TIDMHYDP

14 July 2022

Hydro Hotel, Eastbourne, Plc

("Hydro Hotel" or the "Company")

Interim Results for the Half Year ended 30 April 2022

YOUR CHAIRMAN'S LETTER

Dear Shareholder,

SIX MONTHS TO 30 APRIL 2022

I report on the company's results for the six months to 30 April 2022, which

reflect trading following the removal of all restrictions imposed by the

Government due to the Coronavirus pandemic.

The total turnover for the six month period to 30 April 2022 was £1,822,411

compared to £185,579 for the same period the previous year, an increase of 882%

(compared to a decrease in the six months to 30 April 2021 of 84%).

The gross profit percentage for the period was 3% higher than in the six months

to 30 April 2021 and staff costs (excluding grants received for the Coronavirus

Job Retention Scheme) increased by 73% as the hotel reopened and business

recovered, compared to the figure for the period to 30 April 2021 (36% decrease

in the half year to 30 April 2021).

Overheads increased by 77% reflecting the reopening after the Coronavirus

pandemic (35% decrease in the half year ended 30 April 2021).

Only routine maintenance to the fabric of the building was undertaken during

the six months to 30 April 2022, reflecting uncertainty over future periods of

closure from the Coronavirus pandemic. Consequently, repairs were at a similar

level to the six months ended 30 April 2021.

The profit for the half year to 30 April 2022 was £22,277 compared to a loss of

£383,183 for the half year to 30 April 2021, when the hotel was closed for much

of the period due to the Coronavirus pandemic.

The Board and the management of the company continue to monitor cash resources

and have paid the dividend of £120,000 declared on 21 December 2021. No further

dividends were declared in the period.

The Board wishes to express its thanks to the management and staff of the hotel

for their co-operation and efforts in building up the business following the

exceptional circumstances of the Coronavirus pandemic. The Hydro team look

forward to welcoming new and returning guests in this our 127th year of

operation.

Yours sincerely,

Graeme C King, MA, CA

12 July 2022

STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF YEARED 30 APRIL 2022

Half year to Half year to Year ended

30 April 2022 30 April 2021 31 October 2021

(Unaudited) (Unaudited) (Audited)

£ £ £

TURNOVER 1,822,411 185,579 2,791,482

OPERATING PROFIT/(LOSS) 17,580 (385,397) 461,312

4,697 2,214 5,000

INTEREST RECEIVABLE

INTEREST PAYABLE - - (9,286)

PROFIT/(LOSS) BEFORE TAXATION 22,277 (383,183) 457,026

TAXATION - - (94,366)

PROFIT/(LOSS) FOR PERIOD £22,277 £(383,183) £362,660

Earnings/(Loss) per share 3.71p (63.86)p 60.44p

STATEMENT OF FINANCIAL POSITION

AT 30 APRIL 2022

30 April 2022 30 April 2021 31 October 2021

(Unaudited) (Unaudited) (Audited)

£ £ £

FIXED ASSETS

Tangible Assets 2,504,821 2,578,230 2,500,211

CURRENT ASSETS

Stocks 40,200 24,474 36,657

Debtors 124,131 103,643 115,672

Investments - 3 month notice deposit 451,946 200,325 451,014

accounts

Cash at bank and in hand 1,353,406 684,264 1,328,353

1,969,683 1,012,706 1,931,696

CREDITORS

Amounts falling due within one year (817,611) (326,396) (677,291)

NET CURRENT ASSETS 1,152,072 686,310 1,254,405

TOTAL ASSETS LESS

CURRENT LIABILITIES 3,656,893 3,264,540 3,754,616

CREDITORS: - (240,000) -

Amounts falling due after more than one

year

PROVISION FOR LIABILITIES (94,380) (110,147) (94,380)

NET ASSETS £3,562,513 £2,914,393 £3,660,236

CAPITAL AND RESERVES

Called up share capital 600,000 600,000 600,000

Revaluation reserve 402,651 406,930 402,651

Profit and loss reserves 2,559,862 1,907,463 2,657,585

£3,562,513 £2,914,393 £3,660,236

STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 APRIL 2022

Half year to Half year to Year ended

30 April 2022 30 April 31 October 2021

2021

(Unaudited) (Unaudited) (Audited)

£ £ £

NET CASH INFLOW FROM/(USED IN) OPERATING ACTIVITIES 238,289 (321,460) 829,213

(Note 1)

