportunity for these customers to earn more. With the enhanced

rates offered by Solar Savings enabling them to earn further

still.

As the largest voluntary FiT administrator with over 180,000

customers for whom we process hundreds of millions of pounds in

payments, this is a significant shift. And we have already rolled

the service out to over 40,000 customers, targeting more than

70,000 by the end of the year.

We believe that people who have solar panels should be getting a

fair price for their power and our ambition is for Good Energy to

be known as the as the go-to supplier if you want the best tariffs

for the power you generate from the panels on your roof. Customers

still get paid for what they generate, but now also get paid for

everything that they export, using readings from their smart

meter.

There are significant commercial benefits for Good Energy in

this shift too, providing substantial tradeable power and

efficiencies through lower costs to serve. We expect this to start

providing a very tangible positive financial impact in 2024.

Scaling installation services

Installation of solar panels, battery storage and heat pumps are

a key step on the path to decarbonisation. They are a building

block of our energy services strategy and provide access to high

growth, high margin and low working capital markets. In December

2022, we acquired Igloo Works a heat pump installer and in June

2023 we acquired Wessex Eco Energy, a solar installer based in the

South West of the UK.

Wessex completed 155 installs in 2022 and is on track for 200

installs in 2023. The new business plan looks to double capacity by

the end of 2024.

The heat pump business will see 2023 as a year of investment as

we look to build out the acquired Igloo platform and installation

capacity. We are targeting 100 installs in 2023, with increasing

uptake in recent months. Earnings growth is expected from H2

2024.

The balance of 2023 and the first half of 2024 are a period of

planned investment. Elevated installation capacity is expected to

drive material earnings accretion from 2025, leveraging corporate

overheads to deliver effective customer acquisition and cost to

serve. Performance since the acquisitions has been in line with

expectations.

Coupled with installations, we have been working with Wessex to

provide improved export tariffs for Customers to increase their

overall savings.

Our ambition is to continue to increase our installation

capacity, through both organic and inorganic growth in the near

term. The solar installation market remains highly fragmented with

over 2,000 registered installers and the vast majority installing

less than 200 installs per year. Our growth strategy is focused on

targeting specific regions to develop a fully national capacity in

time.

OPERATING REVIEW

Wholesale energy market conditions

Wholesale Power & Gas prices

Over the past 12 months we have seen a period of decline from

the peak pricing pressures seen in H2 2022. Since late August 2022,

when the day ahead gas prices hit at GBP6.44/therm, we have seen a

significant decline in wholesale costs. By the end of 2022 gas

prices had fallen to GBP1.75/therm and have averaged

c.GBP0.90/therm since late April 2023. However significant

unpredictability is still present, and whilst the trend has been

downwards there have still been periods of significant volatility.

This general reduction in wholesale costs takes time to flow into

lower tariffs. Hedging agreements, fixed tariff durations, and an

OFGEM managed price cap window all impact when wholesale cost

benefits are seen for end consumers.

Weather conditions seen in 2023 continue to reflect what is a

warming and uncertain climate future. Worldwide temperature records

have been broken, and the UK is no exception to this. Provisionally

H1 2023 saw a mean UK temperature of 8.5 degrees, which is highest

it has been since 2007. These warmer, milder conditions, coupled

with the higher tariffs facing consumers in H1 2023 has seen

reduction in average usage by consumers. Good Energy's customers

are no exception to this with gas usage down 13% to 227 GWh in H1

2023 (H1 2022 259GWh). Electricity supplied volumes are also

reduced year-on year by 28% to 257 GWh (2022 356), but this is down

to a combination of factors including a strategic shift within the

business supply sector, alongside lower average domestic

consumption.

Our renewable supply business

Cash collections

Cash collections in H1 2023 remained strong with customer bills

and payments being augmented by continued Government support scheme

payments through the winter and spring period.

There is a continued focus on good quality business partners to

ensure the supply of energy comes hand in hand with good

collections performance - the business is very much focused on

quality over quantity when it comes to customer acquisition and

renewal.

