Hydro Hotel, Eastbourne, Plc; Hydro Hotel, Eastbourne, Plc Final Results

January 29 2020 - 1:01AM

UK Regulatory

TIDMHYDP; HYDP

HYDRO HOTEL, EASTBOURNE, PLC

PRELIMINARY ANNOUNCEMENT OF THE FINAL RESULTS FOR THE YEAR ENDED 31 OCTOBER

2019

HIGHLIGHTS

The profit for the financial year after taxation was GBP224,516 (2018

GBP153,260). Turnover from the Hydro Hotel operation increased during the year

by 2.1% (2018 increase of 3.8%). Earnings per share were 37.42p compared to

25.54p for the previous year.

The Company generated cash from operating activities of GBP504,842 (2018

GBP378,888) and invested GBP341,207 in new fixed assets (2018 GBP173,960).

During the year the Company paid ordinary dividends of GBP126,000 (2018

GBP126,000). At the year end the Company had net current assets of GBP852,027

(2018 GBP858,532).

CHAIRMAN'S STATEMENT

Results for year ended 31 October 2019

I am pleased to report on the company's results for the year ended 31 October

2019. Sales for the year totalled GBP3,733,698, an increase of 2.1% on the

GBP3,658,461 sales for the previous year (2018 3.8% increase). Operating profit

for the year was GBP271,809 (2018 GBP185,135). After interest receivable and

the corporation tax charge, the post-tax profits for the year were GBP224,516

(2018 GBP153,260). Taking into account the level of post-tax profits for the

year and with the company having strong reserves and assets, the Board decided

to increase the dividend to 23p per share (2018 21p per share) absorbing

GBP138,000 (2018 GBP126,000).

The trading environment for the company continued to be challenging. Careful

monitoring of food and drink costs meant that the gross profit percentage

remained similar to the previous year but increased staffing costs affected

profitability. Repair costs decreased with no significant work required to the

fabric of the building in the year.

Capital improvements at the hotel during the year included the replacement of

the fire alarm system, refurbishment of 12 bedrooms and Garden Suite bar area,

and installation of energy efficient lighting in the kitchen.

Developments since 31 October 2019

New marketing techniques will continue to be developed during the year to

encourage direct bookings at the hotel. The Board has been pleased to note that

the new online booking system on the company's website, introduced in September

2018, has reduced the proportion of bookings made via Online Travel Agents with

consequent commission savings.

Updating of the décor and furniture of the conservatory has been undertaken

and, subject to planning permission, a bar will be installed in the Wedgwood

Room. No other major refurbishment of bedrooms or public areas is planned for

the current year.

Our Staff

I would like to congratulate our General Manager, Jonathan Owen, on an improved

profit for the hotel, despite ongoing challenges for the hotel and tourism

industry.

I wish also to record our thanks to our management team and all our staff for

their dedication to the hotel. All staff continued to deliver the Hydro's

renowned quality of service which our customers value so much.

Graeme C King, MA, CA

Chairman of the Board

28 January 2020

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 OCTOBER 2019

2019 2018

GBP GBP

Turnover

Continuing operations 3,733,698 3,658,461

Cost of sales (3,231,920) (3,244,833)

Gross profit 501,778 413,628

Administrative expenses (229,969) (228,493)

Operating profit 271,809 185,135

Interest receivable and similar income 10,265 8,190

Profit before taxation 282,074 193,325

Taxation (57,558) (40,065)

Profit for the financial year GBP 224,516 GBP 153,260

Earnings per share - continuing operations 37.42p 25.54p

Earnings per share have been calculated using 600,000 shares, being the

weighted average number of shares for both years. The company has no potential

ordinary shares, therefore basic and diluted earnings per share is the same

figure.

STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER 2019

2019 2018

GBP GBP

Fixed assets

Tangible Assets 2,759,650 2,620,992

Current assets

Stocks 37,123 30,438

Debtors 129,098 150,087

Investments 200,000 200,000

Cash at bank and in hand 1,107,586 1,089,507

1,473,807 1,470,032

Creditors: Amounts falling due within one year (621,780) (611,500)

Net current assets 852,027 858,532

Total assets less current liabilities 3,611,677 3,479,524

Provisions for liabilities (120,812) (87,175)

Net assets GBP 3,490,865 GBP 3,392,349

Capital and reserves

Ordinary Shares - Authorised and Issued:

600,000 Shares of GPB1.00 each fully paid 600,000 600,000

Revaluation reserve 411,209 415,488

Profit and loss reserves 2,479,656 2,376,861

Total equity GBP 3,490,865 GBP 3,392,349

STATUS OF FINANCIAL INFORMATION

The financial information set out above does not constitute statutory accounts

as defined in section 434 of the Companies Act 2006. This has, however, been

extracted from the statutory accounts for the year ended 31 October 2019. These

accounts have not to date been delivered to the Registrar of Companies. The

Company's auditor, Mazars LLP, has issued an unqualified audit report which

does not contain a statement under section 498 of the Companies Act 2006 in

respect of these accounts.

DIVIDEND ANNOUNCEMENT

An interim dividend of 9.0 pence per share (2019 7.0 pence) was paid on 16

January 2020 to shareholders on the register on 20 December 2019.

The Board have declared a second interim dividend for the year ended 31 October

2019 of 14.0 pence per share (year ended 31 October 2018 14.0 pence) for

payment on 30 April 2020 to shareholders on the register on 17 April 2020. The

directors do not propose the payment of a final dividend.

The Directors of Hydro Hotel, Eastbourne, plc accept responsibility for this

announcement.

For further information please contact:

Hydro Hotel, Eastbourne, plc

Sally Gausden

Telephone: (+44) (0) 1323 431200

Peterhouse Capital Limited

Mark Anwyl

Telephone: (+44) (0) 20 7469 0930

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulation

(EU) No. 596/2014. Upon the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to be in the

public domain.

END

(END) Dow Jones Newswires

January 29, 2020 02:01 ET (07:01 GMT)

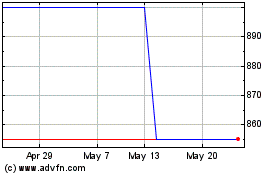

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

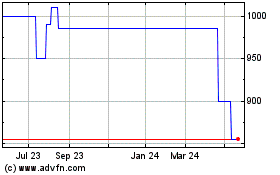

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Nov 2023 to Nov 2024