NET CASH USED IN INVESTING ACTIVITIES (Note 2) (93,236) (19,417) (286,001)

FINANCING ACTIVITIES

Repayment of bank loans - - (240,000)

Dividends paid (120,000) - -

NET INCREASE/(DECREASE) IN CASH AND CASH 25,053 (340,877) 303,212

EQUIVALENTS

CASH AND CASH EQUIVALENTS AT THE BEGINNING 1,328,353 1,025,141 1,025,141

OF THE PERIOD

CASH AND CASH EQUIVALENTS AT THE OF £1,353,406 £684,264 £1,328,353

THE PERIOD

RELATING TO:

Cash at bank and in hand £1,353,406 £684,264 £1,328,353

NOTES TO THE STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 APRIL 2022

Half year to Half year to Year ended

30 April 2022 30 April 2021 31 October 2021

(Unaudited) (Unaudited) (Audited)

£ £ £

Note 1

CASH FLOWS FROM OPERATING

ACTIVITIES

Profit/(Loss) after tax 22,277 (383,183) 362,660

Adjustments for:

Taxation - - 94,366

Depreciation 92,102 93,402 190,102

Loss/(gain) on disposal of fixed assets 289 3,550 3,550

Interest receivable (4,697) (2,214) (5,000)

OPERATING CASH FLOW BEFORE WORKING CAPITAL 109,971 (288,445) 645,678

CHANGES

MOVEMENTS IN WORKING CAPITAL

(Increase)/decrease in stocks (3,543) 3,425 (8,758)

(Increase)/decrease in debtors (8,459) 25,773 (5,590)

Increase/(decrease) in creditors 140,320 (62,213) 178,549

Income taxes refunded - - 19,334

NET CASH GENERATED FROM/(USED IN) OPERATING £238,289 £(321,460) £829,213

ACTIVITIES

Note 2

INVESTING ACTIVITIES

Purchases of tangible fixed assets (97,001) (21,306) (39,987)

Interest received 4,697 2,214 5,000

Payment for other investments (932) (325) (251,014)

NET CASH FLOW USED IN INVESTING ACTIVITIES £(93,236) £(19,417) £(286,001)

NOTES TO THE ACCOUNTS

1 The results are prepared on the basis of the accounting policies set out in

the Company's Annual Report and Accounts for the year ended 31 October 2021.

At the date of this report, there exists considerable uncertainty regarding

the potential impact of the Coronavirus and the economic consequences, both

within the U.K. and overseas, which may result from government policies to

contain the spread. The duration and geographical extent of any possible

lockdown or future government policies are unknown. Whilst we are unable to

predict what the economic consequences may be and the impact on the

company's future ability to continue trading, we have continued to use the

going concern basis as appropriate in the preparation of these accounts.

2 The earnings per share are based on a profit of £22,277 (2021 loss of £

383,183) being the profit on ordinary activities after taxation.

3 The movement in retained Profit and Loss Reserves from £2,657,585 at 31

October 2021 to £2,559,862 at 30 April 2022 includes the profit for the

period and dividends paid of £120,000 ( £120,000 paid in the period and £Nil

accrued).

4 All dividends in 2022 were paid in the period and no accrual is included in

creditors, amounts falling due within one year as at 30 April 2022 (2021: £

Nil dividends paid and no accrual included in creditors, amounts falling due

within one year as at 30 April 2021).

5 A copy of the interim report and accounts and the Chairman's statement

thereto, which were approved by the Board of Directors on 12 July 2022, will

be posted to all registered shareholders shortly thereafter.

6 The financial information set out above does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 October 2021, on which the report of the

auditor was unqualified and did not contain a statement under section 498 of

the Companies Act 2006, have been filed with the Registrar of Companies.

7 The company's auditor, UHY Hacker Young LLP, has not reviewed these

unaudited interim accounts.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

END

(END) Dow Jones Newswires

July 14, 2022 09:09 ET (13:09 GMT)

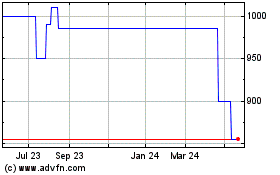

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

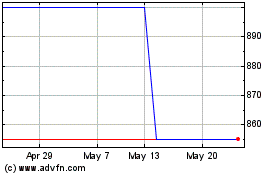

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Feb 2024 to Feb 2025