Whilst wholesale costs are showing signs of stabilisation,

volatility still exists, and cash management is key to managing

well through this environment. The economic environment remains

challenging for consumers and businesses alike, and whilst certain

customers have seen debt levels increase, total live-customer aged

debt has remained at a similar level to the end of 2022, with an

increase in domestic customer debt offset by a corresponding

reduction in business debt. We remain particularly vigilant to

ongoing trends across the industry as we approach the winter.

Business

Total business supply customers fell by 12.1% to 7.0k (8.0k).

This reflects the company's focus on good quality business

partners).

Domestic

We remain committed to ensuring that we offer fair priced,

transparent 100% renewable electricity proposition. High but

stabilising energy prices have the potential to open up the

domestic supply market to increased switching in the future. The

business will continue to counter this by being very clear on its

renewable credentials alongside its strategic energy services

offering.

Feed in Tariff ("FIT")

FIT administration provides the foundation of our energy

services model. Despite the FIT scheme closing to new entrants in

March 2019, we continue to administer the scheme for domestic and

business customers. Customer numbers increased 3.6% to 184k versus

2022.

CFO REVIEW

Overview

Financial performance

Profit and loss

Revenue increased 45% in the period to GBP156.1m (2022:

GBP107.6m) driven by higher tariffs which now reflected the full

effect of the steep rise in wholesale costs in 2022 caused by

worldwide volatility in wholesale power and gas costs. Cost of

sales increased by 29% to GBP122.8m (2022 GBP95.4m) driven largely

by geopolitical impacts on wholesale costs.

Reported gross profit increased 168% to GBP32.7m (2022:

GBP12.2m). The increase reflects a recovery from a loss making H1

2022 as well as a strong H1 2023 performance. Our electricity power

purchase agreements(PPAs), which are typically contracted over a

12-18 month period, provided a cost advantage over the H1 period,

although this will reverse in H2 as commodity costs have fallen

steadily since Sept-22 and tariffs have significantly reduced from

Apr-23 onwards following those wholesale cost reductions. We had

planned and are managing the financial outcome of the year as a

whole, recognising that H2 2023 will be a one-off loss making

period as those commodity input costs lag the sales tariff

reductions that we have continued to provide for our variable

tariff Domestic and SME supply customers since the start of

July.

Total administration costs increased 47% to GBP18.6m. This

increase relates to the strategic expansion into Energy Services;

additional debt provisioning reflecting the higher revenue levels;

and regulatory costs.

The business reported net finance income of GBP0.1m as a result

of the higher cash balance, whilst gross debt remained at

GBP5m.

Reported profit before tax of GBP13.1m. Adding back GBP1.7m of

depreciation, amortisation, finance income & share in loss of

associate gives GBP14.9m EBITDA for the period.

The tax liability for H1 2023 was GBP1.2m (2022 credit of

GBP1.0m).

The reported profit for the period was GBP12.0m (2022:

GBP0.8m).

*A profit bridge slide has been included in the Investor

presentation, which is available on the Company's website. (

https://www.goodenergy.co.uk/investors/results-presentations/ )

Cash flow and cash generation

The profitability seen in H1 2023 has driven strong cash

generation alongside it.

There was a net increase in cash of GBP10.4m and this is after

an initial investment of GBP2.5m for the purchase of the Wessex

EcoEnergy Business.

Cash and cash equivalents at the end of June 2023 were GBP34.9m,

with a further GBP8.4m held in restricted deposit accounts; GBP3.0m

of which relates to Government support scheme monies held

separately pending the full scheme reconciliations being

concluded.

Funding and debt

Our business is debt free on a net basis.

Substantial progress has been made against reducing Group

finance costs and reducing the gearing ratio over the last 2 years.

The remaining Good Energy Bonds II outstanding (GBP4.9m) is held

within short term liabilities. This is due to an annual redemption

request window for bondholders in December with repayment in June

each year.

The Group continues to maintain capital flexibility, balancing

operating requirements, investments for growth and payment of

dividends. Our business remains mindful of the need to capitalise

on strategic business development and investment opportunities.

Prudent balance sheet management remains a key priority.

Earnings

Reported basic earnings per share increased to 72.0p (HY 2022

7.4p).

Dividend

The Board has declared an interim dividend for H1 2023 of 1.00p

per ordinary share.

Good Energy continues to operate a scrip dividend scheme and the

payment timetable of the interim dividend will be announced in due

course.

Expected Credit Loss (ECL)

ECL charge for H1 2023 was GBP3.7m, this is an increase of

GBP2.2m (2022: GBP1.5m).

The main impact in year, is significantly elevated revenue from

the higher tariffs resulting in a larger H1 provision level. H2

2023 ECL charges are expected to be lower reflecting reductions in

tariffs for this period.

Wessex EcoEnergy

On 21 June 2023, Good Energy acquired the entire share capital

of Wessex EcoEnergy Limited for an initial consideration of

GBP2.5m.

Consolidated Statement of profit or loss (Un-audited)

For the 6 months ended 30 June 2023

Notes Unaudited Unaudited Audited

6 months 6 months 12 months

to 30/06/2023 to 30/06/2022 to 31/12/2022

GBP000's GBP000's GBP000's

REVENUE 156,114 107,600 248,682

Cost of Sales (123,457) (95,379) (218,768)

--------------- --------------- ---------------

GROSS PROFIT 32,657 12,221 29,914

Administration Expenses (18,574) (12,725) (28,109)

Other operating income 47 - 66

--------------- --------------- ---------------

OPERATING PROFIT 14,130 (504) 1,871

Finance Income 299 1 633

Finance Costs (169) (247) (351)

Gain on loss of control of

subsidiary - - 7,767

Share of loss of associate (1,139) - (712)

--------------- --------------- ---------------

PROFIT BEFORE TAX 13,121 (750) 9,208

Taxation (1,156) 1,044 (637)

--------------- --------------- ---------------

PROFIT FOR THE PERIOD 11,965 294 8,571

Profit from discontinued

operations before tax - 82 64

Tax on discontinued operations - 440 -

--------------- --------------- ---------------

Profit for the period 11,965 816 8,635

Attributable to:

Equity holders of the

parent 11,965 1,217 9,227

Non-controlling interest - (401) (592)

Earnings per Share

* Basic 10 72.0p 7.4p 55.7p

* Diluted 10 68.6p 7.4p 55.6p

* Basic (continuing operations) 72.0p 4.2p 51.7p

* Diluted (continuing operations) 68.6p 4.2p 51.7p

Consolidated Statement of profit or loss (Un-audited)

For the 6 months ended 30 June 2023

Notes Unaudited Unaudited Audited

6 months 6 months 12 months

to 30/06/2023 to 30/06/2022 to 31/12/2022

GBP000's GBP000's GBP000's

Profit for the period 11,965 816 8,635

--------------- --------------- ---------------

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD ATTRIBUTABLE

TO OWNERS OF THE PARENT

COMPANY 11,965 816 8,635

Attributable to: Equity

holders of the parent 11,965 1,217 9,227

Non-controlling interest - (401) (592)

Consolidated Statement of Financial Position (Un-audited)

As at 30 June 2023

Notes Unaudited Unaudited Audited

6 months 6 months 12 months

to 30/06/2023 to 30/06/2022 to 31/12/2022

GBP000's GBP000's GBP000's

ASSETS

Non-current assets

Property, plant and equipment 306 171 117

Right-of-use assets 46 850 324

Intangible assets 12 5,517 4,233 3,503

Deferred tax asset 87 1,280 162

Equity investments in associate 11,440 - 12,578

--------------- --------------- ---------------

Total non-current assets 17,396 6,534 16,684

Current assets

Inventories 20,252 17,893 9,212

Trade and other receivables 6 49,482 38,262 57,497

Restricted deposit accounts 7 8,489 2,816 8,462

Cash and cash equivalents 8 34,926 21,690 24,487

--------------- --------------- ---------------

Total current assets 113,149 80,661 99,658

--------------- --------------- ---------------

TOTAL ASSETS 130,545 87,195 116,342

--------------- --------------- ---------------

EQUITY AND LIABILITIES

Capital and reserves

Called up share capital 844 842 844

Share premium account 12,915 12,790 12,915

EBT shares (7) (444) (7)

Retained earnings 36,863 17,281 25,234

--------------- --------------- ---------------

Total equity attributable

to members of the parent

company 50,615 30,469 38,986

Non-controlling Interest - (726) -

--------------- --------------- ---------------

Total equity 50,635 29,743 38,986

Consolidated Statement of Financial Position (Un-audited)

As at 30 June 2023

Non-current liabilities

Borrowings 9 89 276 4,927

-------- ------- --------

Total non-current liabilities 89 276 4,927

Current liabilities

Borrowings 9 5,169 5,436 294

Trade and other payables 73,517 51,683 72,135

Current tax payable 1,155 59 -

-------- ------- --------

Total current liabilities 79,841 57,176 72,429

-------- ------- --------

Total liabilities 79,930 57,452 77,356

-------- ------- --------

TOTAL EQUITY AND LIABILITIES 130,545 87,195 116,342

-------- ------- --------

Consolidated Statement of Changes in Equity (Un-audited)

For the 6 months ended 30 June 2023

Share Share Other Retained Revaluation Non-controlling Total

Capital Premium Reserves Earnings surplus interest

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 1 January 2022 840 12,790 (444) 4,773 11,693 (325) 29,327

--------- --------- ---------- ---------- ------------ ---------------- ---------

Profit for the year - - - 816 - (401) 415

Other comprehensive income - - - - - - -

for the year

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total comprehensive income

for the year - - - 816 - (401) 415

Transfer of revaluation

to retained earnings - - - 11,693 (11,693) - -

Dividend paid - - - (187) - - (187)

Total contributions by

and distributions to

owners

of the parent, recognised

directly in equity - - - 11,506 (11,693) - (187)

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 1 July 2022 840 12,790 (444) 17,095 - (726) 29,555

--------- --------- ---------- ---------- ------------ ---------------- ---------

Profit / (Loss) for the

period - - - 8,411 - (191) 8,220

Other comprehensive income - - - - - - -

for the period

--------- --------- ---------- ---------- ------------ ---------------- ---------

Total comprehensive income

for the period - - - 8,411 - (191) 8,220

Exercise of options 1 - 437 (232) - - 206

Share based payments - - - 198 - - 198

Scrip dividends issued 3 125 - (128) - - -

Dividend paid - - - (110) - - (110)

Disposal of Subsidiary - - - - - 917 917

Total contributions by

and distributions to

owners

of the parent, recognised

directly in equity 4 125 437 (272) - 917 1,211

--------- --------- ---------- ---------- ------------ ---------------- ---------

At 31 December 2022 844 12,915 (7) 25,234 - - 38,986

--------- --------- ---------- ---------- ------------ ---------------- ---------

Consolidated Statement of Changes in Equity (Un-audited)

For the 6 months ended 30 June 2023

At 1 January 2023 844 12,915 (7) 25,234 - - 38,986

---- ------- ---- ------- -------

Profit/(Loss) for the period 11,965 - - 11,965

Other comprehensive income - - - - - - -

for the period

---- ------- ---- ------- -------

Total comprehensive income

for the period - - - 11,965 - - 11,965

Dividends declared - - - (336) - - (336)

Total contributions by and

distributions to owners

of the parent, recognised

directly in equity - - - (336) - - (336)

---- ------- ---- ------- -------

At 30 June 2023 844 12,915 (7) 36,863 - - 50,615

Consolidated Statement of Cash Flows (Un-audited)

For the 6 months ended 30 June 2023

Notes Un-audited Un-audited Audited

30/06/2023 30/06/2022 31/12/2022

GBP000's GBP000's GBP000's

Cash flows from operating

activities

Cash inflow from continuing

operations 13,033 (2,173) 5,180

Finance income 65 (1) 17

Finance cost (145) (348) (70)

Net cash flows from operating

activities 11 12,953 (2,522) 5,127

Cash flows from investing

activities

Purchase of property, plant

and equipment (61) - (9)

Purchase of intangible fixed

assets (3) (342) (125)

Deposit into restricted accounts - (401) -

Investment in associate - - (3,494)

Proceeds from disposal of held

for sale assets - 19,575 20,351

Acquisition of subsidiary,

net of cash acquired (2,163) - (1,725)

Net cash flows used in investing

activities (2,227) 18,832 14,998

Cash flows from financing

activities

Payments of dividends - - (297)

Repayment of borrowings (30) (1,000) (1,619)

Capital repayment of leases (257) (321) (626)

Proceeds from issue of shares - - -

Proceeds from sale of share

options - 2 205

------------ ------------ ------------

Net cash flows from financing

activities (287) (1,319) (2,337)

Net increase/(decrease) in

cash and cash equivalents 10,439 14,991 17,788

Cash and cash equivalents at

beginning of period 24,487 6,699 6,699

Cash and cash equivalents

at end of period 34,926 21,690 24,487

Notes to the Interim Accounts

For the 6 months ended 30 June 2023

1. General information and basis of preparation

Good Energy Group PLC is an AIM listed company incorporated and

domiciled in the United Kingdom under the Companies Act 2006. The

Company's registered office and its principal place of business is

Monkton Park Offices, Monkton Park, Chippenham, Wiltshire, United

Kingdom, SN15 1GH.

The Interim Financial Statements were prepared by the Directors

and approved for issue on 18 September 2023. These Interim

Financial Statements do not comprise statutory accounts within the

meaning of section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 December 2022 were approved by the

Board of Directors on 5 May 2023 and delivered to the Registrar of

Companies. The report of the auditors on those accounts was

unqualified and did not contain statements under 498 (2) or (3) of

the Companies Act 2006 and did not contain any emphasis of

matter.

As permitted these Interim Financial Statements have been

prepared in accordance with UK AIM rules and the IAS 34, 'Interim

financial reporting' as adopted by the United Kingdom. They should

be read in conjunction with the Annual Financial Statements for the

year ended 31 December 2022 which have been prepared in accordance

with IFRS as adopted by the European Union.

In accordance with IAS 34, the tax charge is estimated on the

weighted average annual income tax rate expected for the full

financial year. The accounting policies applied are consistent with

those of the Annual Financial Statements for the year ended 31

December 2022, as described in those Annual Financial

Statements.

The Interim Financial Statements have not been audited.

2. Going concern basis

The Group has seen a strong start to 2023 reflecting the benefit

from when power purchase agreements were secured versus market

tariffs. The Group has performed a going concern review, going out

until the mid-2025 considering both an internal base case, and

various externally provided scenarios. The scenarios were provided

by Ofgem in mid-2023 as part of their ongoing check into the

financial stability of UK Energy suppliers. Having reviewed this

forecast, and having applied a reverse stress test, the possibly

that financial headroom could be exhausted is remote.

The Directors are confident in the ongoing stability of the

Group, and its ability to continue operation and meet commitments

as they fall due over the going concern period. The Group therefore

continues to adopt the going concern basis in preparing its

consolidated financial statements.

3. Estimates

The preparation of Interim Financial Statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this set of condensed Interim Financial Statements,

the significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the Annual

Financial Statements for the year ended 31 December 2022.

4. Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk, currency risk, credit risk and liquidity risk.

The condensed Interim Financial Statements do not include all

financial risk management information and disclosures required in

the Annual Financial Statements. They should be read in conjunction

with the Annual Financial Statements as at 31 December 2022.

5. Segmental analysis

H1 2023 Electricity FIT Gas Supply Total Supply Energy Holding Total

Supply Administration Companies as a service Company/

Consolidated

Adjustments

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------ --------------- ----------- ------------- -------------- -------------- ----------

Revenue 122,092 2,730 30,890 155,712 402 - 156,114

Cost of sales (92,003) (93) (30,797) (122,893) (564) - (123,457)

Gross

profit/(loss) 30,089 2,637 93 32,819 (162) - 32,657

Gross margin 25% 97% 0% 21% -40% 21%

Admin costs (16,102) (1,500) (925) (18,527)

------------- -------------- -------------- ----------

Operating

profit/(loss) 16,717 (1,662) (925) 14,130

Net finance

costs - (53) 183 130

Share of

loss of

associate - (1,139) - (1,139)

------------- -------------- -------------- ----------

Profit/(loss)

before tax 16,717 (2,854) (742) 13,121

H1 2022 Electricity FIT Gas Total Electricity Energy Holding Total

Supply Administration Supply Supply Generation as a Company/

Companies service Consolidated

Adjustments

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------ --------------- --------- ---------- ------------ -------- ------------- ---------

Revenue 88,510 2,849 15,638 106,997 - 603 - 107,600

Cost of sales (84,282) (325) (10,573) (95,180) - (155) (45) (95,380)

Gross

profit/(loss) 4,228 2,524 5,065 11,817 - 448 (45) 12,220

Gross margin 5% 89% 32% 11% - 74% 0% 11%

Admin costs (9,716) - (1,227) (1,779) (12,725)

---------- ------------ -------- ------------- ---------

Operating

profit/(loss) 2,098 - (779) (1,824) (505)

Net finance

costs (5) - (24) (216) (245)

Share of - - - - -

loss of

associate

---------- ------------ -------- ------------- ---------

Profit/(loss)

before tax 2,093 - (803) (2,040) (750)

6. Trade Receivables

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

GBP000s GBP000s

Gross trade receivables 63,919 69,007

Provision for impairment/non-payment

of trade receivables (17,203) (15,428)

------------------ ------------------

Net trade receivables 46,716 53,579

Prepayments and other taxation 2,766 3,918

------------------ ------------------

Total 49,482 57,497

The movements on the provision for impairment and non-payment of

trade receivables is shown below:

Movement on the provision for impairment Unaudited Audited

and non-payment of trade receivables As at 30/06/2023 As at 31/12/2022

GBP000's GBP000's

Balance at 1 January 15,428 11,792

Increase in allowance for impairment/non-payment 1,775 3,636

Balance at 30 June 2023 / 31 December

2022 17,203 15,428

------------------ ------------------

Days past due

Unaudited <30 30-60 61-90 >91

As at 30/06/2023 Current days days days days Total

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Expected credit loss

rate 9.7% 14.0% 26.0% 41.6% 86.9%

Estimated total gross

carrying amount at

default 27,162 4,271 1,970 1,564 14,755 49,722

--------- --------- --------- --------- --------- ---------

Expected credit loss 2,622 600 513 650 12,818 17,203

--------- --------- --------- --------- --------- ---------

Days past due

Audited Current <30 30-60 61-90 >91 Total

As at 31/12/2022 days days days days

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Expected credit loss

rate 6.4% 15.0% 27.1% 39.1% 87.9%

Estimated total gross

carrying amount at

default 41,471 3,041 1,805 1,492 12,780 60,589

--------- --------- --------- --------- --------- ---------

Expected credit loss 2,662 456 490 584 11,236 15,428

--------- --------- --------- --------- --------- ---------

7. Restricted deposit accounts

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

GBP000s GBP000s

Restricted deposit accounts 8,489 8,462

------------------ ------------------

Total 8,489 8,462

Restricted deposit accounts include an amount of GBP2,984,085

(December 2022: GBP4,533,381) that relates to Government support

scheme monies received for application to business and domestic

customer accounts. At the end of each scheme all unallocated funds

are due to be returned to the Government.

8. Cash and cash equivalents

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

GBP000s GBP000s

Cash at bank and in hand 34,545 24,063

Security deposits 381 424

------------------ ------------------

Total 34,926 24,487

Included within cash at bank and in hand for both the Parent

Company and the Group is GBP6,911 (December 2022: GBP592,893) in

respect of monies held by the Good Energy Employee Benefit

Trust.

9. Borrowings

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

Current: GBP000s GBP000s

Bond 4,926 10

Bank loans 178 -

Lease liabilities 65 284

------------------- ------------------ ------------------

Total 5,169 294

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

Non-current: GBP000s GBP000s

Bond - 4,921

Bank Loans 19 -

Lease liabilities 70 6

------------------- ------------------ ------------------

Total 89 4,927

The fair values of borrowings have been calculated taking into

account the interest rate risk inherent in the bond. The fair value

estimates and carrying values of borrowings (excluding issue costs)

in place are:

Unaudited Unaudited Audited Audited

As at 30/06/2023 As at 30/06/2023 As at 31/12/2022 As at 31/12/2022

Fair value Carrying Fair value Carrying

GBP000s value GBP000s value

GBP000s GBP000s

Corporate bond 4,847 4,456 4,820 4,486

10. Earnings per share

The calculation of basic earnings per share at 30 June 2023 was

based on a weighted average number of ordinary shares outstanding

for the six months to 30 June 2023 of 16,609,219 (for the six

months to 30 June 2022: 16,528,000 and for the full year 2022:

16,574,697) after excluding the shares held by Clarke Willmott

Trust Corporation Limited in trust for the Good Energy Group

Employee Benefit Trust.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares to assume conversion of

all potentially dilutive ordinary shares. Potentially dilutive

ordinary shares arise from awards made under the Group's

share-based incentive plans. When the vesting of these awards is

contingent on satisfying a service or performance condition, the

number of the potentially dilutive ordinary shares is calculated

based on the status of the condition at the end of the period.

Potentially dilutive ordinary shares are actually dilutive only

when the Company's ordinary shares during the period exceeds their

exercise price (options) or issue price (other awards). The greater

any such excess, the greater the dilutive effect. The average

market price of the Company's ordinary shares over the six month

period to 30 June 2023 was 187p (for the six months to 30 June

2022: 258p and for the full year 2022: 242p). The dilutive effect

of share-based incentives was 839 shares (for the six months to 30

June 2022: 208,252 shares and for the full year 2022: 10,497).

11. Net cash flows from operating activities

The operating cashflow for the six months to 30 June 2023 is an

inflow of GBP13m (for the six months to 30 June 2022: GBP2.5m

outflow and for the full year 2022: GBP5.1m inflow). The difference

in the cashflow between the half year 2023 and its comparative for

the same period is primarily due to timing of working capital

related items.

12. Business Combinations

On 21 June 2023, Good Energy Group PLC acquired the entire share

capital of Wessex EcoEnergy Limited, an established UK based solar

installation business. Building on its acquisition of Igloo Works

in December 2022, the acquisition represents a further milestone in

delivering on Good Energy's strategy to expand its capability in

decentralised energy services.

Unaudited Unaudited Audited Audited

As at 30/06/2023 As at 30/06/2023 As at 31/12/2022 As at 31/12/2022

Fair value Carrying Fair value Carrying

GBP000s value GBP000s value

GBP000s GBP000s

Property, plant and equipment 171 171 23 23

Inventories 362 362 20 20

Receivables 243 243 125 125

Cash 353 353 34 34

Payables (1,010) (1,010) (194) (194)

------------------------------- ------------------ ------------------ ------------------ ------------------

Total identifiable net

assets 119 119 8 8

Unaudited Audited

As at 30/06/2023 As at 31/12/2022

GBP000s GBP000s

Goodwill 2,401 1,805

Consideration 2,520 1,813

The goodwill recognised in respect of the acquisition of Wessex

EcoEnergy at 30th June 2023 is provisional, subject to a fair value

assessment of identifiable intangible assets separable from

goodwill in accordance with the provisions of IFRS3: Business

Combinations.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QVLFFXKLEBBB

(END) Dow Jones Newswires

September 19, 2023 02:01 ET (06:01 GMT)

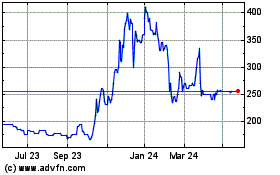

Good Energy (AQSE:GOOD.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

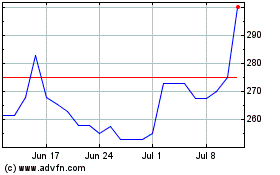

Good Energy (AQSE:GOOD.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025